The Mendel Air Sensor app is the first app I open every morning. Before Reddit, before Gmail, before NYT. I roll over, grab my phone and check my plants. I don’t know if there’s a higher honor I can bestow on an app.

The Mendel Air Sensor is a game-changer for indoor growers. It offers a sophisticated suite of sensors that collects critical information about growing conditions. With a price of $99, there’s very little else on the market that offers the same sort of data collection at an affordable price.

The company behind the Mendel Air Sensor started by building similar sensors for at-home aquariums. This group knows data collection and teamed up with an experienced manufacturer to develop and ship the Mendel Air Sensor.

I know very little about growing plants indoors. I’ve watched some YouTube videos, read a lot of blog posts and asked friends for advice. And yet I have a small growing operation in my basement: tomatoes, romaine lettuce, carrots and, you know, other leafy greens.

Several weeks in, I’m starting to appreciate the data behind growing plants. There’s a lot to consider, from the temperature to types and amount of light, to humidity and how the plants react to humidity through a calculation to determine the vapor pressure deficit (VPD).

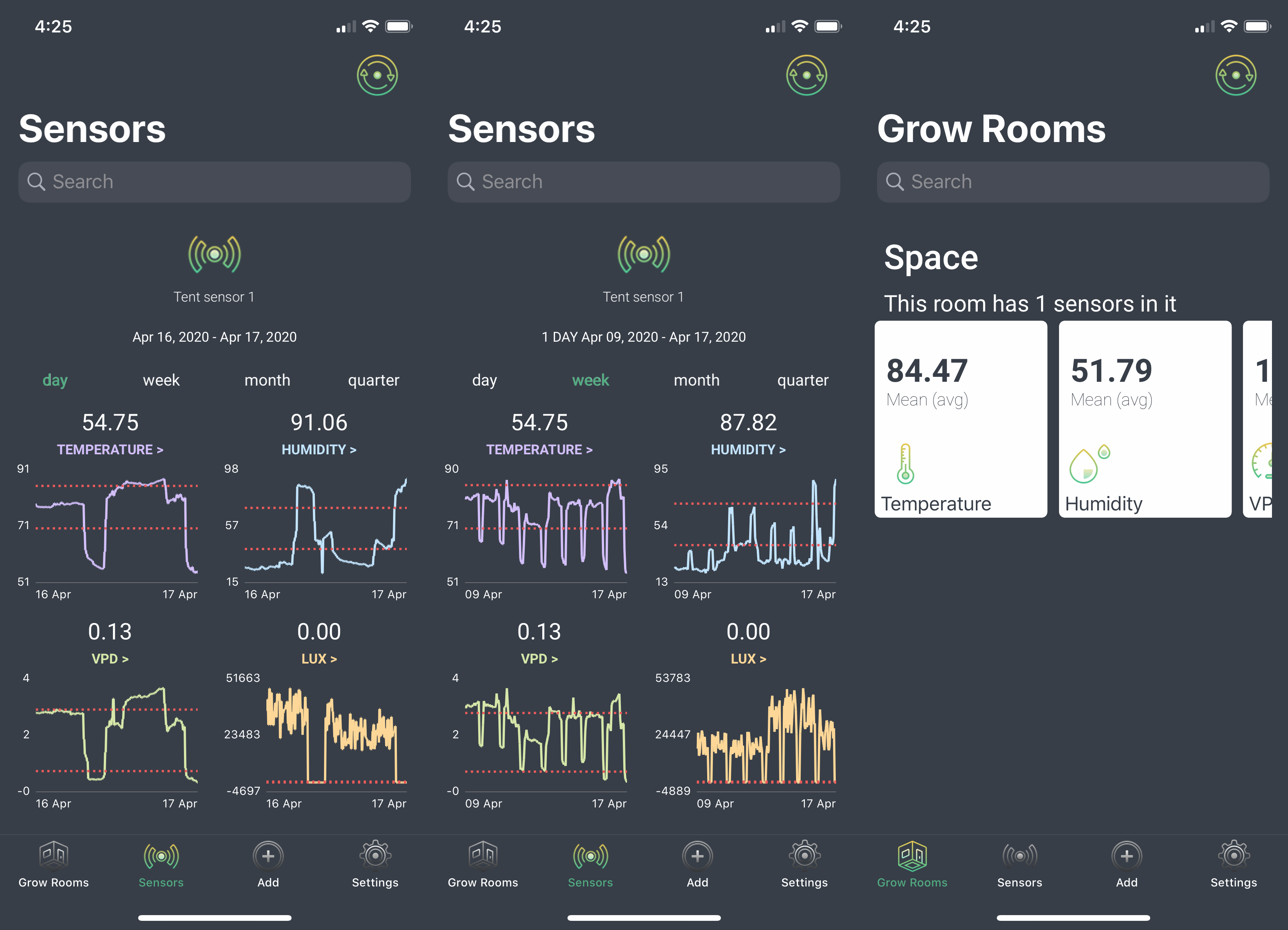

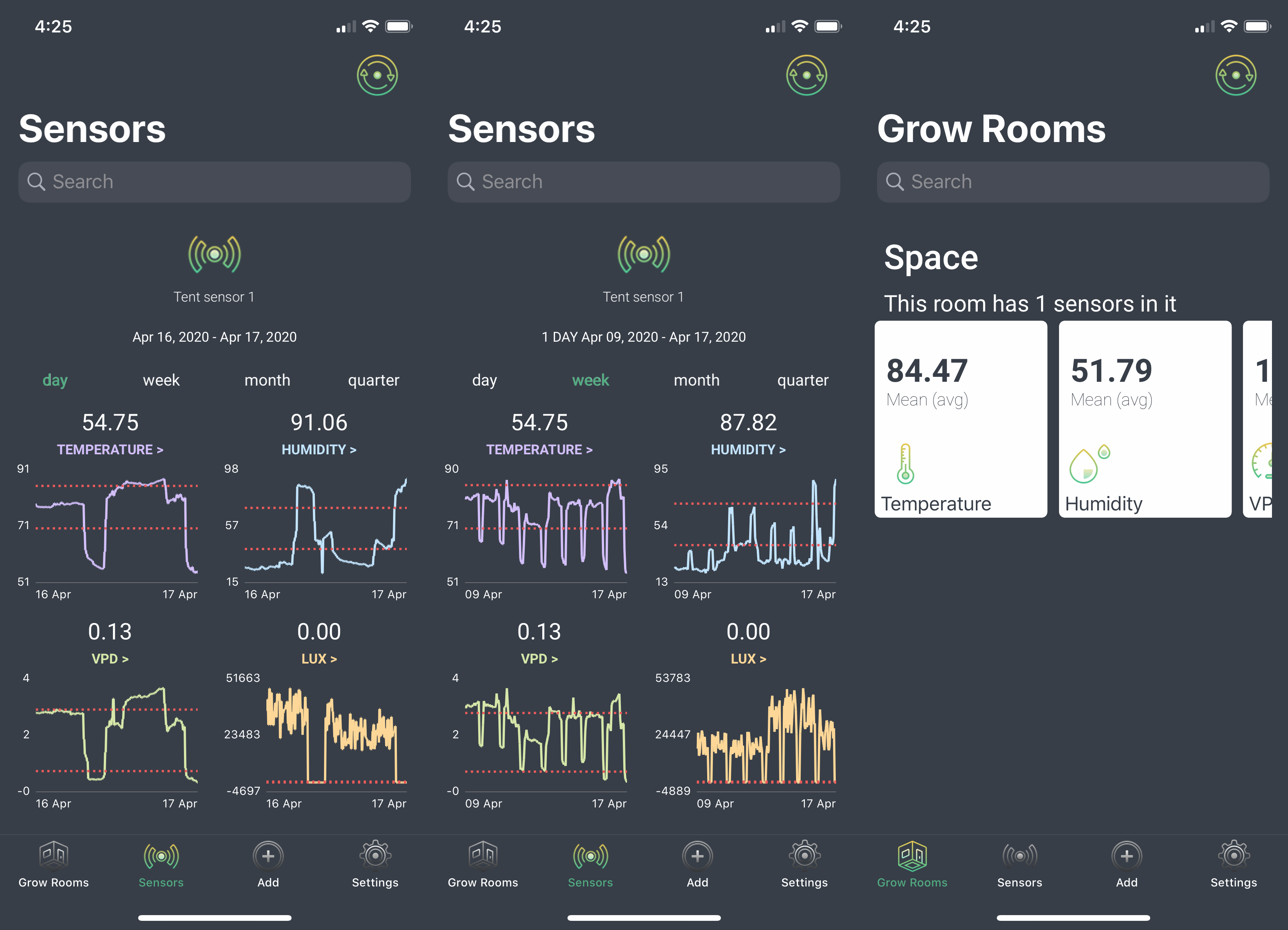

I have a Mendel Air Sensor hanging in one grow tent (pictured at the top), and it’s my new obsession. The small green device collects four data points every 15 minutes and displays the information through a web app or smartphone app. This is allowing me to fine-tune the controlled environment through exhaust fans, light placement and humidifier levels.

