Catch up on the most important news from today in two minutes or less.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

The US Has a ‘Plan’ to Fight Coronavirus: You

So far, government officials have offered little direction and no financial support despite urging people to stay home and take care of themselves.

Is It OK to Make Coronavirus Memes and Jokes?

Humor can relieve anxiety; it can also stoke racial tensions or spread misinformation. So, the answer isn’t simple.

Biden stages a Super Tuesday comeback as Sanders fights for the rest in the West

In a newly narrowed four-way contest, Super Tuesday’s broad delegate pool enticed Democratic primary contenders with race’s biggest prizes yet. Fourteen states voted in Tuesday’s primaries, with the key states of Texas and California alone accounting for a combined 643 delegates.

Former Vice President Joe Biden notched important wins early in the evening, taking Virginia and North Carolina, the third most delegate-rich state in Tuesday’s contest. Vermont Senator Bernie Sanders won his home state early in the night, but failed to carve out a foothold in the East Coast and Midwest.

“Just a few days ago the press and the pundits had declared this campaign dead,” Biden announced in a triumphant speech mid-way through the evening. “I am here to report, we are very much alive.”

As of 8:45 p.m. Pacific Time, Biden had collected Alabama, Arkansas, Minnesota, North Carolina, Oklahoma, Tennessee, Massachusetts and Virginia with Sanders taking Colorado, Utah and Vermont. At the time of writing, a winner has yet to be declared in Maine, Texas and California, with the latter state leaning toward Sanders.

Photographer: David Paul Morris/Bloomberg via Getty Images

Biden stormed into Super Tuesday with new momentum, fresh off a vital win in South Carolina over the weekend and some swiftly collected endorsements of his former rivals, including Amy Klobuchar, Pete Buttigieg and Beto O’Rourke. That momentum created a spate of decisive victories for Biden, as the moderate vote appeared to flow easily to him, overwhelming Sanders in some states the Vermont senator was favored in, including Oklahoma, Minnesota and his neighboring state of Massachusetts.

Lacking endorsements from former candidates but not momentum, Bernie Sanders entered Super Tuesday with 60 delegates to Biden’s 54 and Elizabeth Warren’s eight. His results in early voting states, consistent debate performances and grassroots support marked Sanders as the candidate to beat, but those strengths failed to translate to boosted turnout for Sanders in some key states.

In spite of early narratives, delegate totals before Super Tuesday represented just a sliver of the 1,991 delegates necessary to secure the nomination at the Democratic National Convention this July. A total of 1357 delegates are up for grabs on Super Tuesday.

Super Tuesday marked the first time Bloomberg appeared on a ballot, but his massive cash spend still resulted in an underwhelming night, with the former mayor only picking up a small handful of delegates in American Samoa. Former New York Mayor Mike Bloomberg entered the formal race with more than $400 million spent on ads but zero delegates. Warren also underperformed Tuesday, with a more competitive race than anticipated even in her home state of Massachusetts, which ultimately went to Biden. Oklahoma also showed no loyalty for Warren, who was born in the state—after choosing Sanders in 2016, Oklahoma opted for Biden in Tuesday’s contest.

Tuesday’s results will reshape the race for the Democratic nomination, much as Biden’s long-promised win in South Carolina breathed new life into a flagging campaign. Beyond likely narrowing into a two-person race, the new dynamics emerging out of Tuesday will shift the framing of the contest as a whole. That change is likely to pit political Biden’s promise of incremental political change more directly against Sanders and democratic socialism.

The 2020 race has challenged the tech industry in more ways than one. With both Trump and Bloomberg stress-testing social platforms with a deluge of ads, tech companies are still trying to figure out where to draw their respective lines on political advertising. Those efforts are on top of the imperative for major platforms to avoid a repeat of 2016 by fending off coordinated disinformation campaigns seeking to roil Americans politics.

Beyond platform manipulation concerns, candidates like Warren and Sanders successfully tapped into mainstream backlash against big tech over the course of their campaigns, cultivating even more criticism for companies already under scrutiny from other parts of the government. Depending on which wing of the party seals the nomination, tech could be facing a very different regulatory environment in the event of a Democratic win come November.

Zuckerberg details the ways Facebook and Chan Zuckerberg Initiative are responding to COVID-19

Mark Zuckerberg has outlined some of the steps that Facebook and his family’s non-profit, the Chan Zuckerberg Initiative, are taking to respond to the spread of both the novel coronavirus known as COVID-19 and viral misinformation about the illness, in a statement posted earlier this evening.

Facebook’s response focuses on three areas: providing accurate information; stopping misinformation; and providing data for research (which is not creepy at all coming from Facebook).

To provide accurate information, Facebook is directing users who search for information on the coronavirus on its platform to the World Health Organization or local health authority through an automatic pop-up. That notification on information is also automatically populated into the news feed for everyone who is in a country where the World Health Organization has reported a case of person-to-person transmission.

“Given the developing situation, we’re working with national ministries of health and organizations like the WHO, CDC and UNICEF to help them get out timely, accurate information on the coronavirus,” Zuckerberg wrote. “We’re giving the WHO as many free ads as they need for their coronavirus response along with other in-kind support. We’ll also give support and millions more in ad credits to other organizations too and we’ll be working closely with global health experts to provide additional help if needed.”

