The social media company will pay companies including the New York Times, WIRED—and Breitbart—to distribute their content.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

In a victory over Amazon, Microsoft wins $10B Pentagon JEDI cloud contract

The U.S. Department of Defense today announced that Microsoft has won its Joint Enterprise Defense Infrastructure (JEDI) cloud contract, worth up to $10 billion over a period of 10 years. With this, Microsoft will provide infrastructure and platform services for both the Pentagon’s business and mission operations.

“The National Defense Strategy dictates that we must improve the speed and effectiveness with which we develop and deploy modernized technical capabilities to our women and men in uniform,” DOD Chief Information Officer Dana Deasy said in a related announcement. “The DOD Digital Modernization Strategy was created to support this imperative. This award is an important step in execution of the Digital Modernization Strategy.”

Microsoft beat out Amazon in the final round for this lucrative contract after the two cloud giants beat out other competitors like IBM and Oracle in an earlier round. Most pundits considered Amazon to be the frontrunner to win the deal.

“We’re surprised about this conclusion. AWS is the clear leader in cloud computing, and a detailed assessment purely on the comparative offerings clearly lead to a different conclusion,” an Amazon spokesperson told us in an emailed comment. “We remain deeply committed to continuing to innovate for the new digital battlefield where security, efficiency, resiliency, and scalability of resources can be the difference between success and failure.”

The process to get to this point has been anything but uncomplicated, though, with various lawsuits, last-minute recusals and other controversies, with even the president getting involved at one point.

It’ll remain to be seen how Microsoft’s employees will react to this news. Last year, a number of Microsoft employees posted an open letter asking the company not to bid for the contract. More recently, its employees also protested against GitHub’s relatively small $200,000 contract with the U.S. Immigration and Customs Enforcement agency. Against this backdrop, chances are we’ll see similar protests now that the company has won this deal with the Pentagon.

Update: Amazon provided us with a comment. We’ve added it to the story above. We’ve also reached out to Microsoft for a comment and will add that once/if we receive it.

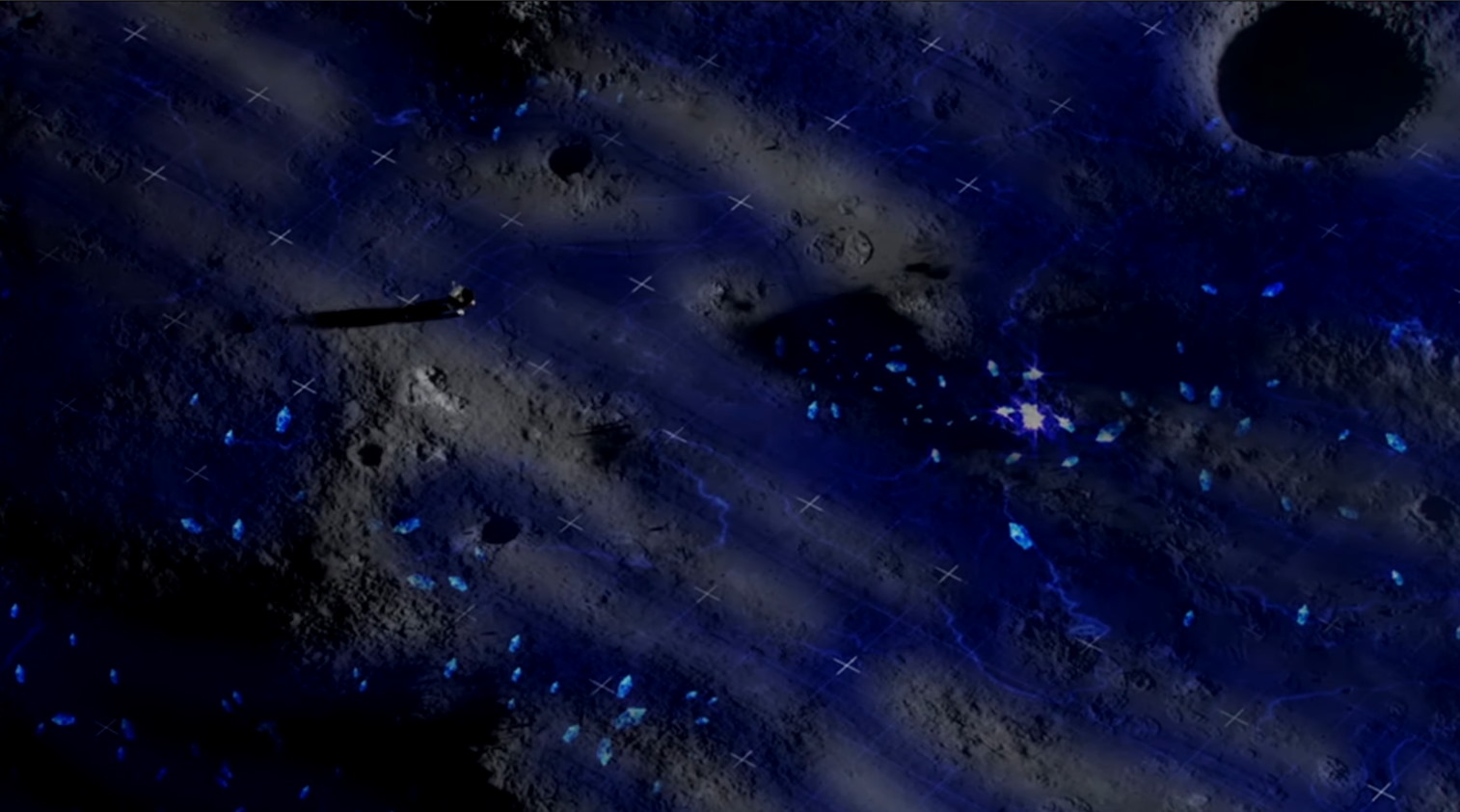

NASA’s VIPER lunar rover will hunt water on the Moon in 2022

NASA is looking for liquid gold on the Moon — not oil, but plain-old water. If we’re going to have a permanent presence there, we’ll need it, so learning as much as we can about it is crucial. That’s why the agency is sending a rover called VIPER to the Moon’s south pole — its first long-term surface mission since 1972.

VIPER, or the Volatiles Investigating Polar Exploration Rover, will touch down in December 2022 if all goes according to plan. Its mission: directly observe and quantify the presence of water in the permanently shadowed polar regions.

These perennially dark areas of the Moon have been collecting water ice for millions of years, since there’s no sunlight to melt or vaporize it. NASA already confirmed the presence of water ice by crashing a probe into the general area, but that’s a bit crude, isn’t it? Better to send a robot in to take some precise measurements.

VIPER will be about the size of a golf cart, and will be equipped with what amounts to prospecting gear. Its Neutron Spectrometer System (mentioned yesterday by NASA Administrator Jim Bridenstine ahead of this announcement) will let the rover detect water beneath the surface.

When it’s over a water deposit, VIPER will deploy… The Regolith and Ice Drill for Exploring New Terrain, or TRIDENT. Definitely the best acronym I’ve encountered this week. TRIDENT is a meter-long drill that will bring up samples for analysis by the rover’s two other instruments, a pair of spectrometers that will evaluate the contents of the soil.

By doing this systematically over a large area, the team hopes to create a map of water deposits below the surface that can be analyzed for larger patterns — perhaps leading to a more systematic understanding of our favorite substance’s presence on the Moon.

A visualization of Moon-based water ice under the surface being mapped by the VIPER rover

The rover is currently in development, as you can see from the pictures at the top — the right image is its “mobility testbed,” which as you might guess lets the team test out how it will get around.

VIPER is a limited-time mission; operating at the poles means there’s no sunlight to harvest with solar panels, so the rover will carry all the power it needs to last about a hundred days there. That’s longer than the U.S. has spent on the Moon’s surface in a long time — although China has for the last few years been actively deploying rovers all over the place.

