Contributor

Three e-mobility startups are accelerating into the U.S. motorcycle market.

Italy’s Energica and California based Alta Motors and Zero Motorcycles have revved up promotion, distribution, and sales.

You may see their machines zip by on American roads before the big two-wheel gas powered companies get EVs to showroom floors.

These startups could reboot U.S. motorcycle sales while shifting the global motorcycle industry toward electric.

The market

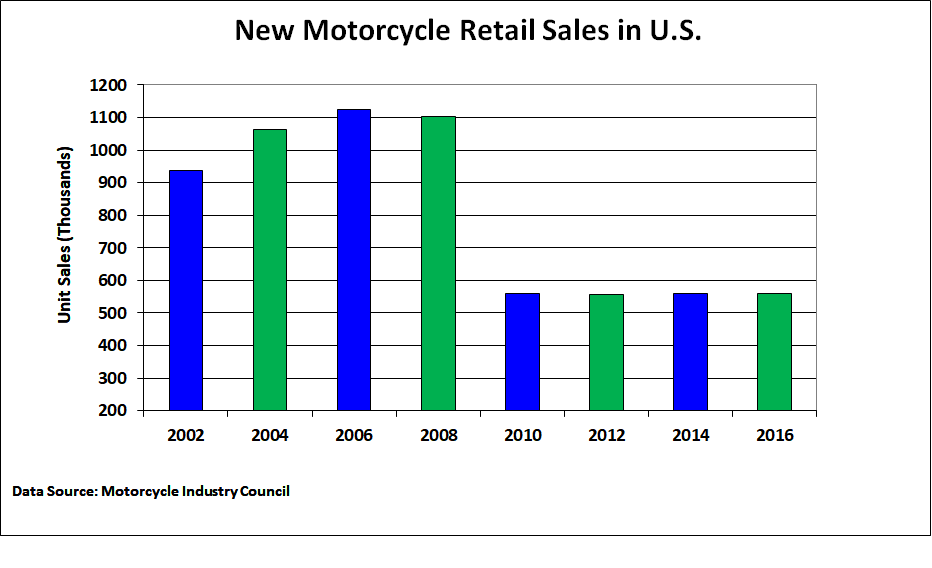

Since the recession, America’s motorcycle sector has been in the doldrums. New bike sales have dropped roughly 50 percent since 2008—with sharp declines in ownership by everyone under 40.

Most of the market is now aging baby-boomers, whose “Live to Ride” days are winding down.

Two bright spots in the space are women and resales. Females are one of the few growing U.S. ownership market segments. And per an Insurance Institute for Highway Safety study, total motorcycles on the road actually increased from 2008 to 2017, though nearly 75 percent of registrations are for bikes over 7 years old.

So Americans are buying motorcycles, but for some reason not choosing new ones.

On the e-moto front, two-wheel gas manufacturers have mostly stagnated around EV concepts. None of the big names—Honda, Kawasaki, Suzuki, BMW—offer a production electric street motorcycle in the U.S.

Harley Davidson jolted the industry in February by committing to produce an EV for sale by August 2019.

