It seems increasingly likely that antitrust and content moderation tools aren’t up to the task. Here’s what we do next.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

Florida’s Condo Collapse Foreshadows the Concrete Crack-Up

Overreliance on the world’s favorite building material will lead to more crumbling towers, dams, bridges, and roads. And way more greenhouse gases.

Which Crops Can Survive Drought? Nanosensors May Offer Clues

The technique can be used to track how water flows through plants—which could be key to breeding more resilient crops in an increasingly hot, dry climate.

How to Take Awesome Photos of Fireworks With Your Phone

Use these battle-tested tips and camera settings to capture dramatic shots of those aerial explosions.

The Games Done Quick Marathon Is More Important Than Ever

For years, GDQ has brought together gamers to speedrun for charity. After a year of loss and loneliness, the event means so much more.

Do These Gadgets Actually Protect You? We Asked the Experts

From cell phone radiation and RFID blockers to UVC sanitizers, we investigated whether popular products are truly keeping you safe—or just scaremongering.

The Miami Tower Collapse and Humanity’s Fight for the Future

From the fallen Champlain Tower to climate change, humans haven’t yet learned to avoid catastrophes they know are coming.

Uber’s first head of data science just raised a new venture fund to back nascent AI startups

Kevin Novak joined Uber as its 21st employee its seventh engineer in 2011, and by 2014, he was the company’s head of data science. He talks proudly of that time, but like all good things, it ran its course and by the end of 2017, having accomplished what he wanted at the company, he left.

At first, he picked up the pace of his angel investing, work he’d already begun focusing on during weekends and evenings, ultimately building a portfolio of more than 50 startups (including the fintech Pipe and the autonomous checkout company Standard Cognition).

He also began advising both startups and venture firms — including Playground Global, Costanoa Ventures, Renegade Partners and Data Collective — and after falling in love with the work, Novak this year decided to launch his own venture outfit in Menlo Park, Ca., called Rackhouse Venture Capital. Indeed, Rackhouse just closed its debut fund with $15 million, anchored by Uber’s first head of engineering, Curtis Chambers; Steve Gilula, a former chairman of Searchlight Pictures, and the fund of funds Cendana Capital. A lot of the VCs Novak knows are also investors in the fund.

We caught up with Novak late last week to chat out that new vehicle. We also talked about this tenure at Uber, where, be warned, he played a major role in creating surge pricing (though he prefers the term “dynamic pricing.”) You can hear that fuller discussion or check out excerpts from it, edited lightly for length and clarity, below.

TC: You were planning to become a nuclear physicist. How did you wind up at Uber?

KN: As an undergrad, I was studying physics, math and computer science, and when I got to grad school, I really wanted to teach. But I also really liked programming and applying physics concepts in the programming space, and the nuke department had the largest allocation of supercomputer time, so that ended up driving a lot of my research — just the opportunity to play on computers while doing physics. So [I] was studying to become a nuclear physicist was funded very indirectly through the research that eventually became the Higgs boson. As the Higgs got discovered, it was very good for humanity and absolutely horrible for my research budget . . .

A friend of mine heard what I was doing and sort of knew my skill set and said, like, ‘Hey, you should come check out this Uber cab company that it’s like a limo company with an app. There’s a very interesting data problem and a very interesting math problem.’ So I ended up applying [though I committed] the cardinal sin of startup applications and wore a suit and tie to my interview.

TC: You’re from Michigan. I also grew up in the Midwest so appreciate why you might think that people would wear a suit to an interview.

KN: I got off the elevator and the friend who’d encouraged me to apply was like, ‘What are you wearing?!’ But I got asked to join nonetheless as a computational algorithms engineer — a title that predated the data science trend — and I spent the next couple of years living in the engineering and product world, building data features and . . .things like our ETA engine, basically predicting how long it would take an Uber to get to you. One of my very first projects was working on tolls and tunnels because figuring out which tunnel an Uber went through and how to build time and distance was a common failure point. So I spent, like, three days driving the Big Dig in Boston out to Somerville and back to Logan with a bunch of phones, collecting GPS data.

I got to know a lot of very random facts about Uber cities, but my big claim to fame was dynamic pricing. . . and it turned out to be a really successful cornerstone for the strategy of making sure Ubers were available.

