The helicopter was flying under “special visual flight rules” that allow pilots to fly through low-visibility conditions.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

An AI Virus Warning System, Mac Malware, and More News

Catch up on the most important news from today in two minutes or less.

Kobe Bryant, an Unforgiving Innovator of the NBA

The basketball star, who died Sunday in a helicopter crash, was constantly eclipsing the game’s limits.

Defying Company Policy, Over 300 Amazon Employees Speak Out

Hundreds of Amazon workers banded together in protest following reports that the company threatened to fire their colleagues over climate change comments.

NASA taps startup Axiom Space for the first habitable commercial module for the Space Station

NASA has selected Houston-based Axiom Space, a startup founded in 2016, to build the first commercial habitat module for the International Space Station (ISS). This module will be used as a destination for future commercial spaceflight missions, potentially housing experiments, technology development and more performed by commercial space travelers taking rides up to the ISS via human-rated spacecraft like the SpaceX Crew Dragon and Boeing Starliner, once those start regular operational service.

Axiom Space was founded in 2016, and is led by co-founder and CEO Michael T. Suffredini, who previously acted as program manager for the ISS at NASA’s Johnson Space Center. The company boasts a lot of ex-NASA talent on its small team, and eventually it plans to make its in-space modules the basis of its own private space station, after first attaching them to the ISS while it’s still operating. NASA has extended the planned service life of the ISS, but the plan of the agency’s current leadership is to eventually encourage private orbital labs and commercial facilities as an ultimate replacement.

In 2018, Axiom teamed up with designer Philippe Starck (yes, the same one who famously designed a luxury yacht for Apple founder Steve Jobs) to provide a look at what their future space station modules might look like, including crew quarters with interactive displays and a cupola that provides a breathtaking view of Earth and surrounding space.

This ISS module may not be a full-fledged private space station, but it is a step in NASA’s goal of further commercializing the existing space station and ultimately paving the way for more commercial activity in low Earth orbit. Axiom’s mandate also includes providing “at least one habitable commercial module,” with the implication being that it might be awarded extensions to build more in the future. Next up for the new partners is negotiating terms and price for a contract for the module, which will also include a timeline for delivery.

One Small Fix Would Curb Stingray Surveillance

The technology needed to limit stingrays is clear—but good luck getting telecoms on board.

‘Star Trek: Picard’ breaks streaming records on CBS All Access

CBS’ streaming service, CBS All Access, credits a trio of high-profile events — including the premiere of its new Star Trek series, “Star Trek: Picard,” as well as the 62nd annual Grammy Awards, not to mention a busy month of football — with helping it to achieve a new record for subscriber sign-ups in a given month. The company says January 2020 surpassed the service’s previous record in February 2019 for subscriber sign-ups. In addition, last week was the second-best sign-up week ever, closely behind the week of the 2019 Super Bowl.

Much of the record-setting had to do with the launch of the highly anticipated show, “Star Trek: Picard,” which brings back fan-favorite Patrick Stewart as Jean-Luc Picard, now a retired Starfleet Admiral whose quiet life on his family’s vineyard is about to be disrupted. The show, set 18 years after the events of the final “Star Trek: The Next Generation” movie, “Star Trek: Nemesis,” not only capitalizes on Stewart’s draw, it also brings back previous “Star Trek” actors including Brent Spiner (Data), Jeri Ryan (Seven of Nine), Marina Sirtis (Troi), and Jonathan Frakes (Riker).

But unlike other reboots, which hope nostalgia alone will bring the viewers, “Picard’s” creators have actually given thought to the story the show is trying to tell, resulting in a 95% critics score on Rotten Tomatoes.

CBS says the premiere of “Picard” also marked a new record for total streams and drove the highest volume of subscribers to stream a CBS All Access original series to date.

“Picard” was up by more than 115% in terms of total streams, when compared to CBS All Access’s first record, which was by its other “Star Trek” show, the less well-received “Star Trek: Discovery.” It was also up by 180+% over “Discovery’s” prior record for subscribers streaming a CBS All Access original.

Meanwhile, CBS said last night’s Grammys were the most-streamed to date and a new record for sign-ups on a Grammys Sunday, surpassing 2019 by more than 80% in new sign-ups and more than 30% in unique viewers on the service.

However, what CBS won’t talk about is the total number of subscribers for CBS All Access alone, nor does it break out how many have upgraded to the ad-free tier.

