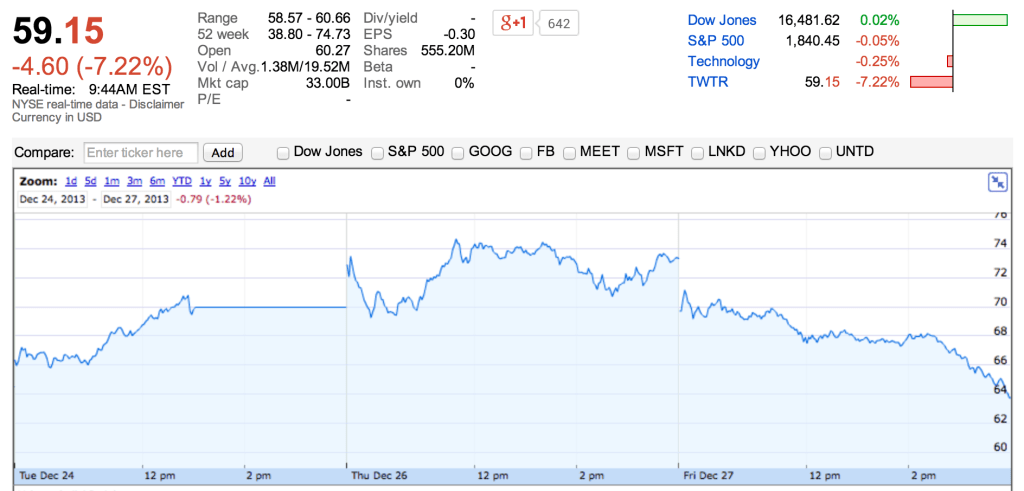

Today at market opening, Twitter shares (NYSE:TWTR) dropped once again. Shares were at $60.27, down 5.46 percent compared to Friday’s closing price of $63.75. This nosedive marks the end of the honeymoon between Twitter and the NYSE as many analysts stated that shares are overpriced. Until now, the stock held strong amid those reports, but that seems to be coming to an end.

It is not the first drop as shares were already down 13 percent on Friday, shaving $5 billion off Twitter’s market capitalization. It was a big correction of Thursday’s good performance — on Thursday, shares popped 5 percent for no apparent reason.

Many analysts find that Twitter is an expensive company. With a market cap of $33.6 billion, the company has yet to turn a profit — analysts don’t expect to see any profit before 2015. But this pessimistic trend on the analyst’s side seems to be increasing. On Friday, Macquarie analyst Ben Schachter downgraded Twitter.

According to Bespoke Investment Group, the average price target stands at $44.27, around 37 percent below today’s trading price.

But why is the stock price dropping today? The Twitter IPO was a great sign for the entire tech industry. Private companies saw that the stock market could be friendly again with tech companies — and now, everyone wants to IPO.

When Twitter became a public company on November 7, the company priced its IPO at $26 a share. Shares popped 74 percent on that day. After this very good IPO performance, the stock price has been relatively flat.

Many commented that the IPO was underpriced on purpose to make a big splash on the NYSE. Leaving money on the table was a way to improve the longterm prospects and overall image. Shares are still up around 135 percent compared to the IPO price.

Yet, there was a recent turning point for Twitter shares. When the company introduced retargeted ads in early December, the advertising industry was very enthusiastic. Ads would soon be more relevant thanks to browser cookies and more user information. And shareholders voted with their wallets.

Shares went from $44.95 on December 6 to $73.31 on December 26. It represents a 63.1 percent increase, or a $15.7 billion increase in market capitalization. But it wasn’t sustainable on the long run. This 3-week honeymoon was great while it lasted, but it’s time to come back to reality.

Update at 9:45 am (ET): Shares are now down 7.22 percent to $59.15 a share.