From the Move to the Beam, we’ve tested every speaker from the venerable brand. We like them all—but here are the best picks to fit your lifestyle.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

12 Best Wireless Earbuds WIRED Has Tried (True Wireless)

True wireless earbuds, fully wireless earbuds, completely wireless earbuds—no matter what you call them, if you’re ready to cut the cord between your ears, these are the best buds we’ve tested.

Steely Eyes, Tragic Ends: The Bromantic Theory of History

It’s no exaggeration to say that emotional affairs of the male heart can influence technology and geopolitics.

Ransomware Has Gone Corporate—and Gotten More Cruel

The DarkSide operators are just the latest group to adopt a veneer of professionalism—while at the same time escalating the consequences of their attacks.

Palantir’s S-1 alludes to controversial work with ICE as a risk factor for its business

Palantir’s mysterious work and its founding origins with Trump ally and anti-press crusader Peter Thiel have inspired a number of controversies in recent years, none as divisive as its ongoing business with ICE. But with a direct listing around the corner, the famously secretive company is in for a lot more scrutiny.

In Palantir’s forthcoming S-1 filing, obtained by TechCrunch, the soon-to-be-public company addresses concerns about managing its brand reputation as some of its contracts attract unwanted attention. Palantir makes the fairly combative claim in the risks portion of the unpublished financial filing that its business could be harmed by “coverage that presents, or relies on, inaccurate, misleading, incomplete, or otherwise damaging information” about the company:

“As our business has grown and as interest in Palantir and the technology industry overall has increased, we have attracted, and may continue to attract, significant attention from news and social media outlets, including unfavorable coverage and coverage that is not directly attributable to statements authorized by our leadership, that incorrectly reports on statements made by our leadership or employees and the nature of our work, perpetuates unfounded speculation about company involvements, or that is otherwise misleading.”

The filing also states that the company has its hands tied in responding to these hypothetical misleading reports due to the “sensitive nature” of its contracts and confidentiality requirements.

Incomplete reporting is inevitable for a company that’s largely shrouded the nature of its business from the public eye. Historically, any information that trickles out about Palantir’s work with U.S. defense and law enforcement agencies comes from FOIAs, like one that recently produced a user manual for Palantir Gotham, the company’s signature software platform developed for defense and intelligence agencies.

Palantir acknowledges that activists and the press have taken a special interest in the company due to its work with “organizations whose products or activities are or are perceived to be harmful.” The S-1 of course doesn’t name Palantir’s work with ICE specifically, but that contract has attracted a swarm of scrutiny, both from outsider observers and employees within the company. The filing notes that unspecified relationships have resulted in public criticism and “unfavorable coverage” of the company.

Last year, The Washington Post reported that Palantir employees were reckoning with the company’s work for the aggressive U.S. immigration agency, “[debating] the ICE contracts in town hall meetings, office hallways, Slack channels and email threads.”

While other tech companies have yielded to critics of defense and law enforcement work, Palantir instead has grown its most controversial contracts over time. The company’s S-1 discusses that decision making process:

“Activists have also engaged in public protests at our properties. Activist criticism of our relationships with customers could potentially engender dissatisfaction among potential and existing customers, investors, and employees with how we address political and social concerns in our business activities.

Conversely, being perceived as yielding to activism targeted at certain customers could damage our relationships with certain customers, including governments and government agencies with which we do business, whose views may or may not be aligned with those of political and social activists.”

In 2018, as the tech industry grappled with the ethical implications of lucrative federal defense work, more than 200 employees wrote a letter to Palantir CEO Alex Karp expressing their concerns over its ICE contracts. Palantir has two current contracts with ICE, one for the agency’s Investigative Case Management (ICM) internal database and another for software known as FALCON. Combined, those contracts are worth as much as $92 million.

Palantir makes a sizable chunk of its revenue by selling U.S. agencies software that weaves together data streams to monitor individuals, but the company draws a thick line at helping China do the same.

“We do not work with the Chinese communist party and have chosen not to host our platforms in China, which may limit our growth prospects,” the S-1 states, calling work with China “inconsistent” with the company’s aims and culture.

“We do not consider any sales opportunities with the Chinese communist party, do not host our platforms in China, and impose limitations on access to our platforms in China in order to protect our intellectual property, to promote respect for and defend privacy and civil liberties protections, and to promote data security.”

Palantir’s anti-China stance isn’t necessarily surprising given Thiel’s penchant for ominous warnings about Chinese tech dominance — a position that also happens to bolster his relationship with a White House that’s since kicked off an unusual crusade against Chinese social media giant TikTok. Still, it’s strange, noteworthy and a sign of the times to see a refusal to do business with China articulated explicitly in a tech company’s S-1.

As losses expand, Asana is confident it has the ticket for a successful public listing

Asana, the project management software developer, dropped its filing for a direct listing on one of the busiest days of a surprisingly busy late summer.

The task management toolkit provider started by Facebook co-founder Dustin Moskovitz and early FB employee Justin Rosenstein isn’t as well known or as well financed as today’s other big public offerings — the game engine developer, Unity, and the $14 billion-valued enterprise cloud storage provider Snowflake — but its modest $1.5 billion valuation may in some way make it a better bellwether for investor appetite in new tech offerings.

That’s because Asana is losing money … and losing money big. Its losses are expanding even as its growth increases. The company lost $118.6 million in fiscal 2020 even as it expanded its revenue to $142.6 million for the same period. In 2019 it saw revenues of $76.8 million and a net loss of $50.9 million.

If the idea is that you have to spend money to make money, then Asana is doing exactly as it should, because the company has been growing. Revenue increased $19.7 million, or 71%, during the three months ending April 30, 2020 compared to the same period in 2019. The company attributed that growth to a shift in its sales strategy toward higher-priced subscription plans and revenue from existing customers.

Cost of revenues for the company grew by 51% as gross margins slightly rose over the same period, according to the company.

One bright spot for Asana is the potential converts it still has yet to win over as paying customers. Asana boasts 3.2 million free accounts and has managed to make its bones off of only 75,000 paying customers. Given the rapid transition to remote work for many knowledge workers, project management tools only become more important.

The path to the public markets has been a long one for Asana, which first appeared on the scene in 2008. The company’s last capital infusion came in 2018, with $125 million raised across two quick investment rounds led by Generation Investment Management, the investment fund co-founded by former Vice President Al Gore.

While Gore’s firm may have ponied up a lot of cash, the biggest winner in Asana’s public listing is likely to be Facebook co-founder Moskovitz. He owns a huge percentage of the company — roughly 35%. That’s a whole lot more than Rosenstein’s 16.2% haul.

Asana had telegraphed its intentions to access public markets via a direct listing earlier this year — even before the pandemic had made the market more receptive to collaboration software tools like the ones it offers.

Xwing plans short, regional flights for its autonomous cargo planes

The path to deploying commercial aircraft that can handle all aspects of flight without a pilot is long, winding, expensive and riddled with regulatory and technical hurdles. Marc Piette, the founder of autonomous aviation startup Xwing, aims to make that path to pilotless flight shorter and more cost-effective.

Instead of building autonomous helicopters and planes from the ground up, Xwing is focused on the software stack that will enable pilotless flight of existing aircraft. Now, the company is sharing details of its go-to-market strategy several months after raising $10 million in new funding and following successful autonomous test flights in a Cessna 208B Grand Caravan. Xwing said it has completed since July more than 70 hours of engine time for ground and flight tests, and more than 40 hours of automated flight time.

The Cessna 208B Grand Caravan, a utility aircraft that has historically been used for cargo, flight training and humanitarian missions, will be the initial centerpiece of its plan to operate commercial cargo flights. The plan is to have a regional focus and operate within a 500-mile range with flight paths over unpopulated areas.

Xwing will operate the fleet. However, Piette said the company is also open to partnerships and licensing the technology to other operators.

Xwing’s so-called Autoflight System is designed to be aircraft agnostic. And it still is, Piette said in a recent phone interview. The Cessna 208B Grand Caravan is just the beginning.

“It’s still in production, it’s a safe aircraft and it’s a good platform for us to convert to an unmanned aircraft here,” Piette said.

Piette believes that retrofitting existing aircraft with its Autoflight System will speed up deployment, while maintaining safety and keeping costs in check. The Autoflight System is integrated with onboard flight control systems that allow the plane to navigate, take off and land autonomously. The system is designed to be supervised by remote operators who work with air traffic controllers, according to Xwing.

Before commercial operations can start, Xwing will need regulatory approval.

Xwing has the necessary Part 135 Air Carrier certificate required to launch its commercial business, which was obtained when it acquired a company running commuter operations. Xwing is now updating the certificate for cargo operations and 208B Cessna Caravans. Xwing still needs the FAA to provide flight certification for unmanned Cessna 208B Grand Caravan aircraft with cargo capacity of over 4,000 pounds. Xwing has been working with the FAA and has also been involved for more than a year with NASA’s Unmanned Aircraft Systems (UAS in the NAS) program, an initiative meant to mature the key remaining technologies that are needed to integrate unmanned aircraft in U.S. airspace.

“I’m not going to minimize the challenge here because this is quite novel for the regulator and it’s also complex in nature from a safety perspective,” Piette said. “I’d love to be able to start these commercial cargo operations unmanned in the U.S, in the very early 2022 time frame. We’ll have to see if we can make that happen.”

Here are the 98 companies from Y Combinator’s Summer 2020 Demo Day 1

Today was part one of Y Combinator’s two-parter Summer 2020 Demo Day, where nearly 100 companies debuted their efforts to the world for the first time.

The Summer 2020 batch of companies was the first fully remote YC cohort, with the ongoing pandemic leading the accelerator to take its program entirely virtual. But it was actually YC’s second virtual demo day; as the severity of the pandemic became more clear back in March, YC moved the Demo Day portion of its Winter 2020 class to virtual at the last minute. Doing so meant dropping key aspects of Demo Day… including, most notably… the demos. Instead of live pitches, each company in the W20 class pitched via a single slide and a brief text description of the company.

YC clearly had a bit more time to prepare this time around, with a Demo Day experience more in line with that of the in-person events. In an incredibly rapid-fire series of live pitches, each company got just 60 seconds to pitch to an audience of investors, media, and fellow founders; it was enough to present the surface of who they are and what they do, but often left the deeper details of how/why for follow-up conversations.

