Traveling with babies, toddlers, or young kids is no picnic—even if food is involved. These accessories should help.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

You Are Already Having Sex With Robots

Sex robots are here, and their AI-enabled pseudosexuality isn’t long behind.

What Is Cyberwar? The Complete WIRED Guide

The threat of cyberwar looms over the future: a new dimension of conflict capable of leapfrogging borders and teleporting the chaos of war to civilians thousands of miles beyond its front.

This Week’s Cartoons: Terrible Passwords, Regulating Tech, and Failing Fast

For the ultimate in password security, try zen-factor authentication.

Why the NFL’s Field Goal Record Is Waiting to Be Smashed

Players, coaches, and scientists alike say that the current record of 64 yards is well shy of what humans are capable of kicking.

ThredUp, whose second-hand goods will start appearing at Macy’s and JCPenney, just raised a bundle

ThredUp, the 10-year-old fashion resale marketplace, has a lot of big news to boast about lately. For starters, the company just closed on $100 million in fresh funding from an investor syndicate that includes Park West Asset Management, Irving Investors and earlier backers Goldman Sachs Investment Partners, Upfront Ventures, Highland Capital Partners and Redpoint Ventures.

The round brings ThredUP’s total capital raised to more than $300 million, including a previously undisclosed $75 million investment that it sewed up last year.

A potentially even bigger deal for the company is a new resale platform that both Macy’s and JCPenney are beginning to test out, wherein ThedUp will be sending the stores clothing that they will process through their own point-of-sale systems, while trying to up-sell customers on jewelry, shoes, and other accessories.

It says a lot that traditional retailers are coming to see gently used items as a potential revenue stream for themselves, and little wonder given the size of the resale market, estimated to be a $24 billion market currently and projected to become a $51 billion market by 2023.

We talked yesterday with ThredUp founder and CEO James Reinhart to learn more about its tie-up with the two brands and to find out what else the startup is stitching together.

TC: You’ve partnered with Macy’s and JCPenney. Did they approach you or is ThredUp out there pitching traditional retailers?

JR: I think [the two companies] have been thinking about resale for some time. They’re trying to figure out how to best serve their customers. Meanwhile, we’ve been thinking about how we power resale for a broader set of partners, and there was a meeting of the minds six months ago

We’re positioned now where we can do this really effectively in-store, so we’re starting with a pilot program in 30 to 40 stores, but we could scale to 300 or 400 stores if we wanted.

TC: How is this going to work, exactly, with these partners?

JR: We have the [software and logistics] architecture and the selection to put together carefully curated selections of clothing for particular stores, including the right assortment of brands and sizes, depending on where a Macy’s is located, for example. Macy’s then wraps a high-quality experience around [those goods]. Maybe it’s a dress, but they wrap a handbag and scarves and jewelry around the dress purchase. We feel [certain] that future consumers will buy new and used at the same time.

TC: Who is your demographic, and please don’t say everyone.

JR: It is everyone. It’s not a satisfying answer, but we sell 30,000 brands. We serve lots of luxury customers with brands like Louis Vuitton, but we also sell Old Navy. What unites customers across all brands is they want to find brands that they couldn’t have afforded new; they’re trading up to brands that, full price, would have been too much, so Old Navy shoppers are [buying] Gap [whose shopper are buying] J. Crew and Theory and all the way up. Consistently, what we hear is [our marketplace] allows customers to swap out their wardrobes at higher rates than would be possible otherwise, and it feels to them like they’re doing it in a more [environmentally] responsible way.

TC: What percentage of your shoppers are also consigning goods?

JR: We don’t track that closely, but it’s typically about a third.

TC: Do you think your customers are buying higher-end goods with a mind toward selling them, to defray their overall cost? I know that’s the thinking of CEO Julie Wainwright at [rival] The RealReal. It’s all supposed to be a kind of virtuous circle of shopping.

JR: We like to talk about buying the handbag, then selling it, but plenty of people will also buy a second-hand Banana Republic sweater because it’s a value [and because] fashion is the second-most polluting industry on the planet.

TC: How far are you going to combat that pollution? I’m just curious if you’re in any way try to bolster the sale of hemp, versus maybe nylon, clothes for example.

JR: We aren’t driving material selection. Our thesis is: we want to stay out of the fashion business and instead ensure there’s a responsible way for people to buy second hand.

TC: For people who haven’t used ThredUp, walk through the economics. How much of each sale does someone keep?

JR: On ThredUp, it isn’t a uniform payment; it depends instead on the brand. On the luxury end, we pay [sellers] more than anyone else — we pay up to 80 percent when we resell it. If it’s Gap or Banana Republic, you get maybe 10 or 15 or 20 percent based on the original price of the item.

TC: How would you describe your standards? What goes into the reject pile?

JR: We have high standards. Items have to be in like-new or gently used condition, and we reject more than half of what people send us. But I think there’s probably more leeway for the Theory’s and J.Crew’s of the world than if you’re buying a Chanel dress.

TC: Unlike some of your rivals, you don’t sell to men. Why not?

JR: Men’s is a small market in secondhand. Men wear the same four colors — blue, black, gray and brown — so it’s not a big resale market. We do sell kids’ clothing, and that’s a big part of our market.

TC: When Macy’s now sells a dress from ThredUp, how much will you see from that transaction?

JR: We can’t share the details of the economics.

TC: How many people are now working for ThredUp?

JR: We have less than 200 in our corporate office in San Francisco, and 50 in Kiev, and then across four distribution centers — in Phoenix; Mechanicsburg [Pa.]; Atlanta; and Chicago — we have another 1,200 employees.

TC: You’ve now raised a lot of money in the last year. How will it be used?

JR: On our resale platform [used by retailers like Macy’s] and on building our tech and operations and building new distribution centers to process more clothing. We can’t get people to stop sending us stuff. [Laughs.]

TC: Before you go, what’s the most under-appreciated aspect of your business?

JR: The logistics behind the scenes. I think for every great e-commerce business, there are incredible logistics [challenges to overcome] behind the scenes. People don’t appreciate how hard that piece is, alongside the data. We’re going to process our 100 millionth item by the end of this year. That’s a lot of data.

Eminem’s publisher accuses Spotify of copyright infringement in new lawsuit

Eminem’s music publisher Eight Mile Style has filed a lawsuit against Spotify, accusing the service of “blatant copyright infringement” in streaming “Lose Yourself” and other Eminem songs.

As explained by The Hollywood Reporter, the suit is tied Spotify’s implementation of the Music Modernization Act, which was signed into law last year. Under the MMA, Spotify can obtain a compulsory license to stream a song, but it would still need to file a “notice of intention” and pay rightsholders.

However, Eight Mile says, “Spotify did not have any license to reproduce or distribute the Eight Mile Compositions, either direct, affiliate, or compulsory, but acted deceptively by pretending to have compulsory and/or other licenses.”

For example, the complaint describes the service’s treatment of “Lose Yourself” as “the most egregious example of Spotify’s willful infringement,” saying that Spotify placed the song in the Copyright Control category, which is “reserved for songs for which the copyright owner is not known so the song cannot be licensed.”

Eight Mile then characterizes this position as “absurd”: “Spotify, and [the Harry Fox Agency], its agent … certainly knew (and had the easy means to know) that Eight Mile is the copyright owner of ‘Lose Yourself.’ ”

In addition, Eight Mile claims that even though the songs in question have been “streamed on Spotify billions of times,” the service has “not accounted to Eight Mile or paid Eight Mile for these streams but instead remitted random payments of some sort, which only purport to account for a fraction of those streams.”

The complaint also takes issue with protections that Spotify might claim under the MMA, saying that if the law limits Spotify’s liability, then it represents “an unconstitutional denial of due process (both procedural and substantive), and an unconstitutional taking of vested property rights.”