TC: How does that go over, when you tell people that you invented surge pricing?

KN: It’s a very quick litmus test to figure out like people’s underlying enthusiasm for behavioral econ and finance. The Wall Street crowd is like, ‘Oh my god, that’s so cool.’ And then a lot of people are like, ‘Oh, thank you, yeah, thank you so much, wonderful, you buy the next round of drinks’ type of thing. . . [Laughs.]

But data also became the incubation space for a lot of the early special projects like Uber pool and a lot of the ideas around, okay, how would you build a dispatching model that enables different people with pooled ride requests? How do you batch them together efficiently in space and time so that we can get the right match rate that [so this] project is profitable? We did a lot of work on the theory behind the hub-and-spoke Uber Eats delivery models and thinking through how we apply our learnings about ride-share to food. So I got the first person perspective on a lot of these products when it was literally three people scribbling on a notepad or riffing on a laptop over lunch, [and which] eventually went on to become these big, nationwide businesses.

TC: You were working on Uber Freight for the last nine months of your career with Uber, so there when this business with Anthony Levandowski was blowing up.

KN: Yeah, it was it was very interesting era for me because more than six years in, [I was already developing the] attitude of ‘I’ve done everything I wanted to do.’ I joined a 20-person company and, at the time, we were closing in on 20,000 people . . .and I kind of missed the small team dynamic and felt like I was hitting a natural stopping point. And then Uber’s 2017 happened and and there was Anthony, there was Susan Fowler, and Travis has this horrific accident in his personal life and his head was clearly not in the game. But I didn’t want to be the guy who was known for bailing in the worst quarter of the company’s history, so I ended up spending the next year basically keeping the band together and trying to figure out what I could do to keep whatever small part of the company I was running intact and motivated and empathetic and good in every sense of the word.

TC: You left at the end of that year and it seems you’ve been very busy since, including, now, launching this new fund with the backing of outsiders. Why call it Rackhouse? You used the brand Jigsaw Venture Capital when you were investing your own money.

KN: Yeah. A year [into angel investing], I had formed an LLC, I was “marking” my portfolio to market, sending quarterly updates to myself and my accountant and my wife. It was one of these exercises that was a carryover from how I was training managers, in that I think you grow most efficiently and successfully if you can develop a few skills at a time. So I was trying to figure out what it would take to run my own back office, even if it was just moving my money from my checking account to my “investing account,” and writing my own portfolio update.

I was really excited about the possibility of launching my first externally facing fund with other people’s money under the Jigsaw banner, too, but there’s actually a fund in the UK [named Jigsaw] and as I started to talk to LPs and was saying ‘Look, I want to do this data fund and I want it to be early stage,’ I’d get calls from them being like, ‘We just saw that Jigsaw did this Series D in Crowdstrike.’ I realized I’d be competing with the other Jigsaw from a mindshare perspective, so figured before things go too big and crazy, I’d create my own distinct brand.

TC: Did you roll any of your angel-backed deals into the new fund? I see Rackhouse has 13 portfolio companies.

KN: There are a few that I’ve agreed to move forward and warehouse for the fund, and we’re just going through the technicalities of doing that right now.

TC: And the focus is on machine learning and AI.

KN: That’s right, and I think there are amazing opportunities outside of the traditional areas of industry focus that, to the extent that you can find like rigorous applications of AI, are also going to be significantly less competitive. [Deals] that don’t fall in the strike zone of nearly as many [venture] firms is the game I want to be playing. I feel like that that opportunity — regardless of sector, regardless of geography — biases toward domain experts.

TC: I wonder if that also explains the size of your fund — your wanting to stay out of the strike zone of most venture firms.

KN: I want to make sure that I build a fund that enables me to be an active participant in the earliest stages of companies.

Matt Ocko and Zack Bogue [of Data Collective] are good friends of mine — they’re mentors, in fact, and small LPs in the fund and talked with me about how they got started. But now they have a billion-plus [dollars] in assets under management, and he people I [like to back] are two people who are moonlighting and getting ready to take the plunge and [firms the size of Data Collective] have basically priced themselves out of the formation and pre-seed stage, and I like that stage. It’s something where I have a lot of useful experience. I also think it’s the stage where, if you come from a place of domain expertise, you don’t need five quarters of financials to get conviction.

