Dive deep into the 5G spectrum, millimeter-wave technology, and why 5G could give China an edge in the AI race.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

This tiny, soft robo-bug scoots with smarts and survives swats

Nature is a good source of inspiration for roboticists, but it’s rare that nature’s elegance and genius can be replicated in any real way. Still, we’re getting closer. This tiny insect-like robot is made of soft materials and weighs less than a gram, yet can move quickly and with some intelligence — and is robust enough to survive a pounding from a fly swatter.

For the most part, tiny robots like this are compromises. For instance, they can move quickly, but only with external power. Or they can navigate intelligently, but only by being controlled remotely. Or they’re power efficient, but unable to move quickly or intelligently.

The DEAnsect, so called for being made of “dielectric elastomer actuators,” is an attempt to create a robot that combines locomotion, intelligence and efficiency into a single package — even if it’s only a little bit of each.

It moves with three little legs, each of which advances ever so slightly when an electric current changes the shape of the elastomer they’re made of, pulling the robot forward a tiny bit. This happens many times per second, too fast for us to see, and giving the impression that the robot is sort of gliding forward at a rate of 0.3 body lengths per second. That’s not much compared to a cockroach or spider, but it’s pretty good compared to other self-powered small robots.

The efficiency and sturdiness of these parts is a new record for soft robotics, and the DEAnsect is strong enough to carry around not just a battery but a bit of onboard electronics (amounting to some five times its own 190 milligram weight) that let it operate with some rudimentary logic. For example, by attaching a tiny optical sensor the robot can be made to follow a black line and not stray onto a white surface.

It’s also able to withstand a bit of abuse, fittingly in the form of a fly swatter, as you see in the gif at top. Of course, it needs to be scraped off the floor there first, but it’s very much to the robot’s credit that it can scoot again with no delay afterwards.

Naturally there isn’t much a robot like this can do right now, but it’s a promising accomplishment nevertheless, showing a number of interesting ways forward in the soft robotics field.

DEAnsect was created by Xiaobin Ji and Matthias Imboden at EPFL’s Soft Transducers Laboratory and the rest of their team there. The robot is described in a paper published today in the journal Science Robotics.

Rocket Lab to open a third launch pad — its second in New Zealand

Small-satellite launch company Rocket Lab just officially declared its second launch pad open, but it has already broken ground on a third. The new one will be located in New Zealand on the Mahia peninsula, right next to its first launch pad at the company’s original launch facility — which is already the first and only privately owned and operated rocket launch facility on Earth.

Rocket Lab’s new launch pad at Launch Complex-1 (LC-1) will provide it with the ability to launch with even more frequency. Already, the company intends its LC-1 to be the locus of its rapid response and high-volume business, while its new launch pad on Wallops Island in Virginia is primarily designed to unlock access to clients who require U.S.-based launch operations from American providers (Rocket Lab is now officially headquartered in LA).

The company has been doing a lot of work to increase its ability to launch multiple missions in quick succession — this year, it unveiled a new room-sized carbon composite manufacturing robot that can turn parts of its Electron launch vehicle construction process, which used to take weeks, into something that is done in just hours. It’s also now in the process of developing a way to recover the first-stage booster of Electron, which would save it even more time and money on building new ones between missions.

Ultimately, Rocket Lab wants to get turnaround time between missions to mere days, and having two active pads at the same site will mean it has a lot more flexibility to do things like bumping a customer up the queue should conditions allow, or adding a new customer with tight timelines on an ad hoc basis.

Daily Crunch: Smart home giants partner on new standard

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Amazon, Apple, Google and Zigbee join forces for an open smart home standard

The Connected Home over IP project seeks to create a connectivity standard designed to increase compatibility across companies and devices. The landscape is pretty scattered at the moment, with each player digging pretty heavily into their own standard and forcing many smaller third-party players to pick sides.

So the biggest names in the connected home category are reaching across the aisle to create an open-source standard. And while the names in the headline are leading the charge, Ikea, Legrand, NXP Semiconductors, Resideo, Samsung SmartThings, Schneider Electric, Signify (nee Philips Lighting), Silicon Labs, Somfy and Wulian are also on the board.

2. SAP spinout Sapphire Ventures raises $1.4B for new investments

The firm, which focuses primarily on enterprise tech companies in the U.S., Europe and Israel, writes checks to Series B through pre-IPO businesses. Its portfolio includes 23andMe, Sumo Logic and TransferWise.

3. Europe’s space agency just launched a satellite to study planets outside our solar system

CHEOPS will specifically be looking to spot exoplanets as they pass in front of their stars — at which point they become observable because they block some of the light emitted from the distant suns.

4. ‘The Rise of Skywalker’ delivers a messy but satisfying finale to the new Star Wars trilogy

How could any single movie live up to 40 years of theories and daydreams from millions of Star Wars fans? (It’s still worth watching, though.)

5. Political ‘fixer’ Bradley Tusk closes second fund on $70M

Tusk, before launching Tusk Ventures, served as campaign manager for Mike Bloomberg, as deputy governor of Illinois and as communications director for Senator Chuck Schumer. He also penned the book “The Fixer: My Adventures Saving Startups from Death by Politics.”

After recovering somewhat during the summer, the value of bitcoin and other cryptocurrencies are sharply down over the last several weeks.

7. 2019: the year podcasting broke

Brian Heater outlines how podcasting became an overnight success, more than 15 years in the making. (Extra Crunch membership required.)

Gift Guide: Leading VCs recommend their favorite reads from 2019

Welcome to TechCrunch’s 2019 Holiday Gift Guide! Need help with gift ideas? We’re here to help! We’ll be rolling out gift guides from now through the end of December. You can find our other guides right here.

As we reach the end of 2019 and approach crunch time for everyone who has procrastinated holiday gift buying, we wanted to highlight a few more great reads that might add value to your life or are just plain-old fun.

Over the past couple of weeks, we’ve asked Extra Crunch members and the TechCrunch editorial staff for their favorite books of the year. Responses covered a huge mix of genres, narrative structures and formats, with titles that would fit the interests of anyone from your techno-nerd co-founder to your craziest second-cousin that you only see around the holidays.

For our last round of book recommendations, we decided to ask the investors who control the capital in Silicon Valley, help catalyze the industry’s biggest winners and ultimately influence what our future will look like. We surveyed a select group of five leading VCs on their top book recommendations for 2019 with the only criteria being that the respondents personally read the title this year and thought it was meaningful. Among our correspondents:

- Josh Wolfe, Lux Capital

- Theresia Gouw, aCrew Capital

- Mamoon Hamid, Kleiner Perkins

- Maha Ibrahim, Canaan

- Jennifer Fonstad, Owl Capital

The books could cover any topic, be fiction or non-fiction and could be old, new or anything in between. Here are the six books that resonated with our panel of investors, all of which they would recommend to you, a friend or a family member looking for a great holiday gift.

