Post-pandemic, many companies plan to allow employees to work from home and a main office. But trying to do both ensures neither experience is good.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

Dyson Airwrap Review: A Pricey Curling Iron, Blow Dryer, and Hot Air Brush in One

Dyson’s Airwrap does all the heavy lifting for you, for a price.

The Tricky Math of Herd Immunity for Covid-19

When will a disease stop spreading through a population? The formula is simple, but the variables are much more complicated.

How Two-Factor Authentication Keeps Your Accounts Safe

Here are some of the best authenticator apps and options. It may take a moment to set up, but once you have 2FA enabled where it counts, you can rest easier.

These Black Founders Succeeded In Spite of Silicon Valley

Spurned by traditional venture capital firms, three businesspeople turned to other funders, government contracts, and their own savings to launch companies.

Startups Weekly: The world is eating tech

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7am PT). Subscribe here.

You could almost hear the internet cracking apart this week as international businesses pulled away from Hong Kong and the US considered a ban on TikTok. Software can no longer eat the entire world like it had attempted last decade. Startups across tech-focused industries face a new reality, where local markets and efforts are more protected and supported by national governments. Every company now has a smaller total addressable market, whether or not it succeeds in it.

Facebook, for example, appears to be getting an influx of creators who are worried about losing TikTok audiences, as Connie Loizos investigated this week. This might mean more users, engagement and ultimately revenue for many consumer startups, and any other companies that rely on paid marketing through Facebook’s valuable channels. But it means fewer platforms to diversify to, in case you don’t want to rely on Facebook so much for your business.

As trade wars look more and more like cold wars, it also means that Facebook itself will have a more limited audience than it once hoped to offer its own advertisers. After deciding to reject requests from Hong Kong-based Chinese law enforcement, it seems to be on the path to getting blocked in Hong Kong like it is on the mainland. But as with other tech companies, it doesn’t really have a choice — the Chinese government has pushed through legal changes in the city that allow it to arrest anyone in the world if it claims they are organizing against it. Compliance with China would bring on government intervention in the US and beyond, among other reasons why doing so is a non-starter.

This also explains why TikTok itself already pulled out of Hong Kong, despite being owned by mainland China-based Bytedance. The company is still reeling from getting banned in India last week and this maneuver is trying to the subsidiary look more independent. Given that China’s own laws allow its government to access and control private companies, expect many to find that an empty gesture.

Startups should plan for things to get harder in general. See: the next item below.

(Photo by Alex Wong/Getty Images)

Student visas have become the next Trump immigration target

International students will not be allowed to stay enrolled at US universities that offer only remote classes this coming academic year, the Trump administration decided this past week. As Natasha Mascarenhas and Zack Whittaker explore, many universities are attempting a hybrid approach that tries to allow some in-person teaching without creating a community health problem.

Without this type of approach, many students could lose their visas. Here’s our resident immigration law expert, Sophie Alcorn, with more details on Extra Crunch:

International students have been allowed to take online classes during the spring and summer due to the COVID-19 crisis, but that will end this fall. The new order will force many international students at schools that are only offering remote online classes to find an “immigration plan B” or depart the U.S. before the fall term to avoid being deported.

At many top universities, international students make up more than 20% of the student body. According to NAFSA, international students contributed $41 billion to the U.S. economy and supported or created 458,000 jobs during the 2018-2019 academic year. Apparently, the current administration is continuing to “throw out the baby with the bathwater” when it comes to immigration.

Universities are scrambling as they struggle with this newfound untenable bind. Do they stay online only to keep their students safe and force their international students to leave their homes in this country? Or do they reopen to save their students from deportation, but put their communities’ health at risk?

For students, it means finding another school, scrambling to figure out a way to depart the States (when some home countries will not even allow them to return), or figuring out an “immigration plan B.”

Who knows how many startups will never exist because the right people didn’t happen to be at the right place at the right time together? What everyone does know is that remote-first is here to stay.

