You might know him for his viral tweets, but Turner Novak wasn’t always a master meme-maker.

Instead, Novak grew up with a single mother in the United States. The financial situation of his family led to the internet being not always accessible. They often hop-scotched between discounted trials and went months without access. The experience, he says, was formative in his relationship with technology more broadly.

“It really made me appreciate just how impactful and how important the internet is” he said. “And it [taught] me how to use it efficiently.”

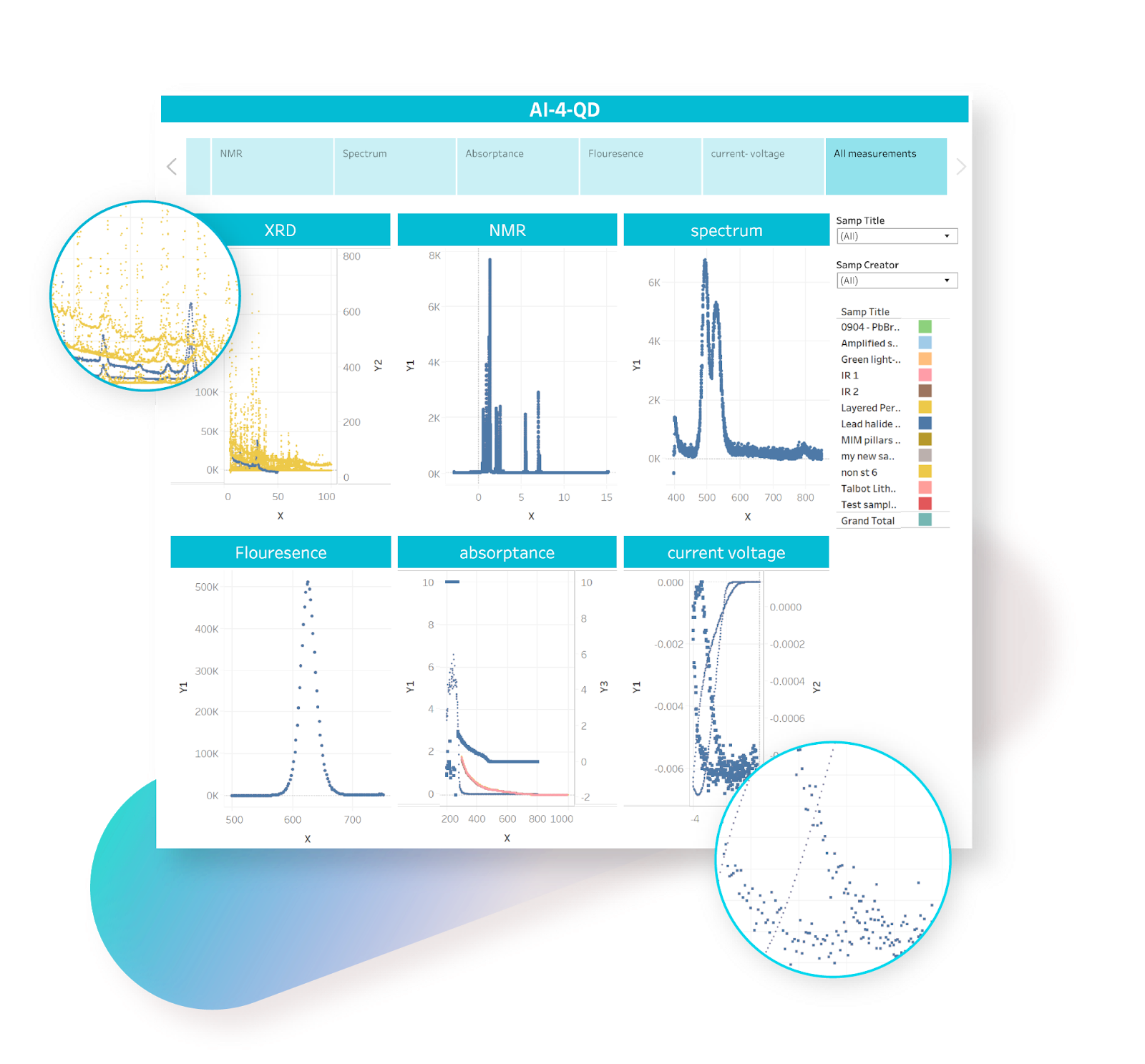

Now, the investor has started a firm peeled from the ethos. Banana Capital is a firm that will seed and source consumer tech founders from the corners of the web. The oversubscribed debut fund is $9.99 million and the average check size is between $25,000 to $300,000. Investors in Banana Capital include Winnie co-founder Sara Mauskopf, Andreessen Horowitz general partner Sriram Krishnan and GGV managing partner Hans Tung. VC Starter Kit, a meme account for tech Twitter, is also an LP.

Novak will be investing in the broad consumer sector, with specific interest in early-stage startups in the social, healthcare and e-commerce sector. He is targeting ownership between 0.2% to 3%. Comparatively, Cleo Capital, a pre-seed stage with the same assets under management, leads checks and targets between 15% to 20% ownership in its rounds.

Novak says he made a choice to actively target low ownership instead of leading rounds to give him flexibility in what stages to play in long term.