Nodes & Links raises $11M to — maybe — save billions on the big projects the world needs now

Nodes & Links is a scheduling platform for large-scale infrastructure projects which works out when the nuts and bolts for the bridge (for example) should be delivered, and in what order. Unsurprisingly, complex infrastructure projects often get this wrong. The company has now raised an $11 million Series A funding round led by urban sustainability-focused fund 2150, alongside Zigg Capital and Westerly Winds, with participation from existing investors Entrepreneur First, ADV and Seedcamp.

Launched in 2018, the company’s Aegis platform is used by Balfour Beatty, Costain and BAM Nuttal, and claims to have delivered millions in cost savings on infrastructure projects, because the building materials and assembly ends up being organized in the right order. Given that most major projects run significantly over time and over budget, scheduling correctly can make a huge difference to costs, as well as the impact on the environment.

The company quotes a survey by Oxford University that found that only 8% of infrastructure projects get delivered on time and on budget.

“Complex projects account for over 4% of the world’s GDP, yet only 8% of them complete on budget and on time,” Nodes and Links CEO Greg Lawton said. “This is largely because humans are responsible for all tasks within projects, even the repetitive and complex ones they’re unsuited to, instead of the high-value, creative activities people are uniquely qualified for. By expanding our workforce to include machines, better decisions will be made and better projects delivered. We firmly believe that the work we’re doing is going to have the same impact as automation did in manufacturing and this new investment will help us accelerate its adoption for the common good.”

Nodes & Links competes with large infrastructure software such as Oracle Primavera, as well as plain old Excel spreadsheets, for obvious reasons.

“The world is accelerating its investment into linear infrastructure, much of it with a focus on sustainability and resilience,” Christian Hernandez, Partner at 2150 said. “Time is the biggest lever available to ensure that trillions of dollars of projects starts delivering benefits to our planet and Nodes & Links has proven that they can help large and complex engineering projects deliver on that.”

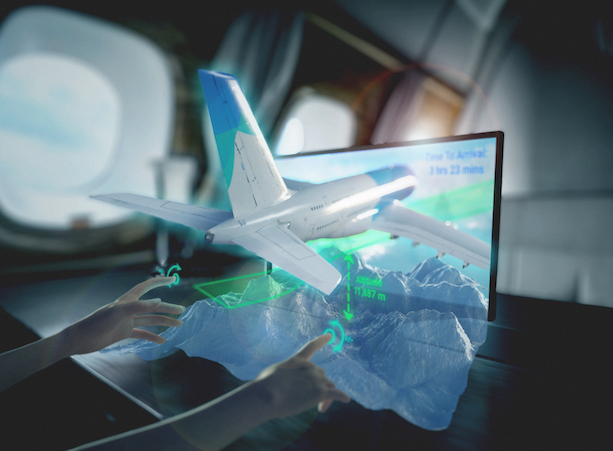

VividQ, which has raised $15M, says it can turn normal screens into holographic displays

VividQ, a UK-based deeptech startup with technology for rendering holograms on legacy screens, has raised $15 million to develop its technology for next-generation digital displays and devices. And it’s already lining up manufacturing partners in the US, China and Japan to do it.

The funding round, a Seed extension round, was led by UTokyo IPC, the venture investment arm for the University of Tokyo. It was joined by Foresight Williams Technology (a joint collaboration between Foresight Group and Williams Advanced Engineering), Japanese Miyako Capital, APEX Ventures in Austria, and the R42 Group VC out of Stanford. Previous investors University of Tokyo Edge Capital, Sure Valley Ventures, and Essex Innovation also participated.

The funding will be used to scale VividQ’s HoloLCD technology, which, claims the company, turns consumer-grade screens into holographic displays.

Founded in 2017, VividQ has already worked with ARM, and other partners, including Compound Photonics, Himax Technologies, and iView Displays.

The startup is aiming its technology at Automotive HUD, head-mounted displays (HMDs), and smart glasses with a Computer-Generated Holography that projects “actual 3D images with true depth of field, making displays more natural and immersive for users.” It also says it has discovered a way to turn normal LCD screens into holographic displays.