This article contains links to affiliate partners where available. When you buy through these links, TechCrunch may earn an affiliate commission.

Josh Wolfe, Lux Capital

Exhalation by Ted Chiang

Knopf / 368 pages / May 2019

This year for me it was Ted Chiang’s “Exhalation”. The gap between sci-fi and sci-fact keeps shrinking. I contend either our authors are becoming less creative or our scientists more creative. Chiang disproves the former. One of the most provocative stories in this collection is The Truth of Fact, The Truth of Feeling which parallels two protagonists set in the near future and the not-too-distant past. One sub-story centers on a Black Mirror-esque technology that gives high-fidelity perfect recall and recordings of prior experience. The other story is of a tribe that lives by oral tradition that has one member encounter an outsider with the technology of writing. Together they make a provocative poignant point on the distinction between being precise and being right—and the meaning in our lives between them.

Summary: “Exhalation” is the latest composition by acclaimed sci-fi writer Ted Chiang, whose short story titled “Story of Your Life” famously acted as the inspiration for the Oscar-nominated film “Arrival.” Chiang’s newest work is a collection of science fiction short stories and novelettes that stray away from the speculative dystopian side of the genre. Using common sci-fi motifs such as aliens and AI proliferation, the selected writings instead dial-in on the characters living in these imagined universes as they examine how societal and technological evolutions impact the ethical, philosophical and cognitive aspects of the human psyche and existence.

Price: $16 on Amazon

Theresia Gouw, aCrew Capital

Alpha Girls: The Women Upstarts Who Took on Silicon Valley’s Male Culture and Made the Deals of a Lifetime by Julian Guthrie

Currency / 304 pages / April 2019

The most interesting book to come out in 2019 that tells the story of tech and venture is “Alpha Girls: The Women Upstarts Who Took on Silicon Valley’s Male Culture and Made the Deals of a Lifetime”, by Julian Guthrie. I find it a fascinating read (even if I weren’t included) – with stories that speak to both men and women, to the deals won and lost (Skype, Imperva, F5, Trulia, Facebook, Salesforce and more) and to the history of Silicon Valley through the lens of four outsiders. Despite having to pave their own path, the women jumped in headfirst in the pursuit of their dreams. You will walk away with a different view of how it is to be a woman in this male-dominated industry, and you will get a sense of the important role of male allies. “Alpha Girls” shows that women have long been “hidden figures” behind big companies and key deals. Finally, their stories are being told.

Summary: Silicon Valley’s massive gender gap is no secret, particularly in the notorious “boys and bros” club that is the venture capital industry. In “Alpha Girls: The Women Upstarts Who Took on Silicon Valley’s Male Culture and Made the Deals of a Lifetime,” esteemed business journalist, international best-selling author and multi-time Pulitzer nominee Julian Guthrie details the career paths of four leading female VCs (disclosure: our respondent Theresia Gouw is one of them) that have played major roles in shaping today’s tech and startup landscape.

Through first-hand accounts, Guthrie explores how Theresia, Magdalena Yesil (Broadway Angels, Salesforce, US Venture Partners), Mary Jane Elmore (Broadway Angels, Institutional Venture Partners (IVP) and Sonja Hoel Perkins (Broadway Angels, Menlo Ventures) first found their way to the male-dominated world of venture capital, the strategies they used to find recurring success and how they navigated the structural disadvantages of an industry built for others.

“Alpha Girls” offers tremendous, difficult-to-find depth around the professional, personal, and familial scenarios underrepresented groups in VC encounter as they look to challenge the status quo, find personal success and redefine an entire industry.

Price: $14 on Amazon

Mamoon Hamid, Kleiner Perkins

The Coddling of the American Mind by Greg Lukianoff and Jonathan Haidt

Penguin Press / 352 pages / September 2018

Our world is rapidly shifting around us – from evolving social norms, to the external stimuli that impact our well-being. It’s a new pace that is acutely felt in how we are raising and educating our kids and young adults. This book deeply explores the societal ramifications, and offers perspective about how we may be doing it all wrong.

Summary: “The Coddling of the American Mind” is a provocative sociological dive into how commonly accepted modern social and parenting practices have led to increased agitation and tension in today’s youth. Written by attorney, public advocate and First Amendment specialist Greg Lukianoff and social psychologist and NYU professor of ethical leadership Jonathan Haidt, “The Coddling of the American Mind” introduces its thesis by examining issues of censorship and free speech on college campuses, which are occurring at a more frequent clip than ever before.

As the authors debate the potential negative impacts that an overly partisan culture of “safety-ism” might have on mental health and development, they retrace the historical social trends and cultural transformations that led to today’s conditions.

Price: $17 on Amazon

Maha Ibrahim, Canaan

The Back Channel by William Burns

Random House / 512 pages / March 2019

For the last two years, I’ve had the pleasure of serving as a Trustee for the Carnegie Endowment for International Peace where Bill Burns serves as President. Bill is the consummate statesman and has been a central figure in international diplomacy for decades. The depth of his knowledge is a testament to his commitment to international order and peace. “The Back Channel” provides readers with an inside look into his career in foreign service, from the Cold War and Middle East affairs to modern-day Russia. My respect for Bill was immense before I read the book and it only grew bigger with every chapter.

Summary: Throughout his illustrious, nearly thirty-year career in foreign service, William Burns has held titles that include the US ambassador to Russia and the Deputy Secretary of State. Burns’ memoirs, “The Back Channel,” focuses on the biggest policy decisions of Burns’ tenure.

Burns uses his own notes, declassified State Department documents and primary-source, first-hand analysis to offer up some inside baseball and help readers understand the strategic rationale and key considerations behind some of the most important U.S. foreign policy decisions that have shaped the global geopolitical landscape over the last two decades.

Price: $13 on Amazon

The Education of an Idealist by Samantha Power

Dey Street Books / 592 pages / September 2019

Ambassador Power is an icon of courage, compassion and resolve. During her recent book tour, I was fortunate enough to interview her and was struck by her humanity. The stories she writes about her impressive career are both powerful and personal. Ambassador Power immigrated to the US as a child and has since dedicated her life to human rights and equality. She is my age and has accomplished so much in her life, most recently as US Ambassador to the UN under President Obama. I don’t know anyone who, at 22, would voluntarily become a war correspondent (in Bosnia). I suspect she will one day run for political office and I will be a big supporter.

