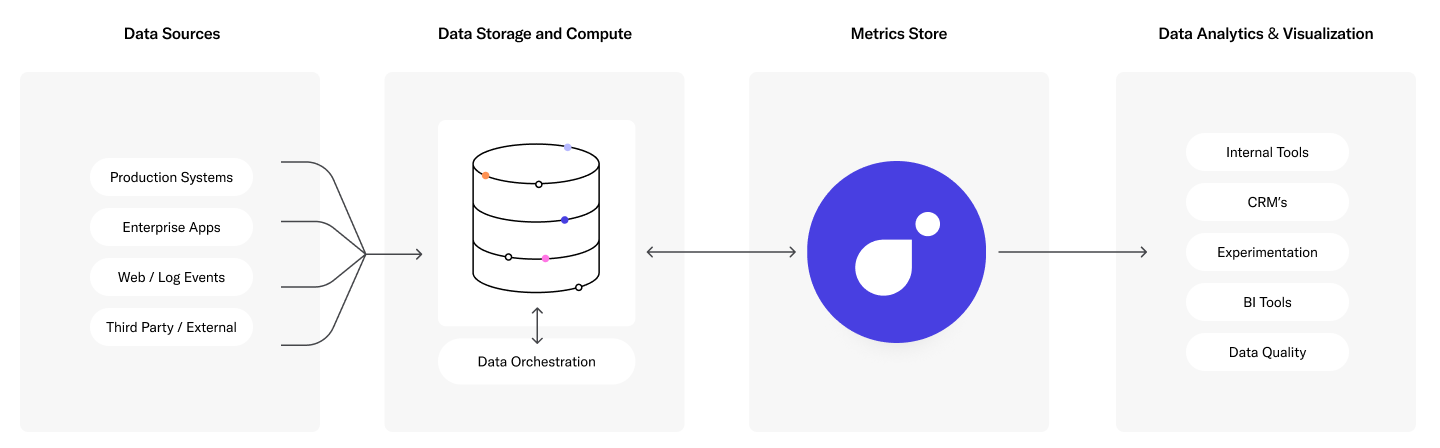

The biggest tech companies have put a lot of time and money into building tools and platforms for their data science teams and those who work with them to glean insights and metrics out of the masses of data that their companies produce: how a company is performing, how a new feature is working, when something is broken, or when something might be selling well (and why) are all things you can figure out if you know how to read the data.

Now, three alums that worked with data in the world of Big Tech have founded a startup that aims to build a “metrics store” so that the rest of the enterprise world — much of which lacks the resources to build tools like this from scratch — can easily use metrics to figure things out like this, too.

Transform, as the startup is called, is coming out of stealth today, and it’s doing so with an impressive amount of early backing — a sign not just of investor confidence in these particular founders, but also the recognition that there is a gap in the market for, as the company describes it, a “single source of truth for business data” that could be usefully filled.

The company is announcing that it has closed, while in stealth, a Series A of $20 million, and an earlier seed round of $4.5 million — both led by Index Ventures and Redpoint Ventures. The seed, the company said, also had dozens of angel investors, with the list including Elad Gil of Color Genomics, Lenny Rachitsky of Airbnb and Cristina Cordova of Notion.

The big breakthrough that Transform has made is that it’s built a metrics engine that a company can apply to its structured data — a tool similar to what Big Tech companies have built for their own use, but that hasn’t really been created (at least until now) for others who are not those Big Tech companies to use, too.

Transform can work with vast troves of data from the warehouse, or data that is being tracked in real time, to generate insights and analytics about different actions around a company’s products. Transform can be used and queried by nontechnical people who still have to deal with data, Handel said.

The impetus for building the product came to Nick Handel, James Mayfield and Paul Yang — respectively Transform’s CEO, COO and software engineer — when they all worked together at Airbnb (previously Mayfield and Yang were also at Facebook together) in a mix of roles that included product management and engineering.

There, they could see firsthand both the promise that data held for helping make decisions around a product, or for measuring how something is used, or to plan future features, but also the demands of harnessing it to work, and getting everyone on the same page to do so.

“There is a growing trend among tech companies to test every single feature, every single iteration of whatever. And so as a part of that, we built this tool [at Airbnb] that basically allowed you to define the various metrics that you wanted to track to understand your experiment,” Handel recalled in an interview. “But you also want to understand so many other things like, how many people are searching for listings in certain areas? How many people are instantly booking those listings? Are they contacting customer service, are they having trust and safety issues?” The tool Airbnb built was Minerva, optimised specifically for the kinds of questions Airbnb might typically have for its own data.

“By locking down all of the definitions for the metrics, you could basically have a data engineering team, a centralized data infrastructure team, do all the calculation for these metrics, and then serve those to the data scientists to then go in and do kind of deeper, more interesting work, because they weren’t bogged down in calculating those metrics over and over,” he continued. This platform evolved within Airbnb. “We were really inspired by some of the early work that we saw happen on this tool.”

The issue is that not every company is built to, well, build tools like these tailored to whatever their own business interests might be.

“There’s a handful of companies who do similar things in the metrics space,” Mayfield said, “really top flight companies like LinkedIn, Airbnb and Uber. They have really started to invest in metrics. But it’s only those companies that can devote teams of eight or 10, engineers, designers who can build those things in house. And I think that was probably, you know, a big part of the impetus for wanting to start this company was to say, not every organization is going to be able to devote eight or 10 engineers to building this metrics tool.”

And the other issue is that metrics have become an increasingly important — maybe the most important — lever for decision making in the world of product design and wider business strategy for a tech (and maybe by default, any) company.

We have moved away from “move fast and break things.” Instead, we now embrace — as Mayfield put it — “If you can’t measure it, you can’t move it.”

Transform is built around three basic priorities, Handel said.

The first of these has to do with collective ownership of metrics: by building a single framework for measuring these and identifying them, their theory is that it’s easier for a company to all get on the same page with using them. The second of these is to use Transform to simply make the work of the data team more efficient and easier, by turning the most repetitive parts of extracting insights into automated scripts that can be used and reused, giving the data team the ability to spend more time analyzing the data rather than just building data sets. And third of all, to provide customers with APIs that they can use to embed the metric-extracting tools into other applications, whether in business intelligence or elsewhere.

The three products it’s introducing today, called Metrics Framework, Metrics Catalog and Metrics API, follow from these principles.

Transform is only really launching publicly today, but Handel said that it’s already working with a small handful of customers (unnamed) in a small beta, enough to be confident that what it’s built works as it was intended. The funding will be used to continue building out the product as well as bring on more talent and hopefully onboard more businesses to using it.

Hopefully might be less a tenuous word than its investors would use, convinced that it’s filling a strong need in the market.

“Transform is filling a critical gap within the industry. Just as we invested in Looker early on for its innovative approach to business intelligence, Transform takes it one step further by providing a powerful yet streamlined single source of truth for metrics,” said Tomasz Tunguz, MD, Redpoint Ventures, in a statement.

“We’ve seen companies across the globe struggle to make sense of endless data sources or turn them into actionable, trusted metrics. We invested in Transform because they’ve developed an elegant solution to this problem that will change how companies think about their data,” added Shardul Shah, a partner at Index Ventures.