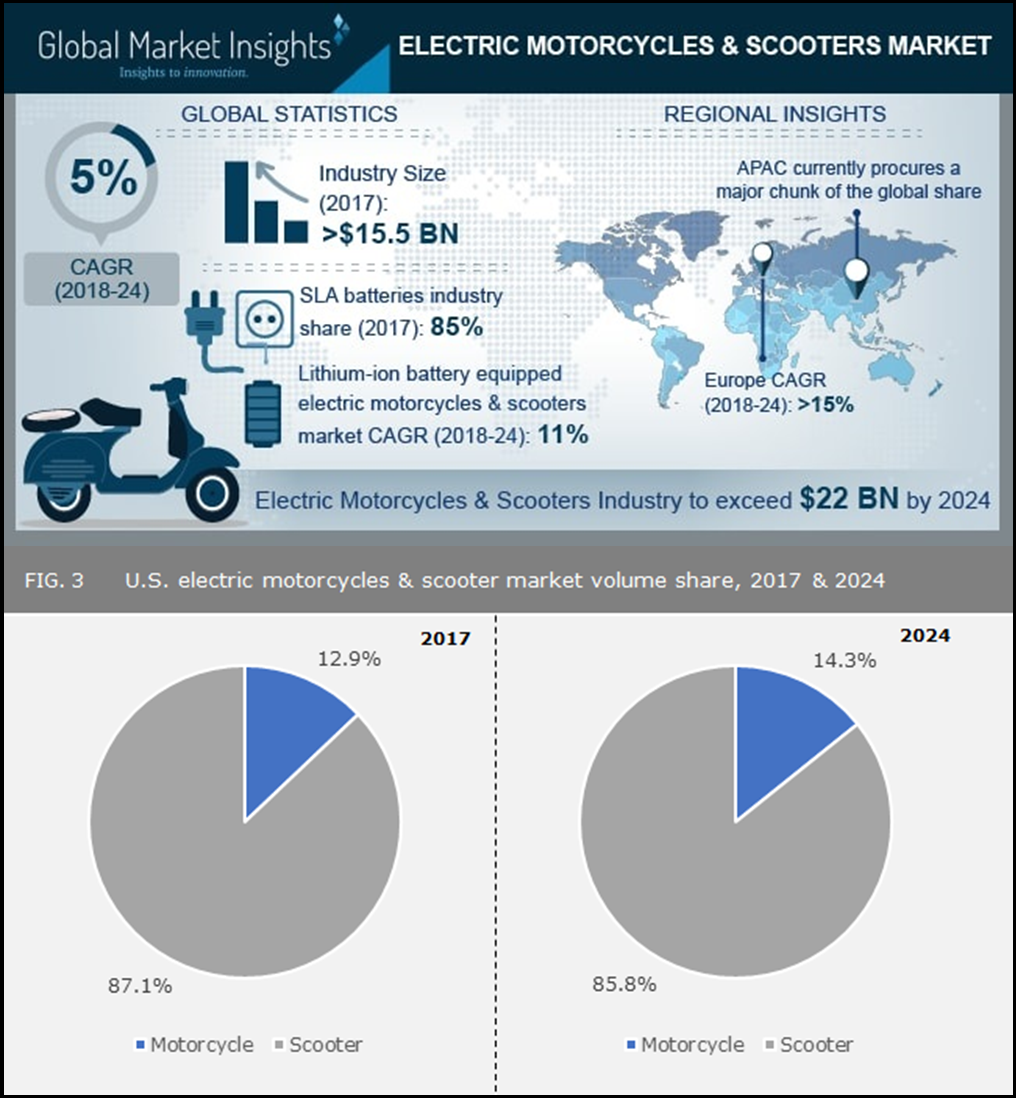

On U.S. e-motorcycle sales, Global Market Insights (GMI) recently tallied 2017 combined American e-scooter and moto sales at 245K units worth $155M. Following worldwide trends, GMI projects that to grow to 598K and $304M by 2024, with the share of U.S. e-motorcycles to scooters increasing.

The startups and motorcycles

Alta, Energica, and Zero have niche markets for their unique tech and design.

Italy’s Energica is targeting the high performance, higher priced superbike segment. On disrupting existing market leaders such as Ducati or Kawasaki, “Of course we want to do that,” CEO Livia Cevolini told me.

Energica offers three models in the U.S.: the EVA ($26,240), EVA ESSEESSE9 ($24,940) and top line 145 horsepower, 150mph EGO ($26,460).

All three share innovative features, including a patented cooling system to optimize performance of their motors and high energy lithium polymer batteries.

08-01-2017 Torino, calcio campionato serie a Tim, gara Juventus-Bologna, nella foto: .photo damiano fiorntini

Energica’s proprietary Vehicle Control Unit syncs to a digital dash and MYEnergica app. The VCU regulates everything from power output and preset riding modes to ABS and regenerative braking.

As a member of the ChargePoint EV network, Energica integrates the group’s 20 minute DC Fast Charging tech “because if want to ride Saturday with your sport bike friends nobody is going to wait 2 hours for you to charge,” said U.S. CEO Stefano Benatti.

He explained the company is expanding its American dealer network from San Francisco, to Chicago, Florida, and New York. Energica is also entering racing. Its EGO motorcycle was named the class bike for FIM’s 2019 Moto-e World Cup.