Here are our notes on each of the companies that presented today:

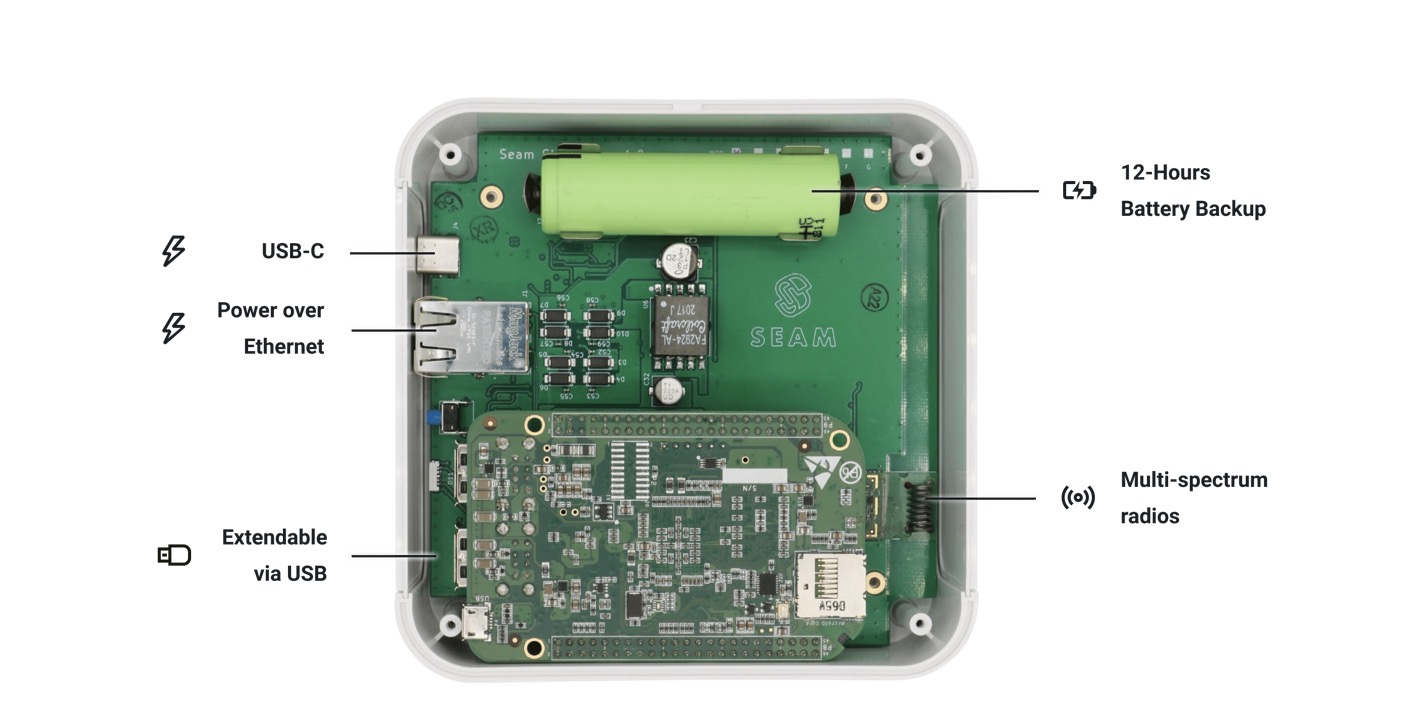

Image Credits: Seam

Seam: An API for homes and buildings, with a hardware hub meant to help developers build apps that can do things like unlock doors, summon elevators, etc. from different device vendors. Currently in 5 pilots.

Evergreen: A digital solution for employees to request purchases and track approvals. The B2B business is built for companies with non-centralized purchases and the need to manage a slurry of different tools.

Farmako Healthcare: A million doctors in India still use paper medical records. Farmako aims to help shift them to electronic ones so they can write prescriptions and see patients online easily and keep records centrally.

PolyOps: SaaS business that provides analytics on e-commerce operations including visibility into returns, shipping and customer acquisition expenses. The startup wants to make e-commerce more efficient. PolyOps claims 15 brands are already onboard with a combined $35 million in GMV. As commerce of all sorts changes, PolyOps is trying to make the world a bit easier to grok, which seems like a smart direction to proceed.

Adyn: This startup is building a test to help women in the US determine which method of birth control is the best fit for their bodies in order to minimize side effects. The company says more than 49M US women struggle with birth control side effects. Once users submit their tests, the company gives them recommendations and can connect them with specialists to discuss options.

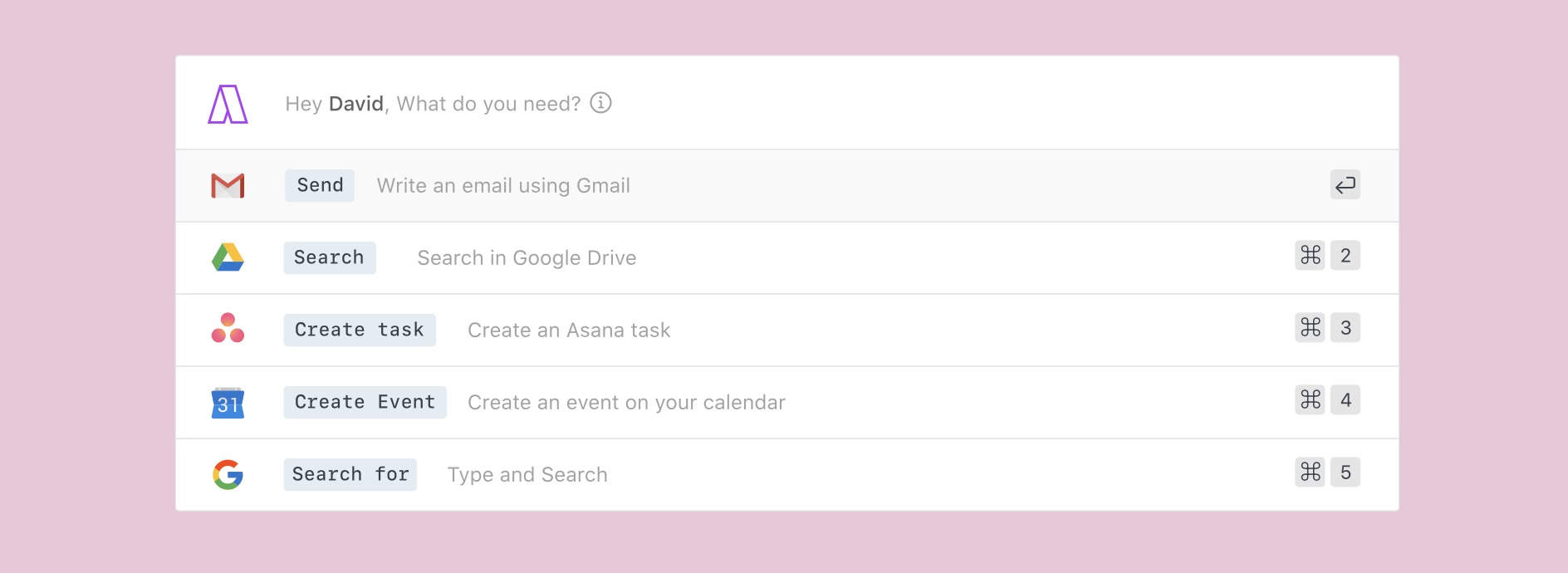

Image Credits: Akiflow

Akiflow: A command line-style tool for building quick shortcut commands across things like email, Google Drive, Slack, or Asana. Available on Windows/Mac. Currently has 2000 users waitlisted.

Inspectify: A software company that helps real estate agents coordinate inspections for home-sellers. The startup wants to grow into a managed marketplace that serves as a broker for all home services, from repairs to insurance.

Bikayi: Shopify isn’t a good match for consumers in the Indian market because of consumer habits that differ from those of the US (for instance, many purchases are made through WhatsApp rather than the web.) The founders started Bikayi after seeing family businesses using pen and paper to handle incoming orders online. They charge merchants $100 per year.

Atomic: A software company that provides a fintech API allowing other platforms to integrate investment accounts into their product, easily. Many modern fintech services allow you to hold cash, like Venmo and Apple Pay. That money could be, instead, invested. Atomic has found some initial traction, with a few companies signed up that give it around $300M in AUM, providing the startup with $1.5M in ARR. After every fintech added checking accounts, perhaps investments accounts are the next step.

Blue Onion Labs: This financial services startup is helping companies make sense of financial transaction data that lives across multiple systems. Their suite of API integrations are aiming to solve a big pain point for accounting teams, serving as a “single source of truth” for understanding the full scope of incoming transactions.

Fancy: Delivery of convenience store items, with delivery promised in under 30 minutes. Currently focused on the UK. Instead of picking up items from existing stores, Fancy operates its own “dark stores” to keep margins higher.

BukuWarung: A micro-accounting app for merchants in Indonesia. It enables mom and pop stores to bring payments and credit to their businesses. The service currently has 350,000 monthly active merchants.

CoreCare: Shuffling data between the hundreds of insurance companies, healthcare providers, and government entities can lead to errors that cost billions per year and can delay treatment. CoreCare synchronizes patient data between them, preventing errors and saving everyone money.

HotPlate: HotPlate is a service that helps unemployed chefs cook food at home, sell it, and deliver it. In its first 8 weeks the startup has secured 10 chefs which are generating around $1,500 in GMV. HotPlate takes a 15% cut of that total. The startups argument is that COVID has changed the world so much that, now, we’ll all want home-cooked meals instead of, we presume, restaurant-prepared food. We’ll see. And given the small GMV generated by each onboarded chef, how the economics will work out over time will prove interesting. Perhaps order size will grow.

ChatPay: ChatPay is building a Substack for WhatsApp, building out a platform that allows people to create exclusive WhatsApp chat channels while allowing admins to monetize the platform via member management.

Electry: A tool for hiring mechanics and electricians, pitched as “LinkedIn for skilled blue-collar workers”. The team says it’s currently seeing $75k monthly revenue, and is profitable.