Interestingly, the rover is planned for deployment via a Commercial Lunar Payload Services contract, meaning one of these companies may be building the lander that takes it from orbit to the surface. Expect to hear more as we get closer to launch.

TikTok, Under Scrutiny, Distances Itself From China

Three senators have called for an investigation into the social media app, which is owned by the Chinese tech giant ByteDance.

Tesla’s new Solar Roof costs less than a new roof plus solar panels, aims for install rate of 1K per week

Tesla has launched the third iteration of its solar roof tile for residential home use, which it officially detailed in a blog post on Friday and in a call with media. Tesla CEO Elon Musk kicked off the call with some explanatory remarks on the V3 Solar Roof, and then took a number of questions. The company says it’ll begin installations in the coming weeks (Musk says some installations have already begun) and that it hopes to ramp production to as many as 1,000 new roofs per week.

Tesla’s solar roof tiles — which are designed to look just like normal roof tiles when installed on a house, while doubling as solar panels to generate power — are something of a work-in-progress. The company is still tinkering with the product three years after announcing the concept, having done trial installations with two different iterations so far. “Versions one and two we were still figuring things out,” said Elon Musk on an earnings call earlier this week, adding that he thinks “version three is finally ready for the big time.”

Tesla’s Solar Roof website now includes a pricing estimator, which lists $42,500 as the total price for the average 2,000 square-foot home, with 10kW solar panels. It also lists $33,950 as the price after an $8,550 federal tax incentive. You can also enter your address and get an updated estimate that takes into account local costs and incentives, and add on any Powerwalls (with three as the default for a 2,000 square-foot roof).

“The solarglass roof is not going to make financial sense for somebody who has a relatively new roof, because this is itself a roof, that has integrated solar power generation,” Musk explained. He went on to note that Tesla has managed with this version three product to achieve a price point that is “less than what the average roof costs, plus the solar panels” that you would add on top of said roof.

“Figuring out how to install it effectively is very non-trivial. And we’re actually going to have […] ‘installathons,’ ” Musk said, which will pit two teams against each other to see who can roof one of two similar-sized/designed roofs faster. Musk reiterated later that there’s “quite a bit of R&D just in the installation process itself.”

Musk also said that while it’s hiring and training specialized installers at first, the plan is to ultimately expand installations to any third-party contractors as well. On the call, he and the Tesla team discussed how they focused on getting the installation time down to where it’s faster than installing traditional shingles, plus solar panels on top of that. Musk added that his ultimate goal is to install the solar glass tiles even faster than comparative shingles. This is a significant change from version two of the solar roof, Musk later said.

“We’re doing installations as fast as we possibly can, starting in the next few weeks,” Musk said about availability, adding that the goal is to “get to 1,000 roofs per week” sometime in “the next several months.”

A report from CNBC from September 2018 found that Tesla still hadn’t performed many actual installations of its solar roof tile, despite the two-year gap between announcement and the date of their investigation, and a January announcement about the initiation of solar roof tile production at Tesla’s Buffalo-based Gigafactory. During the company’s annual general shareholder meeting in June, Musk said that the third iteration of the tile was being worked on, and while he didn’t detail the actual number of installations, he did say that they were in progress in eight different states across the U.S. at that point.

Musk addressed some of the production delays to date, addressing the installation complexity of previous generations, but also citing the Tesla Model 3 production ramp, which he said “really stripped resources from solar for a year or a year-and-a-half.” Now that Model 3 production is in a good place, Musk said that that has unblocked significantly some of the company’s ability to focus on this challenge.

The total addressable market that Musk sees for this product is somewhere on the order of 100 million houses worldwide, and Musk stressed that the company does indeed intend to make this available worldwide.

While at launch there will be only one available look for the Solar Roof, the Tesla CEO also said that the company will roll out additional variants as quickly as it can, including tiles that resemble clay and other alternatives.

The tiles and roof installation carry a warranty of 25 years, which includes their protective weatherization (including 130 MPH wind resistance) and their power generation capability. On balance, the Solar Roof provides more energy generation than a similarly sized roof retrofitted with traditional tiles, though individually, the tile’s power-gathering cells themselves are less energy-efficient than a traditional solar cell. The Solar Roof is better performing, however, because it covers more surface area of a home.

Uber Tipping Behavior Revealed, Apple App Store Malware, and More News

Catch up on the most important news from today in two minutes or less.

Mark Zuckerberg makes the case for Facebook News

While Facebook CEO Mark Zuckerberg seemed cheerful and even jokey when he took the stage today in front of journalists and media executives (at one point, he described the event as “by far the best thing” he’d done this week), he acknowledged that there are reasons for the news industry to be skeptical.

Facebook, after all, has been one of the main forces creating a difficult economic reality for the industry over the past decade. And there are plenty of people (including our own Josh Constine) who think it would be foolish for publishers to trust the company again.

For one thing, there’s the question of how Facebook’s algorithm prioritizes different types of content, and how changes to the algorithm can be enormously damaging to publishers.

“We can do a better job of working with partners to have more transparency and also lead time about what we see in the pipeline,” Zuckerberg said, adding, “I think stability is a big theme.” So Facebook might be trying something out as an “experiment,” but “if it kind of just causes a spike, it can be hard for your business to plan for that.”

At the same time, Zuckerberg argued that Facebook’s algorithms are “one of the least understood things about what we do.” Specifically, he noted that many people accuse the company of simply optimizing the feed to keep users on the service for as long as possible.

“That’s actually not true,” he said. “For many years now, I’ve prohibited any of our feed teams … from optimizing the systems to encourage the maximum amount of time to be spent. We actually optimize the system for facilitating as many meaningful interactions as possible.”

For example, he said that when Facebook changed the algorithm to prioritize friends and family content over other types of content (like news), it effectively eliminated 50 million hours of viral video viewing each day. After the company reported its subsequent earnings, Facebook had the biggest drop in market capitalization in U.S. history.

Zuckerberg was onstage in New York with News Corp CEO Robert Thomson to discuss the launch of Facebook News, a new tab within the larger Facebook product that’s focused entirely on news. Thomson began the conversation with a simple question: “What took you so long?”

The Facebook CEO took this in stride, responding that the question was “one of the nicest things he could have said — that actually means he thinks we did something good.”

Zuckerberg went on to suggest that the company has had a long interest in supporting journalism (“I just think that every internet platform has a responsibility to try to fund and form partnerships to help news”), but that its efforts were initially focused on the News Feed, where the “fundamental architecture” made it hard to find much room for news stories — particularly when most users are more interested in that content from friends and family.

So Facebook News could serve as a more natural home for this news (to be clear, the company says news content will continue to appear in the main feed as well). Zuckerberg also said that since past experiments have created such “thrash in the ecosystem,” Facebook wanted to make sure it got this right before launching it.

In particular, he said the company needed to show that tabs within Facebook, like Facebook Marketplace and Facebook Watch, could attract a meaningful audience. Zuckerberg acknowledged that the majority of Facebook users aren’t interested in these other tabs, but when you’ve got such an enormous user base, even a small percentage can be meaningful.

“I think we can probably get to maybe 20 or 30 million people [visiting Facebook News] over a few years,” he said. “That by itself would be very meaningful.”

Facebook is also paying some of the publishers who are participating in Facebook News. Zuckerberg described this as “the first time we’re forming long-term, stable relationships and partnerships with a lot of publishers.”

Several journalists asked for more details about how Facebook decided which publishers to pay, and how much to pay them. Zuckerberg said it’s based on a number of factors, like ensuring a wide range of content in Facebook News, including from publishers who hadn’t been publishing much on the site previously. The company also had to compensate publishers who are taking some of their content out from behind their paywalls.

“This is not an exact formula — maybe we’ll get to that over time — but it’s all within a band,” he said.

Zuckerberg was also asked about how Facebook will deal with accuracy and quality, particularly given the recent controversy over its unwillingness to fact check political ads.

