A tiny seaweed fossil from a billion years ago may help scientists understand how the first plants came ashore and evolved for life on land.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

How Decades of Offshoring Led to a Mask Shortage in a Pandemic

US companies have shifted production overseas, especially to China. We got cheaper products. But now we can’t make vital health care supplies.

14 Apps and Tools to Stave Off Cabin Fever

Millions of people are staying inside for the indefinite future. Here are a few apps to help you socialize, exercise, and meditate from your own home.

A new FDA-authorized COVID-19 test doesn’t need a lab and can produce results in just 5 minutes

There’s a new COVID-19 test from healthcare technology maker Abbott that looks to be the fastest yet in terms of producing results, and that can do so on the spot right at point-of-care, without requiring a round trip to a lab. This test for the novel coronavirus causing the current global pandemic has received emergency clearance for use by the U.S. Food and Drug Administration, and will begin production next week, with output of 50,000 per day possible starting next week.

The new Abbott ID NOW COVID-19 test uses the Abbott ID NOW diagnostics platform, which is essentially a lab-in-a-box that is roughly the size of a small kitchen appliance. It’s size, and the fact that it can produce either a positive result in just five minutes, or a negative one in under 15, mean that it could be a very useful means to extend coronavirus testing beyond its current availability to more places including clinics and doctor’s offices, and cut down on wait times both in terms of getting tested and receiving a diagnosis.

Unlike the rapid tests that have been used in other countries, and that received a new type of authorization under an FDA guideline that doesn’t confirm the accuracy fo the results, this rapid testing solution uses the molecular testing method, which works with saliva and mucus samples swabbed from a patient. This means that it works by identifying a portion of the virus’ DNA in a patient, which means it’s much better at detecting the actual presence of the virus during infection, whereas other tests that search the blood for antibodies that are used in point-of-care settings can only detect antibodies, which might be present in recovered patients who don’t actively have the virus.

The good news for availability of this test is that ID NOW, the hardware from Abbott that it runs on, already “holds the largest molecular point-of-care footprint in the U.S.,” and is “widely available” across doctor’s offices, urgent care clinics, emergency rooms and other medical facilities.

In total, Abbott now says that it believes it will produce 5 million tests in April, split between these new rapid tests and the lab tests that it received emergency use authorization for by the FDA on March 18.

Testing has been one of the early problems faced by the U.S. in terms of getting a handle on the coronavirus pandemic: The country has lagged behind other nations globally in terms of per capita tests conducted, which experts say has hampered its ability to properly track and trace the spread of the virus and its resulting respiratory disease. Patients have reported having to go to extreme lengths to receive a test, and endure long waits for results, even in cases where exposure was likely and their symptoms match the COVID-19 profile.

As the U.S. shuts down, StockX’s business is booming, says its CEO

StockX, the high-flying resale marketplace that connects buyers and sellers of rare sneakers, streetwear, handbags and other collectible items who agree on pricing, has seen its fortune rise along with the $6 billion global sneaker resale market, which is part of the broader $100 billion sneaker category. In fact, the company, which was assigned a billion-dollar-plus valuation last year, says $1 billion worth of merchandise was sold through its platform last year.

The big question is whether StockX can maintain its momentum. Not only are other rivals biting at the heels of the five-year-old, Detroit-based outfit, which has raised roughly $160 million from investors, but some believe the streetwear “bubble” is on the verge of bursting. Add to the mix a pandemic that’s putting millions of people out of work (and in some cases jeopardizing the health of those still showing up), and you might assume that answer is no.

Yet in an online event earlier this week hosted by this editor and conducted by Erin Griffith of the New York Times, StockX CEO Scott Cutler insisted that the exact opposite is true. By his telling, business is booming. In fact, perhaps unsurprisingly, he argued that StockX looks more durable than the traditional public market right now, and he’s well-acquainted with the latter, having earlier spent nine years as an executive with the New York Stock Exchange. (Cutler was also formerly an executive at eBay and StubHub.)