Image Credits: CapitalG (opens in a new window)

No Code goes global

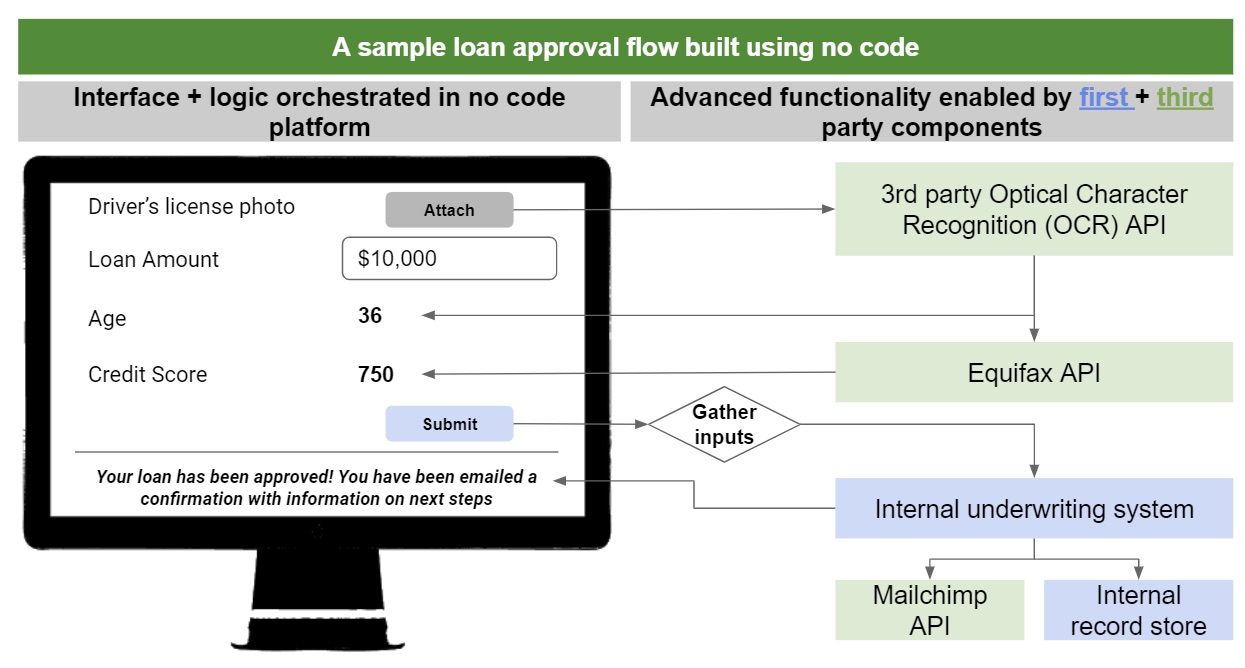

A few tech trends seem unstoppable despite any geopolitics, and one seems to be the universal human goal of making enterprise software suck less. (Okay, nearly universal.) Alex Nichols and Jesse Wedler of CapitalG explain why now is the time for no code software and what the impact will bel, in a very popular article for Extra Crunch this week. Here’s their setup:

First, siloed cloud apps are sprawling out of control. As workflows span an increasing number of tools, they are arguably getting more manual. Business users have been forced to map workflows to the constraints of their software, but it should be the other way around. They need a way to combat this fragmentation with the power to build integrations, automations and applications that naturally align with their optimal workflows.

Second, architecturally, the ubiquity of cloud and APIs enable “modular” software that can be created, connected and deployed quickly at little cost composed of building blocks for specific functions (such as Stripe for payments or Plaid for data connectivity). Both third-party API services and legacy systems leveraging API gateways are dramatically simplifying connectivity. As a result, it’s easier than ever to build complex applications using pre-assembled building blocks. For example, a simple loan approval process could be built in minutes using third-party optical character recognition (a technology to convert images into structured data), connecting to credit bureaus and integrating with internal services all via APIs. This modularity of best-of-breed tools is a game changer for software productivity and a key enabler for no code.

Finally, business leaders are pushing CIOs to evolve their approach to software development to facilitate digital transformation. In prior generations, many CIOs believed that their businesses needed to develop and own the source code for all critical applications. Today, with IT teams severely understaffed and unable to keep up with business needs, CIOs are forced to find alternatives. Driven by the urgent business need and assuaged by the security and reliability of modern cloud architecture, more CIOs have begun considering no code alternatives, which allow source code to be built and hosted in proprietary platforms.