He sidestepped the political ads question, arguing that it’s unrelated to the day’s topics, then said, “This is a different kind of thing.” In other words, he argued that the company has much more leeway here to determine what is and isn’t included — both by requiring any participating publishers to abide by Facebook’s publisher guidelines, and by hiring a team of journalists to curate the headlines that show up in the Top Stories section.

“People have a different expectation in a space dedicated to high-quality news than they do in a space where the goal is to make sure everyone can have a voice and can share their opinion,” he said.

As for whether Facebook News will include negative stories about Facebook, Zuckerberg seemed delighted to learn that Bloomberg (mostly) doesn’t cover Bloomberg.

“I didn’t know that was a thing a person could do,” he joked. More seriously, he said, “For better or worse, we’re a prominent part of a lot of the news cycles. I don’t think it would be reasonable to try to have a news tab that didn’t cover the stuff that Facebook is doing. In order to make this a trusted source over time, they have to be covered objectively.”

Can We Plant 20 Million Trees for 2020? The Math Says Yes

How much land will the \#TeamTrees plan require? A science prof roughs it to assess the feasibility.

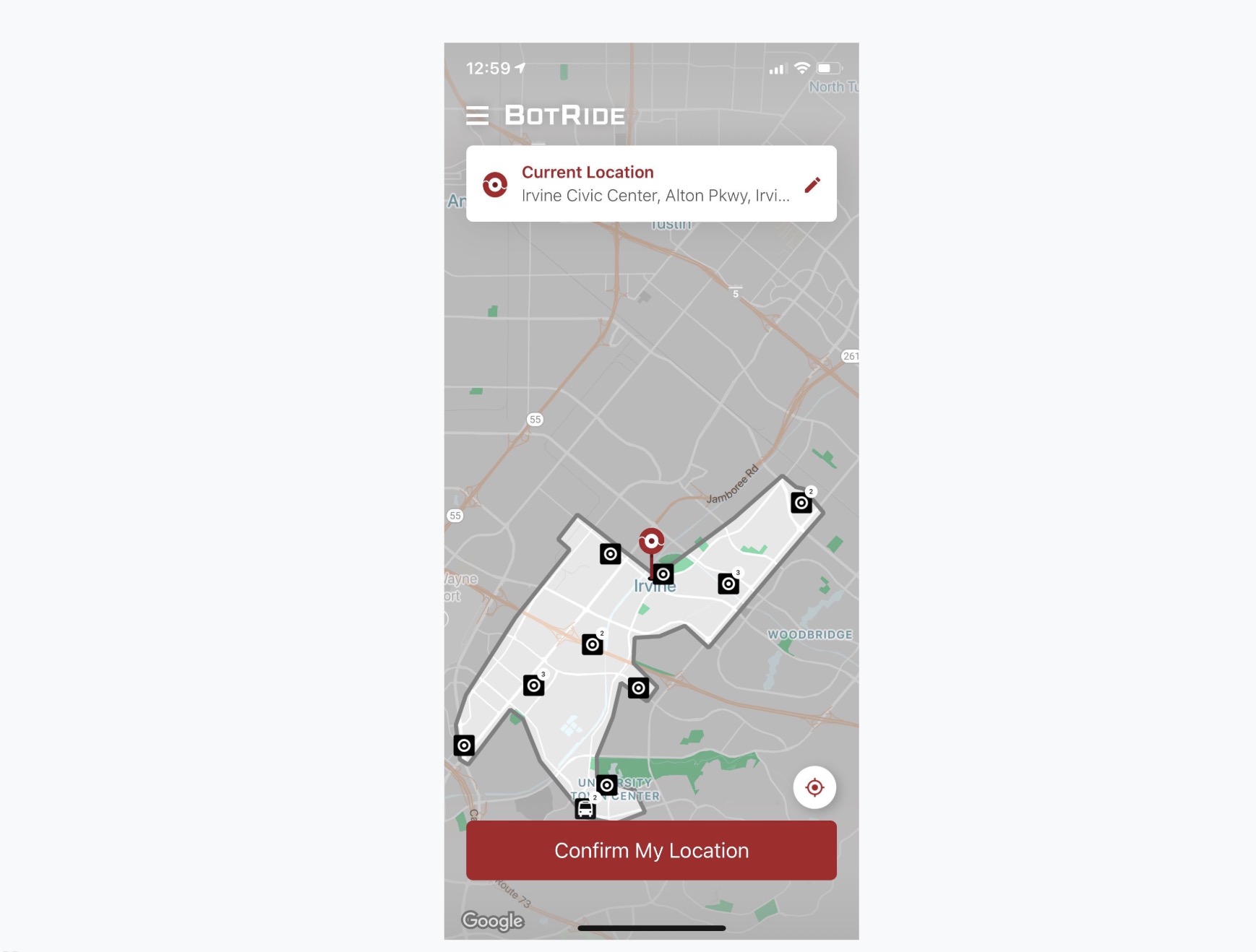

Hyundai is launching BotRide, a robotaxi service in California with Pony.ai and Via

A fleet of electric, autonomous Hyundai Kona crossovers — equipped with a self-driving system from Chinese autonomous startup Pony .ai and Via’s ride-hailing platform, will start shuttling customers on public roads next week.

The robotaxi service called BotRide will operate on public roads in Irvine, California, beginning November 4. This isn’t a driverless service; there will be a human safety driver behind the wheel at all times. But it is one of the few ride-hailing pilots on California roads. Only four companies, AutoX, Pony.ai, Waymo and Zoox have permission to operate a ride-hailing service using autonomous vehicles in the state of the California.

Customers will be able to order rides through a smartphone app, which will direct passengers to nearby stops for pick up and drop off. Via’s expertise is on shared rides, and this platform aims for the same multiple rider goal. Via’s platform handles the on-demand ride-hailing features such as booking, passenger and vehicle assignment and vehicle identification (QR code). Via has two sides to its business. The company operates consumer-facing shuttles in Chicago, Washington, D.C. and New York. It also partners with cities and transportation authorities — and now automakers launching robotaxi services — giving clients access to their platform to deploy their own shuttles.

Hyundai said BotRide is “validating its user experience in preparation for a fully driverless future.” Hyundai didn’t explain when this driverless future might arrive. Whatever this driverless future ends up looking like, Hyundai sees this pilot as a critical marker along the way.

Hyundai said it is using BotRide to study consumer behavior in an autonomous ride-sharing environment, according to Christopher Chang, head of business development, strategy and technology division, Hyundai Motor Company .

“The BotRide pilot represents an important step in the deployment and eventual commercialization of a growing new mobility business,” said Daniel Han, manager, Advanced Product Strategy, Hyundai Motor America.

Hyundai might be the household name behind BotRide, but Pony.ai and Via are doing much of the heavy lifting. Pony.ai is a relative newcomer to the AV world, but it has already raised $300 million on a $1.7 billion valuation and locked in partnerships with Toyota and Hyundai.

The company, which has operations in China and California and about 500 employees globally, was founded in late 2016 with backing from Sequoia Capital China, IDG Capital and Legend Capital.

It’s also one of the few autonomous vehicle companies to have both a permit with the California Department of Motor Vehicles to test AVs on public roads and permission from the California Public Utilities Commission to use these vehicles in a ride-hailing service. Under rules established by the CPUC, Pony.ai cannot charge for rides.

Daily Crunch: Facebook launches its News section

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Facebook starts testing News, its new section for journalism

Facebook’s news section, which was previously reported to be imminent, is here: The company is rolling out Facebook News in a limited test in the U.S. as a home screen tab and bookmark in the main Facebook app.

Should publishers trust Facebook? Well, Josh Constine argues that none of them have learned the right lessons from the last 10 years.

2. Pixelbook Go review: a Chromebook in search of meaning

The Go is clearly Google’s attempt to lead the way for manufacturers looking to explore Chromebook life outside the classroom. It has some nice hardware perks, but it’s not the revolution or revelation ChromeOS needs.

