Apple Arcade introduced the idea of all-you-can-eat subscription-based mobile gaming to the mainstream. Google Play Pass soon followed as a way to subscribe to a sizable collection of both apps and games on Android devices. Today, a startup called GameClub is launching in the U.S. to offer an alternative. For $4.99 per month, mobile consumers will be able to access a library that includes some of the best games to have ever hit the App Store.

To be clear, GameClub is not a cloud gaming platform, like Google Stadia. It’s a way to subscribe to actual App Store games, similar to Arcade. In GameClub’s case, however, the focus is not on new releases but on quality games that already have proven track records and high ratings.

In fact, many GameClub games have made Apple’s own editorially selected “Game of the Year” lists in years past. And like the games offered on Apple Arcade, they don’t have ads or any in-app purchases.

At launch, GameClub’s library includes more than 100 titles, with around half that available for play today. More titles will roll out on a weekly basis in the months ahead. Combined, the games have over 100 million collective downloads, the company says.

On GameClub, you’ll find games like: Super Crate Box, Hook Champ, Mage Gauntlet, Space Miner, Forget-Me-Not, MiniSquadron, Plunderland, Pocket RPG, Sword of Fargoal, Incoboto, Tales of the Adventure Company, Hook Worlds, Orc: Vengeance, Mr. Particle-Man, Legendary Wars, Deathbat, The Path to Luma, Grimm, Zombie Match, Faif, iBlast Moki 2, Kano, Baby Lava Bounce, Run Roo Run, Gears and many others.

It’s a selection that extends across gaming categories, like Action, Arcade, Puzzle, Adventure, Platformer, Retro, Role Playing, Simulation, Strategy and more.

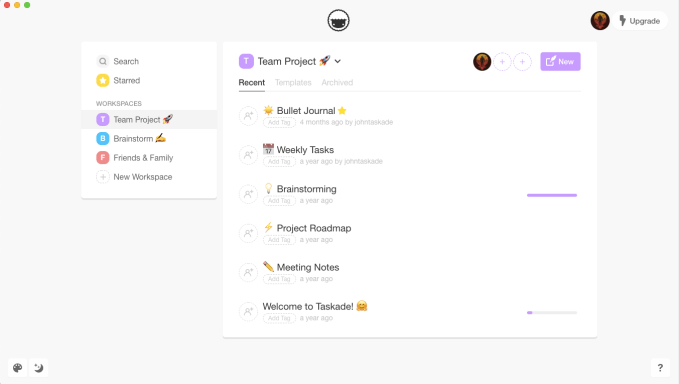

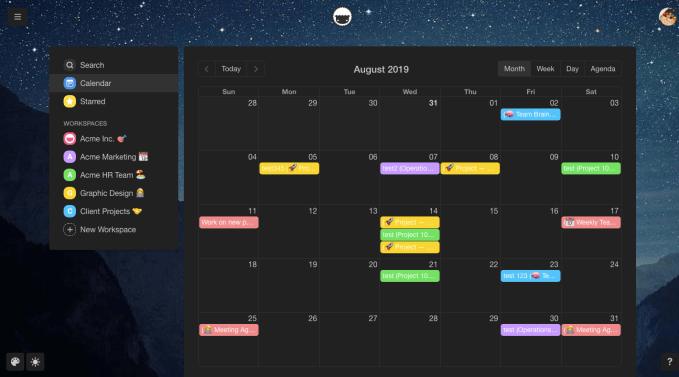

To use the service, you first download the main GameClub app, which becomes the hub for your GameClub activities. You then sign up for the $4.99 per month subscription, which includes a 30-day free trial. Within the main app, you can browse the available titles as well as read editorial content like in-depth overviews and histories, get tips and learn about gaming strategies.

The startup was founded last year by game industry vets Dan Sherman and Oliver Pedersen.

Sherman, GameClub CEO, has worked in the gaming industry for around 17 years, including time spent at EA and his own startup, Tilting Point. His experience has involved, predominantly, signing content partnerships with game creators. Pedersen, meanwhile, built backend systems and platforms for games, including at Yahoo Games.

Though GameClub is seemingly arriving after Apple Arcade’s debut, it actually began before that. The startup was founded in 2018, ahead of any Apple Arcade rumors. It went live on iOS outside the U.S. before Arcade launched.

The founders say they were inspired to address the issues caused by the free-to-play model that has infiltrated the gaming industry. In addition, they had witnessed a decline in consumers’ willingness to purchase content upfront, which was impacting the industry.