Photo: Jason Alden/Bloomberg

Palantir has finally filed to go public

It’s 16 years old, worth $26 billion and widely used by private and public entities of all types around the world, but this employer of thousands is counted as a startup tech unicorn, because, well, it was one of the pioneers of growing big, raising bigger, and staying private longer. Aileen Lee even mentioned Palantir as one of the 39 examples that helped inspire the “unicorn” term back in 2013. Now the secretive and sometimes controversial data technology provider is finally going to have its big liquidity event — and is filing confidentially to IPO, which means the finances are still staying pretty secret.

Alex Wilhelm went ahead and pieced together its funding history for Extra Crunch ahead of the action, and concluded that “Palantir seems like the Platonic ideal of a unicorn. It’s older than you’d think, has a history of being hyped, its valuation has stretched far beyond the point where companies used to go public, and it appears to be only recently growing into its valuation.”

It also appears to be one of the unicorns that has seen a lot of upside lately. It has been in the headlines recently for cutting big-data deals with governments for pandemic work, on top of a long-standing relationship with the US military and other arms of the government. As with Lemonade, Accolade and a range of other IPOing tech companies that we have covered in recent weeks, it is presumably in a positive business cycle and primed to take advantage of an already receptive market.

(Photo by Kimberly White/Getty Images for TechCrunch)

Meaningful change from BLM

In an investor survey for Extra Crunch this week, Megan Rose Dickey checked in with eight Black investors about what they are investing in, in the middle of what feels like a new focus on making the tech industry more representative of the country and the world. Here’s how Arlan Hamilton of Backstage Capital responded when Megan asked what meaningful change might come from the recent heightened attention on the Black Lives Matter movement.

I happen to be on the more optimistic side of things. I’m not at a hundred percent optimistic, but I’m close to that. I think that there’s an undeniable unflinching resolve right now. I think that if we were to go back to status quo, I would be incredibly surprised. I guess I would not be shocked, unfortunately, but I would be surprised. It would give me pause about the effectiveness of any of the work that we do if this moment fizzles out and doesn’t create change. I do think that there is going to be a shift. I can already feel it. I know that more people who are representative of this country are going to be writing checks, whether through being hired, or taken through the ranks, or starting their own funds, and our own funds. I think there’s more and more capital that’s going to flow to underrepresented founders. That alone, I think, will be a huge shift.

Around TechCrunch

Extra Crunch support expands into Argentina, Brazil and Mexico

Five reasons to attend TC Early Stage online

Hear from James Alonso and Adam Zagaris how to draw up your first contracts at Early Stage

Hear how to manage your enterprise infrastructure from Sam Pullara at TechCrunch Early Stage

Kerry Washington is coming to Disrupt 2020

Amazon’s Alexa heads Toni Reid and Rohit Prasad are coming to Disrupt

Minted’s Mariam Naficy will join us at TechCrunch Early Stage

Across the week

TechCrunch

14 VCs discuss COVID-19 and London’s future as a tech hub

Societal upheaval during the COVID-19 pandemic underscores need for new AI data regulations

PC shipments rebound slightly following COVID-19-fueled decline

Here’s a list of tech companies that the SBA says took PPP money

Equity Monday: Uber-Postmates is announced, three funding rounds and narrative construction

Regulatory roadblocks are holding back Colombia’s tech and transportation industries

Extra Crunch

In pandemic era, entrepreneurs turn to SPACs, crowdfunding and direct listings

Four views: Is edtech changing how we learn?

VCs are cutting checks remotely, but deal volume could be slowing

Logistics are key as NYC startup prepares to reopen office

#EquityPod

From Alex:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

We wound up having more to talk about than we had time for but we packed as much as we could into 34 minutes. So, climb aboard with Danny, Natasha and myself for another episode of Equity.

Before we get into topics, a reminder that if you are signing up for Extra Crunch and want to save some money, the code “equity” is your friend. Alright, let’s get into it:

- Robinhood is back in the news this week after a New York Times piece dug into its history, product decisions and more. Tidbits galore are to be had, but the Equity crew wanted to debate the morality of providing exotic financial tooling to less-experienced users.