3. SpaceX wants to land Starship on the Moon before 2022, then do cargo runs for 2024 human landing

SpaceX president and COO Gwynne Shotwell shed a little more light on her company’s current thinking with regards to the mission timelines for its forthcoming Starship spacefaring vehicle.

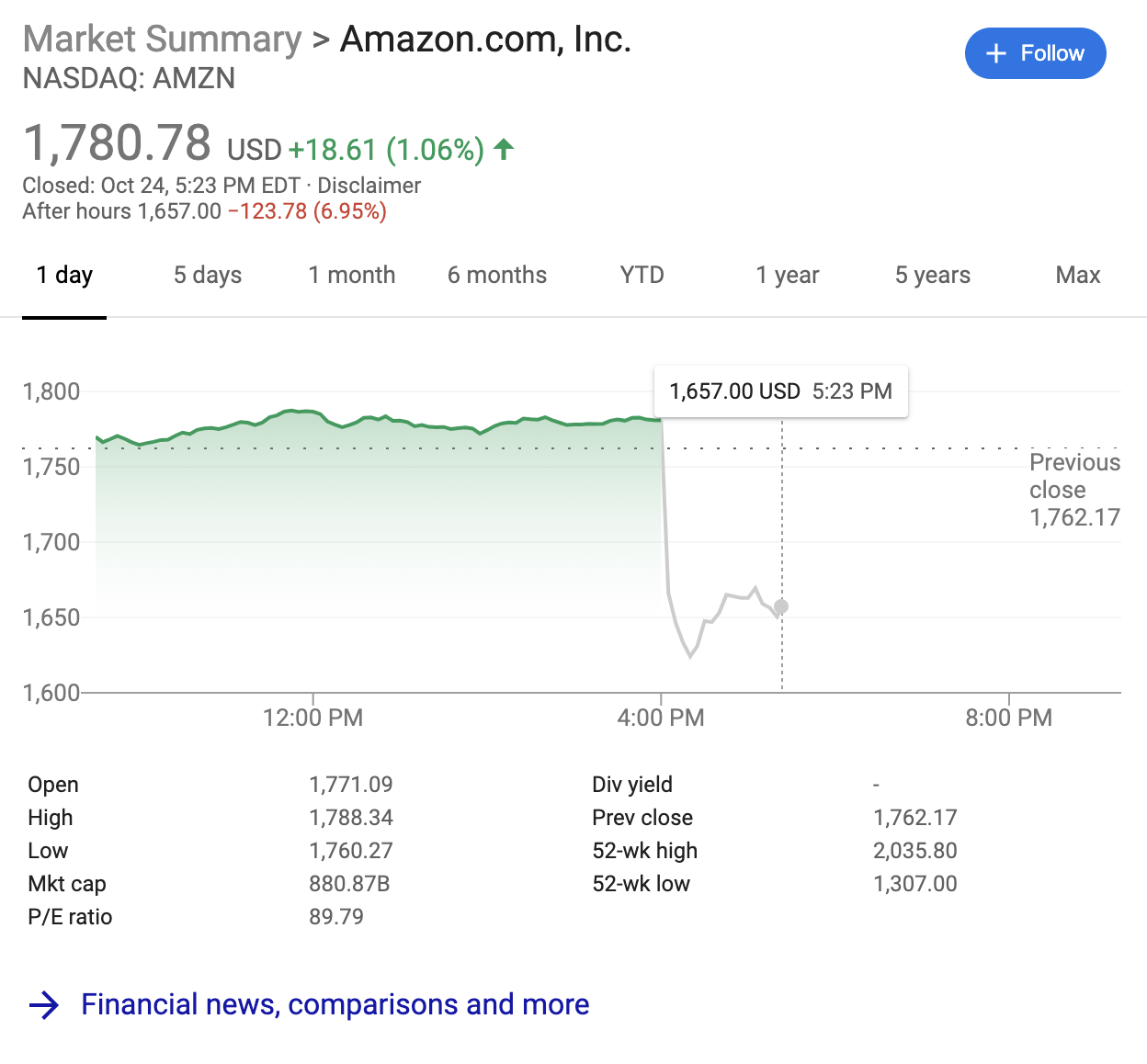

4. After its first earnings miss in two years, Amazon shares get walloped in after-hours trading

Amazon shares fell by nearly 7% in after-hours trading on Thursday after the company reported its first earnings miss in two years.

5. Lawmakers ask US intelligence chief to investigate if TikTok is a national security threat

In a letter by Sens. Charles Schumer (D-NY) and Tom Cotton (R-AR), the lawmakers asked the acting director of national intelligence Joseph Maguire if the app maker could be compelled to turn Americans’ data over to Chinese authorities.

6. The SaaS gold rush will become the ‘Hunger Games’

Enterprise software investor Rory O’Driscoll says that while the cloud is obviously here to stay, the next five years in cloud investing will neither be the same nor as easy as the last 10. (Extra Crunch membership required.)

7. Learn how to raise your first euros at TechCrunch Disrupt Berlin

Startup funding experts — including Forward Partners managing partner Nic Brisbourne, Target Global partner Malin Holmberg and DocSend co-founder and chief executive officer Russ Heddleston — will sit down together on the Extra Crunch Stage at TechCrunch Disrupt Berlin.

Why publishers shouldn’t trust Facebook News

Are we really doing this again? After the pivot to video. After Instant Articles. After news was deleted from the News Feed. Once more, Facebook dangles extra traffic, and journalism outlets leap through its hoop and into its cage.

Tomorrow, Facebook will unveil its News tab. About 200 publishers are already aboard including the Wall Street Journal and BuzzFeed News, and some will be paid. None seem to have learned the lesson of platform risk.

When you build on someone else’s land, don’t be surprised when you’re bulldozed. And really, given Facebook’s flawless track record of pulling the rug out from under publishers, no one should be surprised.

I could just re-run my 2015 piece on how “Facebook is turning publishers into ghost writers,” merely dumb content in its smart pipe. Or my 2018 piece on “how Facebook stole the news business” by retraining readers to abandon publishers’ sites and rely on its algorithmic feed.

Chronicling Facebook’s abuse of publishers

Let’s take a stroll back through time and check out Facebook’s past flip-flops on news that hurt everyone else:

-In 2007 before Facebook even got into news, it launches a developer platform with tons of free virality, leading to the build-up of companies like Zynga. Once that spam started drowning the News Feed, Facebook cut it and Zynga off, then largely abandoned gaming for half a decade as the company went mobile. Zynga never fully recovered.

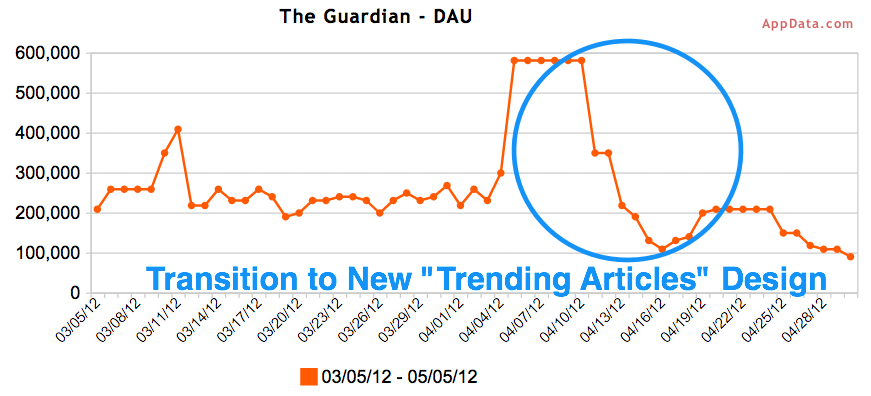

-In 2011, Facebook launches the open graph platform with Social Reader apps that auto-share to friends what news articles you’re reading. Publishers like The Guardian and Washington Post race to build these apps and score viral traffic. But in 2012, Facebook changes the feed post design and prominence of social reader apps, they lost most of their users, those and other outlets shut down their apps, and Facebook largely abandons the platform