To stop the spread of misinformation on the platform, Zuckerberg wrote that Facebook was removing false claims and conspiracy theories flagged by global health organizations and the company is blocking people from running ads that try to exploit the fears of the public by pitching snake oil cures.

Finally, and perhaps most problematically, Facebook is “looking at how people can use our services to help contribute to broader efforts to contain the outbreak,” Zuckerberg wrote. “Researchers are already using aggregated and anonymized Facebook data — including mobility data and population density maps — to better understand how the virus is spreading.”

There are open questions around what controls Facebook has put in place to restrict who has access to the anonymized data and what users might be able to do with that data — or how long they can maintain access once the threat from the virus abates. Facebook had not responded to a request for comment by the time of publication.

Technology from the Chan Zuckerberg Initiative is also helping with the medical efforts to halt the spread of the disease. Working with the Gates Foundation, researchers financed by the two organizations were able to fully sequence the genome of the virus that causes COVID-19 in a matter of days, making it easier for people infected with the virus to be identified.

That same team created a public version of the IDSeq tool so scientists could study the full genome in the context of other pathogens, Zuckerberg wrote.

Chan-Zuckerberg’s Biohub has also been working to develop a cell atlas, which maps different cell types in the body. Some researchers are using that atlas to try and assess how the coronavirus damages the lungs and identify potential treatments that could limit lung damage caused by the virus.

“There’s more we can do to help people feel less isolated and help one another and we’re working on some ideas we’ll share in the next few weeks, but for now the focus is on slowing the spread of the outbreak itself,” Zuckerberg wrote. “This is a difficult time for a lot of people and I’m thinking of everyone affected by this — the people who are sick or quarantined, their friends and family and of course the healthcare workers who are always on the frontlines of any outbreak. We’ll share more updates soon.”

Robinhood offers $15 discount, blames outage on record trades

It wasn’t the leap year, a coding blip, or a hack that caused Robinhood’s massive outages yesterday and today that left customers unable to trade stocks. Instead, the co-CEOs write that “the cause of the outage was stress on our infrastructure — which struggled with unprecedented load. That in turn led to a “thundering herd” effect — triggering a failure of our DNS system.”

Robinhood was offline from Monday at 6:30am Pacific to 11pm Pacific, then had another outage this morning from 6:30am Pacific until just before 9am Pacific.

The $912 million-funded fintech giant will provide compensation to all customers of its Robinhood Gold premium subscription for borrowing money to trade plus access to Morningstar research reports, Nasdaq data, and bigger instant deposits. It’s offering them three months of service.

A month of Robinhood Gold costs $5 plus 5% yearly interest on borrowing above $1,000, charged daily. Before a pricing change, the flat fee per month could range as high as $200. However, compensated users will only get the $5 off per month, for a total of $15. That could seem woefully insufficient if Robinhood users missed out on buying back into stocks like Apple that went up over 9% on Monday. Robinhood is calling it a “first step”.

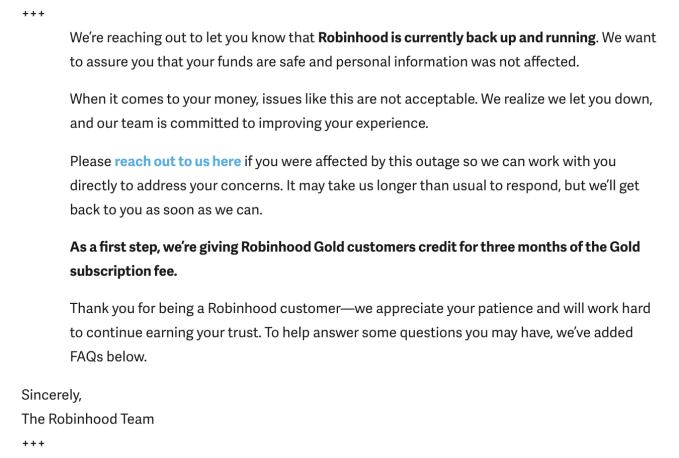

Impacted Robinhood users can contact the company here to ask for compensation. Below you can see the email Robinhood sent to custoemrs late last night.

Robinhood’s email to customers late last night

Robinhood is also working to contact impacted customers on a individual basis, and it’s looking into other forms of compensation on a case by case basis, company spokesperson Jack Randall tells me. It’s unclear if that might include cash to offset what traders might have lost by having their money locked in inaccessible Robinhood accounts during the outage.

Compensation could become a significant cost if the startup assesses that many of its 10 million users were impacted. The markets gained a record $1.1 trillion yesterday, but some Robinhood traders may not have been able to buy back in as the rebound occurred following mass selloffs due to fears of coronavirus.

Now the startup, valued at $7.6 billion, will have to try to regain users’ trust. “When it comes to your money, we know how important it is for you to have answers. The outages you have experienced over the last two days are not acceptable and we want to share an update on the current situation . . . We worked as quickly as possible to restore service, but it took us a while. Too long” wrote co-founders and co-CEO Baiju Bhatt and Vlad Tenev [disclosure: who I know from college].

As for exactly what triggered the downtime, the founders write that “Multiple factors contributed to the unprecedented load that ultimately led to the outages. The factors included, among others, highly volatile and historic market conditions; record volume; and record account sign-ups.” There’s been a frenzy of retail trading activity in the wake of coronavirus. There’s also been sudden spikes in stocks like Tesla amidst mainstream media attention.