“Scenes we know from films, from Iron Man to Star Trek, are becoming closer to reality than ever,” Darran Milne, co-founder and CEO of VividQ, said. “At VividQ, we are on a mission to bring holographic displays to the world for the first time. Our solutions help bring innovative display products to the automotive industry, improve AR experiences, and soon will change how we interact with personal devices, such as laptops and mobiles.”

VividQ

Mikio Kawahara, chief investment officer of UTokyo IPC, said, “The future of display is holography. The demand for improved 3D images in real-world settings is growing across the whole display industry. VividQ’s products will make the future ambitions of many consumer electronics businesses a reality.”

Hermann Hauser, APEX Ventures’ advisor, and co-founder of Arm added: “Computer-Generated Holography recreates immersive projections that possess the same 3D information as the world around us. VividQ has the potential to change how humans interact with digital information.”

Speaking on a call with me, Milne added: “We have put the technology on gaming laptops that can actually take make use of holographic displays on a standard LCD screen. So you know the image is actually extending out of the screen. We don’t use any optical trickery.”

“When we say holograms, what we mean is a hologram is essentially an instruction set that tells light how to behave. We compute that effect algorithmically and then present that to the eye, so it’s indistinguishable from a real object. It’s entirely natural as well. Your brain and your visual system are unable to distinguish it from something real because you’re literally giving your eyes the same information that reality does, so there’s no trickery in the normal sense,” he said.

If this works, it could certainly be a transformation, and I can see it being married very well with technology like UltraLeap.

Daily Crunch: Insecure server exposes Byju’s students’ names, phone numbers, emails and more

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PDT, subscribe here.

Hello and welcome to Daily Crunch for June 30, 2021. It’s the last day of the quarter. It’s the last day of the first half of the year. It’s the halfway mark for your New Year’s resolutions. The kickoff of Q3 means that we are heading into yet another earnings season. To close the second quarter, a number of companies went public including Didi and SentinelOne. The TechCrunch take is that we’re seeing some interesting pricing differentials between companies from the United States compared to China. — Alex

The TechCrunch Top 3

- Robinhood fined ahead of IPO: While we count down to Robinhood’s IPO filing, long expected after a strong first quarter, the company was hit with $70 million in fines and penalties today for what the Financial Industry Regulatory Authority (FINRA) described as “widespread and significant harm suffered by customers.”

- Venture capital drama: TechCrunch’s Natasha Mascarenhas scooped that SF-based Hinge Health booted a board member after they invested in what the company considered to be a competitor. The news is notable by itself, but also underscores how founder-friendly the market truly is today; this might not have happened back when venture capitalists held more power.

- Byju’s leaks student data: Today’s breach involves a startup called Salesken.ai, an exposed server, and Byju’s user data. Byju’s is an Indian edtech company, and a very highly valued one at that. Salesken provides what TechCrunch describes as “customer relationship technology,” which helps explain why it might have had the other company’s data. No excuse, however.

Startups/VC

Let’s start our startup coverage today with three space-related stories:

- Virgin Orbit completes first commercial launch: Sure, SpaceX exists, but competition is a good thing and thus it’s nice to hear that another company is able to put important bits of tech into orbit.

- Gilmour Space wants in on the same action: And the launch company has just raised a $46 million Series C to get to space next year. Gilmour’s rocket is smaller than others that you might be familiar with. But, again, more competition is good. It means lower prices and better service.

- Remember that 3D rocket-printing company that raised $650 million Series E earlier this year? It’s building out a 1,000,000 square foot factory for production. Bring on the cheap rockets. I want to go to space.

Next up, the creator economy:

- Pietra raises $15M to help creators build product lines: Wagers are still being placed on creators making and selling their own goods, it appears. Which makes sense if you consider the creator economy as still in its nascency and thus has lots of room to grow.

- But while that’s a popular perspective, the passion economy — call it what you will — is not all big checks and instant success. We explored the sector today on the Equity podcast with Alexis Gay joining us for the ride.

But that wasn’t all. Here’s more from today’s critical startup coverage:

- $5M for a LGBTQ+ neobank: While many neobanks are targeting the population at large, others are taking a more targeted approach. Such is the case with Daylight, which wants to provide banking services to the queer community. It joins startups like Fair and others in taking a slightly more niche approach to the popular fintech model.

