Contributor

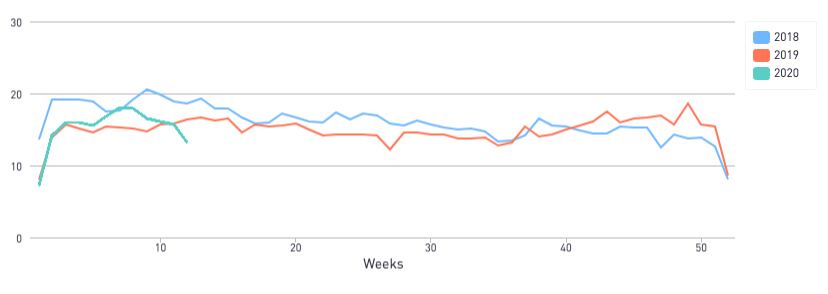

Many founders will have kicked off the new year with a new fundraising round. According to the data we shared last year, March, October and November were the months when VCs were reviewing the most decks.

But the COVID-19 pandemic has ground to a halt many industries, and there are even warnings that this will affect the next two quarters in regards to fundraising.

We’ve reviewed the data in our 2020 DocSend Startup Index and we’ve begun tracking the Pitch Deck Interest Metric. With San Francisco under a shelter-in-place order and many VCs scrambling to adjust their processes to an all-remote world, we saw pitch deck interest drop 11.6% when compared to the same week in 2019. While there has been a drop in interest so far, there is still a lot of activity, and VCs seem to still be reading pitch decks.

We will be monitoring the Pitch Deck Interest Metric in the coming weeks, but if you’re an early-stage startup and are in the middle of your fundraise, or are about to fundraise, there are some things you can do to help insure your startup is ready for funding before you meet with any (more) investors.

The Pitch Deck Interest Metric declined 11.6% compared to the same week in 2019

Expectations have shifted and will continue to do so

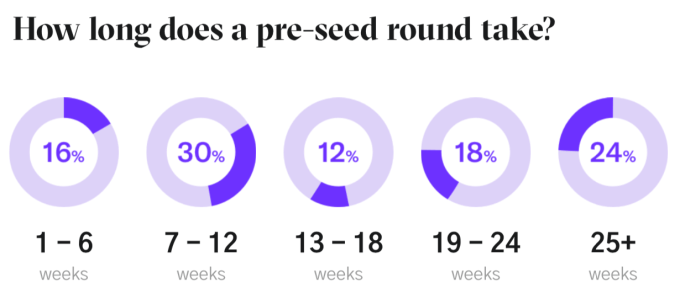

If you were about to kick off a fundraising round, you should have been prepared to contact 50 or more investors, have 20-30 meetings and spend somewhere around 20 weeks before you signed your term sheet. That’s a lot of time and energy to invest, especially when the economy is poised for a downturn and you’re most likely needed in other parts of your business.

If you’ve already started your round and are wondering if you should push through, I’ve written a piece on knowing when to quit and recalibrate versus when to push through (Extra Crunch membership required).

Many factors play into navigating a successful fundraising round, and the expectations of investors are constantly changing — specifically when it comes to the pre-seed round.

Investors are now looking for market-ready products and want to see pitch decks that feature the content they’re expecting. We expect to see this focus intensify over the coming months as VCs have more time to spend not just to review pitch decks, but on due diligence for companies in which they plan to invest. Our new report outlines advice for pre-seed startups that are looking to adjust their fundraising strategy.

Focus on an MVP, not just a great PowerPoint

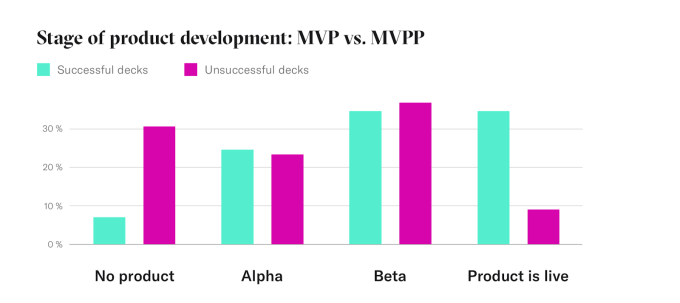

Our analysis reveals a shift in the level of readiness required by institutional investment to receive pre-seed funding. In the past, pre-seed startups could get by with just an MVPP (Minimum Viable PowerPoint). But now, investors are placing their bets on pre-seed startups that have already entered the market and developed an alpha, beta or shipping product.

In fact, 92% of companies with successful pitch decks had either an alpha, beta or shipping product, where only 68% of companies with unsuccessful pitch decks presented the same type of product readiness.

As the economy moves closer to a downturn we can expect VCs to be more cautious with their investments. The current data already shows a preference for companies that have live products; it’s worth the time and effort to be product-ready coming into a pre-seed round or if you’re a startup ready to tackle the round again with a fresh perspective.