This isn’t the first time Eight Mile has challenged digital music platforms: It sued Apple over copyright issues more than a decade ago, and ultimately settled.

In an emailed statement, Eight Mile’s attorney Richard Busch described this as “a very important lawsuit for all songwriters that raises vital issues for those whose songs stream on Spotify or other Digital Music Providers.”

We’ve reached out to Spotify for comment and will update if we hear back.

T-Mobile hit by hours-long nationwide outage

T-Mobile customers across the U.S. said they couldn’t make calls or send text messages following an outage.

We tested with a T-Mobile phone in the office. Both calls to and from the T-Mobile phone failed. When we tried to send a text message, it said the message could not be sent. Access to mobile data appeared to be unaffected.

The outage began around 6pm ET.

Users took to social media to complain about the outage. Users across the U.S. said they were affected. A T-Mobile support account said the cell giant “engaged our engineers and are working on a resolution.”

In a tweet two hours into the outage, chief executive John Legere acknowledged the company was struggling to get back online but noted that the company had “already started to see signs of recovery.”

By 10:34pm ET, the issue had been resolved, tweeted T-Mobile chief technology officer Neville Ray, without saying what caused the four-hour long outage.

T-Mobile is the third largest cell carrier after Verizon (which owns TechCrunch) and AT&T. The company had its proposed $26.5 billion merger with Sprint approved by the Federal Communications Commission, despite a stream of state attorneys general lining up to block the deal.

Updated with acknowledgement by chief executive John Legere, and later from Neville Ray.

Apple warns against storing the Apple Card in leather and denim

First of all, keep it out of the light. It hates bright light, especially sunlight, it’ll kill it. Second, don’t give it any water, not even to drink. But the most important rule, the rule you can never forget, no matter how much it cries, no matter how much it begs, never feed it after midnight.

Oh, and Apple says the card should also avoid contact with denim and leather, as such materials “might cause permanent discoloration that will not wash off.”

Should you raise equity venture capital or revenue-based investing VC?

Contributor

Most founders who are raising capital look first to traditional equity VCs. But should they? Or should they look to one of the new wave of revenue-based investors?

Revenue-based investing (“RBI”) is a new form of VC financing, distinct from the preferred equity structure most VCs use. RBI normally requires founders to pay back their investors with a fixed percentage of revenue until they have finished providing the investor with a fixed return on capital, which they agree upon in advance.

This guest post was written by David Teten, Venture Partner, HOF Capital. You can follow him at teten.com and @dteten. This is the 5th part of our series on Revenue-based investing VC that touches on:

- Revenue-based investing: A new option for founders who care about control

- Who are the major revenue-based investing VCs?

- Should your new VC fund use revenue-based investing?

- Why are revenue-based VCs investing in so many women and underrepresented founders?

- Should you raise equity venture capital or revenue-based investing VC?

From the founders’ point of view, the advantages of the RBI model are:

After a breakout year, looking ahead to the future of podcasting

Contributor

Contributor

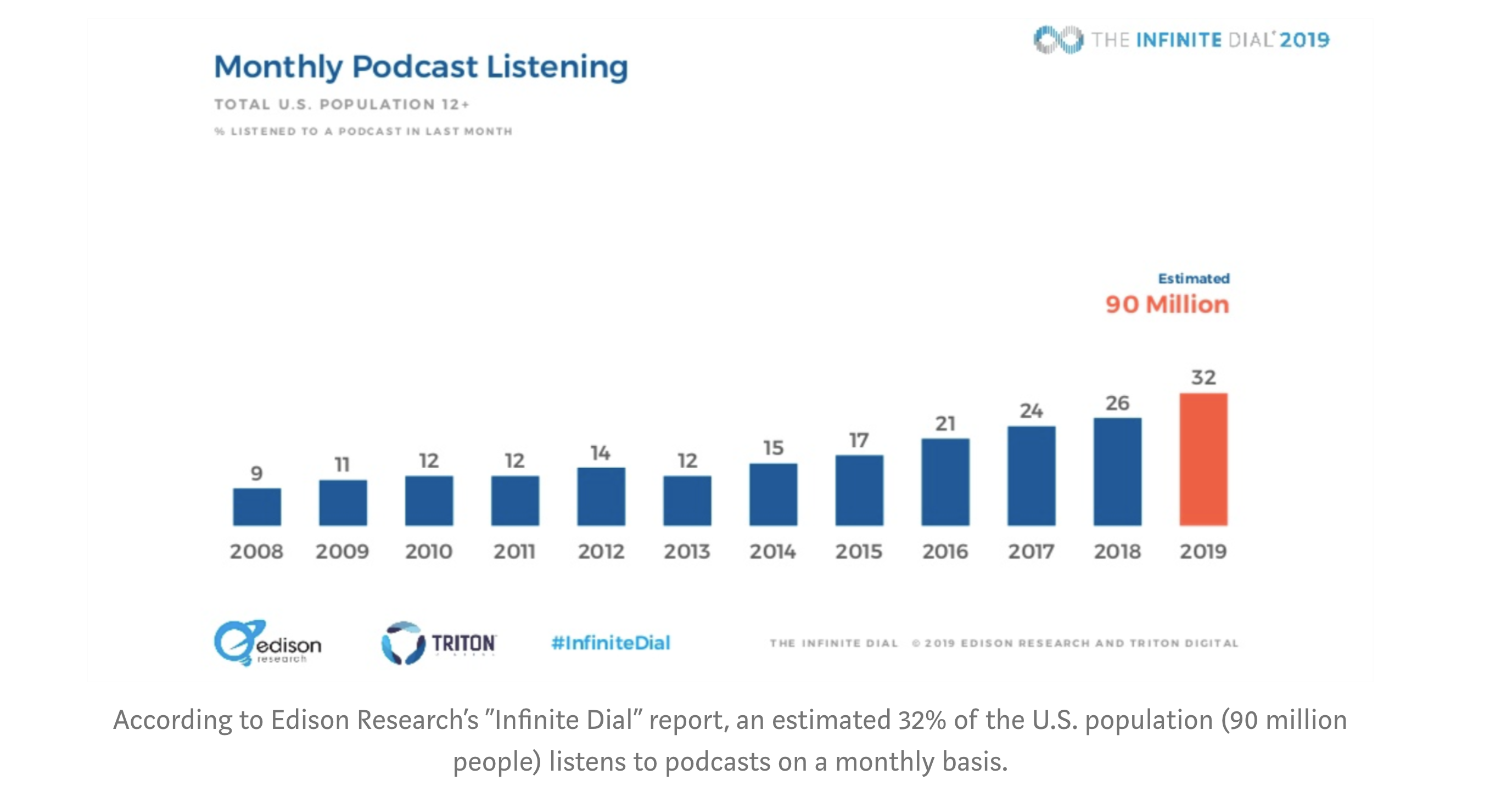

This year has been a breakout one for podcasting. According to Edison Research’s Infinite Dial report, more than half of Americans have now listened to a podcast, and an estimated 32% listen monthly (up from 26% last year). This is the largest yearly increase since this data started being tracked in 2008. Podcast creation also continues to grow, with more than 700,000 podcasts and 29 million podcast episodes, up 27% from last year.