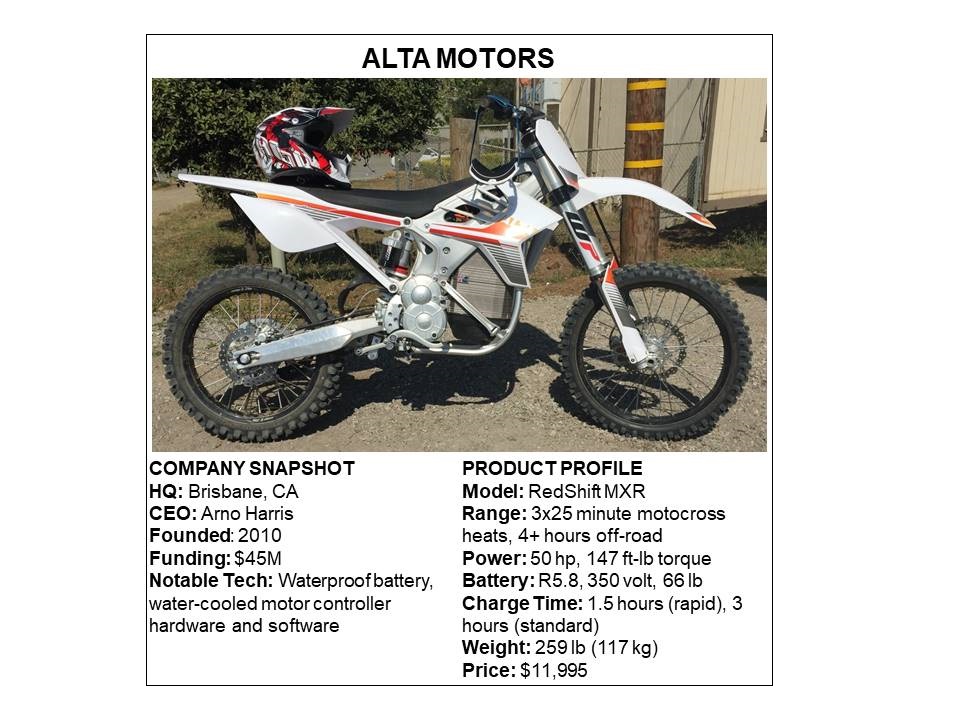

Brisbane, California based Alta Motors focuses primarily on producing electric powered off-road machines. Four of Alta’s five models—including the three that are street legal—are specialized for dirt riding. The MX and Redshift MXR motorcycles are full on motocross racers.

The startup has raised $45M and counts Tesla co-founders Marc Tarpenning and Martin Eberhard among its investors.

From a design perspective Alta’s two-wheelers are distinctly minimalist and produce significant power to weight. “We pioneered a new approach to building 18650 based packs,” Chief Product Officer Marc Fenigstein told TechCrunch—referring to the lithium-ion battery cells used by Tesla.

Alta recently launched its second generation—waterproof, 350 volt, 66 pound—battery. “That pack gives us unique…range per pound for a battery pack and unique economics, not just for the world of electric motorcycles…but pretty much everything smaller than a passenger car,” he said.

Fenigstein estimated “the premium off-road motorcycle market is bigger than people think, at [roughly] $2BN.” He would not divulge Alta Motors revenue or sales figures.

Shortly after their EV commitment, Harley Davidson took an (undisclosed) equity stake in Alta, along with a board seat, and entered into a co-development partnership.

Alta’s CEO revealed Harley’s recent EV announcement “isn’t the program we’re working on”, but confirmed the Alta-HD partnership “should result in a motorcycle.”