Memes and banana peels

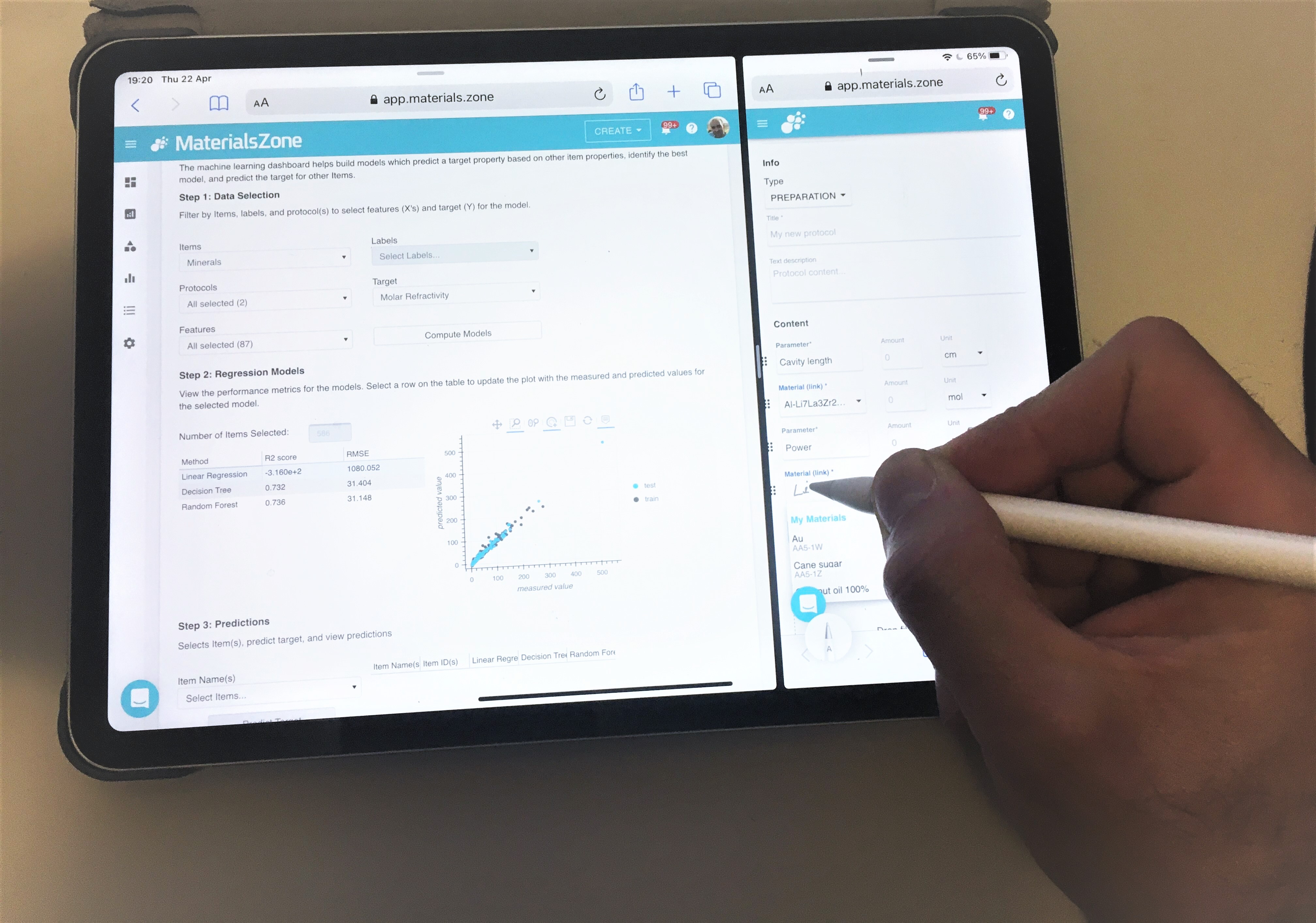

Novak describes Banana Capital as an internet-first fund. But while that phrase can often be a buzzword, his track record gives some color on how a network built by the internet, instead of geography, looks.

Novak’s vibe might be best shown in his meme game. Novak was part of the Eye Mouth Eye (

) campaign that rocked Silicon Valley in June 2020, that used meme culture to illustrate how FOMO and hype are what catch investor attention. He is one of a handful of investors who religiously post memes on Twitter and TikTok about tech. He has a recurring series about audio social app Clubhouse and its fundraisers. One of his viral tweets was a mock video of a startup pitching to a VC, which racked up more than 186,200 views on Twitter, as well as a handful of duets on TikTok.

) campaign that rocked Silicon Valley in June 2020, that used meme culture to illustrate how FOMO and hype are what catch investor attention. He is one of a handful of investors who religiously post memes on Twitter and TikTok about tech. He has a recurring series about audio social app Clubhouse and its fundraisers. One of his viral tweets was a mock video of a startup pitching to a VC, which racked up more than 186,200 views on Twitter, as well as a handful of duets on TikTok.

While some of his tweets are simply for the spice, the memes have become somewhat of a strategy for the emerging fund manager. His mock pitch video, for example, led to an investment in a company. Founders often directly message him after a tweet inviting him to join an open cap table slot. The strategy is part of his differentiation when it comes to deal flow. Banana Capital’s portfolio has 11 known investments, including Flexbase, Skillful and Bottomless.