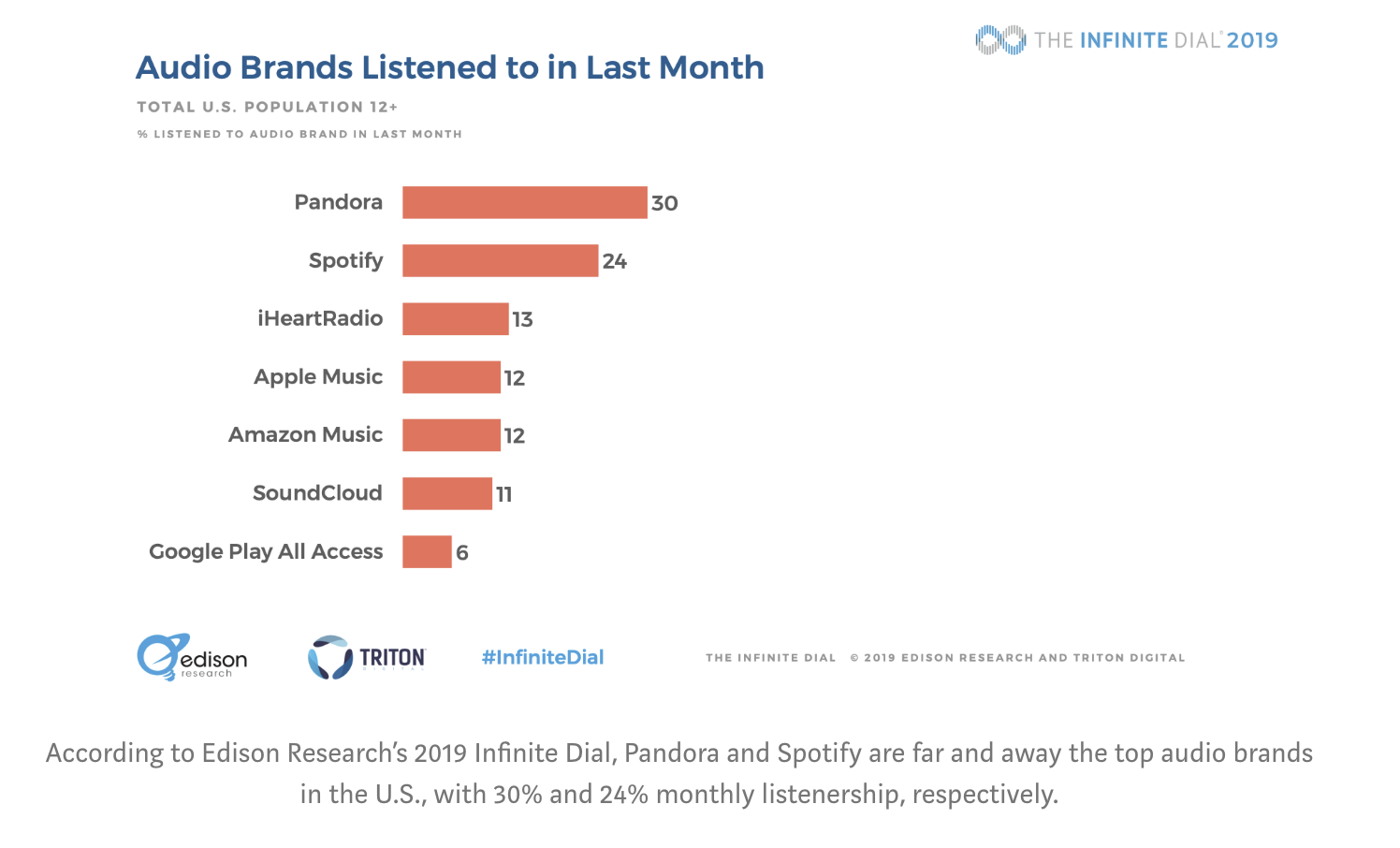

Thanks to this growing listener base, big companies are finally starting to pay attention to the space — Spotify plans to spend $500 million on acquisitions this year, and already acquired content studio Gimlet, tech platform Anchor, and true crime network Parcast for a combined $400 million. In the past week, Google added playable podcasts to search results, Spotify released an analytics dashboard for podcasters and Pandora launched a tool for podcasters to submit their shows.

We’ve been going to Podcast Movement, the largest annual industry conference, for three years, and have watched the conference grow along with the industry — reaching 3,000 attendees in 2019. Given the increased buzz around the space, we were expecting this year’s conference to have a new level of energy and professionalism, and we weren’t disappointed. We’ve summarized five top takeaways from the conference, from why podcast ads are hard to scale to why so many celebrities are launching their own shows.

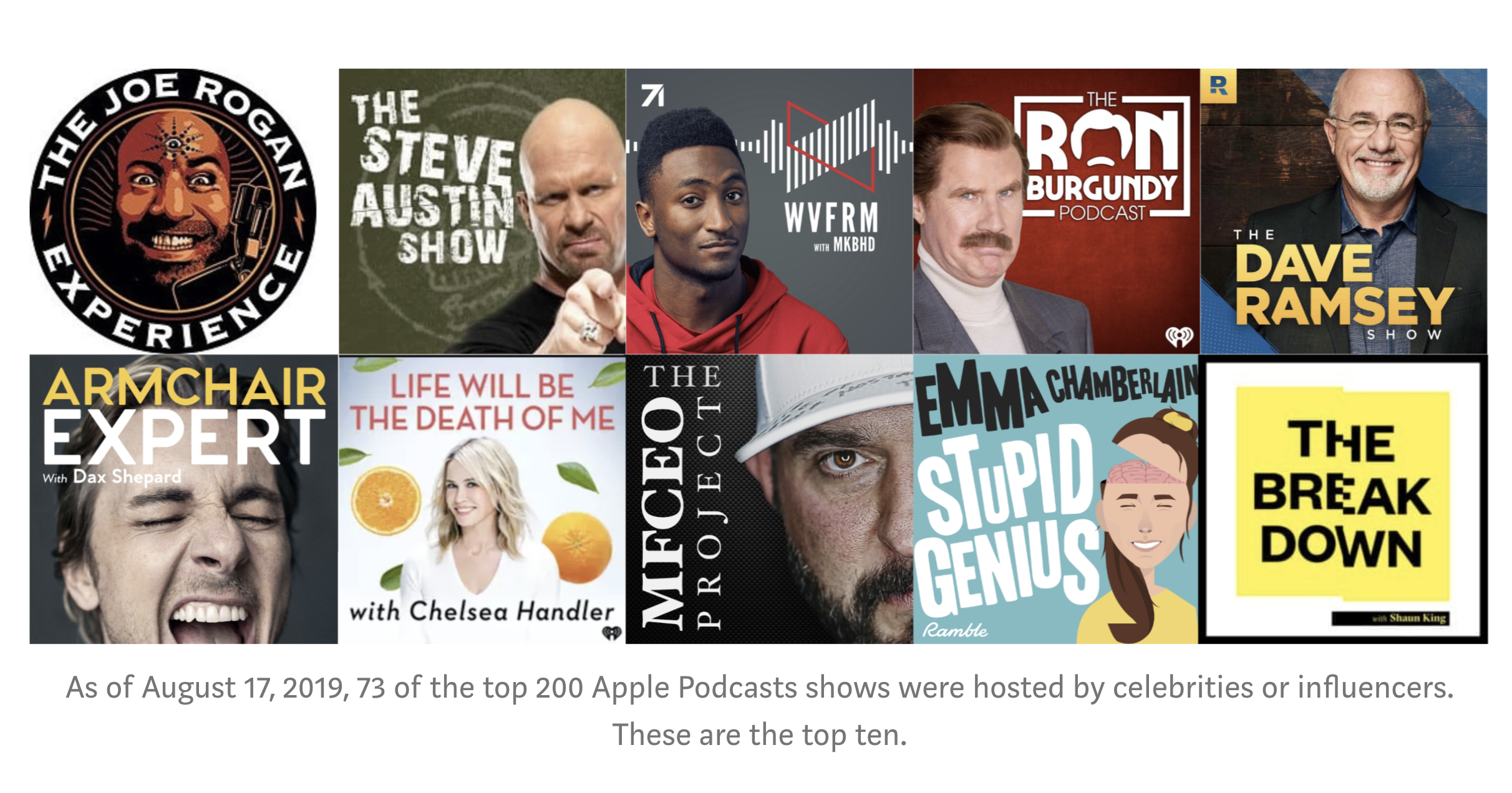

Rise of celebrity podcasters boosts listenership

We’ve officially entered the age of celebrity podcasters. After early successes like “WTF with Marc Maron” (2009), Alec Baldwin’s “Here’s The Thing” (2011) and Anna Faris’ “Unqualified” (2015), top talent is flooding into the space. In 2017, 15% of Apple’s top 20 most-downloaded podcasts of the year were hosted by celebrities or influencers — this jumped to 32% of the top 25 in 2018. And of all the new shows that launched in 2018, 48% of the top 25 were celebrity-hosted.