Instead, the company only shares that CBS All Access and Showtime’s over-the-top service, combined, have more than 10 million total subscribers.

In any event, that figure puts it far behind streaming rivals like Netflix and Hulu, with 61 million U.S. subscribers and 29 million subscribers, respectively. Even newcomers like Disney+ and Apple TV+ have boomed. Disney+ is estimated to have somewhere between 23.2 million and 25 million subscribers. One estimate believes Apple TV+ could be even bigger, but the analyst firm’s methodology is questionable. (After all, Apple TV+ may be available to users with a new Apple device for free for a year, but that doesn’t mean users are watching the service, nor will pay for it later on.)

In short, what these figures mean is CBS needs more than football, seasonal events and a new “Star Trek” series in order to grow. Even if “Star Trek: Picard” becomes a hit, fans who come for “Star Trek” alone are likely to sign up only when the show is airing, then unsubscribe in the off-season. Some may even wait to watch the series until they can binge it all — possibly even during a free trial period.

But as the newly combined ViacomCBS, the company now has options. ViacomCBS’ top execs have indicated they could bring Nickelodeon, BET, MTV and Comedy Central shows to CBS All Access as a result of the Viacom-CBS merger. The company believes it can hit 25 million CBS All Access subscribers by 2022.

“We’ve seen tremendous continued growth in the service, and the new records we’ve experienced due to ‘Star Trek: Picard,’ the Grammy’s and a fantastic season of football are a phenomenal way to kick off what will be a fantastic year for CBS All Access,” said Marc DeBevoise, chief digital officer, ViacomCBS, and president and CEO, CBS Interactive. “CBS All Access continues to build upon its great mix of programming — from original series, to sports and special events — and we’ve strategically programmed 2020 to bring subscribers an ‘always on’ calendar of must-watch series and events,” he added.

With $5 million from international backers, Mexico’s Moons brings its Invisalign killer to YC

Moons, a Mexico City-based startup that’s angling to be the Invisalign for the Latin American market, has joined the ranks of Y Combinator as part of the accelerator’s latest cohort.

The company already has $5 million in financing in the bank from an international group of investors, including Jaguar Ventures, Foundation Capital and Tuesday Capital, along with a whole host of strategic individual investors from Latin America’s dental community.

“We provide dental services throughout Mexico, Colombia and soon throughout Latin America,” says Moon co-founder and chief executive officer, Tommaso Tomba.

Like Invisalign, Moons conducts free initial conversations with potential patients and does a free scan of their teeth. “We have a team of orthodontists that take a look at the patient and determines whether the patient is a good candidate,” says Tomba.

If there’s a good fit, then the company creates a treatment plan and consultation schedule with a patient and fits them out with a pair of 3D-printed aligners — all for around $1,200.

That’s far lower than the treatment costs using established vendors, says Tomba. Already the company has 18 locations in Mexico and another two in Colombia — where Tomba expects operations to expand at a rapid clip. “We’re turning more cases than Invisalign in Mexico because we’ve brought the price right down,” says Tomba.

A graduate of Cambridge and Oxford Universities, Tomba and his founding team chose Latin America to launch their dental business after months of market analysis. Latin America is host to three of the most active destinations for cosmetic surgeries in the world.

Tomba market-tested by creating a website advertising the launch of his new business and taking pre-orders for the service in Europe, Latin America and the U.S. He settled on Mexico in part because of the demand he saw and in part because he’d had experience in the market previously as an early employee of Linio — a Rocket Internet-backed competitor to Amazon on the continent.

During his time at Linio, Tomba met his co-founder Leonardo Miron, a serial entrepreneur whose previous business was a mobile phone repair service called Rescata. Alex Clapp, a university friend of Tomba’s with experience in investment banking and healthcare-focused private equity in London and New York, rounded out the founding team.

The team chose to apply to Y Combinator because of the firm’s access to capital and ability to open doors in the U.S., Tomba said. “In LatAm, access to capital to build long-lasting companies is still relatively limited compared to the U.S., so we think it makes sense to YC so that they help us with investors and attracting talent going forward,” he said.

And Moons has bigger dreams than just the dental market. “We plan to go into other healthcare verticals,” says Tomba. “Always with the core tenet of providing high-quality healthcare and making it accessible.”