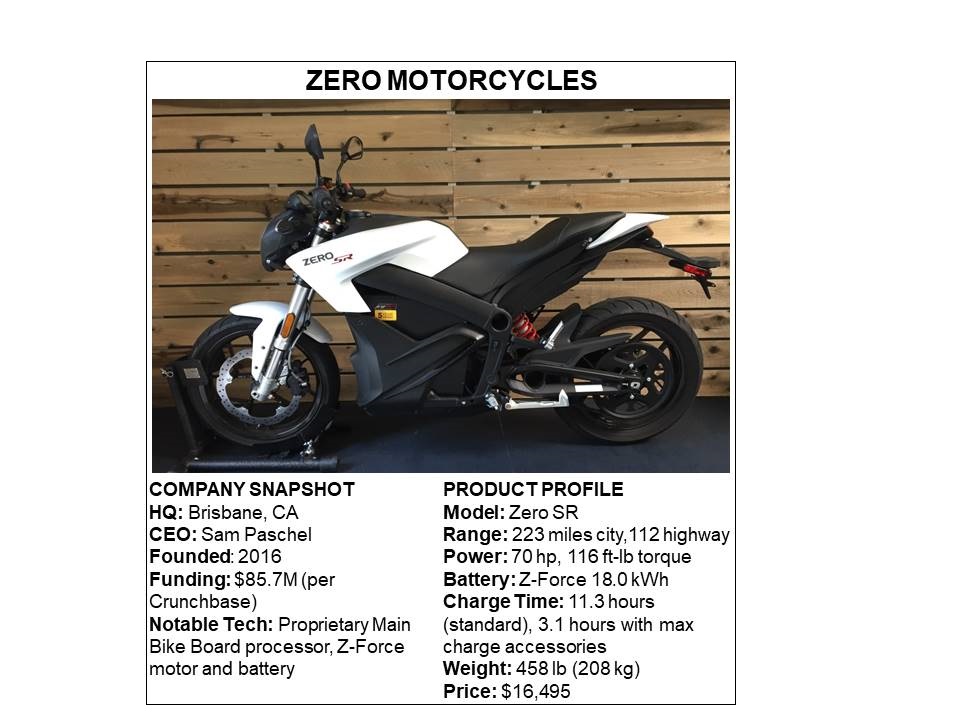

Of the three startups, Scotts Valley, California based Zero Motorcycles has the widest market and model breadth. The company has six base models, three with dual sport capabilities, distribution in 30 countries, and had sales of $90M in 2017 (according to GMI—Zero wouldn’t confirm revenue data).

“We’re the number one full sized electric motorcycle manufacturer in the world. We sell more every year than all our competitors combined,” CEO Sam Pascheltold TechCrunch—though Zero did not provide exact figures.

Like Alta, Zero manufactures its EVs in the USA. The startup’s ZForce battery connects to an internal magnet driven motor. Both are governed by a proprietary Main Bike Board (MBB) processor “the brain…that houses all of our algorithms,” said Zero’s VP for Product Development Brian Wisman.

“The specific energy that’s achieved on Zero’s lithium ion batteries is far greater than anything achieved by automotive EVs right now,” he said.

Zero motorcycles connect via Bluetooth to an app that allows riders to monitor and adjust performance from devices. The company’s EV’s can be fast charged from charging stations or by plugging into the same home outlet that powers your toaster.

In addition to citizen motorcyclists, Zero has started specialized fleet sales to the U.S. military and police departments.

The ride

I got a chance to test models from all three companies. The most significant distinctions between their e-motos and gas two-wheelers are power delivery and no shifting.

Zero, Alta, and Energica’s machines are fully automatic—no clutch or gears.

Simply flick the on switch and twist the throttle to go. When you do an immediate and uninterrupted stream of voltage powered torque launches you forward. The wind is louder than the motor—though each e-motorcycle has a distinct sound—and when you stop there’s silence.

Energica’s big battery acceleration is akin to striking a lightning bolt to the pavement. Alta’s lightweight RedShift MXR is quick, nimble, and flight capable on a motocross track. And Zero’s SR feels distinctly balanced across power, performance, and rideability. I didn’t find myself missing gas motorcycles at any point of the tests.

The biz play

Energica, Alta, and Zero face their own steep climbs to profitability—and the e-moto space has already seen two flops in Mission Motorcycles’ collapse and Brammo sputtering out.

“We do have a burn rate. Like any sub-scale EV manufacturer such as Tesla, we are pre-profit,” said Zero CEO Sam Paschel. “The way to win is scale.”

And while these electric startups probably can’t revive new U.S. motorcycles sales to seven-figures annually—that would take 12 years of five percent growth—they could play a role in transforming the global motorcycle industry.

As their models close gaps on price, performance, weight, recharge times, and ride distance—Zero, Alta, and Energica could shift the market from gas to electric.

Their tech appeal and simplicity to ride could bring more first-time and younger riders into motorcycling, including women.

This — and Harley’s EV production commitment — could pressure the likes of Honda, Yamaha, and Ducati to produce electric motorcycles sooner.

These factors (and regulatory tailwinds) could thrust Alta, Zero, and Energica into an active space for partnerships, mergers, and acquisitions. Their compact, lightweight technology has application for other non-auto, non-motorcycle e-mobility solutions.

Growing competitive pressure and a shift in two-wheel consumer preferences could also make Energica, Zero, and Alta acquisition targets for mainline motorcycle manufacturers.

That’s a lot of speculation, but the big gas manufacturers are apparently watching. “Since Harley’s EV announcement, three of the big motorcycle companies bought one of our bikes,” an exec from one of the startups told me on background.

“We’d like to think they’re just curious to ride our e-motos, but more than likely it’s to break them down and study the tech,” the exec said.