Going forward, Robinhood promises to “work to improve the resilience of our infrastructure to meet the heightened load we have been experiencing. We’re simultaneously working to reduce the interdependencies in our overall infrastructure. We’re also investing in additional redundancies in our infrastructure.” However, they warn that “we may experience additional brief outages, but we’re now better positioned to more quickly resolve them.”

The outage comes at a vulnerable time for Robinhood as oldschool brokerages like Charles Schwab, Ameritrade, and Etrade all recently moved to eliminate per-trade fees to match Robinhood’s pioneering zero-comission trades. Though some of those brokerages experienced infrastructure troubles recently, Robinhood massive outages could push users towards those incumbents that they might perceive as more stable.

Five, the self-driving startup, raises $41M and pivots into B2B, away from building its own fleet

We are still years away from a time when fully-autonomous cars will be able to drive us from A to B, and the complexity of getting to that point is likely going to need hundreds of billions of dollars of investment before it becomes a reality.

That hard truth is leading to some shifts in the self-driving startup landscape. In the latest move, England’s Five (formerly known as FiveAI), one of the more ambitious companies in the space in Europe, is moving away from its original plan, of designing its own fully self-driving cars, and then running fleets of them in its own transportation service. Instead, it now plans to license its technology — starting with software to help test and measure the accuracy of a vehicle’s driving systems — that it has created to others building autonomous cars as well as the wider service ecosystem that will exist around that. As part of that pivot, today it’s also announcing a fresh $41 million in funding.

“A year and a bit ago we thought we would probably build the entire thing and take it to market as a whole system,” said co-founder and CEO Stan Boland in an interview. “But we gradually realised just how deep and complex that would be. It was probably through 2019 that we realised that the right thing to do is to focus in on the key pieces.”

The funding, a Series B, includes backing from Trustbridge Partners, insurance giant Direct Line Group and Sistema VC, as well as previous investors Lakestar, Amadeus Capital Partners, Kindred Capital and Notion Capital. The company has now raised $77 million and while it’s not disclosing its valuation, Boland said that it was definitely up on its last round. (Its Series A, in 2017, was for $35 million, and it didn’t disclose valuation then, either.)

Five’s change in course is a significant development. The high-profile startup, founded by a team that had previously built and sold several chip companies to the likes of Broadcom, Nvidia and Huawei, had been the leading partner for a big government-backed pilot project, StreetWise, to test and work on autonomous driving systems across boroughs in London. The most recent phase of that project, running driver-assisted rides along a 19-km route across south London, got off the ground only last October after initially getting announced in 2018.

Five might continue to work on research projects like these, Boland said, but the primary business aim for the company will no longer be ultimately to build cars for themselves, but to work on tech that will be sold either to other carmakers, or those building services catering to the autonomous industry.

For example, Direct Line, one of Five’s new investors and also a participant in the StreetWise project, could use testing and measurement to determine risk and pricing for insurance packages for different vehicles.

“Autonomous and assisted driving technology is going to play a huge role in the future of cars,” said Gus Park, MD of Motor Insurance at Direct Line Group, in a statement. “We have worked closely with Five on the StreetWise project, and we share a common interest in solving the formidable challenges that will need to be addressed in bringing safe self-driving to market. Insurers will need to build the capability to measure and underwrite new types of risk. We will be collaborating with Five’s world-class team of scientists, mathematicians and engineers to gain the insight needed to build safe, insurable solutions and bring the motoring revolution ever closer.” Park is also joining Five’s board with this round.

There were already a number of big players in the self-driving space when FiveAI launched — they included the likes of Waymo, Cruise, Uber, Argo AI and many more — and you could have argued that the writing was already on the wall then for long-term consolidation in the industry. Indeed, there have been some significant casualties in the meantime, including Drive.AI (which Apple acquired after it ran out of money), Oryx Vision and Quanergy.

Five’s argument for why a UK — and indeed, European — startup was in a good place to build and operate self-driving cars, and the tech underpinning it, was because of the complexity behind building localised systems: a big US or Asian company might be able to map the streets in Europe, but it wouldn’t have as good of a feel for how people behaved on those roads. Added to that, Five firmly believed the economics of building and operating these cars would prove to be too high for wide-scale private ownership. Hence, the strategy (one adopted by many in the autonomous space) of building the technology for fleets, where transportation businesses, not individuals, would own the cars and recoup their investments by charging private individuals for rides.

Yet while it may have been easy to see the potential, the process of getting to that point proved to be too challenging.

“What’s happened in the last couple of years is that there has been an appreciation across the industry of just how wide and deep the challenges are for bringing self driving to market,” Boland said. “Many pieces of the jigsaw have to be assembled…. The B2C model needs billions [of investment], but others are finding their niche as great providers of technology needed to deliver the systems properly.”

As a ballpark figure, Boland believes that to get to a self-driving, Level 5 reality, we’ll need to see “hundreds of billions” of dollars of investment. But so far, collectively, self-driving startups have raised a mere $15 billion, according to figures from Crunchbase — significant money, but nowhere near the amounts that will be needed, and one argument for why only a very few, backed by huge automotive giants, will ever make it.

As FiveAI (named after the “Level 5” that self-driving systems attain when they are truly autonomous), the company built (hacked) vehicles with dozens of sensors and through its tests managed to build a significant trove of vehicle technology.