- $250M for drone logistics: Remember that startup that was using drones to deliver medical supplies in Africa? It was called Zipline. And it has since expanded its goals, technology, and, today, capital base.

- And then there was news from Gusto that the HR-tech unicorn is breaking out pieces of its core technology so that other companies can embed payroll services and the like. While this is cool, what we really want is a Gusto S-1.

Demand Curve: 7 ad types that increase click-through rates

One perennial problem inside startups: Because no one on the founding team has significant marketing experience, growth-related efforts are pro forma and generally unlikely to move the needle.

Everyone wants higher click-through rates, but creating ads that “stand out” is a risky strategy, especially when you don’t know what you’re doing. This guest post by Demand Curve offers seven strategies for boosting CTR that you can clone and deploy today inside your own startup.

Here’s one: If customers are talking about you online, reach out to ask if you can add a screenshot of their reviews to your advertising. Testimonials are a form of social proof that boost conversions, and they’re particularly effective when used in retargeting ads.

Earlier this week, we ran another post about optimizing email marketing for early-stage startups. We’ll have more expert growth advice coming soon, so stay tuned.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Big Tech Inc.

From tech’s biggest companies, we have three stories for you today. Let’s proceed in descending order of market cap, shall we?

- Amazon doesn’t want to be regulated: And it may be worried to boot. That’s our takeaway from news that the company is trying to sideline the current FTC chair. Tough, is our first read of the company’s complaints and demands.

- Instagram wants in on paid following: Following in Big Tweet’s footsteps, Instagram is “building its own version of Twitter’s Super Follow with a feature that would allow online creators to publish ‘exclusive’ content to their Instagram Stories that’s only available to their fans.” So it would be stuff, only available for fans? How interesting. There’s another service that has a similar effort. And Twitter allows for adult content. Instagram does not. Hmm.

- Twitter makes NFTs, because why not: Want to know when something jumps the shark? When a major social network buys in, right? Major social networks are the boomers of the technology world — extending the analogy, Oracle is a ghost that haunts your attic — meaning that they are inherently uncool. And now Twitter has NFTs. Yay, or something.

TechCrunch Experts: Growth Marketing

Image Credits: SEAN GLADWELL (opens in a new window) / Getty Images

TechCrunch wants you to recommend growth marketers who have expertise in SEO, social, content writing and more! If you’re a growth marketer, pass this survey along to your clients; we’d like to hear about why they loved working with you.

If you’re curious about how these surveys are shaping our coverage, check out this interview Miranda Halpern did with Kathleen Estreich and Emily Kramer, co-founders of MKT1, “MKT1: Developer marketing is what startup marketing should look like.”

Lego should snap up this rapid-fire brick-finding iOS app

Lego has worked extremely closely with Apple over the years, experimenting with unreleased iOS tech and demoing it onstage at launch events like WWDC; this has included some pretty heavy tinkering on the augmented reality ARKit platform that they’ve integrated several of their play sets with, adding digital experiences to the physical toys.

But one of the most impressive integrations between iOS tech and physical Lego bricks just popped up on the App Store, and it’s built by a team of fans. The new app Brickit is aiming to one-up what even the Lego Group has created with an app that uses computer-vision tech to quickly make sense of a mountain of bricks.

All users need to do is haphazardly dump Legos into a single layer on the floor. From there the app is able to quickly analyze and identify bricks in the collection and serve up some fun little projects that users have all or most of the bricks they need to build. The most impressive element of the app is its speed — the app is able to make sense of hundreds of bricks in a pile within seconds.

While I unfortunately don’t have access to a pile of Legos at the moment, a TechCrunch colleague demoed the app on iOS and had similarly smooth results to the demo above, with some added loading time in between discovery and when users are able to scroll through suggested projects. While navigating instructions, users are even pointed to the area in the brick pile that a particular needed piece is in.

What the Brickit team has done highlights the power of object recognition in the latest versions of iOS in a way that’s surprisingly useful for this very, very niche use case.

As is, the app is a bit limited by the fact that it’s a third-party design. The App Store’s disclaimer page is quick to specify that this is not an app built by the Lego Group and that its developers are just fans of the product, not employees of the company. Hopefully that’s enough to prevent Lego from overzealously siccing its lawyers on them, but given the app’s impressive use of Apple hardware, it really seems like the company would be better off acquiring the app.

