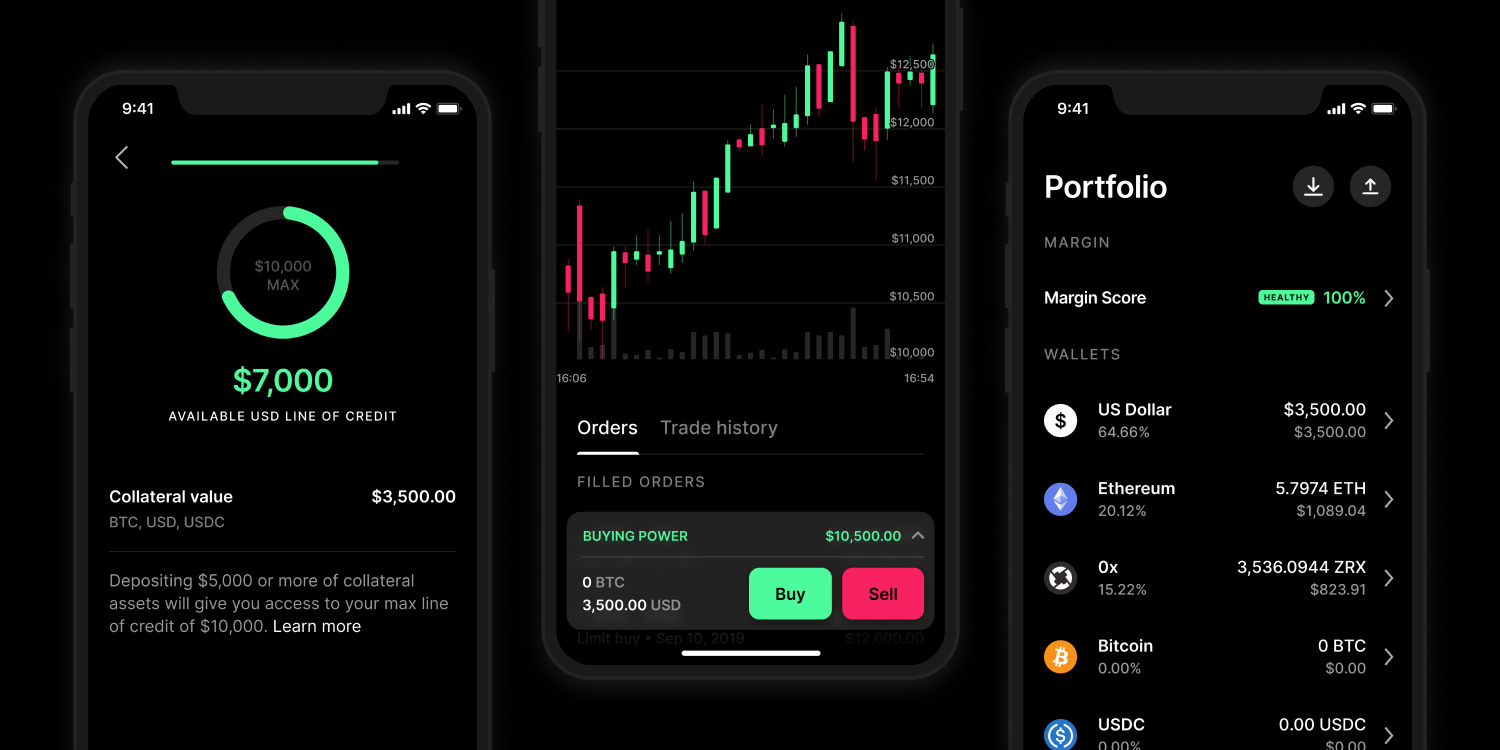

Cryptocurrency exchange Coinbase is launching margin trading today. Margin trading lets you trade on leverage. But it works both ways — margin trading lets you multiply your gains and your losses.

Margin trading is going to be available on Coinbase Pro, the company’s exchange interface for educated investors. Both retail and institutional investors will be able to submit margin trading orders with up to 3x leverage. It’ll work with any pair of assets with USD as the base currency.

For now, the feature is limited to 23 U.S. states if you’re a retail investor. Institutional investors in 45 states and nine international countries can access margin trading, though.

There are many potential use cases for margin trading. For instance, you can allocate a tiny portion of your portfolio to a margin trading order to hedge across multiple positions. Coinbase believes it has enough liquidity to help investors set up sophisticated margin trading orders.

If you’re a retail customer living in one of the 23 states where margin trading is available, you might not be able to use it. The company wants to restrict margin trading to the most advanced traders.

Coinbase is going to track your past activity on Coinbase Pro and look at trades, balances, deposits and withdrawals. If you’re an active trader, you’ll be able to access margin trading.

Here’s the list of 23 U.S. states with margin trading for retail investors: Florida, Texas, Illinois, New Jersey, Virginia, Georgia, Arkansas, Alaska, Oregon, Connecticut, New Hampshire, Massachusetts, Nebraska, North Carolina, Oklahoma, Colorado, Kansas, Maine, South Carolina, Utah, Wisconsin, Wyoming and West Virginia.

Disclosure: I own small amounts of various cryptocurrencies.