- We followed that debate with a dive into immigration, the latest news from the government and our takes on the matter. TechCrunch has covered the recent news, and provided some context on the broader concept. Our takeaway is that doing self-defeating things for no reason isn’t brilliant for the country as a whole.

- Postmates has a home! After winding up somewhere in the middle of the pack of the on-demand cohort a few years back, the rise of DoorDash put Postmates in a pickle. Happily, Uber was on hand to de-brine the unicorn for $2.65 billion in stock. That’s a bit more money than Postmates’ last valuation. What we want to know next is how the sale price impacted common stockholders. Email us if you know.

- Palantir has filed to go public, but privately, so that’s really all there is to say about that. Unless you need a history lesson.

- Finally, funding rounds. We had three this week: MonkeyLearn raising $2.2 million for no-code AI, Quaestor raising $5.8 million for startup financial tooling and $4.5 million for Mmhmm, which is both timely and neat.

Whew! Past all that we had some fun, and, hopefully, were of some use. Hugs and chat Monday!

Equity drops every Monday at 7:00 a.m. PT and Friday at 6:00 a.m. PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Original Content podcast: Yep, ‘Hamilton’ is still very good

With the release of “Hamilton” on Disney+, Jordan and Darrell finally got to watch the musical biography of Founding Father Alexander Hamilton — albeit in recorded form, rather than live on-stage.

And as we discuss on the latest episode of the Original Content podcast, they were pretty delighted by what they found. Not that a Broadway hit that’s won virtually every award really needs defenders at this point — but the Disney+ version is beautifully filmed, and it’s nice to see that five years later, “Hamilton” still works for new viewers.

Anthony, meanwhile, saw the show back in 2015 and has listened to the soundtrack many, many times. But after years of reading about “Hamilton” rather than experiencing it directly, Disney+ gave him a chance to rediscover how virtuosic and entertaining the show is from beginning to end, with one memorable song after another.

We did have a few reservations, about composer Lin-Manuel Miranda’s decision to cast himself as Hamilton, and about the show’s politics — we certainly appreciated its attempt to reclaim the founding story of the United States as a story for immigrants and people of color, but as others have pointed out, downplaying slavery and uncritically celebrating the creation of America’s financial institutions feels a bit strange, at least in 2020.

You can listen to our review in the player below, subscribe using Apple Podcasts or find us in your podcast player of choice. If you like the show, please let us know by leaving a review on Apple. You can also follow us on Twitter or send us feedback directly. (Or suggest shows and movies for us to review!)

If you’d like to skip ahead, here’s how the episode breaks down:

0:00 Introduction

0:21 “Hamilton” review

30:52 “Hamilton” spoiler discussion

This Week in Apps: US ponders TikTok ban, apps see a record Q2, iOS 14 public beta arrives

Welcome back to This Week in Apps, the Extra Crunch series that recaps the latest OS news, the applications they support and the money that flows through it all.

The app industry is as hot as ever, with a record 204 billion downloads and $120 billion in consumer spending in 2019. People are now spending three hours and 40 minutes per day using apps, rivaling TV. Apps aren’t just a way to pass idle hours — they’re a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus.

In this Extra Crunch series, we help you keep up with the latest news from the world of apps, delivered on a weekly basis.

This week, we’re digging into the news of a possible TikTok ban in the U.S. and how that’s already impacting rival apps. Also, both Android and iOS saw beta launches this week — a near-ready Android 11 beta 2 and the public beta of iOS 14. We also look at the coronavirus’ impact on the app economy in Q2, which saw record downloads, usage and consumer spending. In other app news, Instagram launched Reels in India, Tinder debuted video chat and Quibi flounders while Pokémon GO continues to reel it in.

Headlines

Apple release iOS 14 public beta

Image Credits: Apple

The much-anticipated new version of the iOS mobile operating system, iOS 14, became available for public testing on Thursday. Users who join the public beta will be able to try out the latest features, like the App Library, Widgets and smart stacks, an updated Messages app, a brand-new Translate app, biking directions in Apple Maps, upgraded Siri and various improvements to core apps like Notes, Reminders, Weather, Home, Safari and others.

When iOS 14 launches to the general public, it may also include support for QR code payments in Apple Pay, according to a report of new assets discovered in the code base.