PrimaHealth Credit will now lend to borrowers looking to pay for addiction treatment

PrimaHealth Credit, which offers loans to borrowers to pay for medical treatment, is expanding its pitch to cover addiction treatment centers.

Currently, PrimaHealth offers loans for elective healthcare procedures like plastic surgery, LASIK, dental surgery and orthodontics. The move into addiction treatment is both a sign of how broken the American healthcare system is when it comes to substance abuse and addiction — and mental health therapies more broadly — and an indicator of the potential size of the market.

According to the company, PrimaHealth won’t charge any interest for most of its loans — depending on the creditworthiness of the borrower. Instead, the company will make money by charging a fee to the treatment center. If the borrower has poor credit, the APR on loans is 19.99%, according to a spokesperson for the company.

“Addiction treatment centers are under-served in relation to viable financing options to offer their patients,” says Brendon Kensel, founder and chief executive of PrimaHealth Credit, in a statement. “The burden of out-of-pocket costs falls on their patients, who often are unable to start the treatments they urgently need.”

Spending on substance abuse treatment in the U.S. is expected to reach $42.1 billion this year, with patients paying about $3.7 billion out-of-pocket for treatment and services, according to data from the Substance Abuse and Mental Health Services Administration cited by the company.

“Out-of-pocket expenses are often a key barrier to patients proceeding with care,” says Fritz Quindt, marketing director at A Better Today Recovery Services, a leading addiction treatment provider based in Scottsdale, Ariz., in a statement. “PrimaHealth Credit offers a new approach to helping patients fund the treatment they need. Their easy-to-use platform, customer support, and results speak for themselves.”

The company wouldn’t comment on the number of loans it has issued for elective surgeries.

PrimaHealth uses an algorithm to determine the credit-worthiness of potential borrowers and provides a payment management solution for treatment centers. Using underwriting models that use 200 determining factors, the company can issue instant credit decisions and offer different payment plans for borrowers, according to a statement.

For providers, the company offers reduced administrative costs and manages payment services, accounts receivable and credit reporting. PrimaHealth also said it would help addiction providers meet regulatory requirements to collect co-pays and deductibles.

The company’s services are currently available in Arizona, California, Florida and Texas.

Diet autopilot Thistle raises $5M for health food subscriptions

What if it was easier to eat salad than junk food? Most diet routines take a ton of time, whether you’re cooking from scratch, making a meal kit or seeking a nutritious restaurant. But on-demand prepared food delivery companies like Sprig that tried to eliminate that work have gone bankrupt from poor unit economics.

Thistle is a different type of food startup. It delivers thrice-weekly cooler bags customized with meat-optional, plant-based breakfasts, lunches, dinners, snacks, sides and juices. By batching deliveries in the less-congested early morning hours and optimizing routes to its subscribers, or by mailing weekly boxes beyond its own geographies, Thistle makes sure you already have your food the moment you’re hungry. Whether you heat them up or eat them straight out of the fridge, you’re actually dining faster than you could even place an Uber Eats order.

The food on Thistle’s constantly rotating menu is downright tasty. You might get a sunrise chia parfait for breakfast, a chicken tropical mango salad for lunch, a microwaveable bulgogi noodle bowl for dinner, with beet hummus and kale-cucumber juice for snacks. Thistle’s not cheap, with meals averaging about $14 each. But compared to competitors’ on-demand delivery markups and service fees, wasting ingredients from the grocer and the hours of cooking for yourself, it can be a good deal for busy people.

“We see Thistle as part of a movement to make health convenient rather than a high willpower chore,” CEO Ashwin Cheriyan tells me. What Peloton did to shave time off getting a great workout, Thistle does for eating a nourishing meal. It makes the right choice the easiest choice.

Thistle COO Shiri Avnery and CEO Ashwin Cheriyan with their daughter

The idea of a button you can push to make you healthier has attracted a new $5.65 million Series A round for Thistle led by its first institutional investor, PowerPlant Ventures . Bringing the startup to $15 million in funding, the cash will expand Thistle’s delivery domain. Dan Gluck of PowerPlant, which has also funded food break-outs like Beyond Meat, Thrive Market and Rebbl, will join the board.