Though podcasts are undermonetized compared to other forms of media, talent agents now consider them to be an important part of a well-rounded content strategy. Dan Ferris from CAA tells his clients to think of podcasting as a way of connecting with fans that is “much more intimate than social media.” Podcasts also help celebrities find a new audience. Ben Davis from WME said that while his client David Dobrik has a smaller audience on his podcast than on YouTube (1.5 million downloads per episode versus 6 million views per video), the podcast helps him reach a new group of listeners who stumble upon his show on the Apple Podcast charts.

Though podcasts are undermonetized compared to other forms of media, talent agents now consider them to be an important part of a well-rounded content strategy. Dan Ferris from CAA tells his clients to think of podcasting as a way of connecting with fans that is “much more intimate than social media.” Podcasts also help celebrities find a new audience. Ben Davis from WME said that while his client David Dobrik has a smaller audience on his podcast than on YouTube (1.5 million downloads per episode versus 6 million views per video), the podcast helps him reach a new group of listeners who stumble upon his show on the Apple Podcast charts.

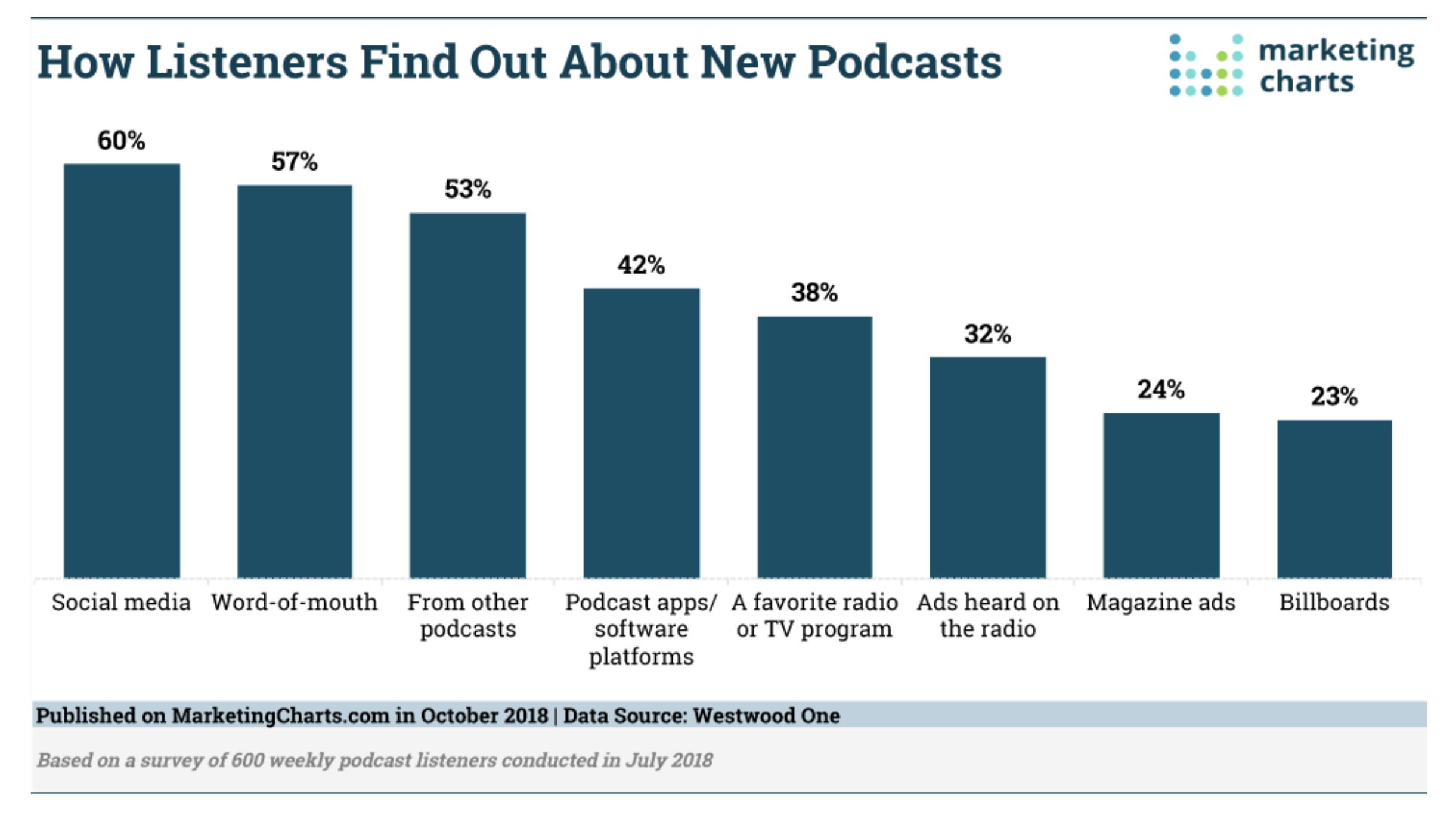

While some podcast veterans grumble about the rise of celebrity talk shows, famous podcasters are good for the industry as a whole. Advertisers are drawn to the space by the opportunity to get to access A-list talent at lower prices. One recent example is Endeavor Audio’s fiction show “Blackout,” which starred Rami Malek, who was fresh off an Oscar win. Endeavor’s head of sales, Charlie Emerson, said brands might have to sign a “seven or eight-figure deal” to advertise alongside Malek’s content in other forms of media. Other podcasters also benefit from new listeners brought into the medium by their favorite stars — a Westwood One survey in fall 2018 found that 60% of podcast listeners report discovering shows via social media, where celebrities and influencers have huge existing audiences to push content to.

Creator backlash against “walled garden” apps

Paid listening apps represent a fairly small percentage of podcast listenership, with production platform Anchor estimating that Apple Podcasts and Spotify control more than 70% of listenership. A venture-backed company called Luminary is trying to change this — it raised $100 million to launch a “Netflix for podcasts” this spring. Consumers pay $7.99/month to access Luminary-exclusive shows alongside podcasts that are free on other apps. Because podcasts have RSS feeds, distributors like Luminary can easily grab free content and put it behind a paywall. The platform, not the creator, benefits from this monetization.

Within days of Luminary’s launch, prominent podcasters and media companies (The New York Times, Gimlet and more) requested their shows be removed from the app. It’s interesting to note that YouTube has a similar premium plan — for $11.99/month, users can access and download ad-free videos. Unlike Luminary, however, YouTube, pays creators a cut of the revenue from these subscriptions based on how frequently their content is viewed.

Unsurprisingly, creator sentiment is more positive toward platforms like Spotify and Pandora . Though these companies do make money from premium subscribers who listen to podcasts, creators can choose whether or not to submit their shows. And podcasters benefit from making their shows discoverable to the existing user base of these platforms, which already dominate “earshare.” Spotify alone has 232 million MAUs, which dwarfs the 90 million people in the U.S. who listen to a podcast monthly.