Griffith kicked off the interview by asking who is driving the marketplace and whether it might be a small number of power users.

“Seventy-five percent of our customers are under the age of 35. And that customer is a now a wide demographic, I would say two years ago, it was defined in sneakers as a “sneakerhead,” meaning somebody that collected sneakers and bought and sell sneakers specifically. But today, that demographic, if you looked at millennials and Gen Z, as an example, 40% of them would define themselves as sneakerheads, and so that’s male and female, and this demographic is around the world. We have customers in over 170 countries and territories.”

Cutler went on to say that StockX is very well-positioned because, unlike with a lot of goods that people might find through Amazon or a Google search and thus compete on some level with them, StockX is itself the “first” shopping destination for most of its customers.

“Even the brands can’t provide access to [what’s for sale at StockX]. So that consumer comes to us as a first destination; they don’t go to those brands to shop to shop . . . That means that we have an incredible opportunity then to deliver exactly what that customer wants at the beginning of the journey, which is very rare in e-commerce, to be that first point of destination.”

Naturally, Griffith asked how the virus has impacted StockX’s bottom line. Cutler said it’s been “great for our business and growth.”

“The recent events over the last couple of months has been a benefit to our business. We’ve had more and more traffic and buyers coming to our site because in some respects, traditional retail in some geographies is not available. We thought we’ve always been a marketplace of scarcity, but now you can’t actually go into a real retail location, so you’re coming to StockX. So on the one hand, it’s been great for our for our business and for our growth.”

Cutler also acknowledged that to accommodate that growth, StockX needs people in the warehouses where sellers send goods so that StockX can authenticate them before shipping out to buyers. He said that StockX has “people in those centers that are coming to work right now, even in places like New Jersey that are certainly impacted.” He called it a “balancing” act of trying to ensure its team members feel “safe” while continuing to operate its business at scale around the world.

As for how, exactly, StockX is ensuring these employees are safe, he said that StockX is “operating under all of the local rules and regulations that we have in all the different places where we operate.” As an added sweetener, he said the company recently gave a “spot bonus” and increased the salaries of employees at its authentication centers by 25%.

And what happens if the warehouses are ordered to shut down or employees begin showing up with the virus? Griffith asked what StockX’s backup plan entailed.

Here, Cutler noted the company’s multiple authentication centers, saying that “in the event that we have to reroute traffic from one authentication center to the other, we will do that. We’ve been operating that way.” (He also said that business continuity planning is currently a “stand-up every single day [wherein] we go through site safety and security and any incidents that come up and we’re making decisions as a team every day on some of that routing logic.”)

Griffith wondered what kinds of conversations StockX’s venture investors are having with the company, given everyone’s focus right now on belt-tightening. ((StockX is backed by DST Global, General Atlantic, GGV Capital Battery Ventures, and GV, among others.)

Cutler acknowledged that the “future, in some respects, is uncertain for many of us, in that you don’t know how long this is going to last.” He said that as the company looks to the future, it’s trying to factor in “different scenarios of macro shifts in demand” but that as it looks at “macro shifts in the supply chains” it has reason for optimism. He pointed to China, for example, where many supply chain factories went down this winter, yet most are back up to to 80% or 90% of their previous capacity.

Asked if StockX is recession-proof should the downturn last (Griffith noted that some of the pricier sneakers on the platform are selling for thousands of dollars), Cutler suggested that he hopes so for the sake of the businesses that are run off its platform.

Said Cutler, “For a lot of our sellers, you have to appreciate that our they depend on StockX for their livelihood. They actually may be running a very sophisticated business that is selling sometimes thousands of pairs of sneakers every single day to [maybe] a student who’s using StockX to fund their education.”

Cutler also compared StockX to the public equities markets, insisting that they aren’t so different and that, to his mind, StockX might even be the safer bet right now.

“We actually have buyers who see this time as a market opportunity and see the price of a rare Jordan 1 [shoe] that’s maybe coming down, and they say, ‘Hey, this is short lived,’ much like somebody may say, ‘Hey, the market is off a little.’