“We could offer tech in a dozen different areas that are hard for autonomous driving companies,” Boland said. Its testing and measuring tools point to one of the toughest challenges among these: how to assure that the deep learning software a company is using is correctly identifying objects, people, weather, and other physical factors when it may have never seen them before.

“We have learned a lot about the types of errors that propagate from perception into planning… and now we can use that for providing absolute confidence” to those testing the systems, he said.

Self-driving cars are one of the biggest AI challenges of our time: not only is the requirement to essentially build from the ground up computer systems that behave as well as (or ideally better) than multitasking humans behind the wheel; but the consequence of doing that wrong is not just a strange string of words, or some other kind of non sequitur, but injury or death. No surprise that there appears still a very long way to go before we see anything like Level 5 systems in action, but in the meantime, investors are willing to continue placing their bets. Partly because of how advanced it got with its car project on relatively little funding, Five remains an interesting company to investors, and Boland hopes that this will help it with its next round down the road.

“We invest in category-leading companies that are delivering transformational change wherever they’re located,” said David Lin of Trustbridge Partners in a statement. “As Europe’s leading self-driving startup, Five is the furthest ahead in developing a clear understanding of the scientific challenges and novel solutions that move the needle for the whole industry. Five has successfully applied Europe’s outstanding science and engineering base to create a world-class team with the energy and ambition to deliver safe self-driving. We are delighted to join them for this next phase of growth.”

Los Angeles-based Talespin nabs $15 million for its extended reality-based workforce training tools

It turns out the virtual and augmented reality companies aren’t dead — as long as they focus on the enterprise. That’s what the Los Angeles-based extended reality technology developer Talespin did — and it just raised $15 million to grow its business.

Traditional venture capitalists may have made it rain on expensive Hollywood studios that were promising virtual reality would be the future of entertainment and social networking (given coronavirus fears, it may yet be), but Talespin and others like it are focused on much more mundane goals. Specifically, making talent management, training and hiring easier for employers in certain industries.

For Talespin, the areas that were the most promising were ones that aren’t obvious to a casual observer. Insurance and virtual reality are hardly synonymous, but Talespin’s training tools have helped claims assessors do their jobs and helped train a new generation of insurance investigators in what to look for when they’re trying to determine how much their companies are going to pay out.

“Talespin‘s immersive platform has transformed employee learning and proven to be an impactful addition to our training programs. We’re honored to continue to support the Talespin team through this next phase of growth and development,” said Scott Lindquist, Chief Financial Officer at Farmers Insurance, in a statement.

Farmers is an investor in Talespin, as is the corporate training and talent management software provider Cornerstone OnDemand, and the hardware manufacturer HTC. The round’s composition speaks to the emerging confidence of corporate investors and just how skeptical traditional venture firms have become of the prospects for virtual reality.

The prospects of augmented and virtual reality may be uncertain, but what’s definite is the need for new tools and technologies to transfer knowledge and train up employees as skilled, experienced workers age out of the workforce — and the development of new skills becomes critically important as technology changes the workplace.

Cornerstone, which led the Talespin Series B round, will also be partnering with the company to develop human resources training tools in virtual reality.

“We share Talespin’s vision that the workforce needs innovative solutions to stay competitive, maximize opportunity and increase employee satisfaction,” said Jason Gold, Vice President of Finance, Corporate Development and Investor Relations at Cornerstone, in a statement. “We’ve been incredibly impressed with Talespin’s technology, leadership team and vision to transform the workplace through XR. Talespin’s technology is a perfect fit in our suite of products, and we look forward to working together to deliver great solutions for our customers.”

Talespin previously raised $5 million in financing. The company initially grew its business by developing a number of one-off projects for eventual customers as it determined a product strategy. Part of the company’s success has relied in its ability to use game engine and animation instead of 360 degree video. That means assets can be reused multiple times and across different training modules.

“Creating better alignment between skills and opportunities is the key to solving the reskilling challenges organizations across the world are facing,” said Kyle Jackson, CEO and Co-Founder of Talespin, in a statement. “That’s why it’s critical companies find a way to provide accelerated, continuous learning and create better skills data. By doing so, we will open up career pathways for individuals that are better aligned to their natural abilities and learned skills, and enable companies to implement a skills-based approach to talent development, assessment, and placement. Our new funding and partnership with Cornerstone will allow us to expand our product offerings to achieve these goals, and to continue building innovative solutions that redefine what work looks like in the future.”

$75M legal startup Atrium shuts down, lays off 100

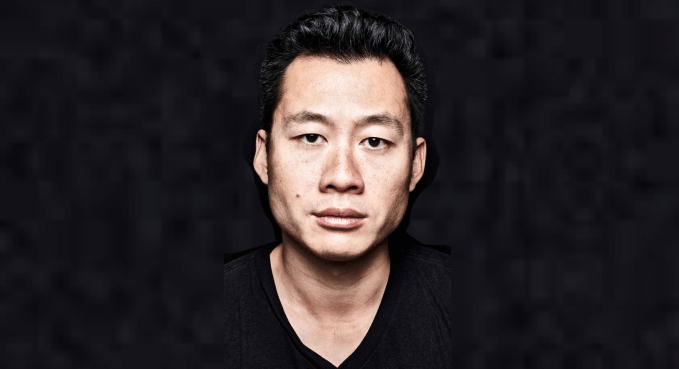

Justin Kan’s hybrid legal software and law firm startup Atrium is shutting down today after failing to figure out how to deliver better efficiency than a traditional law firm, the CEO tells TechCrunch exclusively. The startup has now laid off all its employees, which totaled just over 100. It will return some of its $75.5 million in funding to investors, including Series B lead Andreessen Horowitz. The separate Atrium law firm will continue to operate.