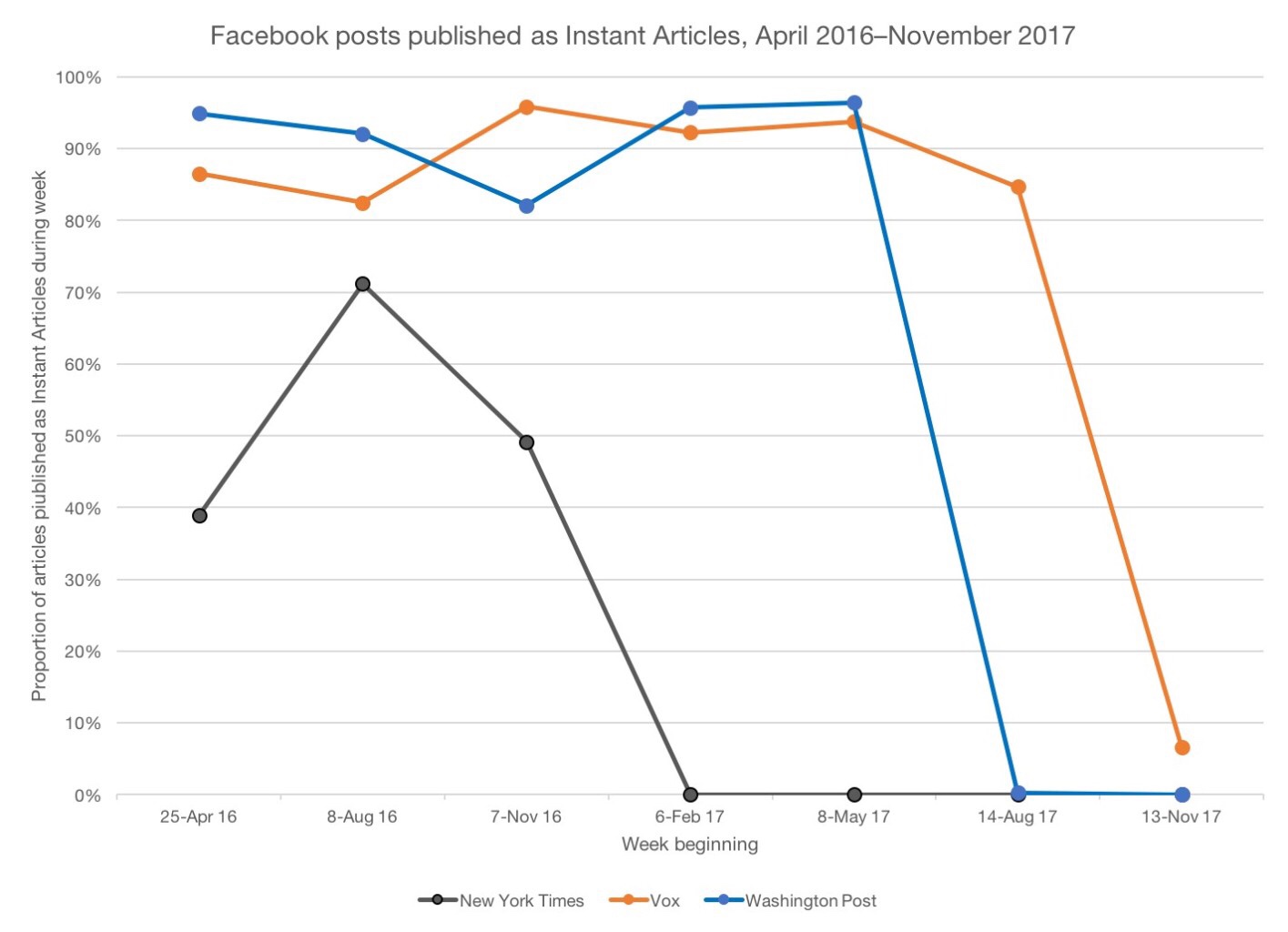

-In 2015, Facebook launches Instant Articles, hosting news content inside its app to make it load faster. But heavy-handed rules restricting advertising, subscription signup boxes, and recirculation modules lead publishers to get little out of Instant Articles. By late 2017, many publishers had largely abandoned the feature.

Decline of Instant Article use, via Columbia Journalism Review

-Also in 2015, Facebook started discussing “the shift to video,” citing 1 billion video views per day. As the News Feed algorithm prioritized video and daily views climbed to 8 billion within the year, newsrooms shifted headcount and resources from text to video. But a lawsuit later revealed Facebook already knew it was inflating view metrics by 150% to 900%. By the end of 2017 it had downranked viral videos, eliminated 50 million hours per day of viewing (over 2 minutes per user), and later pulled back on paying publishers for Live video as it largely abandoned publisher videos in favor of friend content.

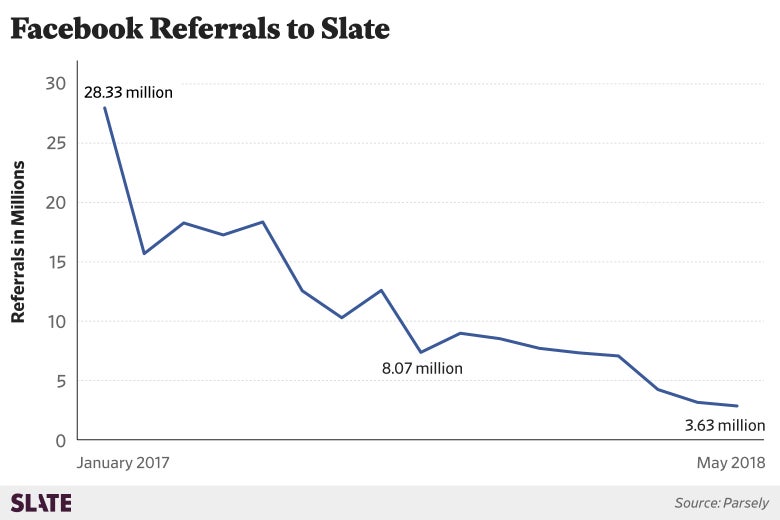

-In 2018, Facebook announced it would decrease the presence of news in the News Feed from 5% to 4% while prioritizing friends and family content. Referral shrank sharply, with Google overtaking it as the top referrer, while some outlets were hit hard like Slate which lost 87% of traffic from Facebook. You’d understand if some publishers felt…largely abandoned.

Facebook referral traffic to slate plummeted 87% after a strategy change prioritized friends and family content over news

Are you sensing a trend?

Facebook typically defends the whiplash caused by its strategic about-faces by claiming it does what’s best for users, follows data on what they want, and tries to protect them. What it leaves out is how the rest of the stakeholders are prioritized.