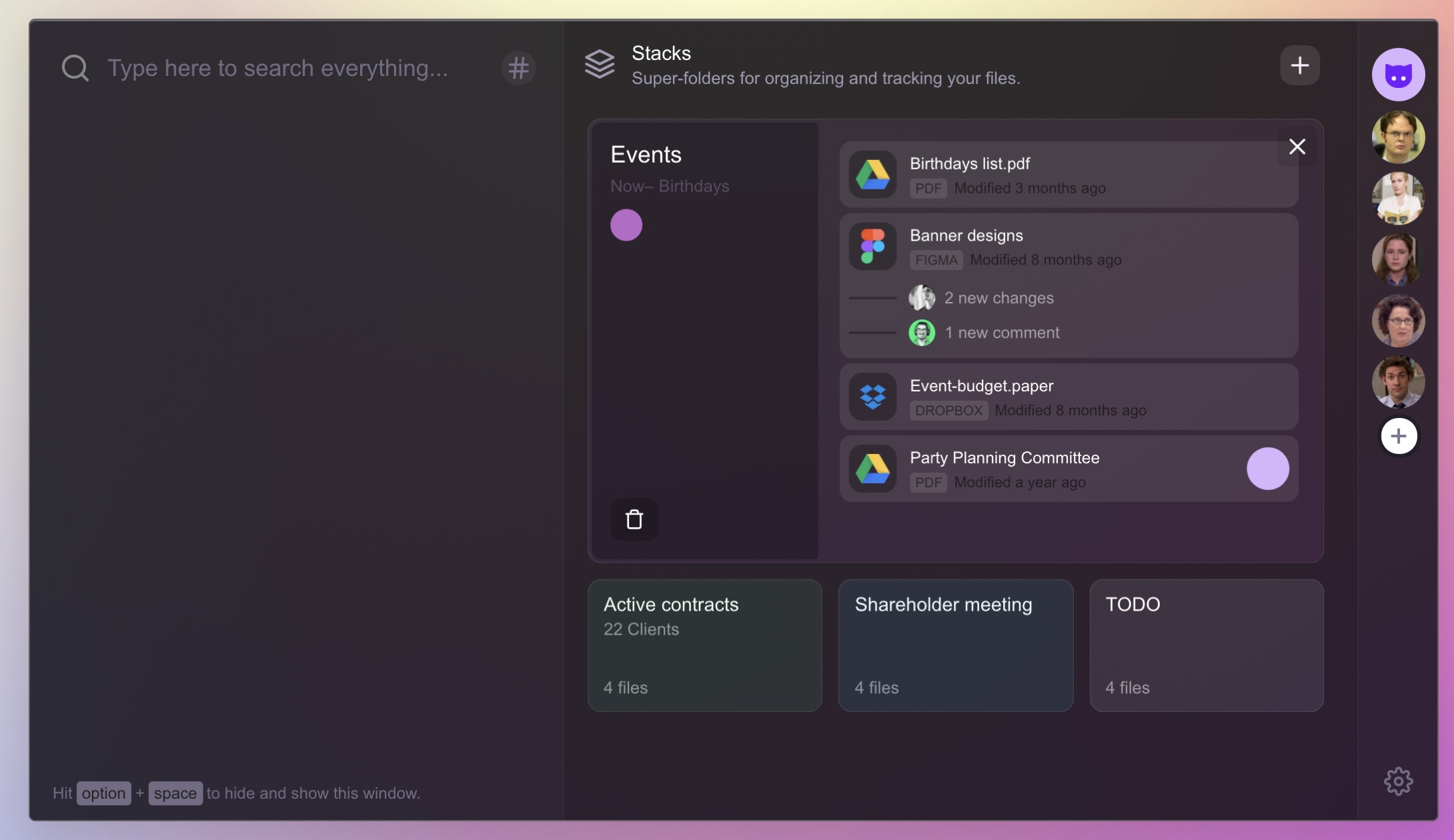

Image Credits: Clew

Clew: We live on so many different cloud-based platforms, from Google Docs to Figma to Github and Dropbox. Clew wants to be the company that helps you streamline all your different cloud-based applications into a single-stream platform that works as a filing system. So far, Clew has lined up 85 paying customers and charges a $50 annual subscription fee.

Arist: Employee training materials like safety and anti-racism courses are usually videos or slideshows. Arist conducts this same training via interactive text messaging, which they say is faster, more natural for today’s users, and leads to higher completion rates. They already have several big ticket clients and say they will soon be profitable.

Decentro: Continuing the X for India trend that is taking shape in this batch, Decentro wants to build Plaid for India. The company provides an API for banking integrations, like Plaid. That Plaid sold for billions of dollars earlier this year is still on the mind of every sentient VC, so the comparison could prove enticing. Decentro is still small, with around $1 million in gross transaction volume (GTV), and around $7,000 in MRR. Still, with just four customers and 45 more in the pipeline, it’s on a good path.

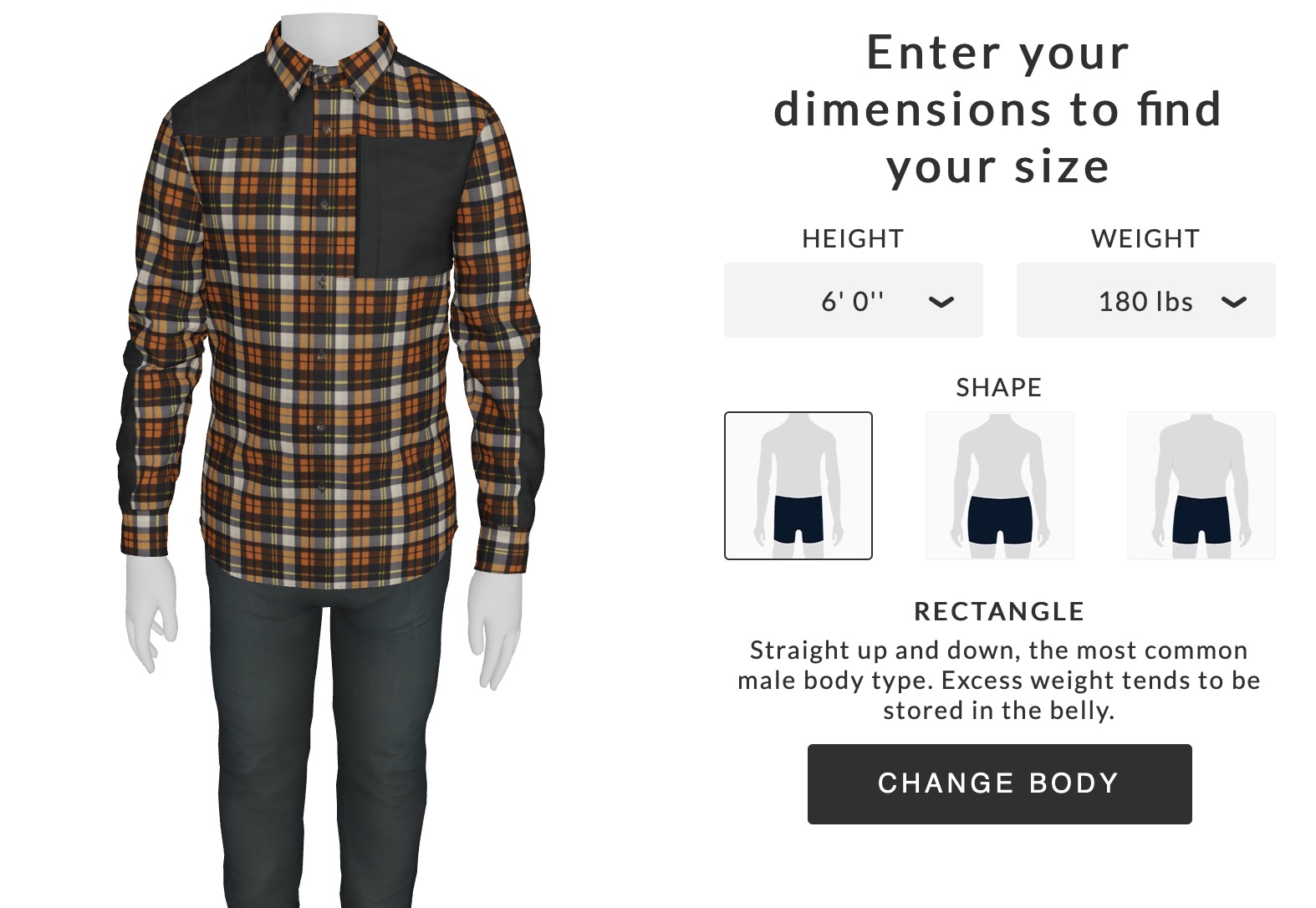

Image Credits: Drapr

Drapr: Drapr is building software to help online shoppers see what their clothing looks like. The company’s online try-on widget helps shoppers get a better idea of how a shirt or other clothing item fits on a customizable 3D mannequin that users can adjust to fit their body type, height and weight.

GitDuck: A video chat tool built specifically for developers. It hooks directly into a developer’s IDE to allow for real-time code sharing, allowing devs to code together remotely. Charges $20 per developer seat.

Hannah Life Technologies: Hannah Life Technologies wants to help couples struggling to get pregnant conceive at home without ever visiting a clinic. The startup sells a small device that can be used during sex which they say can triple the chance of conception. They expect the product to launch with FDA clearance next year.

Hellosaurus: With YouTube making monetization of kids’ content more difficult, there are lots of creators looking to take the next step. Hellosaurus has signed a bunch of them to create an interactive video platform for children, who can play with episodes instead of just watching. It’s a crowded market but with HQ Trivia’s former head of product and some solid creators they may be able to slice off a piece of that $3B market.

Jika: Jika wants to help the average Shopify seller do price testing. The startup said during its pitch that the major online retailers have teams of folks working on pricing. Many smaller Shopify sellers do not change their pricing at all. As we’ve seen from Shopify’s recent quarter, the potential market for Jika’s service is pretty big and growing quickly. Still, Jika is a small thing today, with less than $1,000 MRR today. From small seeds, big trees. Let’s see how quickly Jika can grow its footprint in the Shopify seller market.

Minimall: Minimall bills itself as Pinduoduo for Europe and is another commerce startup aiming to provide consumers access to cheaper goods by cutting out retail middlemen. The company kicked off its efforts by building face masks, moving $450k worth of inventory in 3 months.

Hellometer: Uses off-the-shelf cameras to help fast food restaurant owners analyze how quickly customers are being served. Currently in testing in two locations, with letters of intent to test in 300 more.

MedPiper Technologies: By working with medical schools and government, MedPiper has aggregated the largest database of verified doctors and nurses in India. It charges hospitals a monthly subscription to recruit these medical professionals for open vacancies, faster.

Artifact: Everyone has people and events they’d like to preserve forever. Artifact aids in the creation of a “personal podcast” in which a professional interviewer speaks with someone like your grandparents to get their stories on the record so your grandkids can listen to it without hearing your dog bark in the background.

Charityvest: When rich folks give money away, they often use a donor advised fund, or what Charityvest calls a “a 401K or HSA, but for supporting charities.” The startup’s service allows companies to offer donor advised funds to folks in the middle classes, as an employee benefit. The company has rang up $65,000 in ARR ($5,400 in MRR) thus far. Many big companies match employee donations to some degree. Perhaps this is the obvious next step in that particular progression.

Eatable: Building order-ahead functionality into restaurant workflows, allowing them to sidestep pen-and-paper order taking over the phone and streamline operations.

Heron Data: A B2B company meant to help fintech services categorize/label bank transaction data using methods they promise are more accurate and cheaper than existing solutions.

VoloPay: The startup wants to be Brex for South East Asia. VoloPay seeks to bring approvals, bill payments, expenses, and accounting automation all under one roof and with one platform. It streamlines payments through a corporate credit card, and in 3 months users have spent $90,000.

LendTable: Matching company contributions to your 401K is a great way to save money, but folks living paycheck to paycheck can’t afford to lose that income. LendTable provides cash advance loans to cover the cost of financial employee benefits and takes payments in the form of a single profit-share payment down the line. With 30 million employees not taking advantage of this investment opportunity it could be a big market.

Zuddl: Zuddl is a startup that aims to bring conferences online for big companies. It charges $5 per attendees, and per its pitch has already managed to host a conference with a few thousand attendees. A bit like competitors Hopin and others, Zuddle wants to re-create some familiar in-person scenarios like booths, and lobbies for chatting. Zuddl stands out for racking up $54,000 in revenue in about a month, which, annualized, makes it one of the larger startups demoing.