Industry anxiety around maintaining quality at scale

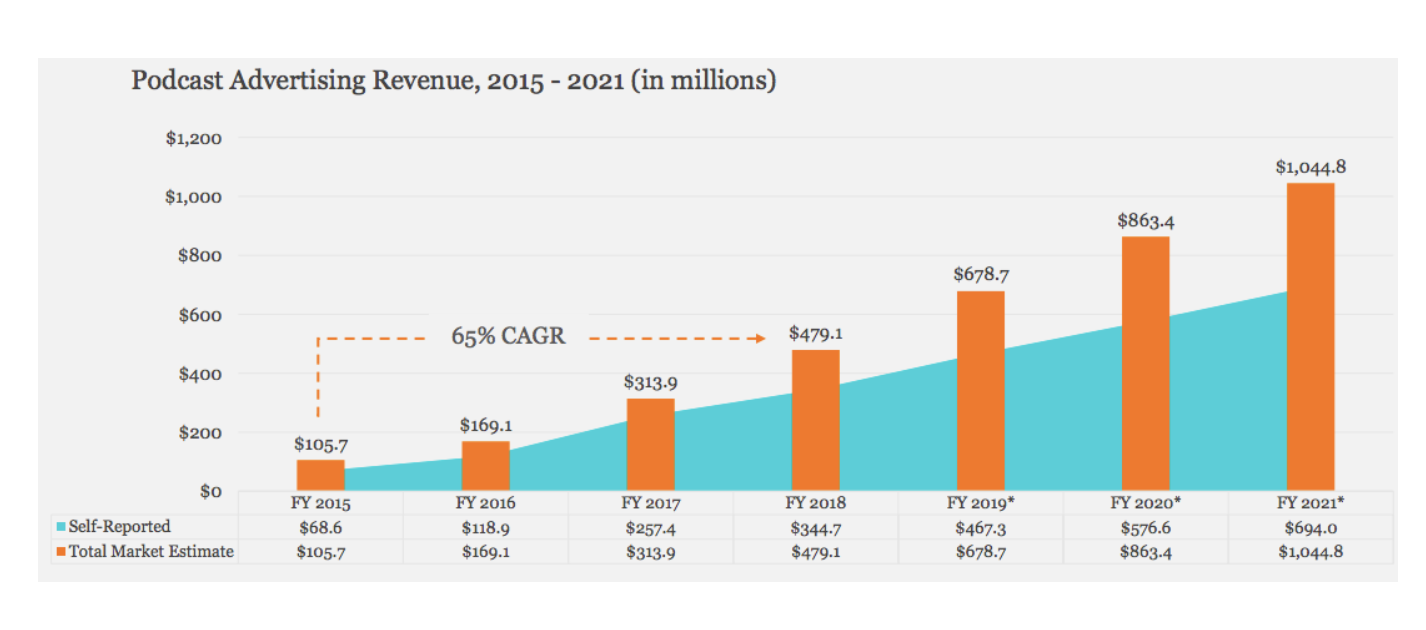

Podcast ad revenue has been scaling quickly, with $480 million in spend last year and a projected $680 million this year. Over the past four years, ad revenue has scaled at a 65% CAGR, and this growth is expected to continue. In its early days, the podcast ad market has largely been driven by D2C brands — you’ve probably heard hundreds of Casper, Blue Apron and Madison Reed ads. However, bigger brands are also starting to enter podcasting (Geico, Capital One and Progressive made the top 10 list for June 2019) due to the growing audience scale and increased precision around targeting and attribution.

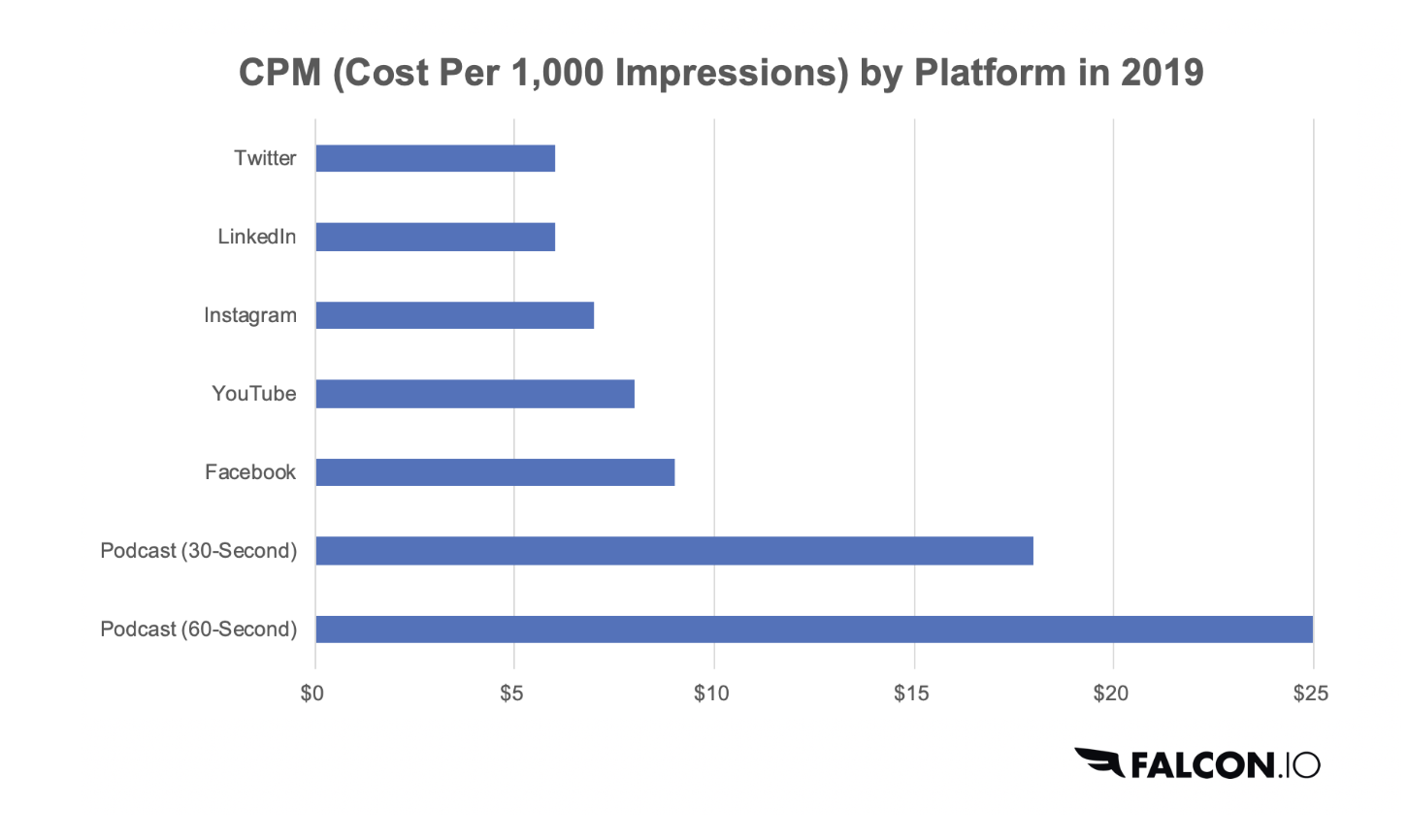

While many attendees were excited by the massive growth in ad revenue, others worried that it may kill what makes podcasting special. They’re particularly concerned that podcasts may go the way of online video, with annoying, generic, low CPM ads. Podcast hosts typically read their own ads, and are often true fans of the product — they share personal stories instead of reciting brand talking points. This results in premium CPMs compared to most digital media — AdvertiseCast’s 2019 survey found an average CPM of $18 for a 30-second podcast ad and $25 for a 60-second ad, more than 2x the average CPM on other digital platforms.