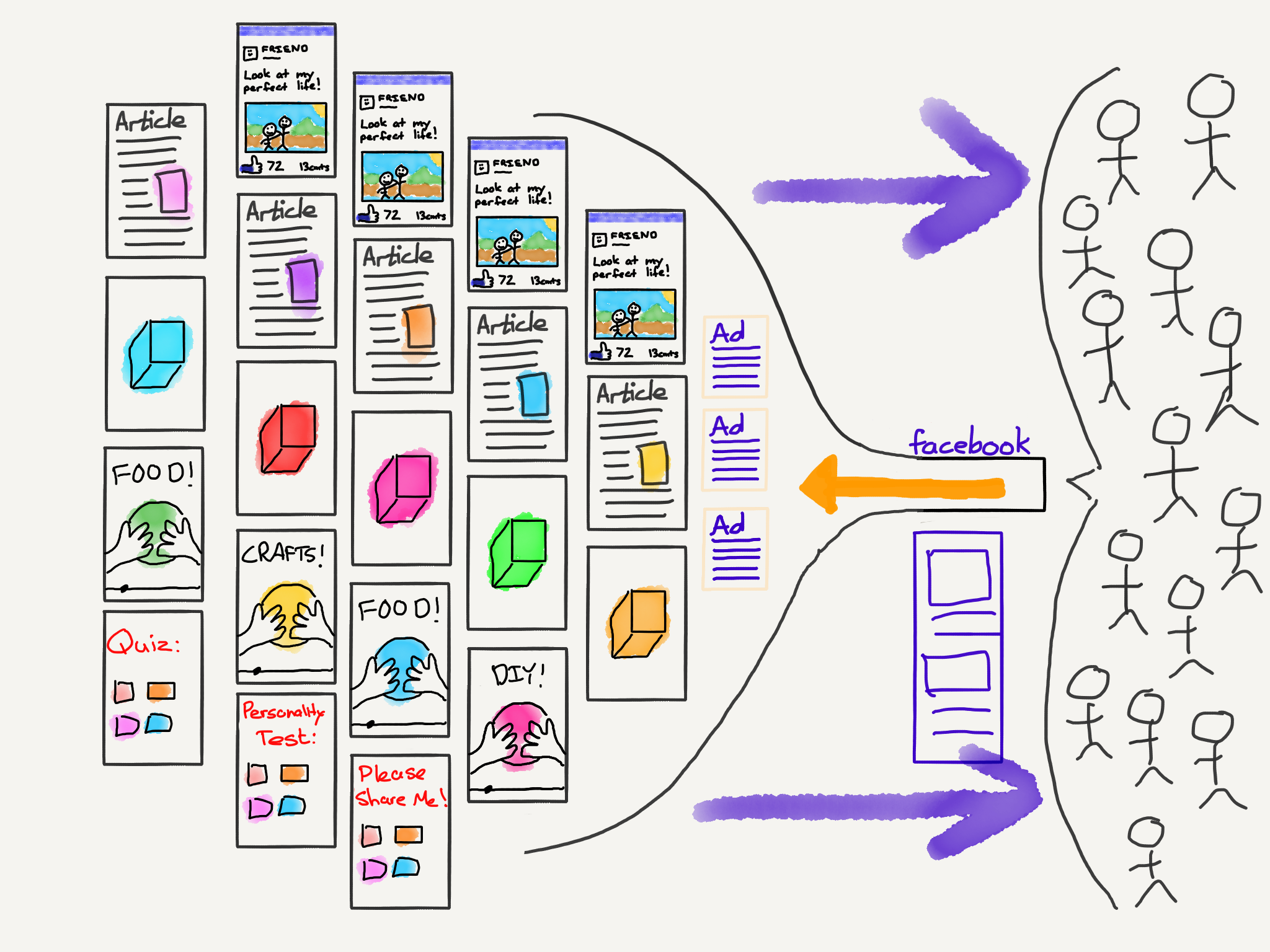

Aggregated to death

I used to think of Facebook as being in a bizarre love quadrangle with its users, developers and advertisers. But increasingly it feels like the company is in an abusive love/hate relationship with users, catering to their attention while exploiting their privacy. Meanwhile, it dominates the advertisers thanks to its duopoly with Google that lets it survive metrics errors, and the developers as it alters their access and reach depending on if it needs their users or is backpedaling after a data fiasco.

Only recently after severe backlash does society seem to be getting any of Facebook’s affection. And perhaps even lower in the hierarchy would be news publishers. They’re not a huge chunk of Facebook’s content or, therefore, its revenue, they’re not part of the friends and family graph at the foundation of the social network, and given how hard the press goes on Facebook relative to Apple and Google, it’s hard to see that relationship getting much worse than it already is.

That’s not to say Facebook doesn’t philosophically care about news. It invests in its Journalism Project hand-outs, literacy and its local news feature Today In. Facebook has worked diligently in the wake of Instant Article backlash to help publishers build out paywalls. Given how centrally it’s featured, Facebook’s team surely reads plenty of it. And supporting the sector could win it some kudos between scandals.

But what’s not central to Facebook’s survival will never be central to its strategy. News is not going to pay the bills, and it probably won’t cause a major change in its hallowed growth rate. Remember that Twitter, which hinges much more on news, is 1/23rd of Facebook’s market cap.

So hopefully at this point we’ve established that Facebook is not an ally of news publishers.

At best it’s a fickle fair-weather friend. And even paying out millions of dollars, which can sound like a lot in journalism land, is a tiny fraction of the $22 billion in profit it earned in 2018.

Whatever Facebook offers publishers is conditional. It’s unlikely to pay subsidies forever if the News tab doesn’t become sustainable. For newsrooms, changing game plans or reallocating resources means putting faith in Facebook it hasn’t earned.

What should publishers do? Constantly double-down on the concept of owned audience.

They should court direct traffic to their sites where they have the flexibility to point users to subscriptions or newsletters or podcasts or original reporting that’s satisfying even if it’s not as sexy in a feed.

Meet users where they are, but pull them back to where you live. Build an app users download or get them to bookmark the publisher across their devices. Develop alternative revenue sources to traffic-focused ads, such as subscriptions, events, merchandise, data and research. Pay to retain and recruit top talent with differentiated voices.

What scoops, opinions, analysis, and media can’t be ripped off or reblogged? Make that. What will stand out when stories from every outlet are stacked atop each other? Because apparently that’s the future. Don’t become generic dumb content fed through someone else’s smart pipe.

As Ben Thompson of Stratechery has proselytized, Facebook is the aggregator to which the spoils of attention and advertisers accrue as they’re sucked out of the aggregated content suppliers. To the aggregator, the suppliers are interchangeable and disposable. Publishers are essentially ghostwriters for the Facebook News destination. Becoming dependent upon the aggregator means forfeiting control of your destiny.

Surely, experimenting to become the breakout star of the News tab could pay dividends. Publishers can take what it offers if that doesn’t require uprooting their process. But with everything subject to Facebook’s shifting attitudes, it will be like publishers trying to play bocce during an earthquake.

[Featured Image: Russell Werges]

Ford’s electric Mustang-inspired SUV will finally get its debut

Ford provided its first peek of a Mustang-inspired electric crossover nearly 14 months months. Now, it’s ready to show the world what “Mustang-inspired” means.

The automaker said Thursday it will debut the electric SUV on November 17 ahead of the LA Auto Show.

Not much is known about the electric SUV that is coming to market in 2020, despite dropping the occasional teaser image or hint. A new webpage launched recently, which provides few details, namely that Ford is targeting an EPA-estimated range of at least 300 miles. The look, specs and price will have to wait until at least the November 17 debut date.

What we do know is that Ford’s future (and certainly its CEO’s) is tied to the success of this shift to electrification. The Mustang-inspired SUV might not be the cornerstone to this strategy (an electric F150 probably deserves that designation), but it will be a critical piece.

Ford has historically backed hybrid technology. Back in 2016, Ford Chairman Bill Ford said at a Fortune event that he viewed plug-in hybrids as a transitional technology.

A lot has changed. Hybrids are still part of the mix. But in the past 18 months, Ford has put more emphasis on the development and production of all-electric vehicles.

In 2018, the company said it will invest $11 billion to add 16 all-electric vehicles within its global portfolio of 40 electrified vehicles through 2022.

Ford unveiled in September at the Frankfurt Motor Show a range of hybrid vehicles as part of its plan to reach sales of 1 million electrified vehicles in Europe by the end of 2022.

It also invested in electric vehicle startup Rivian and locked in a deal with Volkswagen that covers a number of areas, including autonomy (via an investment by VW in Argo AI) and collaboration on development of electric vehicles. Ford will use Volkswagen’s MEB platform to develop “at least one” fully electric car for the European market that’s designed to be produced and sold at scale.

SpaceX intends to offer Starlink satellite broadband service starting in 2020

SpaceX will look to launch its Starlink service for consumers sometime next year, SpaceX President and COO Gwynne Shotwell confirmed at a media roundtable meeting at the company’s offices in Washington during the International Astronautical Congress this week (via SpaceNews). Shotwell, who also appeared on stage at the event to share some updates around SpaceX’s recent progress across the company, told reporters present that in order to make the date, it’ll need to launch between six and eight different grouped payloads of Starlink satellites, a number that includes the batch that went up in May of this year.