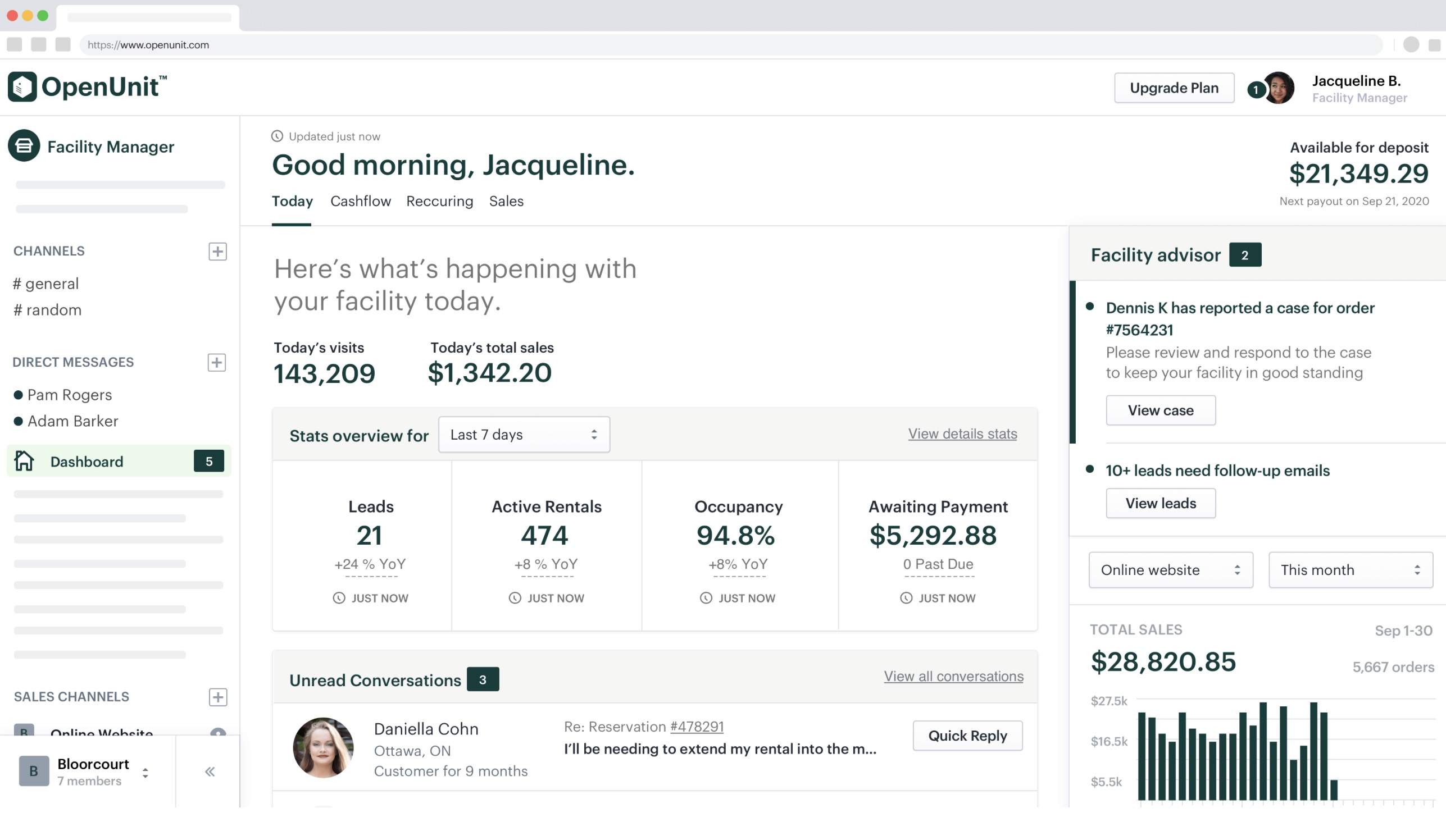

Image Credits: OpenUnit

OpenUnit: OpenUnit is building management software to help self-storage facilities keep an eye on payments and customer accounts. The back office software suite is designed for self-storage facilities of all sizes and is aiming to help provide a highly specified backend that takes care of all the needs these customers have. Here’s our previous coverage.

Ready: Building tools meant to help local ISPs compete with the big nationwide chains, and allow them to cross sell services (like TV or VoIP) from vetted providers to their customers as bundles. Currently working with 5 ISPs with an MRR of $20.5k.

Hubble: Instead of manually tracking data quality, what if software could automatically do that for you? Hubble monitors a company’s data warehouse for errors and missing information, letting in-house engineers focus their time on other tasks. The company launched 3 weeks ago and has three customers. It plans to charge $10,000 per team per year.

OrangeHealth: There are hundreds of thousands of individual doctors with small clinics in India that aren’t set up for online consultations and other telemedicine services. OrangeHealth aims to set them up with the ability to provide online services and billing, as well as delivery and other infrastructure. Customers can keep their local doctor but get quick turnaround online treatments at no extra cost.

DraftWise: Legal work is slow, tedious, and expensive. So, perhaps software can help. That’s what DraftWise wants to do, saying that its service can cut the time needed for a credit agreement from 30 hours to 10. The startup has yet to monetize, but it has nearly a half-dozen letters of intent with some law firms, each it expects to drive seven-figure revenue in time. Indeed, the firm expects to charge big law firms over half a million dollars every year for its service. DraftWise is founded by a lawyer and a few ex-Palantir folks, which sounds fine, provided that they can keep their costs in check. (Hey-o, a Palantir IPO joke!)

Sakneen: Sakneen is another startup aiming to take a model that’s been successful stateside and see how the model fairs internationally. The company is aiming to create Zillow for Egypt and has already built out a database that accounts for 80% of the country’s new housing supply.

SockSoho: A direct-to-consumer clothing company that says it wants to be the “UNIQLO of India”, currently focusing specifically on men’s dress socks. With the majority of their orders taking place over WhatsApp, founder Simarpreet Singh says the company is seeing an MRR of $150K with margins of 70%.

HumanLoop: Building software to annotate, train, and deploy natural language processing atop thorny data sets. The startup is bringing specialized AI to lawyers, doctors, and accountants to process their data, which otherwise would need to be out-sourced to pricey domain experts.

BanditML: The team behind everyone’s favorite algorithm, surge pricing on Uber, is back to bring those ML chops to other companies. This time they’re optimizing when and how to send promotions to customers, and helped send out nearly a million dollars in promos just this month.

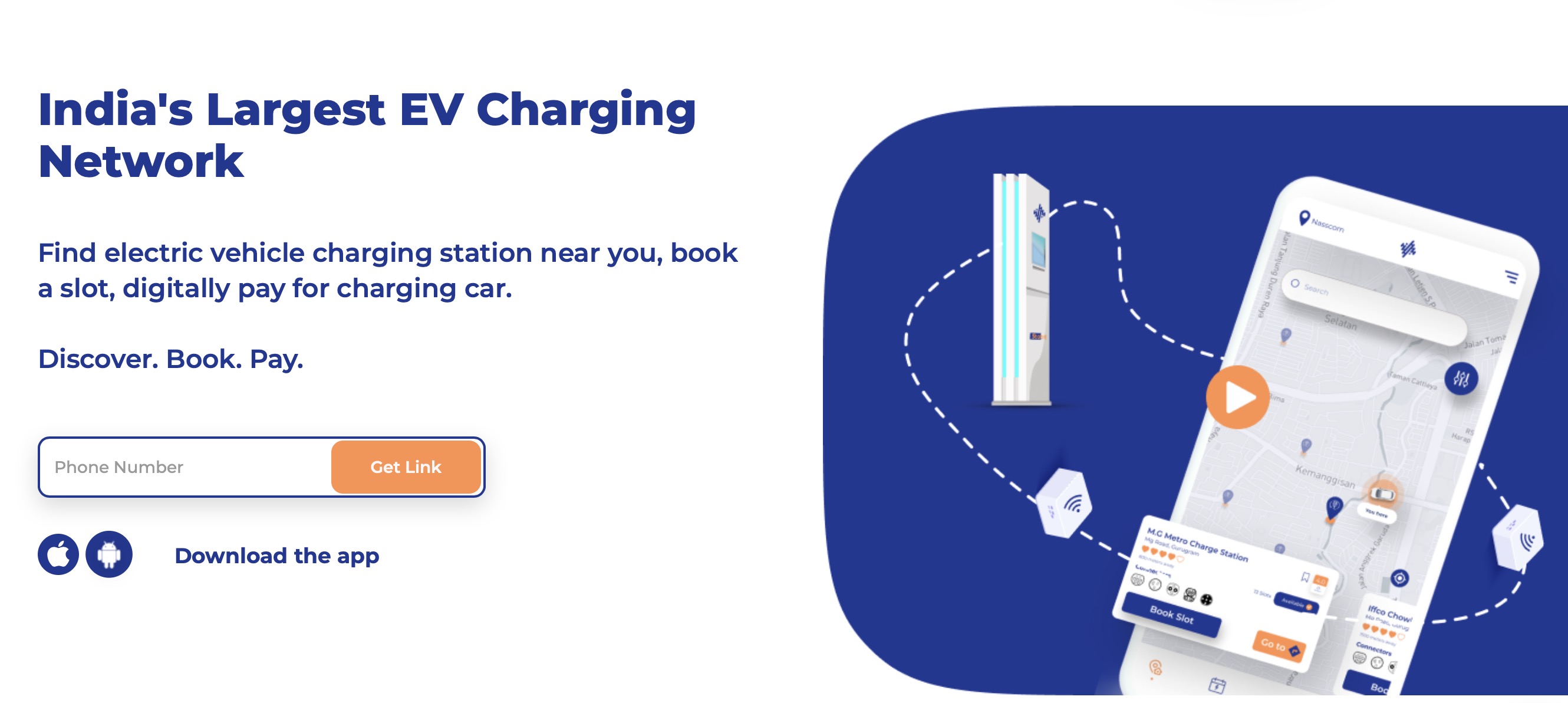

Image Credits: Statiq

Statiq: The company allows individuals and buildings to provide EV-charging points, all accessible via a single unified app. So far it appears to be working, with Statiq seeing 500 weekly charging sessions, or about 70 per day. Its weekly pace is growing by about 10% weekly it says, which is pretty good. Its margins are unclear, but the firm did claim $12,000 in net revenue in the last week. So, a little over $2 per charge, if we can divide accurately. Statiq wrapped by saying that Indian government policies are going to push more EV charging points into the market. Perfect, say, for a startup looking to bring folks to them. We covered Statiq here.

Rally: During the pandemic, Zoom has turned out to be a necessary tool for web users trying to stay in touch with friends. Zoom was built for enterprise; Rally is aiming to create a video chat platform built for social gatherings. The app has shifted the idea of a breakout room, aiming to replicate the experience of sparking up side conversations by allowing you to faintly overhear some of the conversation happening “nearby”.

Jemi: A platform meant to help content creators sell experiences (they mention video calls/shoutouts) and merch to their fans. Currently taking a 15% cut of transactions, the team says they’re currently seeing a GMV of ~$17,000 and growing 30% week-over-week.