Summary: “Education of an Idealist” is the memoir of former US Ambassador to the United Nations and Pulitzer-award-winning author Samantha Power, detailing her journey from a child in Ireland, to an immigrant growing up in the US, through her Ivy League undergrad and legal education, all the way through her careers in journalism and public advocacy and her time working as a senior advisor to President Barack Obama. Even from a purely narrative perspective, Power’s lengthy journey, which brought her across the globe through war zones and revolutions long before her career in politics, is incredibly compelling on its own.

But Ambassador Power’s reflection offers even more value as she recounts how she overcame personal, professional and internal struggles as she traversed different geographies, environments and stages of her career and life.

Additionally, Power’s writing also offers up valuable lessons for those in the startup world. Power’s move from an external public advocate to a government policymaker, in a roundabout way (or at least in the eyes of startup nerds like us), provides a unique look into the transition, differences and challenges one may come across when moving from an externally focused role to an operational one.

Price: $18 on Amazon

Jennifer Fonstad, Owl Capital

The First Congress: How James Madison, George Washington, and a Group of Extraordinary Men Invented the Government by Fergus M. Bordewich

Simon & Schuster / 416 pages / February 2017

As I read about impeachment proceedings, presidential elections, and racial tensions in today’s political climate, it begged the question – how did we get here?

While not knowing exactly what I was undertaking, I recently read the book, “The First Congress.” The book was a remarkable story about how both ordinary and extraordinary people took the ‘startup’ that was the United States in 1789 and launched us on a remarkable ride.

The book takes us through the critical decisions made by the country’s very first Congress, 1789-1791. This includes establishing the Supreme Court, passing the first 10 Amendments to the Constitution (later called the Bill of Rights), establishing the country’s first revenue ‘stream,’ and picking the location of the nation’s capital (putting our country’s hero – George Washington, in a different light).

It’s hard to fathom our nation as a startup. The country was fresh off of its failure as a Confederation of States, deeply in debt, with no source of revenue yet established. Two of the states had not yet ‘signed on’ to the whole enterprise. And while the Constitution put forth certain operating principles, it fell to this group of men (yes, all men and all white) to put many of the mechanisms in place that still guide and define us today. As one always trying to do what I do better and learn from the past, this was a terrific lesson in both getting this startup off the ground as well as the intended and unintended consequences of those decisions.

Summary: Writer and historian Fergus Bordewich’s “The First Congress” puts us in the room for the First Congress in our country’s history, which saw the admission of several states into the union, the passing of the Bill of Rights and several other of the biggest decisions that shaped the United States.

The book details how the founding fathers debated the United States’ structural and operational systems, including the American legal system and national banking system. Additionally, “The First Congress” highlights an interesting yet often overlooked period of US history, where the country was essentially functioning like a startup, grinding and building from scratch, having to create mission statements, organizational hierarchies, operational systems or otherwise for the very first time.

Price: $12 on Amazon

On Farming YouTube, Emu Eggs and Hay Bales Find Loyal Fans

Some farmers have discovered that online stardom can be more lucrative than their crops or livestock.

Paige raises $45M more to map the pathology of cancer using AI

One of the more notable startups using artificial intelligence to understand and fight cancer has raised $45 million more in funding to continue building out its operations and inch closer to commercialising its work.

Paige — which applies AI-based methods such as machine learning to better map the pathology of cancer, an essential component of understanding the origins and progress of a disease with seemingly infinite mutations (its name is an acronym of Pathology AI Guidance Engine) — says it will be use the funding to inch closer to FDA approvals for products it is developing in areas such as biomarkers and prognostic capabilities.

It also plans to use the funding to continue developing better ways of diagnosing and ultimately fighting the disease, as well as exploring further commercial opportunities for its work, specifically within the bio-pharmaceutical industry.

This round is being led by Healthcare Venture Partners, with previous investor Breyer Capital, Kenan Turnacioglu and other funds participating. The company is not disclosing its valuation, but PitchBook noted that a first close of this round (when it raised $33 million) put the valuation at $208 million. That would value Paige now at about $220 million with the $45 million close, more than three times its valuation in its previous round.

Paige first emerged from stealth back in 2018 — with a bang.

Paige.AI — as it was known at the time — was hatched inside the Memorial Sloan Kettering Cancer Center, one of the world’s foremost institutions both for working on cancer therapies and treating cancer patients, and along with a $25 million investment led by Jim Breyer, Paige had secured exclusive access to MSK’s 25 million pathology slides as well as its intellectual property related to the AI-based computational pathology that underpinned its work. These slides make up one of the biggest repositories of its kind in the world, and as all solutions and services built on machine learning are only as good as the data that’s fed into them, they were critical to the startup’s beginnings.

The startup also launched with some serious talent behind it.

Much of the computational pathology being used by Paige had been developed by Dr Thomas Fuchs, who is known as the “father of computational pathology” and is the director of Computational Pathology in The Warren Alpert Center for Digital and Computational Pathology at Memorial Sloan Kettering, as well as a professor of machine learning at the Weill Cornell Graduate School of Medical Sciences.

Fuchs co-founded Paige with Dr David Klimstra, chairman of the department of pathology at MSK, and Fuchs had originally started out as the CEO of Paige, but was replaced earlier this year by Leo Grady, who joined from another bio-startup, Heartflow (another company backed by Healthcare Venture Partners). Fuchs is still supporting the company, but no longer in an executive role.

In the nearly two years since it launched, there have been some milestones reached. The company, which has around 30 employees today, has been the first to get an FDA breakthrough designation (which helps expedite the long process of drug approvals in urgent areas where there are few or no other options for patients) for using AI in oncology pathology. It’s also the first to get a CE mark in the same category, which opens the door to working in Europe, too. Paige has so far ingested 1.2 million images into its slide database and is using them — in algorithms that also take in genomic data, drug response data and outcome data — to work on developing diagnostic solutions.

But as with all new medical products, progress is not measured in quarters as it might be with a more typical tech startup. Moving fast and breaking things is something to be avoided. So even with all of the above advances, there has yet to be any commercial products launched, nor is Grady giving any specific time frames for when they will. And when the company came out of stealth in 2018, it said it would be focusing on breast, prostate and other major cancers, although today it’s not as quick to specify what its targets will be when it does launch commercial products.

Similarly, it’s also expanding its remit from primarily clinical environments to pharmaceutical ones.