While these ads are effective, they’re time-consuming and expensive to produce. Big brands interested in podcast ads often expect to reuse radio spots — they aren’t used to the process of crafting and approving a host-read ad that may only reach 10,000 listeners. Podcasters, meanwhile, value their trust with listeners and don’t want to spam them with loud, unoriginal radio ads. The tension between maintaining the quality of ads while scaling quantity was an underlying theme of most monetization discussions, and industry veterans disagree on how it will play out.

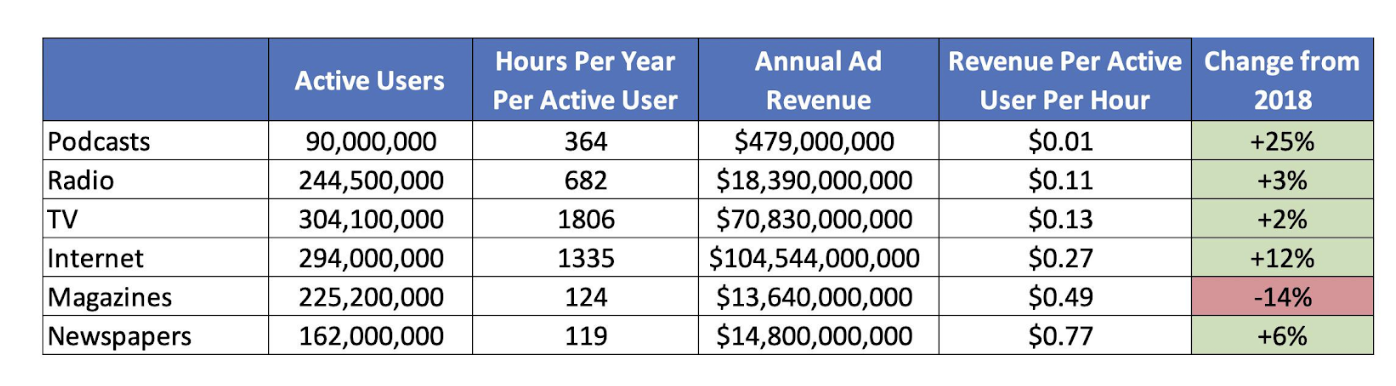

Podcasts are still undermonetized — but there is hope!

Despite the growth in ad revenue and relatively high CPMs, the industry is significantly undermonetized. Using data from Nielsen, IAB and Edison, we calculated that podcasts monetize through advertisements at only $0.01 per listener hour — less than 10 times the rate of radio. Podcast monetization per listener hour has increased over the past year, up 25% by our calculations, but still substantially lags all other forms of media.

Why are podcasts so undermonetized? Unlike many other forms of media, the dominant distribution platform (Apple Podcasts) has no ad marketplace. Creators have historically had to approach brands themselves or sign with podcast networks to construct custom ad deals, and the “long tail” of podcasters were unable to monetize. This is finally changing. Anchor, which reported in January that it powers 40% of new podcasts, has an ad marketplace that has doubled the number of podcasts that are running ads. Other popular platforms like Radio Public have launched programs for small podcasters to opt-in to ad placements.

The second major hurdle in monetization is attribution. Podcasts have historically monetized through direct response campaigns — a podcaster provides a special URL or promo code for listeners to use when making a purchase. However, many people listen to podcasts when exercising or driving, and can’t write down the promo code or visit the URL immediately. These listeners might remember the product and make a purchase later, but the podcaster won’t get the attribution. Thomas Mancusi of Audioboom estimated that this happens in 50-60% of purchases driven by podcast ads.

Startups are trying to bring better adtech into podcasting to fix this issue. Chartable is one example — the company installs trackers to match a listener’s IP address with a purchaser’s IP address, allowing podcasters to claim attribution for listeners who don’t use their URL or promo code. Chartable currently runs on 10,000 shows, and the early results are so promising that ad agencies expect to see higher CPMs and significantly more spend in the space.

Podcast fans of the future ? podcast fans today

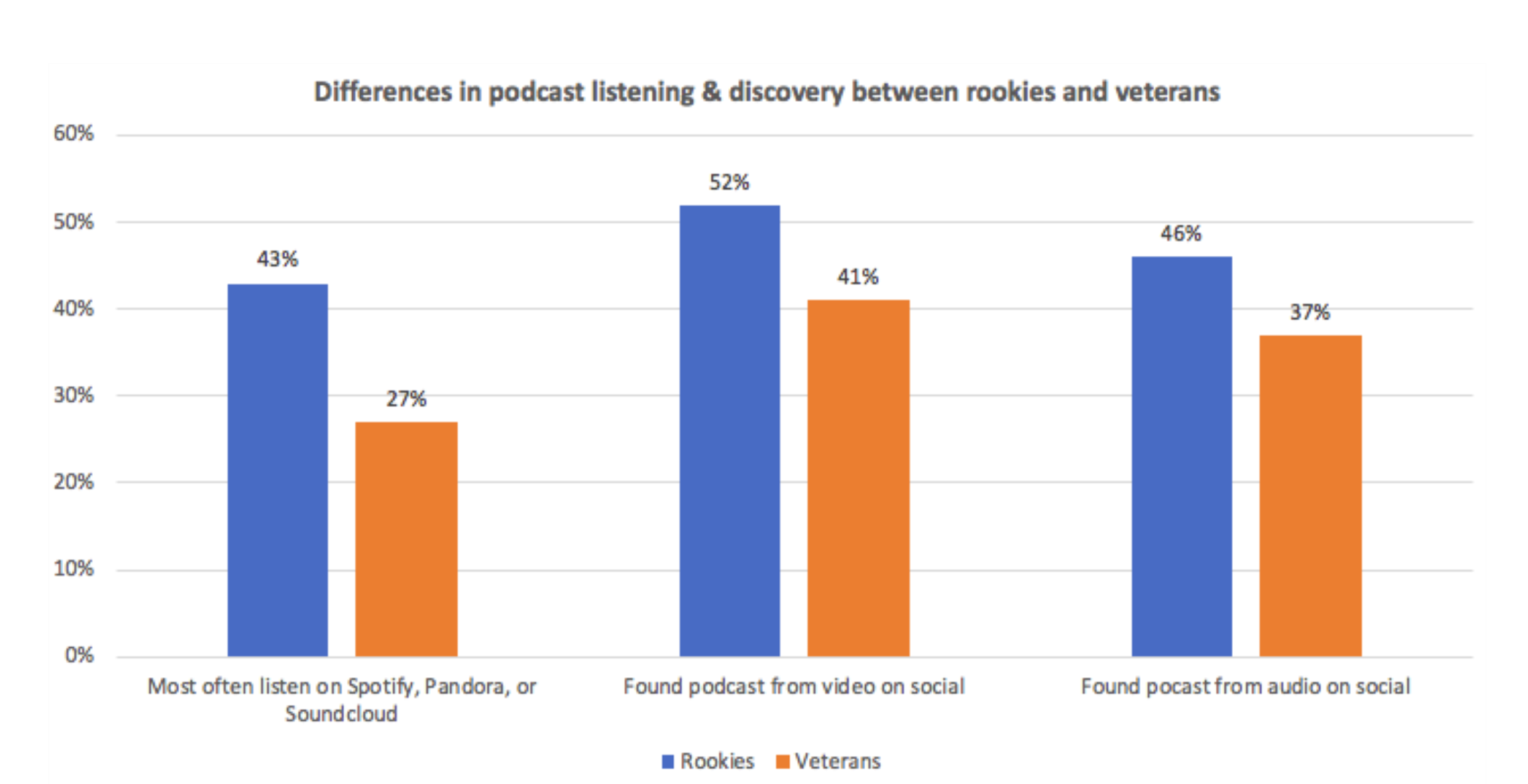

As podcasting grows, the listener base is diversifying. Edison Research looked into data on “rookie” listeners (listening for six months or less) and “veteran” listeners (listening for 3+ years), and found significant demographic differences. Only 37% of veterans are female, compared to 53% of rookies. While the plurality of veterans (43%) are age 35-54, 54% of rookies are age 12-34. Rookies are also 1.6x more likely to say they most often listen to podcasts on Spotify, Pandora or SoundCloud (43% versus 27% of veterans). And social media is an important way that rookies discover podcasts — 52% have found a podcast from video and 46% from audio on social media, compared to 41% and 37% for veterans.