In Stock: As the coronavirus pandemic keeps local retail stores shuttered, In Stock wants to bring delivery services that don’t just compete, but beat, Amazon Prime. The startup helps retail stores offer same-day delivery, at a cheaper price than Amazon Prime. After launching 6 weeks ago in Santa Cruz, In Stock has positive unit economics. In Stock is currently doing 10 orders per day, and per founder Ian McHenry, it is not scared of Amazon.

KeyDB: A NoSQL database that the team says is “up to 5x faster” than Redis. The company notes that it’s currently seeing over 40,000 downloads per month, and named HP Enterprise as an early customer.

Kingdom Supercultures: Microbes have helped to create beer, cheese, kombucha, and wine for thousands of years. Kingdom Supercultures is using existing microbes to design new “microbial communities” with the goal of helping national food brands create foods that have never existed before. The startup is licensing its technology to brands focused on healthy and sustainable food development.

OpenBiome: “We’re like a blood bank, but for poop.” It doesn’t get much more straightforward than that! Fecal transplants help cure certain infections by restoring the balance of bacteria in the body; OpenBiome is the largest provider of transplants in the world, having treated 55,000 patients and saved perhaps thousands of lives. They’re a sustainable nonprofit with $15M in revenue and are hoping to expand to new treatments.

MilkRun: MilkRun is a service that connects folks in a city to local food products, like dairy and produce. It scaled to $425,000 in GMV per month in Portland before setting its sights on Seattle. In the more northern rainy city, MilkRun racked up $62,000 MRR in its first six weeks. Echoing the famous Amazon threat that “your margin is my opportunity,” MilkRun said that most money spent on food today goes to packaging and distribution, and that “that inefficiency is [its] opportunity.”

Thndr: Thndr is aiming to build a Robinhood for the Middle East, helping users invest in stock, bonds and funds commission-free via the company’s free app. Robinhood has taken the US exchanges by storm, but the trend hasn’t hit investors in the Middle East; Thndr is aiming to replicate their success with investors there.

Mesh: A “social network for remote companies”, allowing employees to share what they’re working on, see each other’s progress, and share feedback. It’s currently free for teams with fewer than 10 employees, with plans starting at $5 per employee per month after that. Working with 8 enterprise pilots.

KiteKRAFT: KiteKRAFT builds flying wind turbines, with the goal of creating a more viable wind power system for businesses. The startup claims that its wind turbine uses 10 times less material at half the cost of traditional options, and has already flown a 7-foot wide prototype. KiteKRAFT’s first use case is micro-grids, small energy networks that are normally powered by diesel generators and/or solar energy.

kSense: Companies need to collect lots of data in-house but often need to work with a third party to do so. That’s not always practical, as these CTOs found out in their own companies – so they built this tool to perform data collection internally using an open source core.

Blissway: Paying tolls sucks and stopping to pay tolls sucks even more, so Blissway wants to take the process of paying tolls in the United States and make it better. In its view, the current setup of toll-paying is 90% hardware, and 10% software. It wants to flip that with a solution they say can be deployed on “any highway around the world in months”, with the company handling everything from the tolling hardware to customer billing.

Gilgamesh Pharmaceuticals: Gilgamesh is a medtech company aiming to use psychedelic-related drugs to treat a variety of ailments including ADHD and mood disorders, opioid disorders and depression.

inSoma Bio: A biomaterials company focusing on a gel that helps plastic surgeons “rebuild fat” in surgeries such as breast reconstruction. The company says that their gel can double fat volume, potentially replacing the need for implants.

Future Fields: Cellular agriculture, the science that powers lab-grown meat and other meat alternatives, often struggles to get into consumer homes due to a high cost of production. Future Fields sells cell-growth media products that are more cost effective and scalable than the status quo set forward by commercialized agriculture.

Flat: Flat is flipping homes in Latin America: Buy low, fix it up, sell high. It’s a proven model but in LatAm it’s twice as profitable, founders claim. In addition to being the “Opendoor for Mexico,” Flat has the backing of that company’s founders and a $25M debt line secured to scale up.

Layer: A developer tool that creates staging environments quickly so that developers can immediately see/compare/share the impact of code changes. The startup notes that its service allows developers at smaller companies to have access to a similar workflow as the major tech companies of the world. Per the startup, 18 customers have used its service 6,000 times in the last 30 days.

Lume Health: Lume Health is building a Glassdoor for hospitals, aiming to help nurses make the right choice when searching for jobs. The company integrated the predictable aspects of a jobs board, while also building out a platform of verified reviews from nurses that can speak to what an office or hospital was really like from the inside.

MarketForce 360: Salesforce for retail distribution in Africa. The startup brings more clarity to retail transactions in real-time, a mobile solution to pen and paper tracking. Along with a SaaS fee, MarketForce 360 charges a transaction fee on all orders processed over the platform. It has 40 paying fast-moving consumer good companies to date.

Manycore: Companies produce lots of code that runs on cloud computing resources… but if that code isn’t efficient, it racks up costs correspondingly. Manycore takes final code — first Java, and soon Python and JS, and optimizes it for cloud deployment.

Aquarium Learning: A few ex-Cruise folks have built Aquarium Learning to help customer machine learning teams make their models better by improving their datasets. How that happens was not noted, but the firm did claim that after a few months in the market that it has reached $8,000 in monthly revenue, which is nearly a six-figure run rate. Anyway, ML is only becoming more important which means that there are only more datasets in use that probably suck. Someone is going to build a big company here. Perhaps it’s Aquarium Learning.

Strive School: Strive School is building a Lambda School for Europe, leveraging income-share agreements to train software engineers who don’t pay for the education until they get a job in the industry. Once a graduate lands a role, the ISA terms charge the person 10% of salary for four years with a maximum total of €18,000. Read our coverage here.

Image Credits: Kuleana

Kuleana: Aiming to be the “Impossible Foods of seafood”, they’re making a plant-based raw tuna replacement. Currently has $400k in letters-of-intent.

Once: A Shopify storefront optimized for mobile. The startup is trying to funnel e-commerce traffic into mobile purchases, which is not currently as seamless as the desktop experience. By using Instagram stories, Once has created 12 mobile storefronts. The flagship customer has increased conversation rate by 70 percent.

Justo: In Latin America as in the rest of the world, restaurants are working with delivery services to serve quarantining customers. But the apps often take large cuts and hold customer data hostage. Justo aims to provide custom-built e-commerce websites for restaurant brands and provide order and delivery for a maximum 15 percent take — plus the owners get to keep the precious data accrued from the service.

Glimpse: Glimpse helps consumer brands place products in Airbnbs that are part of the Glimpse network. Glimpse gets paid by the brands, and the brands themselves get to put their goods in front, or in the hands of consumers in the market today. If folks who rent Airbnbs are your jam, then Glimpse might be a good alternative to retail. How inventory is managed and so forth wasn’t mentioned, but if Airbnb is on the way back up, perhaps it’s a good moment for Glimpse to unify the house-sharing and consumer D2C boom into a single experience.

Revel Technologies: Aiming to make a “better caffeine” called Paraxanthine. Founder Jeffrey Dietrich (a BioEngeering PhD) says that double-blind tests have shown Revel’s caffeine alternative increases alertness without the jitters/anxiety.

Omni: Helps sales and support teams get up-to-date and accurate answers for their customers. While a rep is on a call, Omni searches across tools to answer customer questions and confirm if information is accurate and up to date. Think of it as a smarter way to answer burning questions, without having to mine through old Slack conversations for the latest updated information. After launching two months ago, Omni has landed $80,000 in pilot programs from Dave, Notion, and Parsable.

Mailwarm: The founders of Mailwarm in their previous companies used email as their main line of communication with customers, but found that even “legit” marketing emails were relegated to the spam folder 20 percent of the time. Mailwarm is the tool they developed to prevent this from happening, and they’re seeing big organic growth and $50K in MRR after just a few months online.

Papercups: On the heels of news that Intercom has hired a CFO and is going to go public in a few years, Papercups wants to sneak up behind the company and pull its sweater over its head while nicking its wallet. In short, Papercups is building an “open-core” piece of software that may be able to challenge the chat portion of the Intercom product set. Sans revenue, the startup flexed 1,500 GitHub stars. Towards the end of its pitch, Papercups said that it intends to charge $50,000 to $250,000 for an enterprise-version of its product in time. We know that Intercom works, so let’s see what Papercups can do in its shadow.

Atmos: Atmos is building a managed marketplace for homebuilding, connecting users that want to build a house with builders who can help them do just that and the financing to make it happen. Since launching in Q2, the company has brought in more than $500k in booked revenue.