“I was seeing all these amazing game developers leave mobile because the types of games they make are not the types of games that monetize through in-app purchases and ads,” Sherman tells TechCrunch. “The free-to-play model actually only works for a handful of genres,” he explains. “A lot of companies make a lot of money through a very small number of genres and game experiences — to the exclusion of a lot of other types of genres that GameClub is bringing back — action, adventures, arcade, tower defense — anything that can be completed.”

With free-to-play, games are built around perpetual retention loops. “And the freemium model comes out of the casino industry, not the premium game industry,” Sherman points out.

But because this is how games could make money, it led to homogeneity in the marketplace, he says.

GameClub aims to offer a subscription to the premium games that got left behind.

They are meant to be wholesome and fun, not overly addictive. They’re not designed to manipulate you into spending money. You simply pay your subscription fee every month to access the catalog, then play unencumbered.

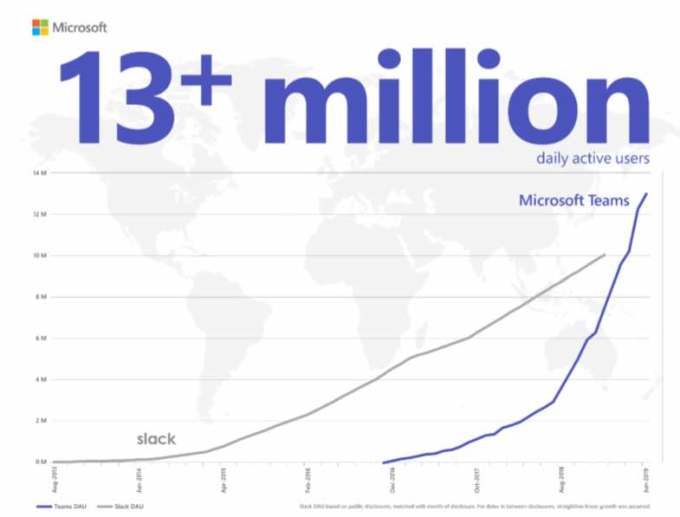

Thanks to Apple Arcade and Google Play Pass, consumers are now comfortable with the idea of the subscription model for mobile games. And other services — like Spotify Netflix, and Xbox Game Pass, for example — have pushed the idea of subscription access to content across platforms and genres.

GameClub is different from Arcade, however, because it’s not funding the development of content upfront — at least, not yet. Instead, it’s forging agreements with largely indie developers to release their existing IP as a GameClub exclusive.

This may include bringing an older game into the 64-bit era — something GameClub handles on their behalf.

“Many of [the GameClub titles] have been gone for many years,” says Sherman. “It’s with our team, our technology and our developers that they’ve been brought back. And they’ve been brought back in a way that is 100% using the original code and the exact same design…but making them look and feel new, with higher resolution, Retina Display assets and by optimizing for the latest screen sizes and configurations,” he adds.

The company doesn’t discuss the business model for GameClub, but it’s not the same as Apple Arcade’s pay-upfront model.

What Sherman could say is that the more important the game is to the GameClub service, the more money the creator makes. Additionally, GameClub says it’s transparent with developers about its subscription revenue, so there’s no question about which games are earning or why.

The same can’t be said for Apple Arcade, which is a total black box to the point that consumers don’t know which Arcade games are most popular, developers can’t see how they’re doing compared with others and third-party measurement firms have no data.

Of course, there could be concerns that GameClub exists in a gray area, with regard to App Store policy. Those with longer memories may recall that Apple banned app-stores-within-a-store starting back in 2012. The company had kicked out apps that recommended other apps like AppHero, FreeAppADay, Daily App Dream, AppShopper and more. It also banned the more popular app recommendation service AppGratis the following year.

But Apple’s concern was that these apps were leveraging their power to manipulate App Store charts and rankings, often charging for that service. GameClub, on the other hand, plays fairly. Its service also benefits Apple, by offering subscription access to quality games that couldn’t thrive as free-to-play titles.

Longer-term, GameClub wants to produce its own original content and offer its service across platforms, starting with Google Play, but eventually tackling PC and console gaming.

The startup is headquartered in New York City, with offices in Copenhagen. In addition to the founders, it includes Eli Hodapp, the former editor-in-chief of the popular game news and review site TouchArcade, and COO Britt Myers, the former chief product officer of subscription-based edtech apps platform Homer.

With the close of a seed round last week, GameClub is backed by $4.6 million in funding.

Investors from a round that closed last year include GC VR Gaming Tracker Fund, CRCM Ventures, Watertower Ventures, Ride Ventures, BreakawayGrowth Fund and others. New investors include GFR Fund, Gramercy Fund, CentreGold Capital, and AET Fund.

GameClub is available on the App Store.