“They’re putting their money in sneakers,” Cutler continued, adding: “My portfolio right now in sneakers is still up on the year. That’s more than I can say about the S&P.”

John Borthwick & Matt Hartman of betaworks discuss coronavirus adaptation strategies

Yesterday, I had the pleasure of hopping on Zoom with betaworks’ John Borthwick and Matt Hartman to discuss the tech world’s adaptation to this new locked-down world, the future of new media and answer questions from the audience.

We discussed whether new media companies can raise capital right now, and touched on emerging trends around audio, voice, AR, live events, travel-related companies and many other topics.

It was a delight, and I’m excited to do more of these in the future.

For those of you who missed the Zoom, here’s a rundown of what we discussed (audio embed below).

Rocket startup Skyrora shifts production to hand sanitizer and face masks for coronavirus response

One of the newer companies attempting to join the rarified group of private space launch startups actually flying payloads to orbit has redirected its entire UK-based manufacturing capacity towards COVID-19 response. Skyrora, which is based in Edinburgh, Scotland, is answering the call of the UK government and the NHS to manufacturers to do what they can to provide much-needed healthcare equipment for frontline responders amid the coronavirus crisis.

Skyrorary says that the entirety of its UK operations, including all human resources and its working capital are now dedicated to COVID-19 response. The startup, which was founded in 2017, had been working towards test flights of its first spacecraft, making progress including an early successful engine test using its experimental, more eco-friendly rocket fuel that was completed in February.

For now, though, Skyrora will be focusing full on building hand sanitizer, its first effort to support the COVID-19 response. The company has already produce their initial batch using WHO guidelines and requirements, and now aims to scale up its production efforts to the point where it can manufacture the sanitizer at a rate of over 10,000 250 ml bottles per week.

There’s actually a pretty close link between rocketry and hand sanitizer: Ethanol, the form of alcohol that provides the fundamental disinfecting ingredient for hand sanitizer, has been used in early rocket fuel. Skyrora’s ‘Ecosene’ fuel is a type of kerosene, however, which is a much more common modern aviation and rocket fuel.

In addition to sanitizer, Skyrora is now in talks with the Scottish Government to see where 3D-printed protective face masks might have a beneficial impact on ensuring health worker safety. It’s testing initial prototypes now, and will look to mass produce the protective equipment after those tests verify its output.

Plenty of companies are pitching in where they can, including by shifting their production lines and manufacturing capacity towards areas of greatest need. It’s definitely an ‘all-hands-on-deck’ moment, but there’s definitely a question of what happens to businesses that shift their focus this dramatically once the emergency passes, especially for young startups in emerging industries.

Duke University uses vaporized hydrogen peroxide to clean N95 face masks for reuse

With shortages of N95 face masks persisting nationwide, healthcare facilities are scrambling to find ways to clean and treat the masks for reuse to protect doctors and nurses most at risk of exposure to COVID-19.

Duke University thinks it has found a solution using vaporized hydrogen peroxide to decontaminate the masks.

The process uses specialized equipment to vaporize hydrogen peroxide, which can then infuse all the layers of the mask to kill germs (including viruses) without degrading mask material.

“This is a decontamination technology and method we’ve used for years in our biocontainment laboratory,” said Scott Alderman, associate director of the Duke Regional Biocontainment Laboratory, in a statement.

The university said it has proven effective and will begin using the technology at all three of its hospitals, according to Matthew Stiegel, the director of the Occupational and Environmental Safety Office at Duke.

Ideally, the hospitals would be able to use fresh masks and not need to try to decontaminate their masks, but these are not ideal times.

Duke’s decision to use hydrogen peroxide to decontaminate N95 masks is based on published studies conducted in 2016, but the practice wasn’t widespread, because the industry wasn’t facing shortages. Those earlier studies also didn’t include fit-testing — or the resizing of masks for individual wearers — after cleaning. Duke has now done that efficacy testing in the real world, the university said.