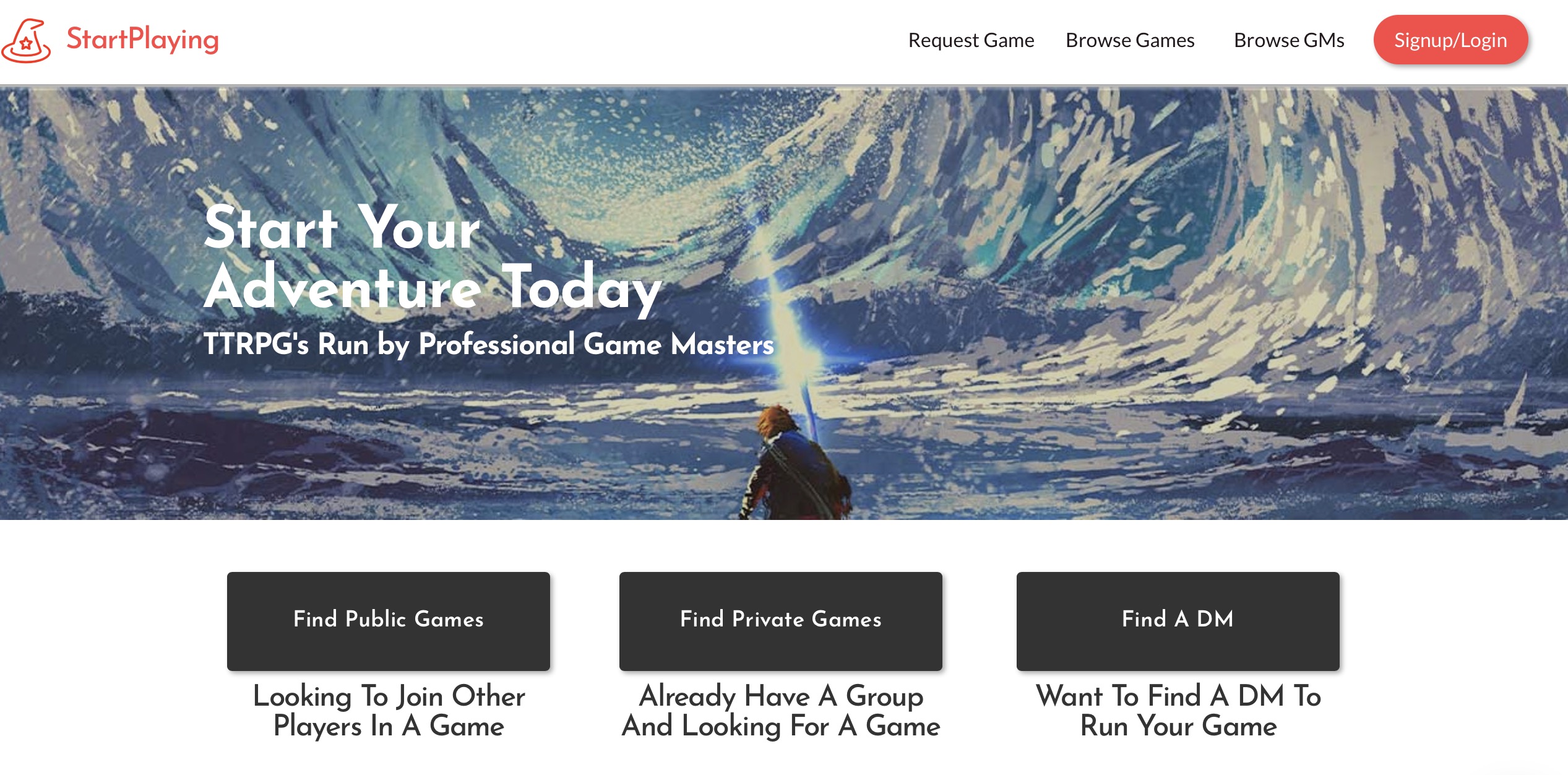

Image Credits: StartPlaying

StartPlaying.Games: A marketplace for hiring hosts for social tabletop games like Dungeons and Dragons. DMs for Hire! Meant to help new players learn to play, or help existing players find experienced hosts. Hosts set their own price. Currently seeing a GMV of over $10k per month.

Together Video Chat: For kids, Facetime and Zoom might not be the most engaging way to communicate. Together Video Chat wants to bring an interactive element to video chatting between families and kids, like reading a book or playing games over the screen. The startup is making $17,000 in monthly recurring revenue.

Reach.live: Lifestyle creators looking to monetize live content like yoga or cooking classes often have to resort to multiple platforms. Reach.live aims to put all of them together: storefront, scheduling, payments, subscriptions, donations, and even the video hosting.

Toolbox: An application and labor marketplace that connects general contractors on construction sites with qualified laborers. The service is currently live in New York City and drove $88,000 in GMV in July, a figure that it expects to rise to $102,000 in GMV in August. Toolbox can help some workers find full-time jobs, or plug in shorter work to fill demand gaps. And, Toolbox thinks that it can snag 25% of the total spend. That’s a big take.

Fig: Fig is building an app store for the terminal that allows developers to access lightweight graphical interfaces for common integrations without leaving terminal. These integrations can be further dialed in by the startup’s Teams product that allows engineerings teams to quickly access internal tools and share workflows.

Perch: Pitching itself as “Credit Karma for the underbanked”, Perch helps users build their credit score by turning recurring payments (like rent) into credit payments. The team says they currently have 22,000 users on the waitlist.

SiPhox: A circuit board for optical chips. The startup wants to replace refrigerator-sized diagnostic machines with a tiny chip. It’s first product is a $1 COVID test on a disposable cartridge.

Vectrix: As companies grow, they constantly accrue cloud services and other tools, and with them the possibility of security problems among and between them. Normally the company’s own security engineers would develop their own methods of scanning and monitoring for security issues, but Vectrix provides a marketplace for these processes so they can be set up faster and easier.

Recurrency: This startup is building an “automated” ERP, or enterprise resource planning service, for wholesalers. So far it appears to be working, with Recurrency growing from $0 to $17,000 in MRR during its time at Y Combinator. Per its quick talk, the company has found hundreds of thousands of potential customers.

Known Medicine: Known Medicine is looking to take the experimentation of how tumors respond to cancer drugs out of the patient’s body and into the lab. The startup breaks down tumor samples into micro tumors, which they treat separately inside specialized micro-environments with different methods and see what works best.

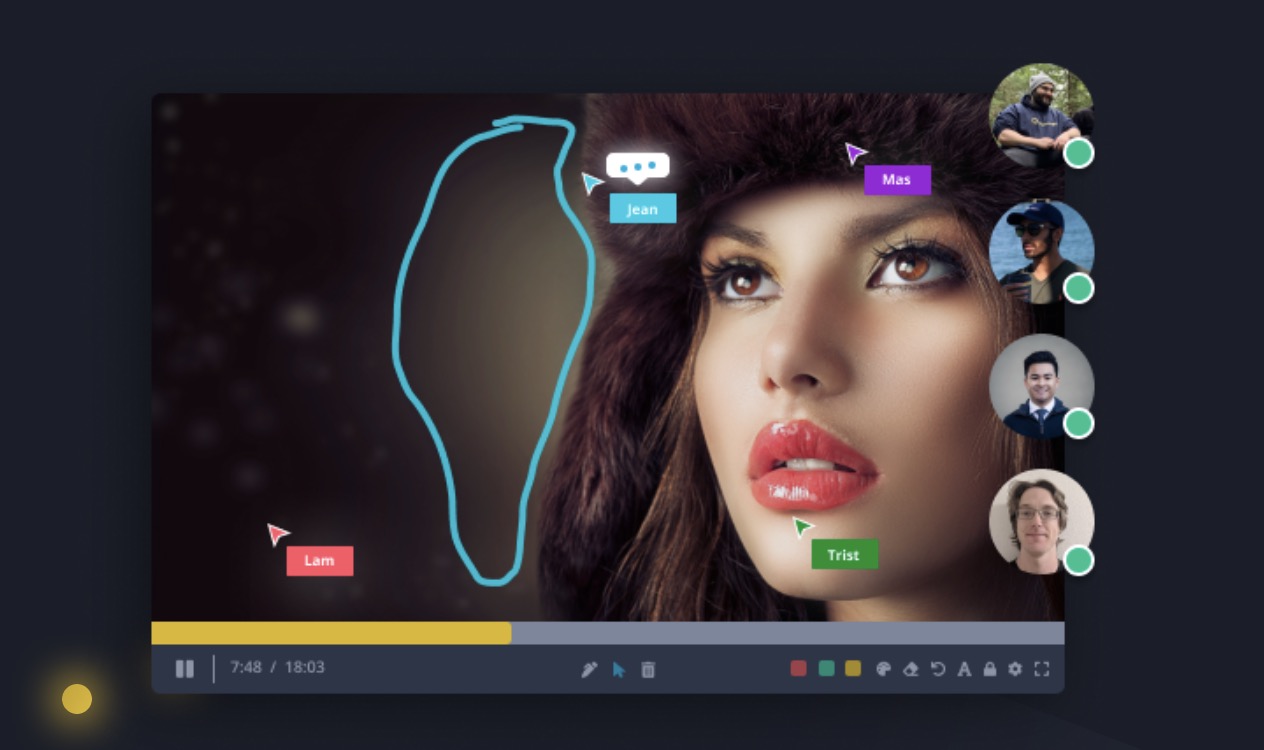

Queue: Real-time collaboration and feedback software for video producers and editors. Allows groups to drop feedback and timestamped comments into the video timeline, or draw notes/concepts directly on the video.

Conta Simples: A digital bank account for startups based in Brazil. The startup helps other online businesses get corporate cards fast and without big fees. Last month, the startup made $50,000 in revenue. The founding team hails from various payments and fintech businesses in Brazil.

Vitable Health: Workers earning living wages often don’t have healthcare options from their employer, and Vitable aims to change that with a plan that costs a tenth of others but still offers primary and urgent care coverage. It relies on nurse practitioners performing telehealth and in home visits, and has catastrophic coverage for emergencies — and costs $50 per month. They’re profitable and small but growing in the Philadelphia area.

ZipSchool: Every parent is worried about their kid’s education this year and the amount of time that those same children are spending on screens. ZipSchool — one of the hotter companies that demoed today, we’re told — is homeschool for kids, on screens, via Zoom. So, it’s screen time, but useful. Its site notes topics that kids might find engaging like art, space, and extreme weather. It’s 2020 and a pandemic and a recession and parents have had to park kidlets with tablets on couches. Why not make that time a bit more constructive?

Minimum: Minimum is another app building a toolset that automatically tracks and offsets a person’s carbon emissions. Minimum is looking to partner with companies directly to help employees stay mindful. It’s a familiar model that pairs a calculator with payments to offset a person’s carbon footprint with Minimum taking 20% off the top.

Image Credits: Sidekick

Sidekick: Standalone, “always-on” video chat hardware meant to help remote teams keep in touch. Charges $50 per user per month. We covered Sidekick here.

Ribbon: Ribbon gives creators and businesses a way to sell tickets for online virtual events, ranging from master classes to fitness workouts. Ribbon has sold $47,000 in tickets sold last week alone, with a 2.8% take rate.

Sameplan: According to Sameplan’s founders, sales reps are basically project managers, but lack the tools PMs usually use to do the job. Sameplan aims to help sales teams share and synchronize data between deals and projects in an organized way, replacing endless email threads and spreadsheets. Heap, Okta and Front have bit for the alpha.

Workbase: A data visualization and analytics tool for account/growth teams, meant to “help B2B companies reduce churn and grow customer spending”. They currently have 3 contracts after launching in May 2020.

Nototo: Nototo is building a visual map interface for note-taking, bringing a very unique interface to a productivity vertical known for its innovative app designs. The app basically encourages users to organize their maps geographically rather than sticking them in nested bullet points and folders.

Plunzo: Helps SMBs in Latin America bring all of their bank accounts into a single UI. The company’s founders say that after launching in early august, they’re already working with over 3,000 retail accounts.

Tella: Tella is building a way to collaboratively edit video from a browser-based application. The startup, which was founded in May, wants to compete with Quicktime and Loom with an easier-to-use edit platform. It helps you piece together video clips from screen and camera recordings, currently sporting 100 weekly users.

Mozart Data: Everything is SaaS now, which means companies may have their data spread over half a dozen tools from Salesforce, Stripe, and so on. Mozart Data collects, organizes, and manages all that data in one place, with no data engineering skills required, in about an hour. The team previously built data tools for companies like Yammer, Clover, Opendoor and others and hope to bring that expertise to growing enterprises looking to scale fast.

Palo Alto Networks to buy digital forensics consulting firm for $265M

It’s been quite a day in the tech world, with a bushel of S-1s being filed to go public. Not to be left out, the ever acquisitive Palo Alto Networks announced its intent to acquire The Crypsis Group, an incident response, risk management and digital forensics consulting firm, for a crisp $265 million.

Nikesh Arora, chairman and CEO at Palo Alto Networks, sees a company that builds on the foundation of services the cybersecurity giant already provides, giving customers a set of services to lean on when a breach happens.

“By joining forces, we will be able to help customers not only predict and prevent cyberattacks but also mitigate the impact of any breach they may face,” he said. While the kinds of tools that Palo Alto provides are designed to prevent attacks, the fact is no set of tools is foolproof, and it’s always going to be a cat and mouse game between companies like Palo Alto and the attackers trying to breach their defenses.