Currently Thistle delivers in-person to the Bay Area, LA metro, San Diego and Sacramento while shipping to most of Washington, Oregon, Utah, Idaho, Nevada and Arizona. Thistle actually held off on raising more since launching in 2013 to make sure it hammered out unit economics to prevent an implosion. It’s also planning broader meal options, additional product lines and fresh distribution strategies like getting stocked in office smart kitchens or subsidized by wellness plans.

“The reasons that so many food delivery companies have failed likely fall into two buckets: one, a lack of focus on margins and unit economics, and two, premature geographic expansion before proving out the business model,” says Cheriyan. “Thistle makes money similar to how a well-run restaurant would make money — by having strong gross margins, efficient customer acquisition costs and solid customer retention / lifetime metrics. We currently deliver tens of thousands of meals on a weekly basis to customers on the West Coast and our annual average growth rate since launch has been 100%+.”

It’s nice that Thistle hasn’t gone out of business, because I’ve been eating its salads 6X a week for three years. It’s been the most efficient way for me to get healthier and lose weight after a half-decade of ordering takeout sandwiches and then feeling sluggish all day. I legitimately look forward to each one since they often have 20+ ingredients and only repeat every few months, so they’re never boring.

It has helped me keep my work-from-home lunches to about 20 minutes so I have more time for writing. Thistle is one of the few startups I consistently recommend to people. When asked how I lost 25lbs before my wedding, I point to Peloton cycling, Future remote personal training and Thistle salads — none of which require me to leave the house.

Cheriyan tells me, “We wanted the better-for-you and better-for-planet choice to be the default choice.”

Growing out of on-demand

Thistle has already pivoted past the business model burning tons of cash across the startup world. The company started as an on-demand cold-pressed juice delivery service, sending hipster glass bottles of watermelon and charcoal extract to doors around San Francisco. It was 2013, yoga was booming and people were paying crazily high prices for liquified lemongrass. Health made simple seemed like a sure bet to the founding team of Alap Shah, Naman Shah, Sheel Mohnot and Johnny Hwin, some of whom run Studio Management, a family office and startup incubator. [Disclosure: Hwin and Alap Shah are friends of mine, but didn’t pitch or discuss this article with me.]

Thistle eventually straightened things out with a shift to subscriptions and batched delivery under the leadership of the newly added co-founders, Cheriyan and his wife and COO Shiri Avnery. “I came from a family of physicians — both my parents, brother, and enough aunts, uncles, and cousins are doctors that they could start a small hospital,” Cheriyan, a former corporate attorney in M&A tells me. “A common point of frustration was about patients suffering from diet-related illnesses who were unable to make a lifestyle change because it was too hard.”

Avnery, a PhD in air pollution and climate change’s impact on agriculture, had become exasperated with the slow pace of policy change and the inaction of governments and corporations. The two quit their jobs, moved to San Francisco, and searched for a point of leverage for positively influencing people’s diets and interaction with the environment. They teamed up with the founders and launched Thistle v1.

A lack of experience in logistics led to the initial detour into on-demand. But rather than trying to fix the problem with VC money, Thistle stayed lean and discovered the opportunity nestled between Uber Eats and Blue Apron: sending people food they don’t have to eat now, but that takes low or no time to prepare when they’re peckish. Through its app, users can customize their meal plans, ban their allergens, pause deliveries and see what they’ll eat next.

A sample of Thistle 8 meal plans

“The unit economics problem most heavily plagued the early on-demand food companies. Food / labor waste and inefficient deliveries were likely the biggest reasons why the economics were unsustainable without venture life support. We know this personally as Thistle started our delivery service as an on-demand company before quickly realizing that the unit economics couldn’t sustain a healthy business,” Cheriyan explains, regarding companies like Sprig, DoorDash and Grubhub. Beyond unsold food, “the margins very likely did not support ordering a $12-$15 single meal for immediate delivery when average hourly driver wages reached $18-20.”

Meal kits were supposed to make dining healthier and cheaper, but they proved too much of a chore and led customers to boxes of ingredients piling up unused. Munchery and Nomiku went out of business while giants like Blue Apron have incinerated hundreds of millions of dollars and seen their share prices sink.

“The meal kit companies fared a little better from a gross margin perspective (due to pre-orders and more efficient deliveries), but suffer most from an easy-to-copy business model. This led to a rise in copycats, and, as a result, heavily rising customer acquisition costs, low switching costs and poor retention,” Cheriyan tells me. “Fundamentally the meal kit companies face another challenge, which is that people have less and less time to cook and are increasingly looking for ready-to-eat options.”