There’s a lot more that Brickit could do with first-party access, mainly in terms of access to integrations with existing libraries of Lego instructions. With Lego’s 2019 acquisition of BrickLink, it’s clear the company has been aiming to capture more of the community fandom around aftermarket creations. Allowing the company to build up a database of the actual bricks that a user has in their possession, thus gaining some insights into the collections of sets that they own, would undoubtedly be valuable data to Lego.

For now the Brickit app is limited to iOS, but the company’s website indicates the team has aims to launch an Android app by the fall.

Dispense with the chasm? No way!

Contributor

Jeff Bussgang, a co-founder and general partner at Flybridge Capital, recently wrote an Extra Crunch guest post that argued it is time for a refresh when it comes to the technology adoption life cycle and the chasm. His argument went as follows:

- VCs in recent years have drastically underestimated the size of SAMs (serviceable addressable markets) for their startup investments because they were “trained to think only a portion of the SAM is obtainable within any reasonable window of time because of the chasm.”

- The chasm is no longer the barrier it once was because businesses have finally understood that software is eating the world.

- As a result, the early majority has joined up with the innovators and early adopters to create an expanded early market. Effectively, they have defected from the mainstream market to cross the chasm in the other direction, leaving only the late majority and the laggards on the other side.

- That is why we now are seeing multiple instances of very large high-growth markets that appear to have no limit to their upside. There is no chasm to cross until much later in the life cycle, and it isn’t worth much effort to cross it then.

Now, I agree with Jeff that we are seeing remarkable growth in technology adoption at levels that would have astonished investors from prior decades. In particular, I agree with him when he says:

The pandemic helped accelerate a global appreciation that digital innovation was no longer a luxury but a necessity. As such, companies could no longer wait around for new innovations to cross the chasm. Instead, everyone had to embrace change or be exposed to an existential competitive disadvantage.

But this is crossing the chasm! Pragmatic customers are being forced to adopt because they are under duress. It is not that they buy into the vision of software eating the world. It is because their very own lunches are being eaten. The pandemic created a flotilla of chasm-crossings because it unleashed a very real set of existential threats.

The key here is to understand the difference between two buying decision processes, one governed by visionaries and technology enthusiasts (the early adopters and innovators), the other by pragmatists (the early majority).

The key here is to understand the difference between two buying decision processes, one governed by visionaries and technology enthusiasts (the early adopters and innovators), the other by pragmatists (the early majority). The early group makes their decisions based on their own analyses. They do not look to others for corroborative support. Pragmatists do. Indeed, word-of-mouth endorsements are by far the most impactful input not only about what to buy and when but also from whom.

SpaceX delivers 88 satellites to orbit, lands first stage onshore for first time in 2021

SpaceX launched 85 satellites for external customers, as well as three Starlink satellites, to orbit on Tuesday, marking the second successful launch of the company’s dedicated rideshare missions. While the Transporter-2 mission will deliver fewer objects to space than the first rideshare mission (the Transporter-1 sent up 143 satellites, a new record), it launched more mass to orbit overall.

The Transporter launches are part of the company’s rideshare business model. Announced in 2019, these missions split up the rocket’s payload capacity among multiple customers, resulting in lower costs for each – many of whom are smaller companies that may find the expenses associated with getting to orbit otherwise impossible to pay. SpaceX still ends up with a full launch and the revenue to operate it.

The Falcon 9 rocket took off from Cape Canaveral in Florida at around 3:31 PM Eastern time. It’s the 20th Falcon 9 launch in 2021 and the first launch this year that featured the first stage returning to land onshore, rather than on a drone ship at sea. The first stage booster separated at around 3:34 PM ET and returned to Cape Canaveral and successfully landed around eight minutes after liftoff. This was its eighth flight.

Image Credits: SpaceX (opens in a new window)

The mission includes nearly 10 customers, some of whom are launch service providers who are themselves organizing customer payloads – like Spaceflight Inc., which is launching 36 small satellites on behalf of 14 customers, as well as its electric propulsion vehicle dubbed Sherpa-LTE. It also includes the first satellite launch for space intelligence company Umbra and Loft Orbital’s “rideshare” satellites, YAM-2 and YAM-3, each of which are equipped with five independent sensors for separate customers.