Crypsis can help figure out how a breach happened and ways to close up the cracks in the foundation to prevent access through that particular weak point in the future. “We have dedicated ourselves to creating a more secure world through the fight against cybercrime. Together with Palo Alto Networks, we will be able to help businesses and governments better respond to threat actors on a global scale,” Bret Padres, CEO of The Crypsis Group said in a statement.

When the deal closes, and The Crypsis Group is in the fold, Palo Alto will gain more than 150 highly trained consultants, who have been handling approximately 1,300 incidents a year. This gives Palo Alto some serious consulting fire power to deal with those times when attackers get through their defenses.

The Crypsis Group has up until now been part of a larger security consultancy called ZP Group. The deal is expected to close in the fiscal first quarter of 2021, which just started when Q42020 closed today. Per usual, the acquisition will be subject to regulatory scrutiny, as Palo Alto is a public company.

Our 11 favorite companies from Y Combinator’s S20 Demo Day: Part I

Startup incubator and investment group Y Combinator today held the first of two demo days for founders in its Summer 2020 batch.

So far, this cohort contains the usual mix of bold, impressive and, at times, slightly wacky ideas young companies so often show off.

This was Y Combinator’s second online demo day, its first all-virtual class and the first time that it held live, remote pitches. The event largely went well, with founders dialing in from around the globe to share a few paragraphs of notes and a single slide. There were few technical hiccups, given the sheer number of startups presenting.

But if you are not in the mood to parse through dozens (and dozens) of entries detailing each startup that showed off its problem, solution and growth, the TechCrunch crew has collected our own favorites based on how likely a company seems to succeed and how impressed we were with the creativity of their vision. For each entry, one staffer made the call that the startup in question was among their favorites.

We’re not investors, so we’re not pretending to sort the unicorns from the goats. But if what you need is a digest of some of the day’s best companies to get a good taste of what founders are building, we have your back.

ZipSchool and Hellosaurus

The next wave of edtech startups is entering a market that demands a better remote-learning solution for younger learners. But that’s the obvious product gap, one that is already being tackled by the biggest names in the booming category.

The non-obvious product-market deficit is how teachers, also impacted by the pandemic, are searching for new ways to interact with students. Teachers are collaborating and cross-pollinating on successful lesson plans that work across stale Zoom screens, so why not monetize that same content?

Daily Crunch: TikTok sues the US government

TikTok fights its U.S. ban, Twitter takes action against another Trump tweet and Unity files to go public. This is your Daily Crunch for August 24, 2020.

The big story: TikTok sues the U.S. government

TikTok is fighting back against the Trump administration’s decision to ban the popular video app in the U.S. market (unless it’s sold to an American buyer). The company filed a lawsuit today claiming that the president’s executive order was signed without evidence or due process.

In its suit, the company argued:

The executive order seeks to ban TikTok purportedly because of the speculative possibility that the application could be manipulated by the Chinese government. But, as the U.S. government is well aware, Plaintiffs have taken extraordinary measures to protect the privacy and security of TikTok’s U.S. user data including by having TikTok store such data outside of China (in the United States and Singapore) and by erecting software barriers that help ensure that TikTok stores its U.S. user data separately from the user data of other ByteDance products.

The tech giants

Twitter hides Trump tweet behind notice for potentially dissuading people from voting — In the tweet, posted on Monday, Trump claimed mail drop boxes are a “voter security disaster” and also said they are “not COVID sanitized.”

Zoom meetings hit by outage — Don’t worry, the outage has been resolved.

Facebook to pay $125 million in back taxes in France — French tax authorities raided Facebook’s offices in Paris in 2012 and later opened an investigation on unpaid taxes covering activities between 2009 and 2018.

Startups, funding and venture capital

Sequoia strikes gold with Unity’s IPO filing — After much anticipation, video game engine Unity filed its Form S-1 with the SEC as it prepares a roadshow to go public in the coming weeks.

SugarCRM acquires Node to gain predictive customer intelligence — The acquisition will add a customer prediction element to Sugar’s platform.

With $11 million in fresh capital, Bolt Bikes rebrands to Zoomo — The new name is meant to reflect a customer base that has expanded beyond gig economy workers to include corporate clients and everyday consumers.

Advice and analysis from Extra Crunch

Five VCs discuss how no-code is going horizontal across the world’s industries — Few topics garner cheers and groans quite as quickly as the no-code software explosion.

Red Antler’s Emily Heyward explains how to get people obsessed with your brand — Heyward’s branding company has worked with some of the most iconic startups of the past decade, such as Casper, Allbirds, Brandless and Prose.

Unpacking the Sumo Logic S-1 filing — The company’s showing strong growth for a business now comfortably into the nine-figure annual revenue range.

(Reminder: Extra Crunch is our subscription membership program, which aims to democratize information about startups. You can sign up here.)

Everything else

Conan is coming to Disrupt 2020 — Conan O’Brien will be discussing his shift to podcasting, and more.

Original Content podcast: On Netflix’s ‘Selling Sunset’, everyone’s a villain — Speaking of podcasts, we’ve got a review of the evil-but-addictive Netflix reality show “Selling Sunset.”

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Sutter Hill strikes ice-cold, $2.5B pre-market return with Snowflake’s IPO filing

Today is the day for huge VC returns.

We talked a bit about Sequoia’s coming huge win with the IPO of game engine Unity this morning. Now, Sequoia might actually have the second largest return among companies filing to go public with the SEC today.

Snowflake filed its S-1 this afternoon, and it looks like Sutter Hill is going to make bank. The long-time VC firm, which invests heavily in the enterprise space and generally keeps a lower media profile, is the big winner across the board here, coming out with an aggregate 20.3% stake in the data management platform, which was last privately valued at $12.4 billion earlier this year. At its last valuation, Sutter Hill’s full stake is worth $2.5 billion. My colleagues Ron Miller and Alex Wilhelm looked a bit at the financials of the IPO filing.

Sutter Hill has been intimately connected to Snowflake’s early build-out and success, providing a $5 million Series A funding back in 2012, the year of the company’s founding, according to Crunchbase.

Now, there are some caveats on that number. Sutter Hill Ventures (aka “the fund”) owns roughly 55% of the firm’s total stake, with the balance owned by other entities owned by the firm’s management committee members. Michael Speiser, the firm’s partner who sits on Snowflake’s board, owns slightly more than 10% of Sutter Hill’s stake directly himself according to the SEC filing.

In addition to Sutter Hill, Sequoia also got a large slice of the data computing company: its growth fund is listed as having an 8.4% stake in the coming IPO. That makes for two Sequoia Growth IPOs today — a nice way to start the week this Monday afternoon.

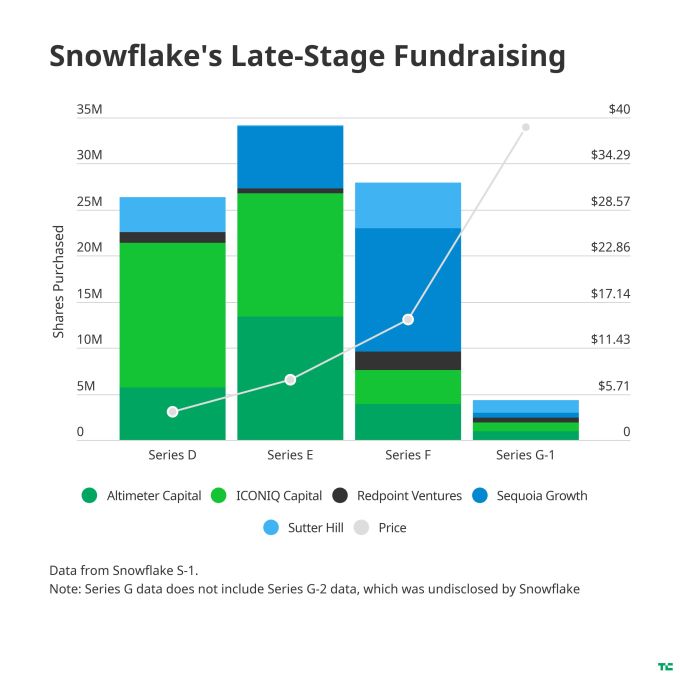

Finally, Altimeter Capital, which did the Series C, owns 14.8%; ICONIQ owns 13.8%; and Redpoint, which did the Series B, owns 9.0%.

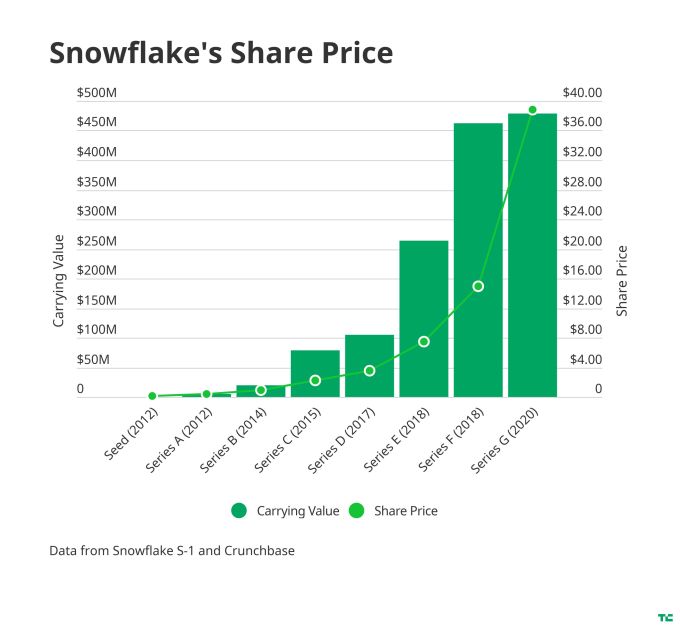

To see the breakdown in returns, let’s start by taking a look at the company’s share price and carrying values for each of its rounds of capital:

On top of that, what’s interesting is that Snowflake broke down the share purchases by firm for the last four rounds (D through G-1) the company fundraised:

That level of detail actually allows us to grossly compare the multiples on invested capital for these firms.

Sutter Hill, despite owning large sections of the company early on, continued to buy up shares all the way through the Series G, investing an additional $140 million in the later-stage rounds of the company. Adding in the entirety of its $5 million Series A round and a bit from the Series B assuming pro rata, the firm is looking on the order of a 16x return (assuming the IPO price is at least as good as the last round price).

Outside Sutter Hill, Redpoint has the best multiple return profile, given that it only invested $60 million in these later-stage rounds while still maintaining a 9.0% ownership stake. Both Sutter Hill and Redpoint purchased roughly 20% of their overall stakes in these later-stage rounds. Doing some roughly calculating, Redpoint is looking at a return of about 12-13x.