Push-button health

A slower, steadier approach with less overhead, more convenience and fewer direct competitors has helped Thistle grow to 400 employees, from culinary to engineering to logistics.

Still, it’s vulnerable. It may still be too expensive for some markets and demographics. Logistics experts like Amazon and Whole Foods could try to barge into the market. Cloud kitchens without dining rooms are making restaurant food more affordable for delivery. And another startup could always take the gamble on raising a ton of cash and subsidizing prices to steal market share, especially where Thistle doesn’t operate yet.

Thistle could counter these threats by further eliminating delivery costs by selling through partners like office smart fridges where employees pay on the spot, or equipping gym lobbies with more than just Muscle Milk.

“One opportunity we’re excited to test is attended and unattended retail — it would be great to be able to pick up Thistle products at your local grocery store, gym or coffee shop,” Cheriyan says. As for offices, “Today’s corporate lunchtime solutions often require a trade-off between health and convenience: either wait in line for 30+ minutes at your favorite salad spot for a healthy option, or opt into catered restaurant meals that leave you feeling sluggish and unproductive.” Thistle could help employers prevent the 3pm energy lull.

The startup’s focus on plant-forward meals also centers it in the path of another megatrend: the shift to environmentally conscious diets. Almost 60% of Americans are trying to eat less meat and 50% are eating meat-alternatives like Impossible Burgers. That stems both from interest in the humane treatment of animals and how 15% of green house emissions come from livestock. But 45% of Americans say they hate to cook. That’s why Thistle makes pre-made meals where meat and egg are optional, but the food is healthy and delicious without them.

In the age of Uber, we’ve acclimated to an effortless life. The new wave of “push-button health” startups like Thistle could finally take the hassle out of aligning your actions in the gym or kitchen with your intentions.

NASA’s advanced vision system for its supersonic test jet is undergoing a key stress test

NASA is keeping things moving with its X-59 program — the one where it’s developing a modern supersonic aircraft that proves the viability of lessening the traditional supersonic “boom” to a mere supersonic “thump,” in order to show that supersonic commercial passenger flights over land could be a real thing. The agency has already developed and flight-tested an innovative eXternal Vision System (XVS), which replaces a traditional transparent windshield to provide the X-59 pilot with a view as they fly, and now they’re subjecting that system to a high-frequency shake test to ensure it’s rigorous enough to work under the typical range of in-flight conditions.

The XVS has actually already flown — last August, it was loaded aboard a decidedly non-supersonic aircraft (the Beechcraft King Air UC-12B to be exact), which let the team working on the system show that it could do everything they needed it to in terms of providing pilots with real-time visibility of the air in front of them. Those tests showed that the XVS theory, technology and implementation all worked as intended, through use and feedback from real test pilots, but they didn’t show that the XVS hardware was able to withstand the kinds of stresses it might encounter when loaded in a fully built X-59 that’s flying faster than the speed of sound.

Obviously, NASA doesn’t want to wait until the X-59’s first flight to figure out if the XVS can handle said flight. That’s why things like the shake testing it’s doing now are so important. The shake test will expose the VS computer, displays and cameras to the kinds of vibrations it would experience during a typical flight. This is technically “pre-qualification” testing, which just means that it’s not supposed to strain the equipment to any extremes just yet. Provided everything goes to plan with this round of vibration tests, the next step will be qualification testing — in which the equipment will indeed be tested to its failure point on purpose.

All of this is prelude to the XVS being installed on the X-59 itself (there will still be temperature and altitude testing before that happens, though) and eventually, flying the aircraft. That’s when NASA hopes to show that the technologies it has developed in building the X-59 could usher in an entirely new era of commercial air travel — one in which supersonic planes regularly zip across populated stretches of land without scaring the crap out of the people on the ground.

Pantheon bets on WebOps as it charts a course to an IPO

It has been 10 years since Pantheon launched. At the time, it was mostly a hosting service for Drupal sites, but about six years ago, it added WordPress hosting to its lineup and raised more VC money as some of its competitors did the same. After its 2016 Series C round, things started quieting down, though the company has clear ambitions to become a public company in the next few years. To chat about those plans and the overall state of the business, I sat down with Pantheon co-founder and CEO Zack Rosen and new Pantheon board member Elissa Fink, former CMO of Tableau.