These new listeners will have a profound impact on the future of podcasting, in both the type of content produced and the way it’s distributed. Industry experts are already noting significant new demand for female-hosted podcasts, as well as audio dramas that appeal to young people looking for a fast-paced, suspenseful story. They’re advising podcasters to share clips of their content on social media, and to leverage broader listening platforms like YouTube and SoundCloud for distribution.

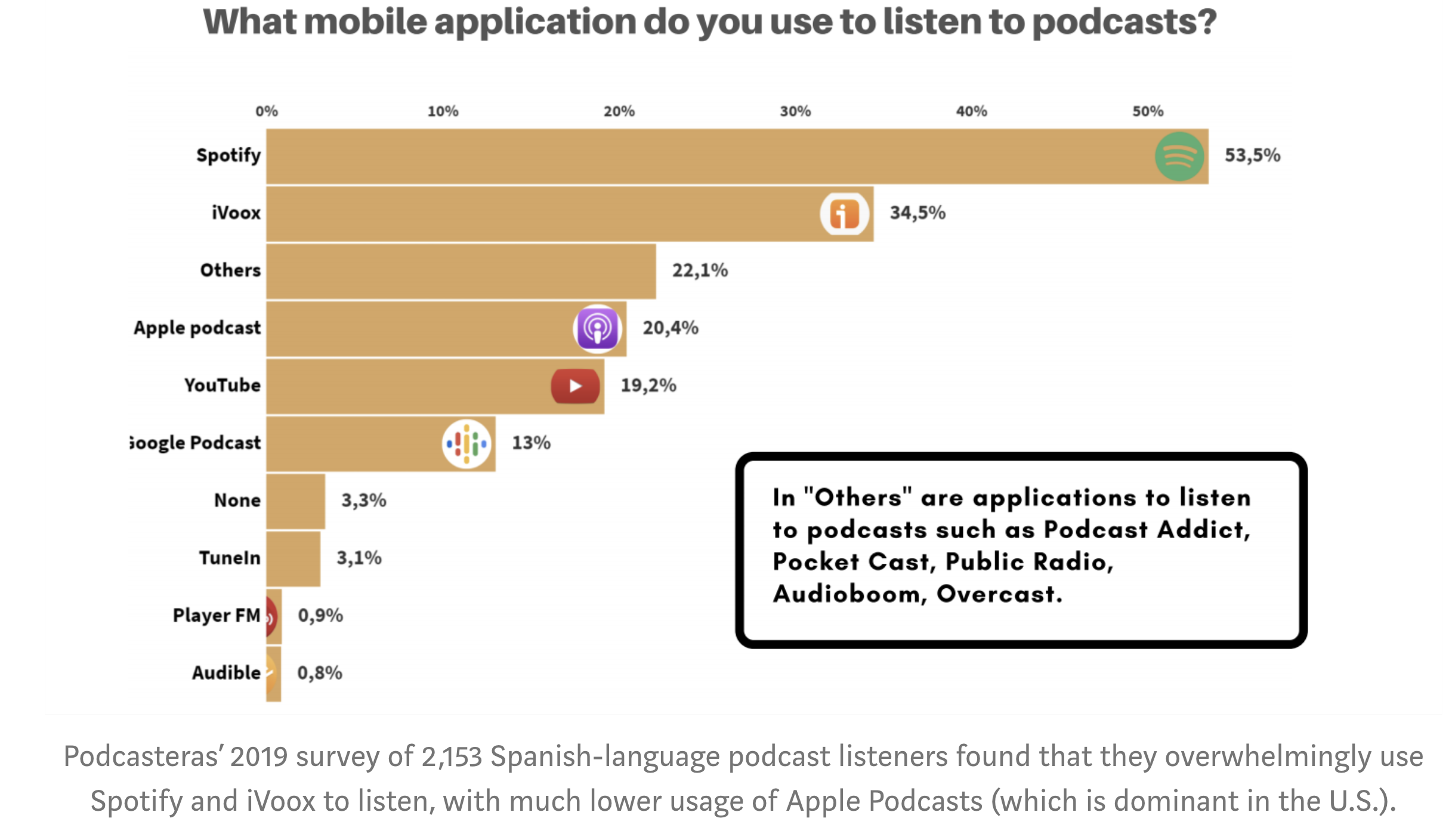

International markets also represent an enormous opportunity for growth. Most podcast listeners today live in the U.S. or China, but content producers are starting to see significant demand elsewhere. Castbox’s Valentina Kaledina said that many fans abroad have resorted to listening in their non-native language, with the top 100 shows in each country comprising a mix of English and local language. Adonde Media’s Martina Castro, who recently conducted the first listener survey on Spanish-language podcast fans, said that 53% of the survey’s 2,100 respondents reported listening to podcasts in English — and only 20% of them use Apple Podcasts.

Larger podcast producers are beginning to translate shows for non-English-speaking markets. Wondery CEO Hernan Lopez announced at the conference that the company’s hit show Dr. Death is now available in seven languages. Lopez noted that it was an expensive process, and he doesn’t expect the shows to generate profit in the near future. However, he believes that Wondery will eventually see a significant return from investing in the development of new podcast markets — and if they do, other podcast companies will likely follow in their footsteps.

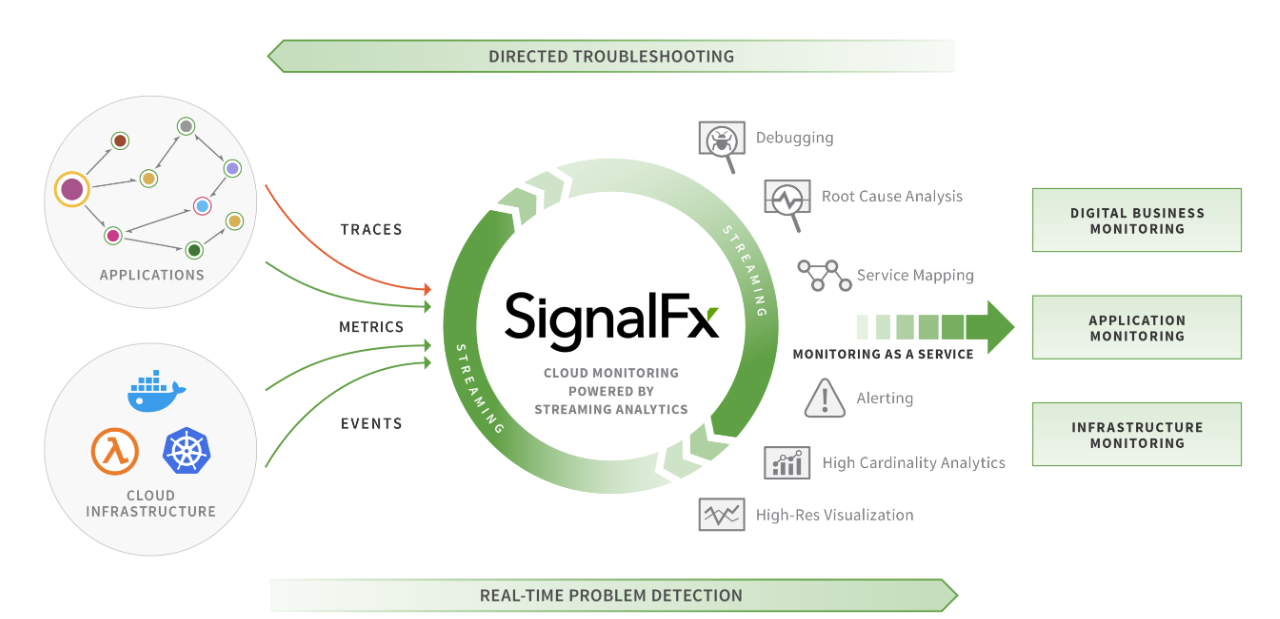

Splunk acquires cloud monitoring service SignalFx for $1.05B

Splunk, the publicly traded data processing and analytics company, today announced that it has acquired SignalFx for a total price of about $1.05 billion. Approximately 60% of this will be in cash and 40% in Splunk common stock. The companies expect the acquisition to close in the second half of 2020.