As I’ve found, it’s critical to watch this data throughout the day. I’ve yet to stabilize the environment to a point where I set it and forget it. About twice a day, because of the Mendel Air Sensor, I make slight changes to the growing tent, which results in dramatic changes to the environment. Without access to this data, I wouldn’t know something is off until the plant shows warning signs — and as I understand it, that’s when it’s too late.

At $99, it’s a good value, and there are only a few competitors in the space. Most are double or triple the price, though their charting products seem more mature.

CEO Nate Levine tells TechCrunch Mendel started as a 50/50 partnership with another bootstrapped company, RapidLED out of the Bay Area. This company has sold lights for indoor growers for the last few years and already has an established base of customers in this field. But Levine didn’t start to build a product for monitoring plants; instead, he created, FishBit, a product for monitoring aquariums.

The parallels between the two markets helped Levine’s team jump into the indoor gardening space. As Levine told TechCrunch, the consumer demands are similar, and like with aquariums, indoor growers are increasingly looking for ways to increase capabilities. Instead of keeping fish alive, though, they’re trying to get more tomatoes. Or weed.

Levine said that unlike with aquariums, indoor growers can be less stingy with their cash, though, right now, with cannabis, margins are slim. There isn’t a gold rush, he said, but noted that the cannabis market, in particular, is at the right spot for companies to launch new products.

The company is marketing the same product to home growers, and commercial growers thought this could be a challenge with the current web app. It lacks robust features found on other products. For a small grower like me, it’s okay, but I expect commercial customers expect better logging, more detailed analysis and a variable monitoring cycle instead of just every 15 minutes.

To make it available for international users, the company needs to swap out the USB power supply.

Don’t call this is a pivot. Or at least Levine doesn’t call it a pivot. As he told TechCrunch, if he goes back to the original pitch deck, the company is still driving at the same goal for FishBit, and everything the team learns on Mendel is implemented in FishBit, too. The goal is to build an entire product line of smart hardware and software for the indoor grower.

RapidLED approached Levine and the team at an aquarium conference and offered to build the hardware if Levine could make the software. My plants are happy that the two companies forged the partnership.

As for my plants, I’ve learned a few things because of the Mendel Air Sensor. First, my grow lights put out much more heat than I expected, and I need to dump the cheap set and get a name brand unit. Second, the humidity was much lower than I had expected, so I added a humidifier. Finally, monitoring the VPD is much easier than it seems if the calculations are automated.

Growing plants is hard, but it’s easier with the data from the Mendel Air Sensor.

has $60B trade deficit a year with China

has $60B trade deficit a year with China