Alongside the public beta, developers received their second round of betas for iOS 14, iPadOS 14 and other Apple software.

Google’s efforts in speeding up Android updates has been good news for Android 10

The Exchange: Remote dealmaking, rapid-fire IPOs, and how much $250M buys you

Welcome to The Exchange, an upcoming weekly newsletter featuring TechCrunch and Extra Crunch reporting on startups, money, and markets. You can sign up for it here to receive it regularly when it launches on July 25th. You can email me about it here, or talk to me about it on Twitter. Let’s go!

Ahead of parsing Q2 venture capital data, we got a look this week into the VC world’s take on making deals over Zoom. A few months ago it was an open question whether VCs would simply stop making new investments if they couldn’t chop it up in person with founders. That, it turns out, was mostly wrong.

This week we learned that most VCs are open to making remote deals happen, even if 40% of VCs have actually done so. This raises a worrying question: If only 40% of VCs have actually made a fully remote deal, how many deals happened in Q2?

Judging from my inbox over the past few months, it’s been an active period. But we can’t lean on anecdata for this topic; The Exchange will parse Q2 VC data next week, hopefully, provided that we can scrape together the data points we need to feel confident in our take. More soon.

Private markets

As TechCrunch reported Friday, some startups are delaying raising capital for a few quarters. They can do this by limiting expenses. The question for startups that are doing this is what shape they’ll be in when they do surface to hunt for fresh funds; can they still grow at an attractive pace while trying to extend their runway through burn conservation?

But there’s another option besides waiting to raise a new round, and not raising at all. Startups can raise an extension to their preceding deal! Perhaps I am noticing something that isn’t a trend, or not a trend yet, but there have been a number of startups recently raised extensions lately that caught my eye. For example, this week MariaDB raised a $25 million Series C extension, for example. Also this week Sayari put together $2.5 million in a Series B extension. And CALA put together $3 million in a Seed extension. Finally, across the pond Machine Labs put together one million pounds in another Seed extension this week.

I don’t know yet how to numerically drill into the available venture data to tell if we’re really seeing an extension wave, but do let me know if you have any notes to share. And, to be completely clear, the above rounds could easily be merely random and un-thematic, so please don’t read into them more deeply than that they were announced in the last few days and match something that we’re watching.

Public markets

On the public markets front, the news is all good. Tech stocks are up in general, and software stocks set some new record highs this week. It’s nearly impossible to recall how scary the world was back in March and April in today’s halcyon stock market run, but it was only a few months back that stocks were falling sharply.

The return-to-form has helped a number of companies go public this year like Vroom, Accolade, Agora, and others. This week was another busy period for startups, former startups, and other companies looking to go out.

In quick fashion to save time, this week we got to see GoHealth’s first IPO range, nCino’s second (more on the two companies’ finances here), learned that Palantir is going public (it’s financial history as best we can tell is here), and even got an IPO filing (S-1) from Rackspace, as it looks towards the public markets yet again.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, and now you can receive it in your inbox. Sign up for The Exchange newsletter, which drops every Friday starting July 25.

The IPO waters are so warm that Lemonade is still up more than 100% from its IPO price. So long as growth companies that are miles from making money can command rich valuations, expect companies to keep running through the public market’s door.

There’s fun stuff on the horizon. Coinbase might file later this year, or in early 2021. And the Airbnb IPO is probably coming within four or five quarters. Gear up to read some SEC filings.

Funding rounds worth noting

The coolest funding round of the week was obviously the one that I wrote about, namely the $2.2 million that MonkeyLearn put together from a pair of lead investors. But other companies raised money, and among them the following investments stood out:

- Sony poured a quarter of a billion dollars into the maker of Fortnite, for a 1.4% stake. This rounds stands out for how small a piece of Epic Games that Sony got its hands on. It feels reminiscent of the recent investment deluge into Jio.

- TruePill raised $25 million in a Series B. In the modern world it seems batty to me that I have to get off my ass, go to Walgreens or CVS, wait in line, and then ask someone to please sell me Claritin D. What an enormous waste of time. TruePill, which does pharma delivery, can’t get here fast enough. Also, investors in TruePill are probably fully aware that Amazon spent $1 billion on PillPack just a few year ago.