Maybe the biggest change at Pantheon is that when it launched, its team was almost solely focused on the developer experience. And while Pantheon was essentially a hosting service and offers personal plans, its focus was never on individuals who wanted a WordPress blog (which a lot of companies focused on, especially in the pre-Twitter days). Its efforts always revolved around businesses, large enterprises and the agencies that serve them.

“Back then, our overriding focus was really around the developer experience — the practitioner experience — of using our product,” Rosen explained. “And frankly, at the time, we actually really didn’t know what to call it. It really didn’t have a category, but we always felt it was something new.” He noted that over the last few years, Pantheon started talking to a lot of marketers and realized that the needs of these marketing leaders are driving this space.

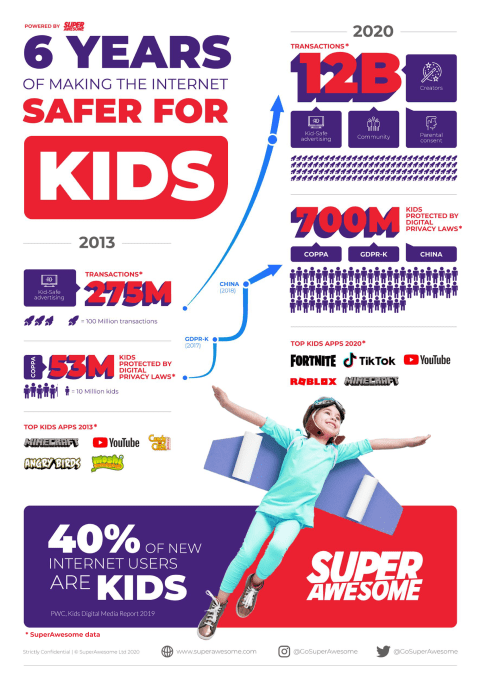

Kidtech startup SuperAwesome raises $17M, with strategic investment from Microsoft’s M12 venture fund

Kidtech startup SuperAwesome has raised an additional $17 million in funding, which includes a new strategic investment from Microsoft’s venture fund, M12. Others participating in the round include existing investors Mayfair Equity, Hoxton Ventures and Ibis, along with other angels.

To date, SuperAwesome has raised $37 million in outside investment.

SuperAwesome has been tapping into the need for more kid-friendly technology on the web that’s now used just as much by younger children as it is by adults.

“Historically the internet was designed to be used by adults, but now over 40% of new users are kids,” said SuperAwesome CEO Dylan Collins. “We’re in the middle of a structural shift in the composition of the internet that requires investment in privacy and kidtech to support children. This is as big a transition as mobile was for the desktop internet,” he noted.

The company’s platform includes products for kid-safe advertising, social engagement tools, authentication and parental controls. The breadth of this lineup has attracted big-name kids’ brands as customers, including Activision, Hasbro, Mattel, Lego, Cartoon Network, Spin Master, Nintendo, Bandai, WB, Shopkins maker Moose Toys, WPP, Omnicom, Dentsu, Niantic and Wildworks, among others.

Today, the company has more than 300 customers in total.

SuperAwesome’s technology has arrived at a critical time for many working in the kids’ app space, as governments are newly enacting and enforcing a range of kids’ privacy laws like COPPA (the U.S. Children’s Online Privacy Protection Rule) and GDPR-K in the E.U., as well as other laws in major markets like China, Brazil and India. In the U.S., for example, the FTC has slapped apps like Musical.ly (now TikTok) and YouTube with record fines for violations of children’s privacy regulations.

These changes have been a boon to SuperAwesome, which is now fully profitable and powering more than 12 billion kids’ digital transactions per month. Last year, the company pulled in $55 million in revenue and is on track for $80 to $90 million in revenue in 2020, Collins told TechCrunch.

SuperAwesome and Microsoft aren’t yet talking in detail about how the two companies will be teaming up, following the strategic investment. One thing being discussed by the two, however, are the opportunities around family identity, we’re told. In addition, Microsoft today is focused on both privacy and kids across its products — for example, with its web browser as well as with its educational efforts involving Minecraft, among other things.

“After we spent time with the M12 team and folks in Microsoft, it was clear we shared the same vision of where the internet is going: more kids and more privacy,” Collins said.