All told, SpaceX has shared previously that it’ll need 24 launches in order to make the constellation global, and it also shared at that time that it intends to start with service in the Northern United States and parts of Canada beginning next year. Though 24 launches will provide full global coverage, Shotwell told media that it’ll still be doing additional launches after that in order to expand and improve coverage.

SpaceX President and COO Gwynne Shotwell

In fact, SpaceX recently filed paperwork to launch as many as 30,000 satellites in addition to the 12,000 it has already gotten permission to put up, for a total constellation size of up to 42,000. A SpaceX spokesperson previously described this as “taking steps to responsibility scale Starlink’s total network capacity and data density to meet the growth in users’ anticipated needs” in a statement provided to TechCrunch.

Owning and operating a global broadband satellite constellation could be a considerable revenue driver for SpaceX, and an important product pillar upon which the company can rely for recurring profit as it pursues its more ambitious programs, including eventual Mars launch services. Setting up the satellite constellation, especially at the scale intended, will definitely be a cost-intensive process on its own, but SpaceX is looking to its product developments like its Starship, which will be able to take much more cargo to orbit in terms of payload capacity, to reduce its own, and customer launch costs over time.

Shotwell also told reporters at the gathering that the company is already testing Starlink connectivity for U.S. Air Force Research Laboratory use, and while she didn’t reveal consumer pricing, did note that many in the U.S. pay $80 for service that is sub-par already, per SpaceNews.

The SaaS gold rush will become the ‘Hunger Games’

Contributor

SaaS has been the motherlode of enterprise software investing for two decades now. Venture investors, entrepreneurs, and Wall Street have all learned to pile on, leading to a shared consensus that cloud investing is “a sure thing.” Nothing is more destructive to investors over the long term than a sure thing, so I began to wonder, “what could cause the wonderful economics of cloud investing to unravel?”

My conclusion is that while the cloud is obviously here to stay, the next five years in cloud investing will neither be the same nor as easy as the last 10. My reason for writing this post is not to be a party pooper, but to provide a context for startups to navigate this potentially harsher environment. This post identifies three different startup strategies, all of which can work even in the more competitive cloud economy that I envisage. More on that below.

Big picture, the summary points are as follows:

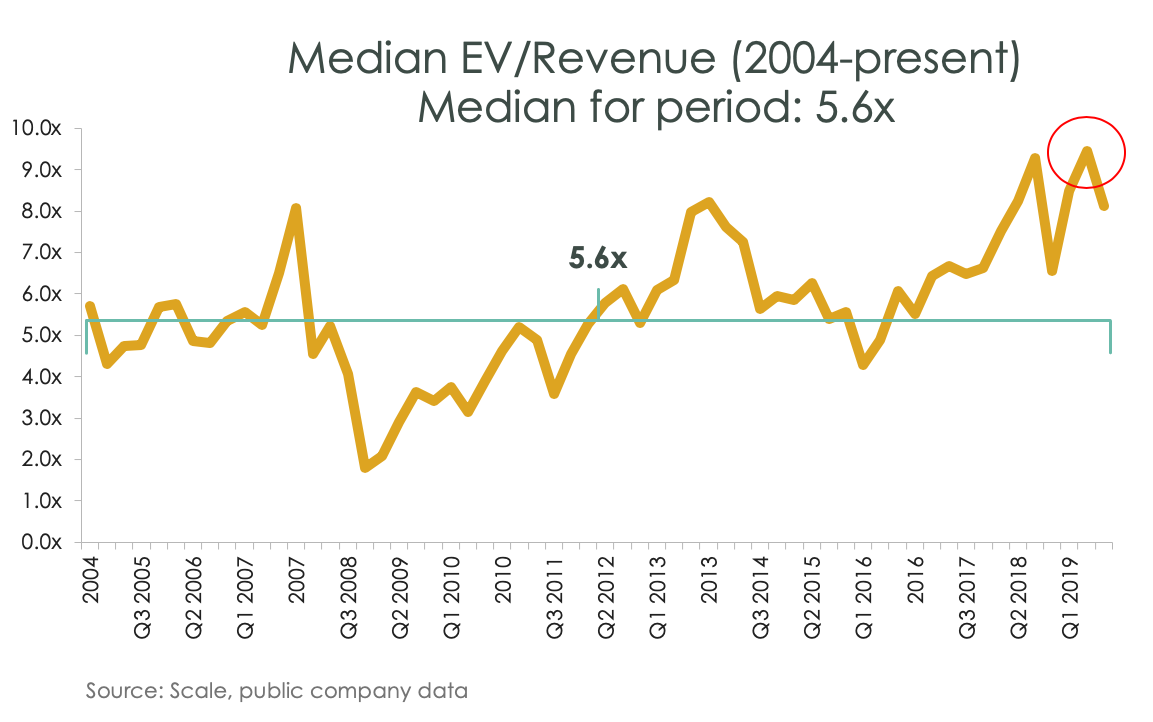

First, cloud company valuations are at all-time highs which cannot be justified by improved company operating performance but can explained by 20 years of consistent 30% growth in the cloud software market. This has given investors the comfort to “pay up.”

Second, within the next two to three years, there will be a “growth crunch” as many cloud markets saturate. At that point the Gold Rush will become the Hunger Games, as cloud companies large and small compete against each other for survival.

Third, there will be three winning strategies for a startup when this happens: fight, or compete head on in an existing cloud market; focus, or find those parts of the cloud market where there is still low competition and good growth; fly, which is to build a company based on more than just the move to the cloud.

Fourth, “beyond the cloud” means “assume the cloud” and build on top of that stack using newer technologies and a design approach where instead of the user working for the software, the software works for (or instead of) the user. At Scale, we think of this as building the Intelligent Connected World (ICW).

Let’s walk through the details.

How did we get here?

We got here because the cloud model works. It works as a computer architecture, and there is no clear replacement architecture on the horizon. It works for customers by aligning incentives with vendors to keep their software working. And it works – brilliantly – as a financial model. In a world of low growth and low interest rates, SaaS looks like a perpetual motion machine and the valuations show it. Today the median SaaS multiple is 8.5x run rate versus an all-time average of 5.6x. Higher growth companies trade at even loftier multiples of 20x and 30x.

Are cloud companies performing better than ever?