“I’m really grateful to the customers and the team members who came along with me and our investors. It’s unfortunate that this wasn’t the outcome that we wanted but we’re thankful to everyone that came with us on the journey,” said Kan. He’d previously founded Justin.tv, which pivoted to become Twitch and later sold to Amazon for $970 million. “We decided to call it and wind down the startup operations. There will be some capital returned to investors post wind-down,” Kan told me.

Atrium had attempted a pivot back in January, laying off its in-house lawyers to become a more pure software startup with better margins. Some of its lawyers formed a separate standalone legal firm and took on former Atrium clients. But Kan tells me that it was tough to regain momentum coming out of that change, which some Atrium customers tell me felt chaotic and left them unsure of their legal representation.

More layoffs quietly ensued as divisions connected to those lawyers were eliminated. But trying to build software for third-party lawyers, many of whom have entrenched processes and older leadership, proved difficult. The streamlined workflows may not have seemed worth the thrash of adopting new technology.

“If you look at our original business model with the verticalized law firm, a lot of these companies that have this kind of full stack model are not going to survive,” Kan explained. “A lot of these companies, Atrium included, did not figure out how to make a dent in operational efficiency.”

Disrupting law firms proves difficult

Founded in 2017, Atrium built software for startups to navigate fundraising, hiring, acquisition deals and collaboration with their legal team. Atrium also offered in-house lawyers that could provide counsel and best practices in these matters. The idea was that the collaboration software would make its lawyers more efficient than a traditional law firm so they could get work done faster, translating to savings for clients and Atrium.

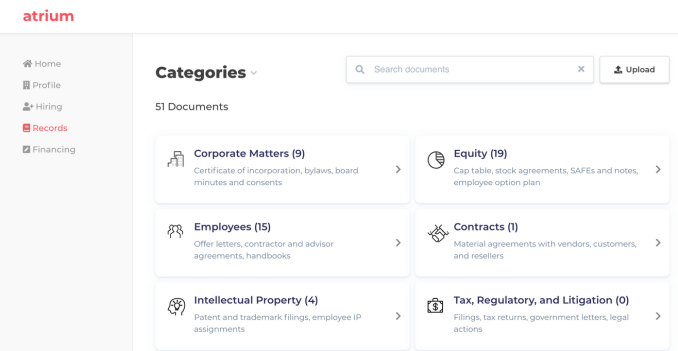

Atrium’s software included Records, a Dropbox-esque system for keeping track of legal documents, and Hiring, which instantly generated employment offer letters based on details punched into a form while keeping track of signatures. The startup hoped it could prevent clients and lawyers from wasting time digging through email chains or missing a sign-off that could put them in legal jeopardy.

The company tried to generate client leads by hosting fundraising workshops for startups, starring Kan and his stories from growing Twitch. A charismatic leader with a near-billion-dollar exit under his belt, investors and founders alike were quick to buy into Kan’s vision and advice. Startups saw Atrium as an ally with industry expertise that could help them avoid dirty term sheets or botched hires.

But keeping a large squad of lawyers on staff proved costly. Atrium priced packages of its software and legal assistance under subscriptions, with momentous deals like acquisitions incurring add-on fees. The model relied less on milking clients with steep hourly rates measured down to six-minute increments like most law firms.

Yet eliminating the busywork for lawyers through its software didn’t materialize into bountiful profits. The pivot sought to create a professional services network where Atrium could route clients to attorneys. The layoffs had shaken faith in the startup as clients demanded stability, lest they be caught without counsel at a tough time.

Rather than trudge on, Kan decided to fold the company. The standalone Atrium law firm will continue to operate under partners Michel Narganes and Matthew Melville, but the startup developing legal software is done.

Atrium’s implosion could send ripples through the legal tech scene, and push other entrepreneurs to start with a more focused software-only approach.

WellSet is doing a limited launch in Los Angeles of its alternative medicine booking platform

Alternative and holistic healthcare seekers in the Los Angeles area have a new service they can turn to in WellSet, the listing platform that launched on Tuesday.

Through the service, customers coming off the company’s existing waitlist can access its marketplace for finding acupuncturists, massage therapists, functional medicine practitioners, craniosacral therapists, nutritionists, life coaches and holistic therapists.

WellSet will serve up practitioners based on a users’ health concerns, as well as the price, location and type of practice on offer.

The company takes a 30% referral fee for its first booking and a 3% booking fee for future appointments booked through its platform. It also provides backend services like intake form management, insurance management and other logistical offerings, according to co-founder Tegan Bukowski.

Co-founder Sky Meltzer and Bukowski began working on the company two-and-a-half years ago, according to Bukowski. A former Yale-educated architect who worked for the starchitect Zaha Hadid, Bukowski founded the company because of her own experience with the healthcare industry. While in school she suffered through frequent trips to the hospital for what was an undiagnosed “mystery illness,” which she eventually treated holistically.

For the first 10,000 people to sign up for the company’s waitlist, WellSet is offering a $20 credit for the first session booked on the platform, once WellSet launches in their city.

So far the company has roughly 7,000 practitioners on the service and enough providers to launch in at least five major markets. Its deliberate rollout strategy will see the company opening its virtual doors in New York and San Francisco in the coming months.