“The clinical side is still our focus, but this is an expansion and realisation that this has a broader impact, and that includes pharmaceutical customers,” Grady said.

And the dropping of the .AI in its name was also intentional, in part a reaction it seems to how much AI gets thrown around today.

“There is a fundamental misconception, which is thinking of AI as a product and not a technology,” said Grady. “It’s a technology set that can allow you to do many things that could not have been done in the past, but you need to apply it in a meaningful way. Developing a good AI and putting that on the market will not cut it in terms of clinical adoption.”

The funding round, Grady said, saw a lot of interest from strategic investors, although the company intentionally has stayed away from these.

“We were approached by all of the scanner vendors and some of the biopharmaceutical companies,” he said. “But we made the decision to not take a strategic investment with this round because we wanted to be neutral with hardware vendors and not be too tied with any one.”

He also pointed to the challenges of talking to investors when you are working in a cutting-edge area (a challenge that has foxed many an investor also into backing the wrong horses, too, such as Theranos).

“We’re at the intersection of three areas: tech, medical devices and clinical medicine, and life sciences and biotech,” he said. “Many investors sit squarely in one and don’t feel comfortable in others. That makes the conversations challenging and short. But there has been an increasing blend between those three sectors.”

That’s where Healthcare Venture Partners fits into the mix. “Paige exemplifies the benefits of digital pathology and represents the bright future of AI-driven medical diagnosis,” said Jeff Lightcap of Healthcare Venture Partners, in a statement. “As hospitals embark on digital transformations, they will face challenges associated with these transitions. We believe Paige addresses many of these issues by enhancing the ability of clinical teams and pathologists to collaborate. We’re confident in Paige’s future and believe they will continue to develop cutting-edge technologies that enable pathology departments to transform their practices, which have changed little in the last century.”

“We applaud Paige’s commitment to building clinical AI products that will improve the diagnostic process and patient care,” added Jim Breyer of Breyer Capital, in a statement. “This is a critical time for Pathology, as pathologists are carrying a heavier workload than ever before. Paige understands their needs and the team has built cutting-edge technologies to address them. Paige represents the future of computational pathology and we look forward to their continued growth and success.”

The World of ‘Watchmen’ Ended Twice This Week

Two sequels to the classic comic book series came to a conclusion just days apart—one more successfully than the other.