- From the slightly off-the-wall category, this headline from TechCrunch: “UK’s Farewill raises $25M for its new-approach online will writing, funerals and other death services.” Farewill is a startup name that is so bad it probably works; I won’t forget it any time soon, even though I don’t live in the U.K.! And this deal goes to show how big the internet really is. There’s so much demand for digital services that a company with Farewill’s particular focus can put together enough revenue growth to command a $25 million Series B.

- Finally, TechCrunch’s Ron Miller covered a $50 million investment into OwnBackup. What matters about this deal was how Ron spoke about it: “OwnBackup has made a name for itself primarily as a backup and disaster-recovery system for the Salesforce ecosystem, and today the company announced a $50 million investment.” What to take from that? That Salesforce’s ecosystem is maybe bigger than we thought.

That’s The Exchange for the week. Keep your eye on SaaS valuations, the latest S-1 filings, and the latest fundings. Chat Monday.

15 Billion Stolen Logins Are Circulating on the Dark Web

Plus: Facebook’s Roger Stone takedown, the BlueLeaks server seizure, and more of the week’s top security news.

What Happens After a ‘Million-Mile Battery’ Outlasts the Car?

Electric vehicle makers hope to roll out super long-lasting batteries. That raises interesting questions about resources, performance—and a battery’s second act.

Prepare for Artificial Intelligence to Produce Less Wizardry

A new paper argues that the computing demands of deep learning are so great that progress on tasks like translation and self-driving is likely to slow.

The Best Gear to Make Beer, Wine, Cider, and Mead at Home (2020)

Your homegrown tomatoes won’t help you forget how terrible everything is right now. Here’s what you need to make booze at home.

The 19 Best Weekend Deals: Tech, Home Gear, and More

Heatwave and quarantine got you stuck indoors? These deals might help you spruce up your space for more comfort.

CBP says it’s ‘unrealistic’ for Americans to avoid its license plate surveillance

U.S. Customs and Border Protection has admitted that there is no practical way for Americans to avoid having their movements tracked by its license plate readers, according to its latest privacy assessment.

CBP published its new assessment — three years after its first — to notify the public that it plans to tap into a commercial database, which aggregates license plate data from both private and public sources, as part of its border enforcement efforts.

The U.S. has a massive network of license plate readers, typically found on the roadside, to collect and record the license plates of vehicles passing by. License plate readers can capture thousands of license plates each minute. License plates are recorded and stored in massive databases, giving police and law enforcement agencies the ability to track millions of vehicles across the country.

The agency updated its privacy assessment in part because Americans “may not be aware” that the agency can collect their license plate data.

“CBP cannot provide timely notice of license plate reads obtained from various sources outside of its control,” the privacy assessment said. “Many areas of both public and private property have signage that alerts individuals that the area is under surveillance; however, this signage does not consistently include a description of how and with whom such data may be shared.”

But buried in the document, the agency admitted: “The only way to opt out of such surveillance is to avoid the impacted area, which may pose significant hardships and be generally unrealistic.”

CBP struck a similar tone in 2017 during a trial that scanned the faces of American travelers as they departed the U.S., a move that drew ire from civil liberties advocates at the time. CBP told Americans that travelers who wanted to opt-out of the face scanning had to “refrain from traveling.”

The document added that the privacy risk to Americans is “enhanced” because the agency “may access [license plate data] captured anywhere in the United States,” including outside of the 100-mile border zone within which the CBP typically operates.

CBP said that it will reduce the risk by only accessing license plate data when there is “circumstantial or supporting evidence” to further an investigation, and will only let CBP agents access data within a five-year period from the date of the search.

When asked about its privacy assessment, CBP spokesperson Matthew Dyman responded: “How would you be able to opt out of a license plate reader? Can I opt out of speed cameras here in DC?”

CBP doesn’t have the best track record with license plate data. Last year, CBP confirmed that a subcontractor, Perceptics, improperly copied license plate data on “fewer than 100,000” people over a period of a month-and-a-half at a U.S. port of entry on the southern border. The agency later suspended its contract with Perceptics.

Updated with CBP response.