The Los Angeles-based company was founded by Bukowski, who serves as co-founder and chief executive officer. Meltzer, the company’s executive chairman and co-founder, was the former chief executive of the yoga company Manduka. Rounding out the team is Hanna Madrigan, a former Pinterest employee who now serves as the chief operating officer.

The company is backed by investors including Kleiner Perkins, Broadway Angels (a female-focused Silicon Valley investment firm) and Kelly Noonan Gores, writer, producer and director of the documentary “Heal.”

There’s a small holistic healing community growing in Los Angeles. Gwyneth Paltrow’s Goop is by far the best funded of these new companies, but startups like Kensho Health are making their presence felt, as well.

Increasingly, holistic healing and functional medicine are seen as viable options for certain types of chronic conditions. The Centers for Medicare and Medicaid recently added acupuncture as a reimbursable treatment — opening the door to the possibility that other conditions may be covered by the government and private insurers.

Los Angeles gets a new consumer fund as founders of Sprinkles seek $25 million for CN2 Ventures

Charles and Candace Nelson traded their investment banking careers in Silicon Valley for the sweet, sweet life as captains of the cupcake and confectionery chain Sprinkles.

Now they’re putting both their consumer and brand development skills and former investment banking chops to work at CN2 Ventures, a new firm they’re setting up with the goal of pulling in $25 million to invest, incubate and support new business ideas.

The firm already has three businesses in its portfolio and two others that it’s still in the process of launching, said Charles Nelson.

There’s the pizza chain, Pizzana; the kids playspace, Play 2 Progress; and the direct to consumer clothing brand, Willy California.

“We’re focusing on retail and consumer areas,” says Charles Nelson. “Both branded retail and doing some direct to consumer. Our plan is to raise a fund… ideally around $25 million if we can.”

The couple sees their investment sweet spot in the marriage of technology and retail. It’s the space where they found their initial success at Sprinkles — which included high-tech touches like pre-ordering and customization through its touchscreen services at its retail locations.

“We started as brick and mortar people,” says Candace Nelson. “Even as D2C… it feels soulless unless you experience the brand physically in some way.”

So far, the firm has been taking large equity stakes in the businesses it’s backing — in part because it can, but also because these portfolio companies can almost be seen as subsidiaries operating under the larger CN2 Ventures umbrella.

Minority investments will be an option, according to Charles Nelson, but the company intends to be targeted in the types of investments it makes. For the most part, the defining characteristic for both founders of the firm is that they’re true believers in the businesses they’re backing.

“Candace and I will never invest in something that we aren’t super passionate about and a brand that we don’t love.”

Candace Nelson points to the couple’s investment in Pizzana as an example. “We joked post-Sprinkles, ‘no more food businesses,’ but we met Daniele [Uditi] and he totally turned our minds,” she said.

How Stack Overflow’s new CEO plans to kickstart enterprise growth

Stack Overflow has long been the Q&A site of choice for developers. But while that’s what most people know the company for, it has also built out a jobs site and Teams, its private Q&A service for enterprise clients, over the years. Now, it’s looking to capitalize on that and kickstart growth of Teams, especially, under its new CEO, Prashanth Chandrasekar.

Chandrasekar, a former investment banker and Rackspace exec, took over as Stack Overflow’s CEO. Teresa Dietrich, who was previously at McKinsey New Ventures, joined him at the beginning of the year as the company’s chief product officer. Ahead of today’s Teams product update, which mostly includes a number of new integrations, I sat down with Chandrasekar and Dietrich to talk about the company’s plans for the future and the role Teams will play in that.

Chandrasekar tells me that Stack Overflow itself, even after 12 years, has about 50 million monthly users. In addition, another 70 million each month visit the rest of the Stack Exchange sites around culture, science and other topics.

The Stack Overflow jobs product accounts for about half of the company’s revenue, he also noted. “That’s the very steady business that has existed for all of the entire duration of the company’s life,” he said. Ads and the Teams product split the remaining 50%, but it’s the two-and-a-half-year-old Teams service that is seeing the strongest growth now, with revenue nearly doubling year-over-year. “Our expectation is that in the next couple of years, it’ll become the primary business for us,” he said, adding that this is also why he took this job.

“The company has always done a great job creating these products and the community continues to thrive,” Chandrasekar said. “But at the same time, there was a recognition that for us to really scale this in the context of a true SaaS company, you need several fundamental components we had to put in place.”

The first task was to bring in someone who had experience scaling organizations, which is why Chandrasekar was hired. He also brought on Dietrich as CPO, as well as new VP of Customer Success Jeff Justice (formerly with Dropbox), and will soon announce a new chief revenue officer. “All these components we’ve put in place so that we can actually be a high-scale SaaS company,” said Chandrasekar. “That’s really where we’re headed.”

Uber sold its food delivery business in India to Zomato for $206M

Uber sold its food delivery business in India to the local rival Zomato for $206 million, the American ride-hailing company disclosed in a regulatory filing in one of its key overseas markets.

In January, Uber announced that it had sold the India business of Uber Eats to Zomato for a 9.99% stake in the loss-making Indian food delivery startup. The two companies had not disclosed the financial terms of the deal, which some Indian news outlets slated to be $350 million in size. TechCrunch had reported that Uber Eats’ India business — and a 9.99% stake in Zomato — was valued at about $180 million.