SignalFx, which emerged from stealth in 2015, provides real-time cloud monitoring solutions, predictive analytics and more. Upon close, Splunk argues, this acquisition will allow it to become a leader “in observability and APM for organizations at every stage of their cloud journey, from cloud-native apps to homegrown on-premises applications.”

Indeed, the acquisition will likely make Splunk a far stronger player in the cloud space as it expands its support for cloud-native applications and the modern infrastructures and architectures those rely on.

Ahead of the acquisition, SignalFx had raised a total of $178.5 million, according to Crunchbase, including a recent Series E round. Investors include General Catalyst, Tiger Global Management, Andreessen Horowitz and CRV. Its customers include the likes of AthenaHealth, Change.org, Kayak, NBCUniversal and Yelp.

“Data fuels the modern business, and the acquisition of SignalFx squarely puts Splunk in position as a leader in monitoring and observability at massive scale,” said Doug Merritt, president and CEO, Splunk, in today’s announcement. “SignalFx will support our continued commitment to giving customers one platform that can monitor the entire enterprise application lifecycle. We are also incredibly impressed by the SignalFx team and leadership, whose expertise and professionalism are a strong addition to the Splunk family.”

Porsche invests in ‘low visibility’ sensor startup TriEye

Porsche’s venture arm has acquired a minority stake in TriEye, an Israeli startup that’s working on a sensor technology to help vehicle driver-assistance and self-driving systems see better in poor weather conditions like dust, fog and rain.

The strategic investment is part of a Series A financing round that has been expanded to $19 million. The round was initially led by Intel Capital and Israeli venture fund Grove Ventures. Porsche has held shares in Grove Ventures since 2017.

TriEye has raised $22 million to date. Terms of Porsche’s investment were not disclosed.

The additional funding will be used for ongoing product development, operations and hiring talent, according to TriEye.

The advanced driver-assistance systems found in most new vehicles today typically rely on a combination of cameras and radar to “see.” Autonomous vehicle systems, which are being developed and tested by dozens of companies such as Argo AI, Aptiv, Aurora, Cruise and Waymo, have a more robust suite of sensors that include light detection and ranging radar (lidar) along with cameras and ultrasonic sensors.

For either of these systems to function properly, they need to be able to see in all conditions. This pursuit of sensor technology has sparked a boom in startups hoping to tap into demand from automakers and companies working on self-driving car systems.

TriEye is one of them. The premise of TriEye is to solve the low visibility problem created by poor weather conditions. The startup’s co-founders argue that fusing existing sensors such as radar, lidar and standard cameras don’t solve this problem.

TriEye, which was founded in 2017, believes the answer is through short-wave infrared (SWIR) sensors. The startup said it has developed an HD SWIR camera that is a smaller size, higher resolution and cheaper than other technologies. The camera is due to launch in 2020.

The technology is based on advanced nano-photonics research by Uriel Levy, a TriEye co-founder and CTO who is also a professor at the Hebrew University of Jerusalem.

The company says its secret sauce is its “unique” semiconductor design that will make it possible to manufacture SWIR HD cameras at a “fraction of their current cost.”

TriEye’s technology was apparently good enough to get Porsche’s attention.

Michael Steiner, a Porsche AG board member focused on R&D, said the technology was promising, as was the team, which is comprised of people with expertise in deep learning, nano-photonics and semiconductor components.

“We see great potential in this sensor technology that paves the way for the next generation of driver assistance systems and autonomous driving functions,” Steiner said in a statement. “SWIR can be a key element: it offers enhanced safety at a competitive price.”

Peak Design’s Travel Duffel 35L is as simple or as powerful as you need it to be

A good, solid duffel bag is a mainstay for many travelers — especially those who like packing up a car for a weekend away, or frequent flyers who disdain the thought of checking a bag. Peak Design introduced its own take on the duffel bag this year, with a couple of different twists on the concept. The Peak Design Travel Duffel 35L is the most fundamental of the company’s options, and it delivers a lot of packing space and support for Peak’s packing tools if you want to get real serious about space optimization.

I’m an unabashed fan of Peak Design’s Everyday camera bags, its capture clips and basically its entire ecosystem. This is a company that you can tell things deeply about the problems it’s aiming to solve for its customers — because they’re the problems shared by the company’s founders themselves. The Travel Duffel is actually probably a bit more mainstream and less specialized than most of their offerings, but that only makes it more appealing, not less.

You’ll find the same weatherproof nylon coating in this bag that Peak uses in its other packs, and it’s a very durable material that also looks great both up close and at a distance. If there’s a complaint here, it’s that the black color I prefer tends to pretty easily pick up dust, but it also wipes or washes off just as easily. The heavy-duty nylon canvas shell should also stand up to the elements well, and the zipper is the especially weather sealed kind, plus there’s a waterproof bottom liner in case you’re less than careful about where you drop your pack while en route.

The Duffel includes both hand straps and a longer padded shoulder strap, and the unique connector hardware system means you can reposition the straps in a number of ways to suit your carrying preferences. The hand straps double as shoulder straps for wearing it like a backpack and though this is a bit tight for my larger frame, it’s still a way to quickly alleviate shoulder or hand strain for longer treks with the bag in tow. The connectors here are also super smart — there are no moving parts, they just snap on and off the sewn-in loops placed around the bag — which means added durability and ease of use.

Plenty of pockets inside and out give you lots of divided storage options, and there’s also a security loop feature on the main zipper to make it much harder for someone to quickly yank the bag open and grab what’s inside if they’re targeting a quick theft opportunity. A dedicated ID card holder is a nice touch that tells you exactly who this is ideal for, too.

As I alluded to above, there’s also support for the rest of Peak’s packing tools. I’ve got their small camera cube in the bag width-wise in the photo below, and it should be able to fit up to three of these in this orientation. Peak also offers packing cubes, dop kits and more, and you can use the slide hooks provided with those with internal elastic attachment points if you want to ensure things won’t shift around. But the best part about this bag is that it has everything you need in a straightforward duffel out of the box — the rest of the packing tools are totally optional and don’t take away form its fundamental effectiveness at all.

The 35L carrying capacity of this bag is perfect for a weekend trip, or even a few days longer if you’re an economical packer. At $129.95, it’s actually very reasonable for a high-quality duffel bag, too, and definitely one of the better bargains in the Peak lineup when it comes to value for the money.

YC is doubling down on these investment theses in its most recent batch

Nearly 200 startups have just graduated from the prestigious San Francisco startup accelerator Y Combinator . The flock of companies are now free to proceed company-building with a fresh $150,000 check and three-months full of tips and tricks from industry experts.

As usual, we sent several reporters to YC’s latest demo day to take notes on each company and pick our favorites. But there were many updates to the YC structure this time around and new trends we spotted from the ground that we’ve yet to share.