Yahoo put of lot of effort and investment toward presenting a new Yahoo to the world in 2013, and a lot of that has hinged on improving its mobile business. There have been significant updates to old apps; over a dozen (out of a total of 28) mobile-related acquisitions to pick up talent, technology and products; and tests for what Yahoo should focus on next. But even as it has managed to grow its mobile audience this year, Yahoo is exiting 2013 on a mobile low note: not one of its apps is in the top 100 chart on the iTunes App Store.

This dearth of winners is a sign of how, despite all the effort, Yahoo has not (yet?) managed to tap into a ‘breakthrough’ app that has remained a perennial favorite, with the downloads to prove it. Nevermind the new-look apps, and the out with the old, in with the new logo: Yahoo! remains Yahoo!

As a point of comparison, consider how other app publishers are faring in Apple’s top 100: Google has five apps (Google Search, Google Maps, Gmail, YouTube and Chrome). Facebook has three (Facebook, Facebook Messenger, Instagram). Twitter has two (Twitter and Vine). And a number of companies like Microsoft (Skype), Netflix, Amazon, eBay, Pinterest, Snapchat, Uber — “even fucking Groupon,” as one observer noted to us — have one apiece.

(Tumblr, acquired by Yahoo for $1.1 billion and with its own recent update, also failed to make the cut. According to AppAnnie, it’s currently at No. 110.)

So what’s going on here? You could argue Yahoo has yet to tap into a blockbuster on the platform it has chosen as its primary one, and as a result is finishing 2013 not with a mobile bang but a whimper.

“It is very clear that whatever they are doing over there is not working because people have spoken and they do not want Yahoo’s apps on their mobile,” our observer notes.

What is worth pointing out, though, are a couple of important caveats, which either will help Yahoo buy time, or may prove to be a strategy in its own right.

While Yahoo may not have a single bona-fide hit on its hands, what it is doing is spreading its bets, doing alright (if not brilliantly) on Android, and continuing to get repeat usage among those who have already downloaded its apps.

Comscore, according to its latest U.S. smartphone usage statistics from earlier this month (October 2013 figures) notes that Yahoo is the third most-popular property behind Google and Facebook on smartphones, with a reach of nearly 78 percent, some 11 percentage points behind Google. Yahoo has managed to hold on to that No. 3 spot for a while now, although its reach has declined compared to the previous few months (eg September: 82.2 percent reach; August: 83.2 percent).

Although Yahoo has long been making efforts to streamline its presence on mobile, Yahoo currently has 15 apps in the U.S. App Store (16 if you count Tumblr).