In the filing, Uber said the “fair value of the consideration” it received for Uber Eats’ India business from Zomato was $206 million, which included $35 million of “reimbursement of goods and services tax receivable from Zomato.”

The deal underscores a significant cut in the 11-year-old Indian firm’s valuation, which was reported to be worth $3 billion when it disclosed a $150 million fresh investment earlier this year.

In an interview with Indian news agency PTI in December, Zomato co-founder and chief executive Deepinder Goyal said the company was in the process of raising as much as $600 million by the end of January. The company has yet to secure the rest of the capital. A Zomato spokesperson declined to comment.

The exit of Uber Eats from India has made the local food delivery market a duopoly between Zomato and Prosus Ventures-backed Swiggy, which raised $113 million in an ongoing round last month. According to industry estimates, Swiggy is the top food delivery business in India.

Both the startups are struggling to find a path to profitability in India, however, as they continue to dish out more than $15 million each month to win new customers and keep the existing ones happy.

Finding a path to profitability is especially challenging in India, as, unlike in the developed markets such as the U.S., where the value of each delivery item is about $33, in India, a similar item carries the price tag of $4, according to estimates by Bangalore-based research firm RedSeer.

Anand Lunia, a VC at India Quotient, said in a recent podcast that the food delivery firms have little choice but to keep subsidizing the cost of food items on their platform, as otherwise most of their customers can’t afford them.

If that wasn’t tough enough, the two startups are staring at a new competitor. TechCrunch reported last week that Amazon plans to enter India’s food delivery business by as soon as end of March.

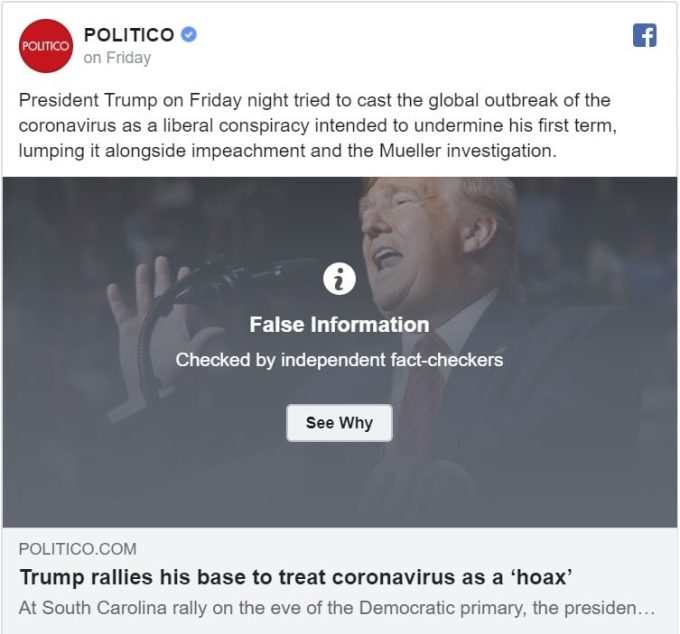

Facebook fact-check feud erupts over Trump virus ‘hoax’

Who fact-checks the fact-checkers? Did Trump call coronavirus the Democrats’ “new hoax”?

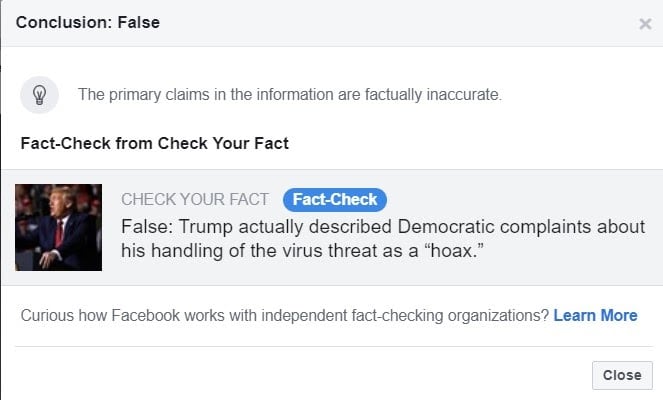

Those are the big questions emerging from a controversial “false” label applied to Politico and NBC News stories by right-wing publisher The Daily Caller. Its Check Your Fact division is a Facebook fact-checking partner, giving it the power to flag links on the social network as false, demoting their ranking in the News Feed as well as the visibility of the entire outlet that posted it.

Critics railed against Facebook’s decision to admit The Daily Caller to the fact-checking program last April due to its history of publishing widely debunked articles. Now some believe their fears of politically biased fact-checks are coming true.

Image via Judd Legum

This week, Check Your Fact rated two stories as false. “Trump rallies his base to treat coronavirus as a ‘hoax’ ” from Politico, and “Trump calls coronavirus Democrats’ ‘new hoax’ ” from NBC News, as highlighted by Popular Information’s Judd Legum. The fact-check explanation states that “Trump actually described complaints about his handling of the virus threat as a ‘hoax’. ”

Trump had said at a rally (emphasis ours):

“Now the Democrats are politicizing the coronavirus. You know that, right? Coronavirus. They’re politicizing it. We did one of the great jobs . . . They tried the impeachment hoax. That was on a perfect conversation. They tried anything, they tried it over and over, they’ve been doing it since you got in. It’s all turning, they lost, it’s all turning. Think of it. Think of it. And this is their new hoax. But you know, we did something that’s been pretty amazing. We’re 15 people [cases of coronavirus infection] in this massive country. And because of the fact that we went early, we went early, we could have had a lot more than that . . . we’ve lost nobody, and you wonder, the press is in hysteria mode.“

It’s hard to tell exactly what Trump means here. He could be calling coronavirus a hoax, concerns about its severity a hoax or Democrats’ criticism of his response a hoax. Reputable fact-checking institution Snopes rated the claim that Trump called coronavirus a hoax as a mixture of true and false, noting, “Despite creating some confusion with his remarks, Trump did not call the coronavirus itself a hoax.”