announcing TikTok startup pitch: duet this video pitching your startup

https://t.co/gNTBfrUzW7 pic.twitter.com/aJUtmcYgIx

— Turner Novak (@TurnerNovak) October 20, 2020

“It just kind of happens where [my investments] are people who understand the culture of the internet, to understand memes and understand wit and humor and appreciate that a little bit more,” he said. “Those are probably the people that are more naturally intuitive investments, so it definitely does skew that direction.”

While Novak didn’t share explicit targets or mandates around investment in diverse founders, he pointed to his track record at Gelt VC, in which 41% of capital went to woman CEOs. To date, 65% of Banana Capital’s portfolio founding teams include non-white founders and 50% of the teams include more than one gender.

Novak plans on staying in Ann Arbor, Michigan for the foreseeable future, but couldn’t resist a poke at Miami, a growing, buzzy tech hub. URL jokes aside, his geography, so to speak, will be the internet.

“My network is not in San Francisco and New York, it’s more so just people like on the internet,” he said. “That’s just how I meet people.”

Novak had multiple explanations for why he is choosing to call his firm Banana Capital. First, bananas are one of the most consumed fruits out there and have been through numerous iterations and bio-engineering processes throughout history, with a nod to the focus of his investments in the consumer sphere.

Second? “There really are no fruit funds out there,” he said. “My vibe is that I take myself a little less seriously than other people and the name just reflected that.