Sequoia’s multiple on investment is capped a bit given that it only invested in the most recent funding rounds. Its 8.4% stake was purchased for nearly $272 million, all of which came in these late-stage rounds. At Snowflake’s last round valuation of $12.4 billion, Sequoia’s stake is valued at $1.04 billion — a return of slightly less than 4x. That’s very good for mezzanine capital, but nothing like the multiple that Sutter Hill or Redpoint got for investing early.

Doing the same back-of-the-envelope math and Altimeter is looking at a better than 6x return, and ICONIQ got 7x. As before, if the stock zooms up, those returns will look all the better (and of course, if the stock crashes, well…)

One final note: The pattern for these last four funding rounds is unusual for venture capital: Snowflake appears to have “spread the love around,” having multiple firms build up stakes in the startup over several rounds rather than having one definitive lead.

A quick peek at Snowflake’s IPO filing

Snowflake filed to go public today joining a bushel of companies making their S-1 documents public today. TechCrunch has a longer digest of all the IPO filings coming soon, but we could not wait to get into the Snowflake numbers, given the huge anticipation that the company has generated in recent quarters.

Why? Because the cloud data warehouse company has been on a fundraising tear in recent years, including a $450 million Series F in late 2018 and a $479 million Series G in February of this year. The latter round valued the mega-unicorn at around $12.5 billion. More on this later.

Snowflake is, then, one of the world’s most valuable former startups that is still private. Its public debut will make a splash. But what did its $1.4 billion in capital raised (Crunchbase data) build? Let’s take a peek at the numbers.

Growth

Even glancing at the Snowflake S-1 makes it clear what investors are excited about when it comes to the big-data storage service: Its growth. In its fiscal year ending January 31, 2019, for example, Snowflake had revenue of $96.7 million. A year later that number was $264.7 million, or growth of around 150% at scale.

More recently, the company’s growth has remained impressive. In the six months ending July 31, 2019, Snowflake’s revenue was $104.0 million. A year later, those two quarters generated revenues of $242.0 million. That’s growth of 132.7% on a year-over-year basis. Impressive, and just the sort of top line expansion that private investors want to staple their wallet to.

So, lots of growth. But how high-quality is the revenue?

Margins

Let’s take a look at the company’s gross margins over different time periods. The data will help us better understand the company’s value, and its gross margin improvement, or impairment over time. Given Snowflake’s soaring valuation over time, we are expecting to see improvements as time passes:

- Fiscal year ending January 31, 2019: 46.5%

- Fiscal year ending January 31, 2020: 56.0%

- Six months ending July 31, 2019: 49.4%

- Six months ending July 31, 2020: 61.6%

Et voilà?! Just like we expected, improving gross margins over time. Recall that the higher (stronger) a company’s gross margins are, the more of its revenue it gets to keep to cover its operating costs. Which is, notably, where the Snowflake story goes from super-exciting to slightly harrowing.

Let’s talk losses.

Losses

In no way does Snowflake’s operations pay for themselves. Indeed, the company is super unprofitable on both an operating and net basis.

In its fiscal year ending January 31, 2019, Snowflake lost $178.0 million on a net basis. A year later the figure swelled to $348.5 million. In the six months ending July 31, 2019, the company’s net loss was $177.2 million. In the same two quarters of this year, it was slightly lower at $171.3 million.

And that’s why the company is probably trying to go public. Now that it can point to falling net losses as its revenues grow and its gross margins improve, you can chart a path to break-even. And Snowflake’s operations are burning less cash over time. The pace was north of $50 million a quarter in the two three-month periods ending July 31, 2019, for example.

And even more, if we look inside the last two quarters, the most recent period (three months ending July 31, 2019) is larger than the one preceding it in revenue terms ($133.1 million versus $108.8 million), and its net loss is smaller ($77.6 million versus $93.6 million). This lowered the company’s net margin from -86% to -58%. Still bad! But far less bad in short order, which could cut worries about Snowflake’s enormous history of unprofitability at scale.

How we got here

Since Snowflake first appeared in 2012, its ability to take the idea of a data warehouse, a concept that has existed on prem for years, and move into a cloud context had great appeal — and it attracted great investment. Imagine taking virtually all your data and having it in a single place in the cloud.

The money train started slowly at first, with $900,000 in seed money in February 2012, followed quickly by a $5 million Series A later that year. Within a few years investors would be handing the company bundles of cash and the train would be the high-speed variety, first with former Microsoft executive Bob Muglia leading the way, and more recently with former ServiceNow CEO Frank Slootman in charge.

By 2017 there were rapid-fire rounds for big money: $105 million in 2017, $263 million in January 2018, $450 million in October 2018 and finally $479 million this past February. With each chunk of money came gaudier valuations, with the most recent weighing in at an eye-popping $12.4 billion. That was triple the company’s $3.9 billion valuation in that October 2018 investment.

Telegraphing the inevitable

In February, Slootman did not shy away from the IPO question. Unlike so many startup CEOs, he actually embraced the idea of finally taking his company public, whenever the time was right, and apparently that would be now, pandemic or not.

He actually almost called the timing in a conversation with TechCrunch at the time of the $479 million round:

I think the earliest that we could actually pull that trigger is probably early- to mid-summer time frame. But whether we do that or not is a totally different question because we’re not in a hurry, and we’re not getting pressure from investors.

All money talk aside, at its core, what Snowflake offers is this ability to store vast amounts of data in the cloud without fear of locking yourself in to any particular cloud vendor. While all three cloud players have their own offerings in this space, Snowflake has the advantage of being a neutral vendor — and that has had great appeal to customers, who are concerned about vendor lock-in.

As Slootman told TechCrunch in February:

One of the key distinguishing architectural aspects of Snowflake is that once you’re on our platform, it’s extremely easy to exchange data with other Snowflake users. That’s one of the key architectural underpinnings. So content strategy induces network effect which in turn causes more people, more data to land on the platform, and that serves our business model.

So what?

When it rains it pours. Unity filed. JFrog filed. We still need to talk X-Peng. Corsair has filed as well. And there are still a host of companies that have filed privately, like Airbnb and DoorDash, that could drop a new filing at any moment. What an August!

Unity’s IPO numbers look pretty … unreal?

Unity, the company founded in a Copenhagen apartment in 2004, is poised for an initial public offering with numbers that look pretty strong.

Even as its main competitor, Epic Games, is in the throes of a very public fight with Apple over the fees the computer giant charges developers who sell applications (including games) on its platform (which has seen Epic’s games get the boot from the App Store), Unity has plowed ahead, narrowing its losses and maintaining its hold on over half of the game development market.

For the first six months of 2020, the company lost $54.2 million on $351.3 million in revenue. The company narrowed its losses compared to 2019, when the company lost $163.2 million on $541.8 million in revenue, and 2018 when the company lost $131.6 million on $380.8 million in revenue. As of June 30, 2020 the company had total assets of $1.29 billion and $453.2 million in cash.

Increasing revenue and narrowing losses are things that investors like to see in companies that they’re potentially going to invest in, as they point to a path to profitability. Another sign of the company’s success is the number of customers that contribute more than $100,000 in annual revenue. In the first six month of the year, Unity had 716 such customers, pointing to the health of its platform.

The company will trade on the NYSE under the single-letter ticker “U”. The NYSE only has a few single letters left to offer, although Pandora gave up the letter P when it was bought by Liberty Media back in 2018.

Unlike Epic Games, Unity has long worked with the major platforms and gaming companies to get their engine in front of as many developers and gamers as possible. In fact, the company estimates that 53% of the top 1,000 mobile games on the Apple App Store and Google Play Store and over 50% of mobile, personal computer and console games were made with Unity.

Some of the top titles that the platform claims include Nintendo’s Mario Kart: Tour, Super Mario Run and Animal Crossing: Pocket Camp; Niantic’s Pokémon GO and Activision’s recent Call of Duty: Mobile are also Unity games.

The knock against Unity is that it’s not as powerful as Epic’s Unreal rendering engine, but that hasn’t stopped the company from making forays into industries beyond gaming — something that it will need to continue doing if it’s to be successful.

Unity already has a toehold in Hollywood, where it was used to recreate the jungle environment used in Disney’s “Lion King” remake (meanwhile, much of “The Mandalorian” was created using Epic’s Unreal engine).

Of course, Unity’s numbers also reveal that the size of its business is currently a bit smaller than its biggest rival. In 2019, Epic said it had earnings of $730 million on revenue of $4.2 billion, according to VentureBeat . And the North Carolina-based game developer is now worth $17.3 billion.

Still, the games market is likely big enough for both companies to thrive. “Historically there has been substantial industry convergence in the games developer tools business, but over the past decade the number of developers has increased so much, I believe the market can support two major players,” Piers Harding-Rolls, games analyst at Ampere Analysis, told the Financial Times.

Venture investors in the Unity platform have waited a long time for this moment, and they’re certainly confident in the company’s prospects.

The last investment round valued the company at $6 billion, with the secondary sale of $525 million worth of the company’s shares.

TikTok-rival Triller inks deal with Reliance’s JioSaavn in India push

Triller, an app that functions similarly to TikTok, has inked a strategic partnership with a platform owned by India’s richest man to cash in on the Chinese app’s ban in its biggest international market.

The Los Angeles-headquartered firm said on Monday it has partnered with Reliance’s JioSaavn music app to embed Triller videos into the streamer “front and center.”

As part of what Triller said was the “first of many announcements to come from these two digital powerhouses,” JioSaavn app will also provide a “prominent” button on its main screen that will enable its users to create a Triller video, the American firm said.

The announcement comes as scores of local startups have rushed to fill the void from New Delhi’s ban on TikTok and 58 other Chinese apps over cybersecurity concerns created at the end of June this year.

Some of the local firms that are attempting to cash in on TikTok’s absence include on-demand video streaming service Zee5, news aggregator app DailyHunt and Times Internet’s music streaming service Gaana and video streamer MX Player.

Top Android apps in India, by download figures, 50-odd days before New Delhi banned dozens of Chinese apps (left) Vs. 50-odd days since the ban. pic.twitter.com/OLUj6AKNHp

— Manish Singh (@refsrc) August 24, 2020

So Indian billionaire Mukesh Ambani’s JioSaavn, one of the largest music streaming services in India, showing user-generated videos doesn’t sound like an absurd idea anymore.

Triller claims JioSaavn has amassed over 300 million users in India. I don’t think so: Its Android app had fewer than 30 million weekly active users earlier this month, according to one of the top mobile insight firms. And a press release from two months ago on JioSaavn’s website says it had over 104 million monthly active users.

But what is more interesting about this partnership is that it exists at all. As of early this month, Reliance Industries, the firm that runs telecom giant Jio Platforms, was in early discussions with ByteDance to invest in TikTok’s operations in India. (Jio Platforms, which has raised over $20 billion from Facebook and a dozen other investors this year, operates a bouquet of digital services, including JioTV, JioCinema, and Haptik.)

At any rate, Rishi Malhotra, co-founder and chief executive of JioSaavn, said the partnership with Triller will enable “artists to create and express our culture in the most innovative ways. We are confident that this partnership will exponentially grow both companies.”

Bobby Sarnevesht, executive chairman of Triller, said he was pleased, too, in a statement.