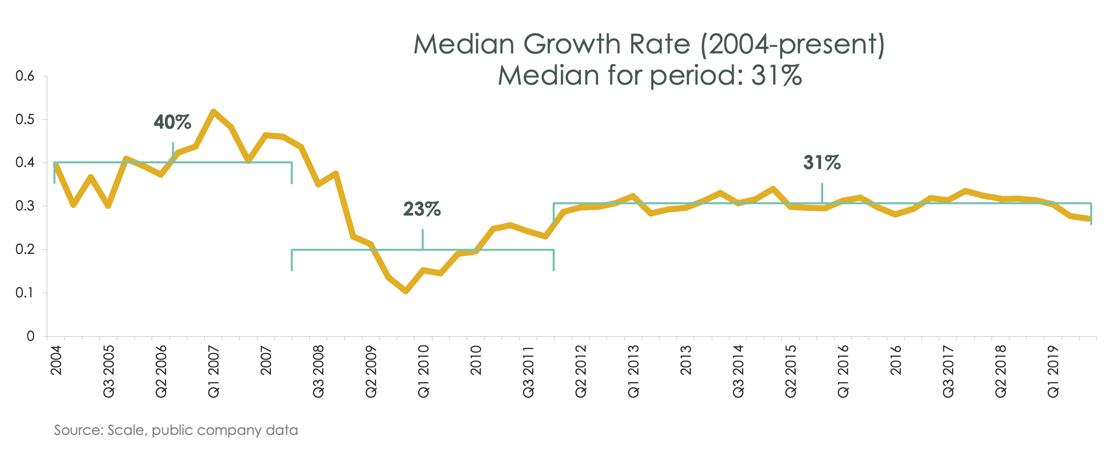

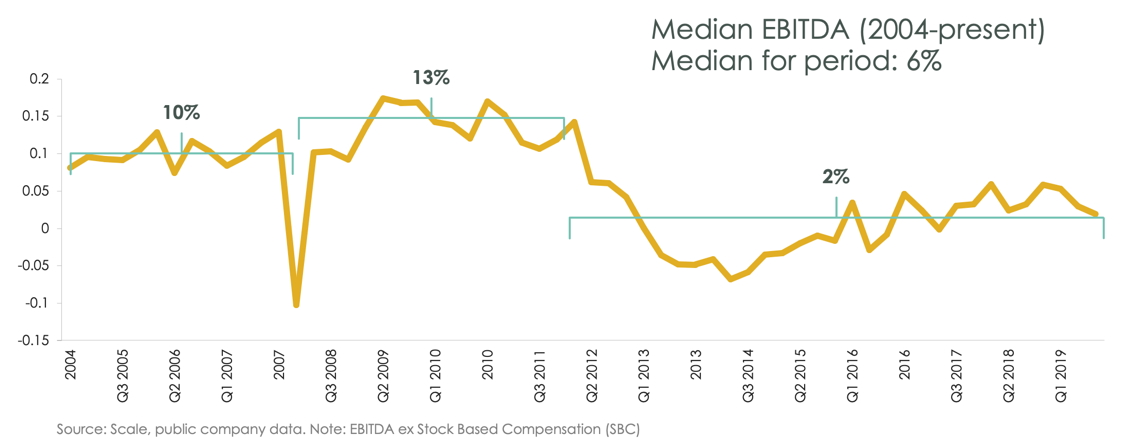

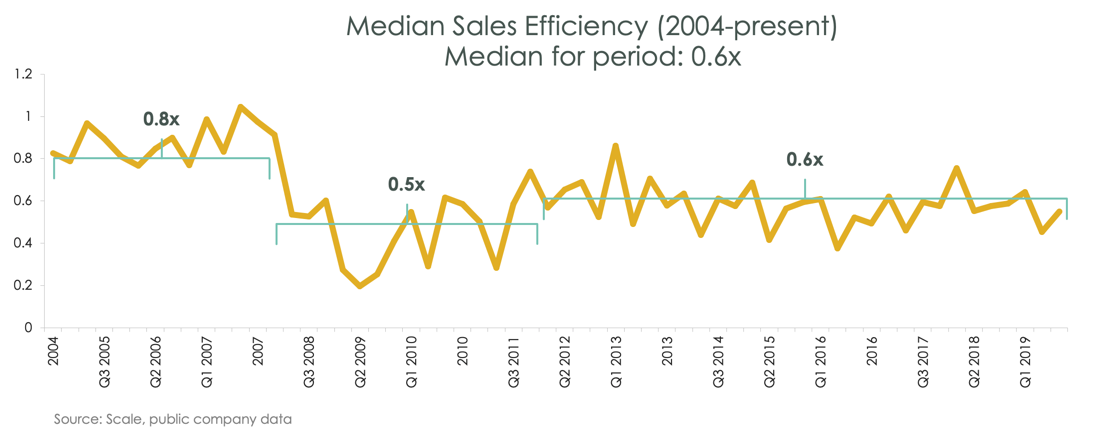

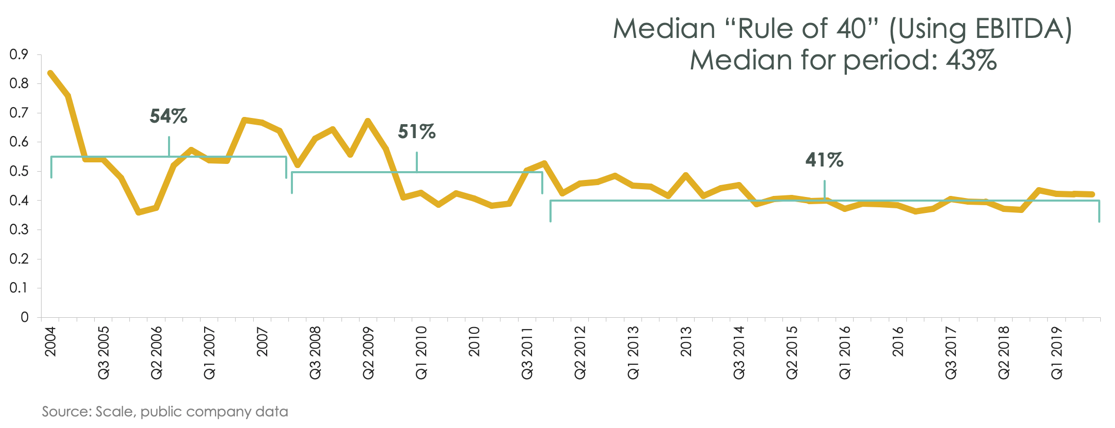

The short answer is no. The four charts below show growth rate, profitability, Sales Efficiency and the Rule of 40 (a combination of growth and profitability) for the entire public SaaS universe from 2004 to today. Each chart also shows separately the median for three sub-periods within this time period: pre-crash (2004 to 2008), the crash period (2009 to 2011), and post-crash (2011 to today).

The story is the same in every case. Pre-crash operating performance was stellar in what was then a new uncrowded market. The crash was brutal on growth and forced companies to get profitable fast. But since 2011, growth rates, EBITDA, Sales Efficiency and Rule of 40 measures have all been roughly flat and provide no justification for almost a doubling of valuations in the last two years.

So why are these companies trading so richly?

It’s all about the growth

Sometimes the answer is in plain sight. The big picture in all the above numbers is that public companies in this sector have been growing at 30% plus for 15 years now, since the Salesforce IPO in 2004. Growth has not gone up but, far more importantly, it has not gone down.

After its first earnings miss in two years, Amazon shares get walloped in after-hours trading

Amazon shares fell by nearly 7%, or $118.38, in after-hours trading on Thursday after the company reported its first earnings miss in two years.

Financial analysts had predicted that the launch of one-day shipping would eat into Amazon’s earnings, but even with the forewarning investors pummeled the stock after the market closed. It didn’t help that the company predicted revenues for the fourth quarter — including the all-important holiday season — also look soft.

The good news for Amazon amidst all the bad news was that revenue was actually up at the company. For the quarter Amazon raked in $70 billion, beating analysts’ expectations of $68.8 billion.

However, the company reported a profit of $2.1 billion, or $4.23 a share versus the $4.62 that analysts had projected. And even though sales were up this year, earnings per share were down from $5.75 in the year-ago period. As MarketWatch noted, it’s the first time earnings at the company have shrunk since 2017.

Another potential warning sign for investors was the revenue from the company’s web services business, which came in at $9 billion. Analysts had predicted roughly $9.2 billion from the business line. If competition starts eating into the services business (which still grew at a healthy 35% over the year-ago period), that could spell problems for the company’s stock — which has used AWS revenues to buoy spending elsewhere.

The company has been spending heavily all year to offer new services. The expansion of its free one-day delivery program has cost Amazon more than $800 million in the second quarter.

Amazon founder and chief executive Jeff Bezos defended the move to one-day shipping in a statement.

“Customers love the transition of Prime from two days to one day — they’ve already ordered billions of items with free one-day delivery this year. It’s a big investment, and it’s the right long-term decision for customers,” Bezos said. “And although it’s counterintuitive, the fastest delivery speeds generate the least carbon emissions because these products ship from fulfillment centers very close to the customer — it simply becomes impractical to use air or long ground routes.”

Looking ahead to the holiday season Amazon predicted net sales of between $80 billion and $86.5 billion, with operating income between $1.2 billion and $2.9 billion, versus $3.8 billion from a year-ago period. Analysts were expecting to see revenue numbers more in the $87 billion range.