Rethink your deck

That said, even if you do have an MVP, rethinking your pitch deck may be something else to consider. Here’s a good test. Using your pitch deck, spend three to four minutes (that’s all the time you’ll get from a VC) to pitch your business to a friend or family member who knows nothing about your business. Afterward, ask them for a one-sentence description of your company. If they’re not clearly describing what your company does and the problem it’s trying to solve, you probably need to rethink your pitch deck.

According to our recent report, a “less is more” attitude toward creating a compelling pitch deck for meetings could mean more success in pre-seed fundraising.

Your pitch deck will be your main calling card right now. As community events are being replaced with online gatherings during the COVID-19 pandemic, we can expect to see less one-to-one engagement at these events. So pitching a VC in person is not likely to happen anytime soon. Whether you’re sending them a cold email, or getting a warm intro from a portfolio company, you’re going to need to lead with your pitch deck.

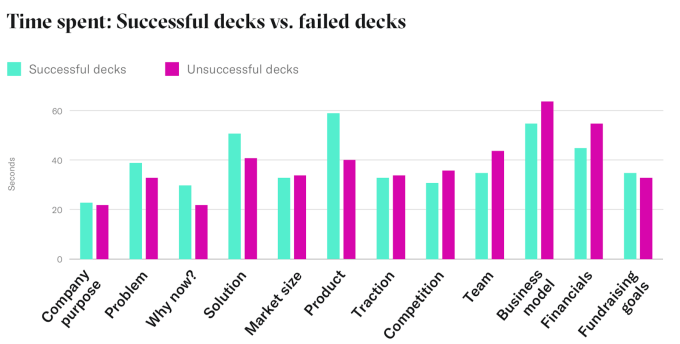

Despite the product taking a more prominent role in the fundraising round, the pitch deck is still a focal point and should be tailored to tell your story in the most effective way, as investors are spending less time evaluating them. On average, investors are spending just 3 minutes and 21 seconds on the pitch deck and the average deck is just 20 slides.

If you are in the process of reevaluating your pitch deck, it could be helpful to make sure your slides feature the right content in the right order. Investors spend nearly 50% more time on the product slides in successful pitch decks and over 18% longer on the business model in unsuccessful pitch decks. Additionally, investors spent more time on solution slides in successful decks than unsuccessful decks.

It’s a numbers game… to a certain extent

Another area that could benefit from reevaluation is the number of investors contacted, meetings held and the number of weeks spent in a funding round. Generally speaking, the average amount of investors contacted for successful fundraising rounds is 56, resulting in 26 meetings. On average, successful pre-seed startups will spend 20.5 weeks on fundraising.

When it comes to fundraising, there are diminishing returns for investor outreach. You shouldn’t need to send your deck to more than 60-70 investors and have more than 20-30 meetings. If you’re doing more than that, the ROI on your time just isn’t worth it. Because the current crisis is affecting VCs’ willingness to invest, you’re better off finding a small list of investors who are active and targeting your pitch to them. If you’ve reached out to more than 70 investors, but you’re still faced with a wall of “nos” you’re better off pausing your fundraising and addressing the feedback you’ve received so far. For more on when you should quit and reevaluate versus push through you can read my article here (Extra Crunch membership required).

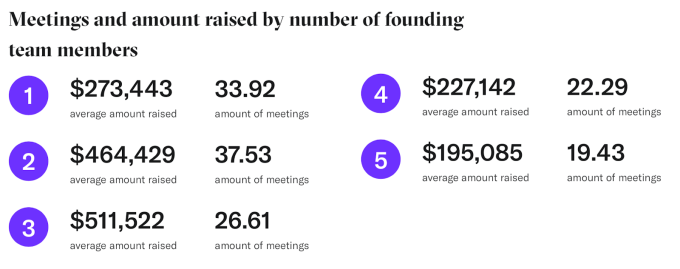

Another area pre-seed startups should evaluate is the number of founders of a company. Our data shows investors still prefer teams of two-three founders, though our data shows that being a solo founder is preferable to having too many founders. For teams of five founders, they averaged earning $195,085 while founding teams of three garnered $511,522.

This may be the right time to find a co-founder. With many people working from home or out of work, this could be the opportunity to take your idea and bring on the technical founder you need. There are online groups and events popping up everywhere in response to social distancing. If you’re worried being a solo founder is going to hold you back, you may want to invest time in those new communities.

Get some perspective

For many startups, especially if you are not in Silicon Valley where a substantial amount of funding happens, the process of fundraising can be very opaque. DocSend’s purpose in analyzing this data is to bring some transparency to the process. This in turn provides perspective.

But what founders should do, if they haven’t done so already, is to get some additional perspective. Talk to experts outside your immediate circle of influence. Don’t have a mentor or advisors? Find them. Get a different take on your product idea or the market conditions. Especially now that community events are going virtual, location doesn’t have to hold you back from joining the startup community and finding people to offer feedback on your product or company.

Fundraising is both an art and science. Combining the insights from our data with the benefit of your own community can help you get back on your feet and pitching your company with hopefully a better outcome.

)

)