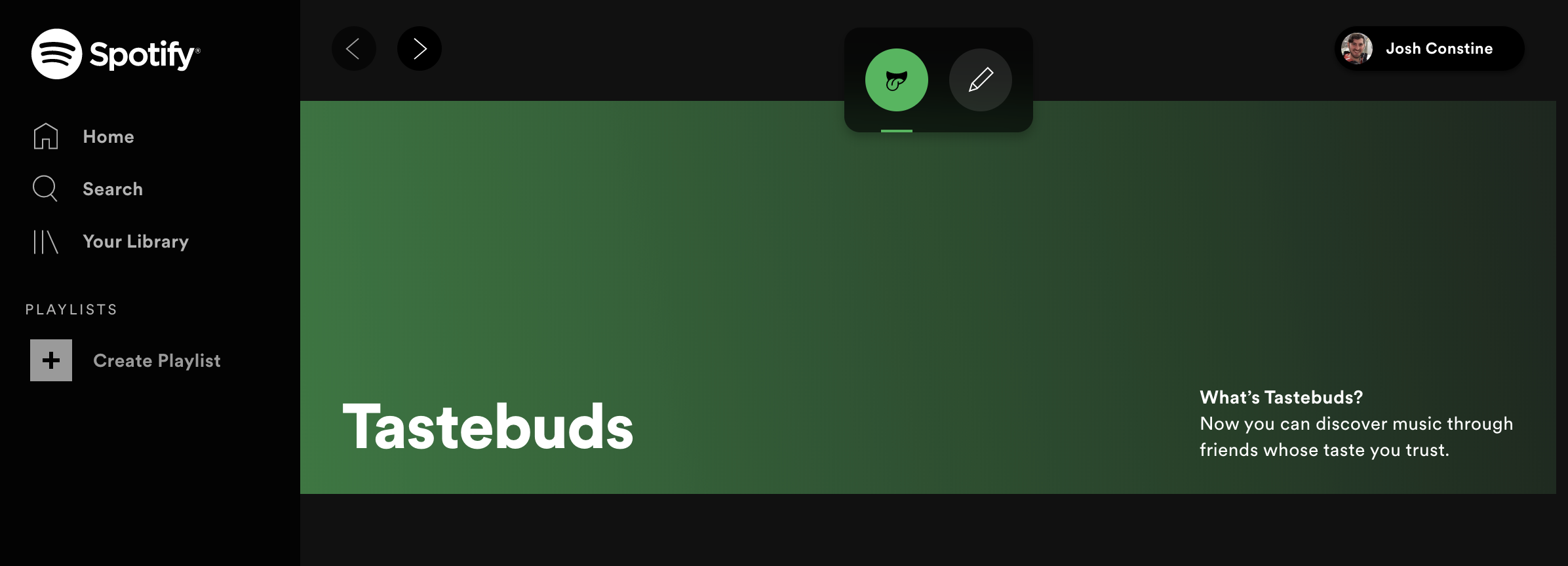

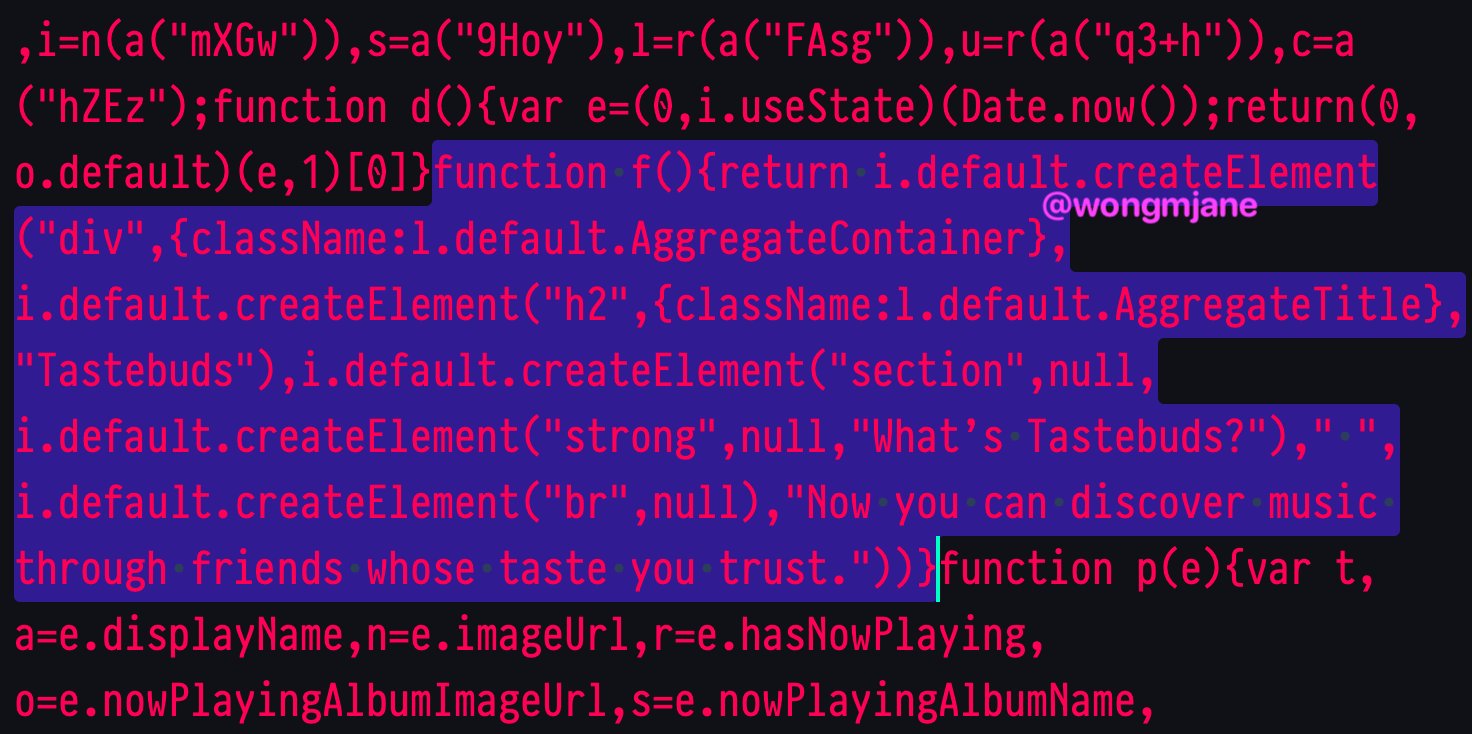

Spotify prototypes Tastebuds to revive social music discovery

Spotify is prototyping a new way to see what friends have been listening to, called “Tastebuds.” Despite how discovering music is inherently social, Spotify has no features for directly interacting with friends within its mobile app after axing its own inbox in 2017 and keeping its Friend Activity ticker restricted to desktop.

It seemed like Spotify was purposefully restricting social features to force users to rely on the company’s own playlists and discovery surfaces. This gave Spotify the power to play king-maker, massively influencing which artists got featured and rose to stardom. This in turn gave it leverage in its combative negotiations with record labels, which worried their artists might get left off playlists if they don’t play nice with Spotify in terms of sustainable royalty rates and access to exclusives.

That strategy seems to have paid off with Spotify improving its licensing deals and becoming a critical promotional partner for the labels, paving the way to its IPO. Spotify’s shares sit around $152, up from its direct listing price of $132, though down from its first-day pop that saw it rise to $165. More comfortable in its position, now Spotify seems ready to relinquish more control of discovery and enable users to be better inspired by what friends are playing.

Spotify Tastebuds code via Jane Manchun Wong

Tastebuds is designed to let users explore the music taste profiles of their friends. Tastebuds lives as a navigation option alongside your Library and Home/Browse sections. Anyone can access a non-functioning landing page for the feature at https://open.spotify.com/tastebuds. The feature explains itself, with text noting “What’s Tastebuds? Now you can discover music through friends whose taste you trust.”

The prototype feature was discovered in the web version of Spotify by reverse engineering sorceress and frequent TechCrunch tipster Jane Manchun Wong, who gave us some more details on how it works. Users tap the pen icon to “search the people you follow.” From there they can view information about what users have been playing most and easily listen along or add songs to their own library.

Without Tastebuds, there are only a few buried ways to interact socially on Spotify. You can message friends a piece of music through buttons for SMS, Facebook Messenger and more, or post songs to your Instagram or Snapchat Story. Spotify used to have an in-app inbox for trading songs, but removed it in favor of shuttling users to more popular messaging apps. On the desktop app, but not mobile or web, you can view a Friend Activity ticker of songs your Facebook friends are currently listening to. Or you can search for specific users and follow them or view playlists they’ve made public, though Spotify doesn’t promote user search much.