“The ability to reuse the crucial N95 masks will boost the hospitals’ ability to protect front-line healthcare workers during this time of critical shortages of N95 masks,” said Cameron Wolfe, MD, associate professor of medicine and infectious disease specialist.

Monte Brown, MD, vice president at Duke University Health System, said the Duke team is working to spread the word about the technique, making the protocols widely available. He said several health systems and many pharmaceutical companies already have the needed equipment, which is currently used in different ways, and could ramp up operations to come to the aid of their local hospitals.

“We could stand up in front of our staff and state with confidence that we are using a proven decontamination method,” Brown said. “It has been a proven method for years. While this alone will not solve the problem, if we and others can reuse masks even once or twice, that would be a huge benefit given the current shortages.”

Attract, engage and retain employees in the new remote-work era

Contributor

When looking for answers, where do people first turn? For many, it’s Google.

During the first half of March, we saw Google searches for “work from home” reach a 12-month high, garnering at least 50% more search interest than the anticipated peak, which usually occurs within the first week of January. This number will continue to grow as outside circumstances evolve.

This search behavior reflects the world around us. Today, employees and employers alike are grappling with the new norm — at least for the short-term — which is working remotely. While having a remote-ready model in place was once viewed as a competitive advantage to attract talent, it’s now a must-have to keep organizations afloat.

With vacant positions costing organizations around $680 daily, the impact that interrupted recruiting efforts can have on a business’ bottom line is jarring. As such, HR professionals were early adopters of successful remote communication practices, learning lessons that can be applied across the business to successfully make personal connections without being in-person. Employers are doing all they can to address their existing employee base at this critical time, while also working hard to maintain their hiring efforts.

Having the right technology in place to sustain work-from-home practices is more important now than ever before. There are four steps that employers can take to successfully integrate and adapt successful virtual hiring technologies into their business continuity plans, considering all outside circumstances, and without sacrificing their productivity and unique company culture.

Prepare and plan. Employers have an obligation to provide their people with clear direction in times of disruption.

Trump orders GM to start ventilator production for COVID-19 amid contract dispute

President Donald Trump signed Friday a presidential directive ordering GM to produce ventilators and to prioritize federal contracts, just hours after the automaker announced plans to manufacture the critical medical equipment needed for patients suffering from COVID-19, the disease caused by the coronavirus.

The order, made under the Defense Production Act, marks a sudden reversal by Trump, who has touted the efforts by GM and other manufacturers to try to ramp up production of ventilators and personal protective gear that is in short supply as COVID-19 cases continue to rise. The order came amid a dispute with GM over a contract to produce the ventilators.

GM and its partner Ventec Life Systems had already announced plans to start producing the ventilators “at cost,” despite the lack of a federal contract. The order would force GM to prioritize federal contracts, which would prevent the automaker from selling to states, or at least make it more difficult.

“Our negotiations with GM regarding its ability to supply ventilators have been productive, but our fight against the virus is too urgent to allow the give-and-take of the contracting process to continue to run its normal course. GM was wasting time. Today’s action will help ensure the quick production of ventilators that will save American lives,” Trump said in a statement.

GM responded Friday afternoon to Trump’s order noting that it has been “working around the clock” with Ventec and its supply base “to meet this urgent need.”

“Our commitment to build Ventec’s high-quality critical care ventilator, VOCSN, has never wavered,” the GM statement continues. “The partnership between Ventec and GM combines global expertise in manufacturing quality and a joint commitment to safety to give medical professionals and patients access to life-saving technology as rapidly as possible. The entire GM team is proud to support this initiative.”

Earlier Friday, GM said it would start producing Ventec Life Systems ventilators even as a purchase order with the federal government remained in limbo. The companies said Friday that the ventilators will be produced at GM’s engine plant in Kokomo, Ind., using about 1,000 workers.

The GM and Ventec announcement followed sharp criticism by Trump via several tweets that blasted GM and its CEO and chairman Mary Barra via Twitter, accusing the company of falling short of its promised capacity and asking for “top dollar,” a term that seems to imply the automaker was trying to profit off of the contract.