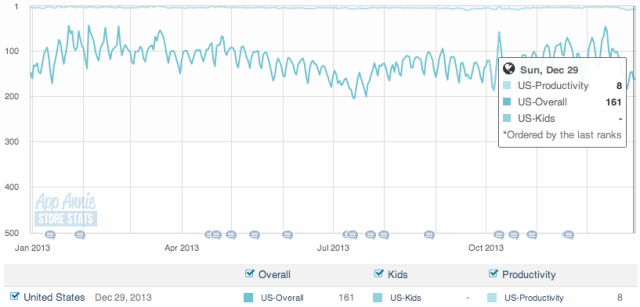

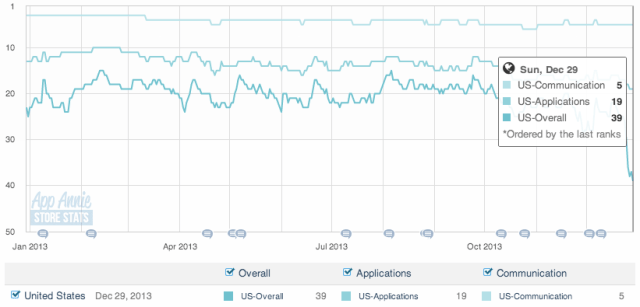

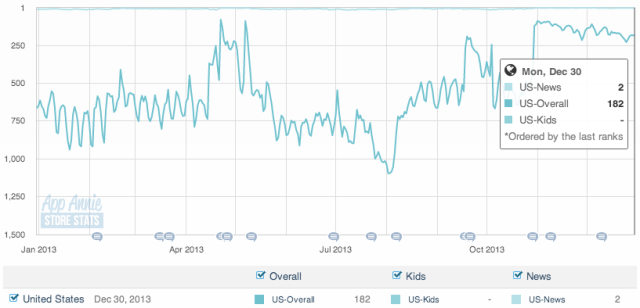

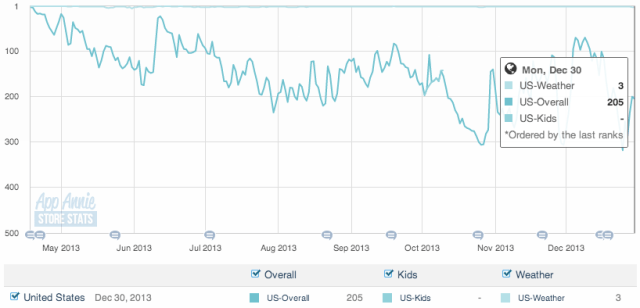

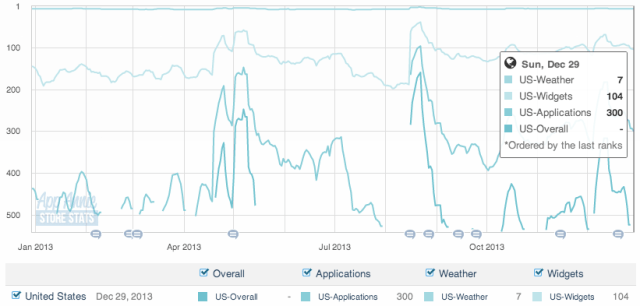

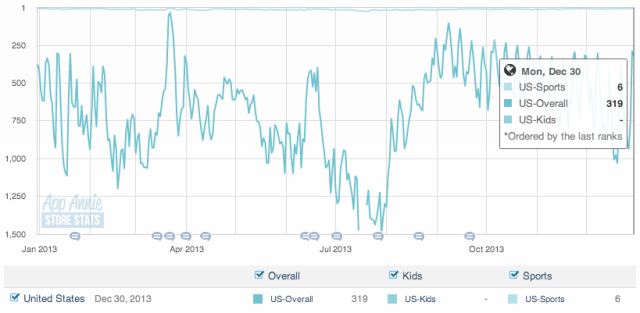

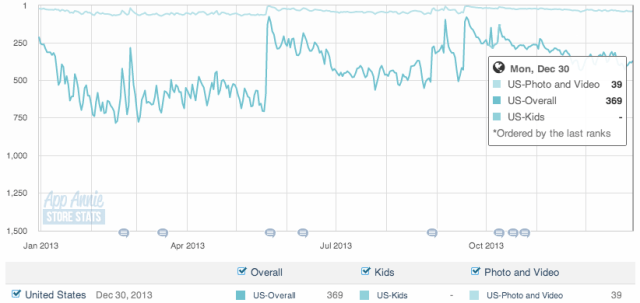

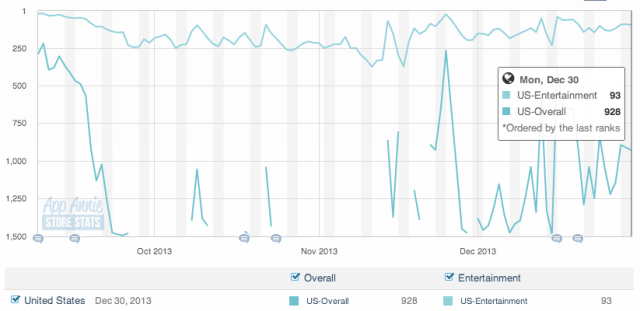

Using App Annie’s historical data, you can see that within individual categories like Weather, News and Sports, Yahoo has been consistent at the top of the rankings, even as its overall standing for each app has fluctuated with spikes around updates. I’ve included the figures on Android where they are available.

Yahoo Mail:

(iOS)

(Android)

Yahoo (News):

Yahoo Weather:

(iOS)

(Android)

Yahoo Sports (formerly Sportacular):

Flickr:

Less successful (and a sign of how video will need a lot more focus if Yahoo indeed makes this a core focus of its revenue and audience growth) is Yahoo Screen:

Yahoo Screen:

Most-downloaded versus most-used

Interestingly, none of these apps make it to the most-used app rankings as detailed by comScore.

Instead, its most recent figures note that Yahoo Stocks (a widget perhaps, since there is no standalone app by that name, unless comScore means Yahoo Finance), and Yahoo’s Weather Widget (not app) are the company’s most popular smartphone apps at the moment, respectively ranking 9th and 11th, with reaches of 29.9 percent and 23.6 percent. They are separated by Instagram, which has a reach of 25.5 percent.

What this also implies is that installed usage may not always correlate to downloads, too. But it also muddles something: monetizing something like Snapchat or Instagram is likely to be a whole lot bigger of an opportunity than monetizing a weather widget.

In November 2013, Yahoo’s CEO Marissa Mayer said the company had 400 million monthly active users on mobile, compared to the 390 million the company noted a month before, and the 350 million Mayer noted during the TC Disrupt conference in September. This points to an audience that continues to increase, if slowly.

Can Yahoo sustain that growth with its current mobile portfolio, and is it enough to translate to wider financial success for the company? Mayer has said in the past that getting to where Yahoo would like to be could take another three to four years.

The question is whether its lack of popularity so far is simply a premature red herring, or a sign of more lacklustre things to come.