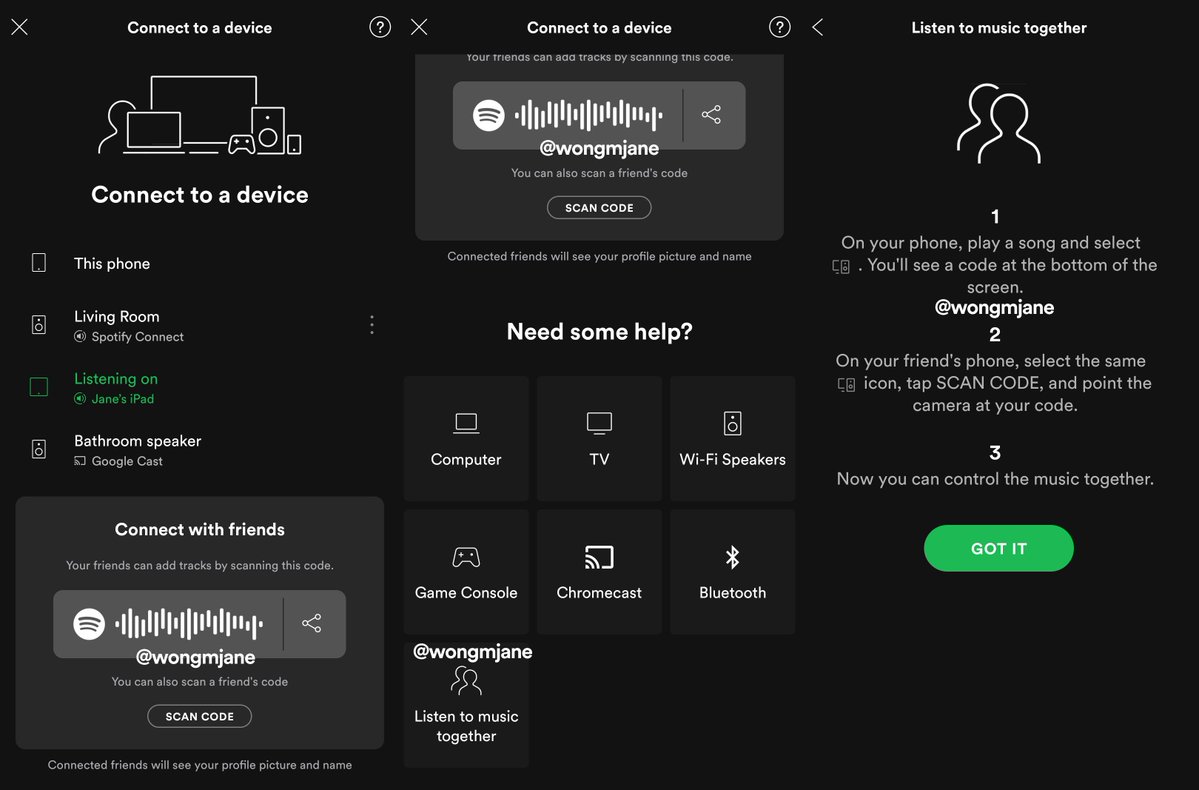

Spotify has a few other social features it has experimented with but never launched. Those include a Friends Weekly playlist spotted last year by The Verge’s Dani Deahl. Then this May, we reported Wong had spotted a shared-queue Social Listening feature that let you and friends play songs simultaneously while apart. Back in 2014, I wrote that Spotify should move beyond blog-esque browsing to create a “PlayFeed” playlist that would dynamically update with algorithmic recommendations, new releases from your top artists and friends’ top listens. It has since launched Discovery Weekly and Release Radar, and Tastebuds could finally bring in that final social piece.

Spotify’s simultaneous social listening prototype

The result is that you can only see either a myopic snapshot of friends’ current songs, the few and often outdated playlists they manually made public or you message them songs elsewhere. There was no great way to get a holistic view of what a friend has been jamming to lately, or their music preferences overall.

We’ve reached out to Spotify seeking more information about how Tastebuds works, how privacy functions around who can see what and if and when the feature might launch. We’re also interested to see if Spotify has any deal in place with a music dating startup called Tastebuds.fm which launched way back in 2010 to help people connect and flirt through song sharing. [Update: A Spotify spokesperson confirms that “We’re always testing new products and experiences, but have no further news to share at this time.” They also said this is not related to the Tastebuds.fm startup.]

Social is a huge but under-tapped opportunity for Spotify. Not only could social recommendations get users listening to Spotify for longer, thereby hearing more ads or becoming less likely to cancel their subscription, it also helps Spotify lock in users with a social graph they can’t find elsewhere. While competitors like Apple Music or YouTube might offer similar music catalogs, users won’t stray from Spotify if they become addicted to social discovery through Tastebuds.

Tech startups going public raise 3x more today than in 2015

Hello and welcome back to our regular morning look at private companies, public markets and the grey space in between.

Today we’re exploring the 2019 IPO cohort from a capital-in perspective. How much did tech companies going public in 2019 raise before they went public, and what impact that did that have on their valuation when they debuted?

Looking ahead, the tech startups and other venture-backed companies expected to go public in 2020 will include a similar mix of mid-sized offerings, unicorn debuts and perhaps a huge direct listing. What we’ve seen in 2019 should be a good prelude to the 2020 IPO market.

With that in mind, let’s examine how much money tech companies that went public this year raised before their IPO. Spoiler: It’s a lot more than was normal just a few years ago. Afterwards, I have a question regarding what to call companies in the $100 million ARR club (more here) that we’ve been exploring lately. Let’s go!

Privately rich

According to CBInsights’ recent IPO 2020 IPO report, there’s a sharp, upward swing in the amount of capital that tech companies raise before they go public. It’s so steep that the data draw a nearly linear breakout from a preceding, comfortable normal.

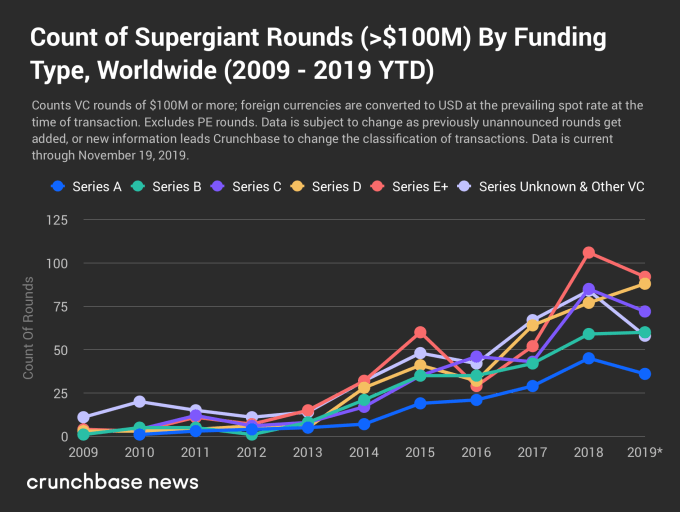

Here’s the chart:

There are two distinct periods; from 2012 to 2015, raising up to $100 million was the norm (median) for tech companies going public. That’s still a lot of cash, mind.

The second period is more exciting. From 2016 on we can see a private capital arms race in which tech companies going public stacked ever-greater sums under their mattresses before debuting. This is generally consistent with a different trend that you are also aware of, namely the rise of $100 million financings.

Before we turn back to the CBInsights data, let’s observe a chart from Crunchbase News that underscores the simply astounding rise of $100 million financings that was published just a few weeks ago. As you look at this chart, remember that prior to 2016, more than half of venture-backed technology companies going public had raised less than $100 million total:

Now, compare the two data sets.

Cloud flaws expose millions of child-tracking smartwatches

Parents buy their children GPS-enabled smartwatches to keep track of them, but security flaws mean they’re not the only ones who can.

This year alone, researchers have found several vulnerabilities in a number of child-tracking smartwatches. But new findings out today show that nearly all were harboring a far greater, more damaging flaw in a common shared cloud platform used to power millions of cellular-enabled smartwatches.

The cloud platform is developed by Chinese white-label electronics maker Thinkrace, one of the largest manufacturers of location-tracking devices. The platform works as a backend system for Thinkrace-made devices, storing and retrieving locations and other device data. Not only does Thinkrace sell its own child-tracking watches to parents who want to keep tabs on their children, the electronics maker also sells its tracking devices to third-party businesses, which then repackage and relabel the devices with their own branding to be sold on to consumers.

All of the devices made or resold use the same cloud platform, guaranteeing that any white-label device made by Thinkrace and sold by one of its customers is vulnerable.