GM, which is a contract supplier for Ventec, has said it is “donating its resources at cost,” a term that means it will not profit off of any sales of the masks and ventilators it produces. Whether the federal government would sign a purchase order with the companies has been a lingering question that looked less certain as talks unfolded, according to sources.

Efforts to set up tooling and manufacturing capacity at the factory are already underway to produce Ventec’s critical care ventilator, VOCSN, according to GM. The automaker said production will begin in the next seven to 14 days with the first shipments of the FDA-cleared ventilators scheduled to begin in April. Ventec is also trying to ramp up production at its manufacturing facility in Bothell, Wash.

Separately, GM also said it will start next week producing Level 1 surgical masks at its Warren, Mich. manufacturing facility. The automaker expect to ramp up mask production capacity to 50,000 masks per day within the next two weeks with the potential to increase to 100,000 per day.

As usual with “this” General Motors, things just never seem to work out. They said they were going to give us 40,000 much needed Ventilators, “very quickly”. Now they are saying it will only be 6000, in late April, and they want top dollar. Always a mess with Mary B. Invoke “P”.

— Donald J. Trump (@realDonaldTrump) March 27, 2020

Trump’s tweets came after The New York Times reported that U.S. government officials canceled a planned announcement outlining the GM and Ventec deal to produce as many as 80,000 ventilators for the Federal Emergency Management Agency. The announcement, which was supposed to happen Wednesday, was canceled after FEMA balked at the more than $1 billion price tag.

TechCrunch has independently confirmed that the federal government canceled the announcement because of reservations over the cost. FEMA and White House trade adviser Peter Navarro had balked at the cost, according to a source at GM.

Trump’s tweets attacking Barra and GM — as well as calling for the automaker to start production at an Ohio factory that the automaker no longer owns — lies in stark contrast from public comments the president made earlier in the week when he touted efforts by companies to mobilize their resources to help alleviate a shortage of medical supplies such as face masks and ventilators.

Trump has repeatedly said he does not need to use the Defense Production Act to compel companies to help in the effort to manufacture needed supplies. But that changed Friday when he said he would use it because of the GM ventilator purchase order.

The cost of ventilators

As COVID-19 spread and health and government officials grew increasingly concerned about a shortage of ventilators and personal protective equipment, a number of manufacturers announced plans to ramp up production capacity or donate any existing supplies. GM was among that group.

On March 20, GM and Ventec announced plans to work to increase production of respiratory care products, a partnership that grew out of StopTheSpread.org, a coordinated effort of private companies to respond to COVID-19.

Before that announcement was made, GM investigated the feasibility of sourcing the more than 700 components needed to build up to 200,000 of Ventec’s critical care ventilators called VOCSN. Ventec describes these VOCSN devices as multi-function ventilators that were cleared in 2017 by the FDA.

GM identified the Indiana plant as the likely location and determined it would need to build a new clean room within the factory that was large enough to produce the ventilators, according to the source. GM estimated it would cost about $750 million, a price that included retrofitting a portion of the engine plant, purchasing materials to make the ventilators and paying the 1,000 workers needed to scale up production, the source said. The remaining $250,000 of estimated costs came from Ventec.

GM estimated that it could ramp up production in time to deliver ventilators by mid-April, a time when states are expected to be dealing with a surge of COVID-19 cases. The companies said they are poised to deliver the first ventilators next month and ramp up to a capacity of more than 10,000 critical care ventilators per month with the infrastructure and capability to scale further.

We’ve come full rectangle: Polaroid is reborn out of The Impossible Project

More than a decade after announcing that it would keep Polaroid’s abandoned instant film alive, The Impossible Project has done the… improbable: It has officially become the brand it set out to save. And to commemorate the occasion, there’s a new camera, the Polaroid Now.

The convergence of the two brands has been in the works for years, and in fact Impossible Project products were already Polaroid-branded. But this marks a final and satisfying shift in one of the stranger relationships in startups or photography.