As this was SpaceX’s 20th launch this year (and 127th mission to date), it’s pretty safe to assume that the company will far surpass last year’s record of 26 launches.

This was the second attempt of the Transporter-2 launch, which was originally scheduled for June 29. That launch was halted at T-11 seconds after a rotary aircraft entered the flight zone. SpaceX CEO Elon Musk called the regulatory system broken in response.

Unfortunately, launch is called off for today, as an aircraft entered the “keep out zone”, which is unreasonably gigantic.

There is simply no way that humanity can become a spacefaring civilization without major regulatory reform. The current regulatory system is broken.

— Elon Musk (@elonmusk) June 29, 2021

BMW i Ventures announces new $300 million fund to invest in sustainable technology

BMW i Ventures, the venture capital arm of BMW Group, has announced a new $300 million fund to further its investment in technologies that make transportation, manufacturing and supply chains more sustainable.

The firm doesn’t operate as a traditional corporate venture capital fund, but rather acts independently from BMW while being fully backed by the German automaker. Its previous €500 million (about $525 million at the time) fund, which was announced when the firm moved to Silicon Valley in 2016, is now at the end of its period for new investments. From now on, new investments will come from Fund II.

Fund I focused more on autonomous and digital vehicle technology, customer experience and advanced production. For example, autonomous truck company Kodiak Robotics, which last week announced an investment from BMW i Ventures, was a part of this fund. Fund II will further emphasize sustainability and zero emissions in all the sectors that lead up to designing, manufacturing and building a car, rather than specifically investing in core car technology.

“Sustainable supply chain is one of the things we’re really interested in right now,” Marcus Behrendt, managing partner at BMW i Ventures, told TechCrunch. “BMW Corp has announced that it wants to significantly reduce its carbon footprint, and therefore it’s looking at all ways of producing this, not just emission from the vehicles, but also the emissions that are produced when manufacturing and developing the cars.”

BMW i Ventures started dipping its toes into such sustainable investments at the end of 2019, investing in Turntide Technologies, a company developing a smart electric motor system, Solid Power, a solid-state battery technology company and Boston Metal, a company looking to decarbonize the metal industry. Its most recent investments, says Behrendt, are indicative of what Fund II will bring. The firm has already made its first investment out of the new fund with U.K.-based Motorway, a used car marketplace.

“We have two goals right now, so the first is the financial goal and that’s our most important driver,” Kasper Sage, managing partner at BMW i Ventures, told TechCrunch. “Certain CVCs out there don’t really care for the return on investment, they just get to benefit from the business deal that comes with the investment, which could actually hurt the business they’re investing in. Our goal is to make the company as successful as we possibly can.”

BMW i Ventures’ second goal is to provide strategic value back to the “mothership,” or BMW Group in Munich. By mainly investing in early-stage companies, the firm has an early market signal that it can convey back to BMW.

“In some cases it’s just making them aware that this new technology exists and might be coming your way,” said Sage. “For example, we invested in Lime, so that’s micromobility, nothing that will ever make its way into a car. But it is important to understand that this is a part of the future of how people move from A to B.”

Behrendt and Sage both said BMW i Ventures has no intentions of acquiring any of its investments, but rather wants to be at the forefront of finding companies with high potential that can work with BMW or the rest of the industry in the future.

Sage said the firm has had 12 exits so far, plus six public companies at the moment and one that recently filed for a S-1 and will soon be public.

“We don’t need corporate buy-in to make an investment,” said Behrendt. “We do consult our engineers for due diligence and we also connect them with other startups. We’re trying to combine the best of both worlds. So we are acting like a financial VC, we’re taking board seats, we’re leading rounds, we can make quick decisions. And on the other hand we’re providing all the connections within our organization to the company.”

The startups that BMW i Ventures invests in get the benefit of networking with BMW engineers and employees and learning from a legacy company how the automotive ecosystem works. Behrendt says for a company like Solid Power, where the technology is another four or five years out, there’s a strong collaboration between BMW’s business unit and the company to help them grow.

“This is a win-win situation,” said Behrendt. “We are introducing them and will bring them into the company, they will be talking to the right engineers. There’s no guarantee that they will get a contract in, but they will start working together and exploring and getting help and maybe helping out with quick solutions.”