“We are proud to welcome the SuperAwesome team to the M12 portfolio. Dylan has cultivated a mission-driven team dedicated to keeping the internet safer for kids—a critical priority for digital-first generations,” said Nagraj Kashyap, Microsoft corporate vice president and global head of M12, in a statement about the funding. “Given Microsoft’s footprint in the identity management space, we’re excited to explore opportunities for partnership with SuperAwesome as well,” Kashyap added.

Daily Crunch: Tech notables react to Kobe Bryant’s death

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. LA tech industry mourns Kobe Bryant

The Los Angeles startup community is joining the rest of the world in mourning the death of NBA superstar, entrepreneur and investor Kobe Bryant who was killed in a helicopter crash in Calabasas, Calif. on Sunday.

Bryant launched his venture career with partner and serial entrepreneur Jeff Stibel back in 2013, making investments in Los Angeles-based companies like LegalZoom, Scopely, Art of Sport, The Honest Company, RingDNA, FocusMotion, DyshApp and Represent.

2. N26 reaches 5 million customers, including 250,000 in the US

N26 expanded to the United States during the summer of 2019. It represents a huge market opportunity, even though N26 faces competition from local players, such as Chime.

The two companies are teaming up to support Otter’s expansion into the Japanese market, where DOCOMO will be integrating Otter with its own AI-based translation service subsidiary, Mirai Translation.

4. Samasource CEO Leila Janah passes away at 37

Janah, a serial entrepreneur who was the CEO and founder of machine learning training data company Samasource, passed away at the age of 37 due to complications from epithelioid sarcoma, a form of cancer, according to a statement from the company. She focused her career on social and ethical entrepreneurship with the goal of ending global poverty.

5. As the venture market tightens, a debt lender sees big opportunities

David Spreng spent more than 20 years in venture capital before dipping his toe into the world of revenue-based financing and realizing there was a growing appetite for alternatives to venture capital. (Extra Crunch membership required.)

6. Clayton Christensen, author of ‘The Innovator’s Dilemma,’ has passed away at age 67

Christensen’s most famous book put forth a theory about why people buy products that are often cheaper and easier to use than their more sophisticated and more expensive predecessors, a theory resonated widely as one incumbent after another — Xerox, U.S. Steel, Digital Equipment Corp. — stumbled while other companies began rising in their dust: Think Amazon, Google and Apple.

7. This week’s TechCrunch podcasts

The Equity team looks at a big funding round for email collaboration startup Front, while the shorter Monday episode discusses coronavirus-spurred equity selloffs in Asia and Europe. And on Original Content, we review “Little America,” which has been described as the best show on Apple TV+.

Bird confirms acquisition of Berlin scooter rival Circ

If you didn’t see this coming, then clearly you didn’t have your eyes on the road. Bird, the LA-founded e-scooter giant, has confirmed that it is acquiring European competitor Circ, the micromobility company founded by Lukasz Gadowski of Delivery Hero fame.

The deal, for which terms remain undisclosed, was first reported by FT late last week. Meanwhile, TechCrunch revealed in late November that Circ was facing difficulties and had issued a round of layoffs following so-called “operational learnings.”

At the time, Gadowski put on a brave face, telling TechCrunch that Circ needed to learn how to operate a micromobility service across many European markets simultaneously. “Basically figure out how to be more efficient, how to run a micromobility operation; it’s not optimized yet and we learned over the summer,” he said.

He also conceded that, within the micromobility space more generally, there had been something of a land grab strategy that is now perhaps inevitably shifting toward greater emphasis on capital efficiency. “When we started this there was a focus on time to market, but now it is not about time to market but efficiency,” he told TechCrunch.

We also understand Circ was in the midst of trying to raise a Series B, which is what prompted talks with Bird. Early last year, the startup closed a Series A north of $60 million, funding it used to push into 12 countries and 43 cities, a spokesperson tells us.

On the funding front, Bird is also taking this announcement as an opportunity to share that they’ve added to their own funding, tacking on another $75 million onto their Series D, which now sits at $350 million.

Micromobility companies have been hard-pressed to cut spending and push toward profitability. One of Bird’s chief competitors, Lime, announced earlier this month they were laying off 100 employees and leaving 12 markets with the goal of becoming profitable in 2020.

Three hundred employees will be added to Bird’s European operations as a result of the deal, the company says.