I first wrote about The Impossible Project in early 2009 (and apparently thought it was a good idea to Photoshop a Bionic Commando screenshot as the lead image), when the company announced its acquisition of some Polaroid instant film manufacturing assets.

Polaroid at the time was little more than a shell. Having declined since the ’80s and more or less shuttered in 2001, the company was relaunched as a digital brand and film sales were phased out. This was unsuccessful, and in 2008 Polaroid was filing for bankruptcy again.

This time, however, it was getting rid of its film production factories, and a handful of Dutch entrepreneurs and Polaroid experts took over the lease as The Impossible Project. But although the machinery was there, the patents and other IP for the famed Polaroid instant film were not. So they basically had to reinvent the process from scratch — and the early results were pretty rough.

But they persevered, aided by a passionate community of Polaroid owners, continuously augmented by the film-curious who want something more than a Fujifilm Instax but less than a 35mm SLR. In time the process matured and Impossible developed new films and distribution partners, growing more successful even as Polaroid continued applying its brand to random, never particularly good photography-adjacent products. They even hired Lady Gaga as “Creative Director,” but the devices she hyped at CES never really materialized.

In 2017, the student became the master as Impossible’s CEO purchased the Polaroid brand name and IP. They relaunched Impossible as “Polaroid Originals” and released the OneStep 2 camera using a new “i-Type” film process that more closely resembled old Polaroids (while avoiding the expensive cartridge battery).

Polaroid continued releasing new products in the meantime — presumably projects that were under contract or in development under the brand before its acquisition. While the quality has increased from the early days of rebranded point-and-shoots, none of the products has ever really caught on, and digital instant printing (Polaroid’s last redoubt) has been eclipsed by a wave of nostalgia for real film, Instax Mini in particular.

But at last the merger dance is complete and Polaroid, Polaroid Originals and The Impossible Project are finally one and the same. All devices and film will be released under the Polaroid name, though there may be new sub-brands like i-Type and the new Polaroid Now camera.

Speaking of which, the Now is not a complete reinvention of the camera by far — it’s a “friendlier” redesign that takes after the popular OneStep but adds improved autofocus, a flash-adjusting light sensor, better battery and a few other nips and tucks. At $100 it’s not too hard on the wallet, but remember that film is going to run you about $2 per shot. That’s how they get you.

It’s been a long, strange trip to watch, but ultimately a satisfying one: Impossible made a bet on the fundamental value of instant film photography, while a series of owners bet on the Polaroid brand name to sell anything they put it on. The riskier long-term play won out in the end (though many got rich running Polaroid into the ground over and over), and now with a little luck the brand that started it all will continue its success.

Attorney Sophie Alcorn answers readers’ immigration questions

We had a great time hosting noted immigration attorney Sophie Alcorn on a live conference call with Extra Crunch members earlier this week.

Sophie writes our “Dear Sophie” column, where she answers questions about immigration status, particularly for founders and others in the tech ecosystem who want to work in the United States.

In our conference call, we talked about the changes happening to H-1B visas, what COVID-19 is doing to the immigration system and some of the top concerns of founders in these perilous times. Below the jump, you’ll find an edited transcript, or you can listen to the call in its entirety.

As with all legal advice, always speak with your own retained attorney about specific details regarding your own cases as illustrative examples may or may not apply to your own unique situation.

The FDA just okayed multiple 15-minute blood tests to screen for coronavirus, but there are caveats

On Thursday, the FDA amended their emergency policy around diagnostic testing for SARS-CoV-2, the novel coronavirus that causes COVID-19. Following on a change made March 16, the agency opened the door for a number of specific private entities and labs to develop and distribute tests that can provide results on the spot in as little as 15 minutes — but there are some pretty big caveats to keep in mind as you hear about more of these coming to market.