Ken Munro, founder of Pen Test Partners, shared the findings exclusively with TechCrunch. Their research found at least 47 million vulnerable devices.

“It’s only the tip of the iceberg,” he told TechCrunch.

Smartwatches leaking location data

Munro and his team found that Thinkrace made more than 360 devices, mostly watches and other trackers. Because of relabeling and reselling, many Thinkrace devices are branded differently

“Often the brand owner doesn’t even realize the devices they are selling are on a Thinkrace platform,” said Munro.

Each tracking device sold interacts with the cloud platform either directly or via an endpoint hosted on a web domain operated by the reseller. The researchers traced the commands all the way back to Thinkrace’s cloud platform, which the researchers described as a common point of failure.

The researchers said that most of the commands that control the devices do not require authorization and the commands are well documented, allowing anyone with basic knowledge to gain access and track a device. And because there is no randomization of account numbers, the researchers found they could access devices in bulk simply by increasing each account number by one.

The flaws aren’t just putting children at risk, but also others who use the devices.

In one case, Thinkrace provided 10,000 smartwatches to athletes participating in the Special Olympics. But the vulnerabilities meant that every athlete could have their location monitored, the researchers said.

Child voice recordings found exposed

One device maker bought the rights to resell one of Thinkrace’s smartwatches. Like many other resellers, this brand owner allowed parents to track the whereabouts of their children and raise an alarm if they leave a geographical area set by the parent.

The researchers said they could track the location of any child wearing one of these watches by enumerating easy-to-guess account numbers.

The smartwatch also allows parents and children to talk to each other, just like a walkie-talkie. But the researchers found that the voice messages were recorded and stored in the insecure cloud, allowing anyone to download files.

A recording of a child’s voice from a vulnerable server of a smartwatch reseller. (We’ve removed the audio to protect the child’s privacy.)

TechCrunch listened to several recordings picked at random and could hear children talking to their parents through the app.

The researchers likened the findings to CloudPets, an internet-connected teddy bear-like toy, which, in 2017, left their cloud servers unprotected, exposing two million child voice recordings.

Some five million children and parents use the smartwatch sold by the reseller.

Disclosure whack-a-mole

The researchers disclosed the vulnerabilities to several white-label electronics makers in 2015 and 2017, including Thinkrace.

Some of the resellers fixed their vulnerable endpoints. In some cases, the fixes put in place to protect vulnerable endpoints later became undone. But many companies simply ignored the warnings, prompting the researchers to go public with their findings.

Rick Tang, a spokesperson for Thinkrace, did not respond to a request for comment.

Munro said that while the vulnerabilities are not believed to have been widely exploited, device makers like Thinkrace “need to get better” at building more secure systems. Until then, Munro said owners should stop using these devices.

NASA’s mission to once again fly astronauts from US soil readies for key milestone with Friday launch

NASA and partners Boeing and the United Launch Alliance (ULA) are gearing up for a crucial milestone moment on Friday: The “Orbital Flight Test” (OFT) of the Boeing Starliner CST-100 Crew Capsule. The capsule, a spacecraft designed to carry astronauts on board from U.S. soil for the first time since the end of the Space Shuttle program, will be launched on an Atlas V rocket provided by ULA — without anyone on board this time, but in a mission that is one of the last key steps before astronauts take their first ride.

What’s happening

On Friday, pending weather and everything else cooperates, ULA’s Atlas V rocket will carry the Boeing Starliner CST-100 crew capsule to the International Space Station (ISS). This launch will be essentially a full run-through of the forthcoming Crew Flight Test (CFT), the first flight of the Boeing crewed spacecraft with actual astronauts on board.

While this is one key component before that CFT mission takes place, it’s not the only one remaining: Starliner must still undergo three remaining reliability tests for its parachute system, on top of the data gained about this crucial component of the overall launcher, before the spacecraft is certified for regular service transporting astronauts to and from the ISS in a non-testing capacity.

During the mission, the Starliner will ascend atop the Atlas V rocket to a height of 98 nautical miles, at which point it’ll separate from the rocket and continue under its own power for the remainder of the trip to orbit, where it’ll rendezvous with the ISS for docking. Astronauts on board the ISS will assist with docking using the station’s robotic arm, and then unload around 600 lbs of equipment and supplies that’s being carried aboard the crew capsule as a secondary mission, before the capsule undocks and returns to Earth.

When and where it’s going down

The launch is scheduled for Friday morning, December 20th at 6:36 AM EST (3:36 AM PST). It’ll launch from Space Launch Complex 41 (SLC-41) at Cape Canaveral Air Force Station in Florida. Weather conditions are looking 80% favorable based on current forecasts, which means that as it stands, there’s a good chance weather will be within acceptable limits for take-off.

The launch window is instantaneous, meaning that it only opens for that specific time and if anything prevents the launch from happening, there are backup dates potentially available — December 21 and 23, as well as options on either Christmas Day or a few days following. After launch, the Starliner will dock with the station on the morning of December 21, and then spend around a week at the ISS, before undocking on December 28 for its return trip. The journey back is as important as the trip to the ISS in terms of proving out the spacecraft’s proper functioning.

What happens after that

Should everything go to plan, Boeing’s Starliner CST-100 will be much closer to its ultimate goal of transporting people to space. As mentioned above, the parachute system still requires some additional testing for certification purposes, but the crewed CFT test launch should happen sometime in “early 2020,” according to Boeing, provided everything meets their strict requirements in terms of safety and other readiness standards.

On Wednesday, ULA rolled out its mobile launch platform and the Atlas V rocket to the launchpad in preparation for Friday’s mission. The teams will now conduct pre-launch preparations leading up to Friday, a process it already conducted two weeks ago in dress rehearsal mode covering everything right up to the actual ignition.

We’ll have live coverage of the launch right here on TechCrunch as it happens, and a summary of how the launch went immediately following, so check back Friday for updates.

Philadelphia’s Jenzy has a tool to size kids’ feet and a marketplace to buy them the right shoes

Of all the startup jawns that could possibly come from Philadelphia, perhaps none is as unexpected as Jenzy, the startup that provides an online marketplace and virtual sizing tool for kids’ shoes.

The company, which has raised $1.25 million from Morgan Stanley’s Multicultural Innovation Lab, was born of desperation and grew up on two continents.

Co-founders Eve Ackerley and Carolyn Horner met five years ago in China while working as English language teachers in the remote corners of Yunnan province. Without much in the way of retail options, the two women resorted to doing much of their shopping online… and it was while searching for shoes that they realized one of the major pain points of the online retail experience was finding the right size.