Image via Judd Legum

Perhaps Politico and NBC News’ headlines went too far, or perhaps the headlines fairly describe Trump’s characterization of the situation.

But the bigger concern is how Facebook has designed its fact-checking system to prevent other fact-checking partners from auditing the decision of The Daily Caller.

When asked about this, Facebook deflected responsibility, implying the audit process wouldn’t be necessary because all of its fact-checking partners have been certified through the non-partisan International Fact-Checking Network. This group publishes ethics guidelines that include an accuracy standard that requires checkers “maintain high standards of reporting, writing, and editing in order to produce work that is as error-free as possible.” Checkers are also supposed to follow criteria for determining story accuracy, and can apply mid-point labels like “Partly False” or “False Headline,” which The Daily Caller didn’t use here.

Facebook tells me that because it doesn’t think it’s appropriate for it to be the arbiter of truth, it relies on the IFCN to set guidelines. It also noted that there’s an appeals process where publishers can reach out directly to a fact-checker to dispute a rating. But when I followed up, Facebook clarified that publishers can only appeal the fact-checker that labeled them, and can’t appeal to other fact-checkers for a second decision or audit of the original label.

That leaves very little room for controversial or inaccurate labels to be rolled back. A fact-checker would have to be formally rejected by the IFCN for violating its guidelines to lose its status as a Facebook partner.

If Facebook doesn’t want to be the arbiter of truth, it should still establish a process for a quorum of its fact-checking partners to play that role. If consensus amongst other partners is that a label was inaccurate and a story might instead warrant a lesser label or none at all, that new decision should be applied. Otherwise, mistakes or malicious bias from a single fact-checker could suppress the work of entire news outlets and deprive the public of the truth.

NASA moves forward with 17 companies as part of bid to transform urban aerial transportation

NASA and a clutch of startup and established companies are moving forward with plans to transform mobility in urban environments through the Urban Air Mobility Grand Challenge.

If it’s fully implemented, the new Urban Air Mobility system could enable air transit for things like package delivery, taxi services, expanded air medical services and cargo delivery to underserved or rural communities, the agency said in a statement.

The Grand Challenge series brings together companies developing new transportation or airspace management technologies, the Agency said.

“With this step, we’re continuing to put the pieces together that we hope will soon make real the long-anticipated vision of smaller piloted and unpiloted vehicles providing a variety of services around cities and in rural areas,” said Robert Pearce, NASA’s associate administrator for aeronautics, in a statement.

The idea is to bring companies to collaborate and also give regulatory agencies a window into the technologies and how they may work in concert to bring air mobility to the masses in the coming years.

“Our partnership with the FAA will be a key factor in the successful and safe outcomes for industry that we can expect from conducting these series of Grand Challenges during the coming years,” Pearce said, in a statement.

Getting the agreements signed are the first step in a multi-stage process that will culminate in the challenge’s official competition in 2022. There are preliminary technological tests that will take place this year.

“We consider this work as a risk reduction step toward Grand Challenge 1,” said Starr Ginn, NASA’s Grand Challenge lead. “It is designed to allow U.S. developed aircraft and airspace management service providers to essentially try out their systems with real-world operations in simulated environments that we also will be flight testing to gain experience.”

Partnerships for the challenge fall into three categories:

- Developmental Flight Testing: These are industry partners providing vehicles that will fly in the challenge.

- Developmental Airspace Simulation: Companies will test traffic management services in NASA-designed airspace simulations for urban air mobility.

- Vehicle Provider Information Exchange: These partners are also working closely with NASA to provide information about their vehicles so NASA can prep them for possible flight activities that will occur during the 2022 Grand Challenge.

The Grand Challenge is managed through NASA’s Advanced Air Mobility project, which was established in the agency’s Aeronautics Research Mission Directorate to coordinate urban air mobility activities.

Companies participating in the challenge include:

- Joby Aviation of Santa Cruz, California

- AirMap, Inc., of Santa Monica, California

- AiRXOS, Inc., of Chantilly, Virginia

- ANRA Technologies, Inc., of Chantilly, Virginia

- ARINC Inc., of Cedar Rapids, Iowa

- Avision, Inc., of Santa Monica, California

- Ellis & Associates, Los Angeles, California, a wholly owned subsidiary of Lacuna Technologies, Palo Alto, California

- GeoRq LLC of Holladay, Utah

- Metron Aviation, Inc., of Herndon, Virginia

- OneSky Systems Inc., of Exton, Pennsylvania

- Uber Technologies, Inc., of San Francisco, California

- The University of North Texas of Denton, Texas

- Bell Textron of Ft. Worth, Texas

- The Boeing Company of Chantilly, Virginia

- NFT Inc., of Mountain View, California

- Prodentity, LLC of Corrales, New Mexico

- Zeva Inc., of Spanaway, Washington