The tests, which are “serological,” meaning they identify the presence of antibodies in a person’s blood, differ considerably from the molecular testing that is currently in use under Emergency Use Authorization (EUA) by FDA-approved labs and drive-through testing sites. The serological tests show that a person has developed antibodies to SARS-CoV-2, which means they very likely came into contact with it (and either have it, or have already recovered from having it). The molecular tests actually detect the presence of viral DNA in the blood stream, which is a much more definitive indicator that they currently have an active infection (at least at the time the swab was taken).

Serological tests have still been used widely in countries where the response to the COVID-19 pandemic has been shown to be effective, including in China, Taiwan and Singapore. They’ve also been used in different communities in the U.S., based on earlier guidelines around private lab diagnostics. But on March 26, the FDA named 29 entities that provided notification to the agency as required and are now therefore able to distribute their tests.

It’s important to note that these tests have not been reviewed or validated by the FDA, unlike those molecular tests that are included in the organization’s emergency use category. Instead, the FDA “does not intend to object to the development and distribution by commercial manufacturers” of these tests, provided they meet a number of criteria, including qualifying the results of their reported test results with the following information:

- This test has not been reviewed by the FDA.

- Negative results do not rule out SARS-CoV-2 infection, particularly in those who have been in contact with the virus. Follow-up testing with a molecular diagnostic should be considered to rule out infection in these individuals.

- Results from antibody testing should not be used as the sole basis to diagnose or exclude SARS-CoV-2 infection or to inform infection status.

- Positive results may be due to past or present infection with non-SARS-CoV-2 coronavirus strains, such as coronavirus HKU1, NL63, OC43, or 229E.

The FDA specifically notes in its emergency use FAQ that these entities have reported their own validation of these tests, and that they won’t be pursuing Emergency Use Authorization. That said, there’s now nothing stopping the entities on this list from distributing their tests, which means they will be able to be put to use in testing Americans and painting a larger picture of the potential spread of the novel coronavirus — with the caveat noted above that the FDA doesn’t consider these tests used alone to be positive confirmation of a definite SARS-CoV-2 case, or conversely, a sure indicator that someone doesn’t have the virus.

Still, in the absence of better options like expanded availability of the tests that are approved under the EUA, these serological tests (many of which can provide on-site results with just a pinprick of blood) will be useful in painting a more accurate picture of the overall spread and reach of the coronavirus, especially for smaller clinics, GP clinics and local labs that don’t have priority access to the equipment and supplies needed for the molecular testing efforts.

For instance, one test on this list, the Healgen Scientific COVID-19 IgG/IgM (Whole Blood/Serum/Plasma) Rapid Test Device, requires no instrumentation and can provide results in just 15 minutes. Distributor Ideal Rehab Care is working with its legal representation Fox Rothschild to begin importing the tests from Singapore for use “as soon as possible.”

The FDA updating its website with Healgen as one of the entities that have notified it of intent to use its serological test is what unlocked the ability for the company to begin distribution: It’s still illegal for anyone not on this list to do so, and the FDA still also specifically prohibits the use of at-home serological tests on its official guidelines.

It looks like Brandon Middaugh is heading up the $1B Microsoft climate fund

Earlier this year, Microsoft made waves in the corporate community by coming out with one of the most ambitious and wide-ranging strategies to reduce carbon emissions from the company’s operations.

Part of that plan was a $1 billion fund that would invest in climate change mitigation technologies — specifically focused on decarbonization. At the time, details were scarce, but it looks like the strategy is becoming a little more clear, with details beginning to emerge about who will be running the show.

According to sources — and a LinkedIn profile search — it appears that Brandon Middaugh is taking point on the investment fund.

Middaugh has been at Microsoft for more than four years and worked as one of the architects of the company’s climate strategy during her tenure at the company. In her previous role as part of the company’s Cloud Energy and Sustainability team, Middaugh led the distributed energy strategy and was a part of the partnership Microsoft initiated with the East Coast regional transmission organization, the PJM — which manages the power grid for a large swath of the Northeastern and Mid-Atlantic region of the U.S.

It appears that Middaugh is going to be taking point on the deployment of that $1 billion fund Microsoft announced in January, according to people who have discussed the company’s investments.