Jenzy founders Carolyn Horner and Eve Ackerley

When they returned to the U.S. the idea stuck with them. So they set out to develop an application that would be able to size feet using nothing more than a smartphone, and worked with vendors to ensure that women could know their sizes and buy the right shoes.

As the idea evolved, the two first-time entrepreneurs realized that however annoying the buying process was for adults, the need for appropriately sized shoes and a marketplace to buy them was even more acute among children.

“The most proprietary part of what we do is standardize all the shoes on our platform,” says Horner.

The company works with brands like Converse, Saucony and Keds to send kids shoes that actually fit their feet. “A kid could be wearing a six in one shoe and a seven in another,” says Horner. Using Jenzy, the shoes will arrive in the right size for each foot. “We work with the suppliers to make sure that we’re sending the correct size to a parent when they check out on Jenzy.”

For retailers, it’s an opportunity to reduce what amounts to a huge cost. The industry average rate for returns is 30%, and Horner says that Jenzy reduces that figure to 15%. And those savings matter in what’s an $11 billion industry, according to Horner’s estimates.

The company launched the first version of its app in July 2017 and just released an update earlier this year. To date, Horner estimates the company has sized 25,000 feet and had 15,000 downloads since May.

“The plan was to see about if we still were interested when we got back from China,” Horner says of the company’s early days.

Initially, the two partners worked out of Ackerley’s parents’ house in California, but eventually moved to Philadelphia when the company pivoted to focus on children’s shoes to be close to their beta testers — Horner’s family, who had a lot of kids.

Theresia Gouw’s ‘multigenerational’ new firm, Acrew, just closed a $250 million debut fund

Four months after the news broke that veteran VCs Theresia Gouw and Jennifer Fonstad were going separate ways after forming their own venture firm in 2014, Gouw says her new firm, Acrew Capital, has closed its debut fund with an impressive $250 million in capital commitments.

The firm, with offices in both San Francisco and Palo Alto, was originally targeting between $175 million and $200 million, says Gouw, adding that many of the investors — including Melinda Gates — are the same who participated in Aspect Ventures, the outfit that Gouw and Fonstad will eventually wind down. (They’re currently investing in follow-on rounds in the startups that Aspect had backed with its two funds: a $150 million vehicle, followed by a $200 million fund.)

Certainly, Acrew’s limited partners know the young firm’s investing team. Gouw launched Acrew with Lauren Kolodny, Mark Kraynak, Vishal Lugani and Asad Khaliq, all of whom worked previously at Aspect and all of whom are partners, except for Khaliq, who joined Aspect in 2016 and remains a principal for now. Indeed, on a call earlier this week, Gouw emphasized the collaborative nature of Acrew, stressing that she sees her team as co-founders, and sharing that any two partners can push a deal through, while it takes just one partner to nix something.

“Team is at the center of everything we do,” said Gouw, who has been named to the Forbes Midas List eight times in her investing career, much of it spent with Accel Partners. “VC is best practiced as as team sport, and every win is going to be a team win.”

If you’re curious, not everyone is on equal financial footing just yet, but Gouw suggests that Acrew’s founding team has more transparency than do many other partnerships into how the economics breaks down — and that the goal is for everyone to receive the same share of returns over time, and likely sooner than later. She said the firm launched very intentionally with a “multigenerational founding team” — which is rare in the venture business — not just because of the “business advantages it [confers] now” but also because it “positions us well through many funds and many cycles.”

So far, Acrew has made six investments, including in the digital bank Chime, which just last week closed on $500 million in fresh funding at a $5.8 billion valuation. The startup, which was valued at $1.5 billion as of March, is also a portfolio company of Aspect Ventures. (Gouw credits Kolodny with leading the company’s Series A round.)

Other Acrew investments include Klar, a challenger bank akin to Chime in Mexico City that closed on $57.5 million in debt and equity funding in September, and Augtera Networks, a startup that helps large enterprises automate their network operations and which announced $4 million in funding just last week, led by Bain Capital Ventures.

Generally, says Gouw, the firm will be looking to invest in half a dozen areas, including cybersecurity, where Gouw is widely considered expert; financial services; the future of work; and interconnected data.

As an example of the latter, Gouw points to PredictHQ, a New Zealand-based startup whose Series A round was led by Aspect last year; it helps companies like ride-share outfits better predict when there’s likely to be a spike in demand for their services.

In terms of the checks Acrew will be writing, Gouw says that Acrew will participate in seed rounds, investing as little as $1 million or less. It will also lead Series A rounds, writing initial checks of between $4 million and $7 million, as needed. It needn’t always be the lead investor in a round, however. “If because of the size of their fund, another firm needs to write an $8 million check, we can write a check for $1 million to $2 million” to fill out the round.

As for what happened at Aspect, Fonstad — who is separately raising a debut fund for her own new firm, Owl Capital — told the WSJ back in September that she and Gouw “saw very much eye to eye in terms of our investments and strategy. But we had very different leadership styles and different ways of operating at the portfolio level.”

Asked at a recent TechCrunch Disrupt event what Fonstad meant, Gouw declined to flesh out their differences, saying she would speak instead to how she operates. “I have four co-founders in Acrew Capital, so there’s five of us, and we operate as a team, and we all have equal say in investment decisions, and that’s my management style.”

You can check out more of that conversation below.

Here’s a Mickey Mouse version of Amazon’s Echo Wall Clock

Amazon’s original Echo Wall Clock was mostly fine. Some consumers ran into connectivity issues with the device, but it was mostly okay. It’s one of the most passive members of the Echo family of devices, mostly doing its wall clock thing, until you need a time set.

The latest addition to the line has something its predecessor lacked, however: a giant Mickey Mouse. From the looks of it, things are mostly exactly the same here, with the important addition of a large, smiling rodent whose little mouse arms point out the hours and minutes.

There’s the standard 60 LED ring that serves both to designate minutes and lights up for timer countdowns. The clock pairs with Echo devices, responding to voice commands and automatically adjusting for daylight savings time. Also these handy features:

-

Echo Wall Clock – Disney Mickey Mouse Edition helps you stay organized and on time.

-

Easy-to-read analog clock with iconic design cover shows the time of day.

Which is to say, it’s a clock. Which is also to say that, even when it’s broken, it’s right twice a day. How many gadgets can say that? The Echo Wall Clock – Disney Mickey Mouse Edition is available now for those who still somehow have more room in their life for Disney, and should get to you before Christmas if you order now. It runs $50 — $20 more than the standard edition.