At the January event, Microsoft committed to going “carbon negative” by 2030 and said that it would remove by 2050 the equivalent of all the carbon it had emitted into the atmosphere since its founding in 1975. Those commitments are far more aggressive than any made by any other corporation in any industry.

Part of the plan involves expanding the carbon fee the company has imposed internally on its direct emission across its supply and value chains. The $1 billion fund is part of that effort to reduce emissions from suppliers and customers by financing projects and technologies that can reduce emissions with new generation or efficiency technologies, or capture and remove carbon from the atmosphere.

Equity and debt investments have to meet four criteria, including: the ability to drive meaningful decarbonization, climate resilience or other sustainability-related goals; have additional market impacts for future climate solutions; can address Microsoft’s own climate debt; and have implications for the unequal distribution of climate impacts.

Late last year, Amazon committed that it would move to 100% renewable energy powering its operations by 2030 and that it would achieve net zero carbon emissions by 2040. Meanwhile, Alphabet has been developing renewable energy projects under its moonshot division and has long been an investor in climate mitigation technologies, including the use of renewables to power its operations.

All of these efforts will need to be met by additional work from corporations and financial institutions across every industry if the world is to reduce the most dire effects of dramatic climate change. Already forest fires, flooding and other climate-related catastrophes have led financial investors and insurers to push for better mitigation strategies and to bring climate impacts front and center within corporate strategies.

Microsoft had not replied to a request for comment by the time of publication.

When is it time to stop fundraising?

Contributor

No one wants to prepare for their fundraising round to fail. Many founders spend months (or even years) getting their businesses to a point where they’re ready to pitch investors. But there are times when, no matter how hard you try, you’re just not going to be able to close a deal.

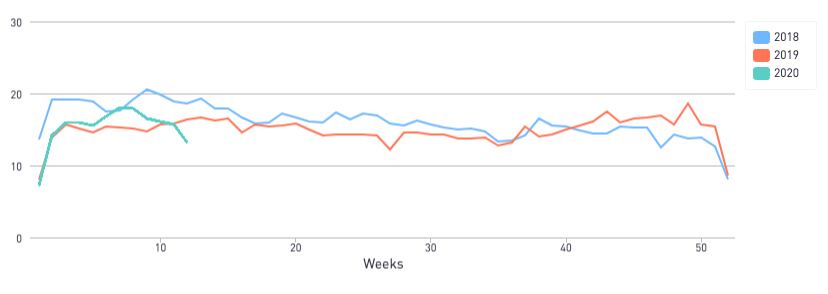

With the current COVID-19 pandemic, the entire VC community is in a state of uncertainty, and there is no clear answer when it comes to the question, “can I still raise funds for my company?” However, there’s hope for early-stage startups. We used the 2020 DocSend Startup Index to track Pitch Deck Interest among investors and found that last week, despite seismic changes across the country, pitch deck interest has only been 11.6% lower than the same week in 2019 so far.

We will be monitoring the Pitch Deck Interest Metric in the coming weeks, but if you’re an early-stage startup and you were planning to raise, there is still opportunity to come away with a term sheet. But if things don’t go as planned, how do you know if it’s time to give up or if you just need to push through?

According to recent DocSend data, you’ll know pretty quickly if it’s time to call it quits. While the average founder who was successful in fundraising contacted 63 investors during their process, startups that weren’t able to raise funds stopped at 27. Why stop? Because the founder listened to the feedback they were getting. If you hear the same concern or piece of feedback twice you should take it to heart, but if you hear it three times you probably need to stop and rethink things.

The Pitch Deck Interest Metric declined 11.6% compared to the same week in 2019

According to our study on the fundraising process of pre-seed startups, founders who were unsuccessful in raising had just nine meetings. That should give you enough feedback to know if you have a deal breaker in your deck.

But negative feedback doesn’t mean all is lost. In fact, of startups studied in the 2020 DocSend Startup Index, 86% reported that they were going to try to fundraise again after addressing the feedback they’d received.