California’s blazes have sent a haze across the United States. An experimental model shows where that cloud ends up.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

Are Radioactive Diamond Batteries a Cure for Nuclear Waste?

Researchers are developing a new battery powered by lab-grown gems made from reformed nuclear waste. If it works, it will last thousands of years.

I Was a Floating Head at an NBA Game. It Gets Weirder

Crowds of spectral, legless virtual fans are part of the league’s stab at preserving the ambiance of pre-pandemic basketball. I took a seat.

Apple Accidentally Approved Malware to Run on MacOS

The ubiquitous Shlayer adware has picked up a new trick, slipping past Cupertino’s “notarization” defenses for the first time.

Twitter flags Republican leader’s video as ‘manipulated’ for altering disabled activist’s words

Twitter flagged an inflammatory video by House Republican Whip Steve Scalise on Sunday for altering footage of a conversation between progressive activist Ady Barkan and Joe Biden. The video is now labeled as “manipulated media” in a tweet from Scalise, though remains online.

The inflammatory video pulls in out-of-context quotes from a number of Democrats and activists, but appears to have crossed a line by altering Barkan’s words from a portion of the conversation about policing reform. Barkan, who has ALS, speaks with an assistive eye-tracking device.

“These are not my words. I have lost my ability to speak, but not my agency or my thoughts,” Barkan tweeted in response, adding “…You owe the entire disability community an apology.”

These are not my words.

I have lost my ability to speak, but not my agency or my thoughts.

You and your team have doctored my words for your own political gain.

Please remove this video immediately. You owe the entire disability community an apology. https://t.co/N6G5RgMXlO

— Ady Barkan (@AdyBarkan) August 30, 2020

In the video excerpt, taken from a longer conversation about policing and social services, Barkan appears to say “Do we agree that we can redirect some of the funding for police?” In reality, Barkan interrupted Biden during the conversation to ask “Do we agree that we can redirect some of the funding?”

In the video, Barkan’s altered sentence is followed by a dramatic black background stamped with the words “No police. Mob rule. Total chaos. Coming to a town near you?” Those ominous warnings are followed by a logo for Scalise’s reelection campaign.

The addition of the two words, falsely rendered in Barkan’s voice, don’t significantly change the meaning of his question, but the edit still crossed a line. A Twitter spokesperson confirmed that the tweet violated the company’s policy for “synthetic and manipulated media,” though did not specify which part of the video broke the rules.

The synthetic and manipulated media policy states that Twitter “may label Tweets containing synthetic and manipulated media to help people understand their authenticity and to provide additional context.” In the policy, Twitter explains specifically that “new video frames, overdubbed audio” and other edits count as deceptive and significant manipulation.

The Station: Luminar takes the SPAC path and Voyage lifts the hood on its next-gen robotaxi

The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every Saturday in your inbox.

Hello and welcome back to The Station, a newsletter dedicated to all the present and future ways people and packages move from Point A to Point B.

I’ll skip the typical wind up and get right to things this week. We’ve got SPACs, venture deals and micromobility news along with a peek at one AV company’s newest vehicle.

I wanted to mention one item before we launch because it speaks to a larger issue of safety and how some shared mobility startups are turning to tech in an attempt to improve it.

Shared electric moped startup Revel resumed operations in New York City a month after shutting down its service following several deaths. The startup’s blue mopeds (3,000 of them) that had become a familiar sight in New York City are back, but with a number of new protocols and features aimed at boosting safety and assuaging city officials. Revel is leaning heavily on tech, and specifically its app, to improve safety, including training videos and tests, a helmet selfie feature that requires photographic evidence the user is wearing a helmet and a community reporting tool. The question is, will this effort be sufficient?

Alright, let’s go!

Email me anytime at [email protected] to share thoughts, criticisms, offer up opinions or tips. You can also send a direct message to me at Twitter — @kirstenkorosec.

Micromobbin’

Remember last week when I told y’all about California Assembly Bill 1286? Here’s a quick refresher: the bill passed the Assembly in 2019 and moved over to committee within the Senate. It sat untouched until this month, when it popped up and passed a committee vote, an action that sent it to the full Senate.

To say the micromobility industry was caught off guard, might be an understatement. The action set off alarm bells and a coalition of micromobility companies, advocacy groups and bike share operators sent a letter to Senate leadership arguing that the bill was an existential threat to shared micromobility in the state. The group was specifically concerned with a line in the bill that would prohibit companies from putting a liability waiver in the user agreement.

That language was removed this week, prompting at least a few emails with comments like “micromobility in California has been saved.”

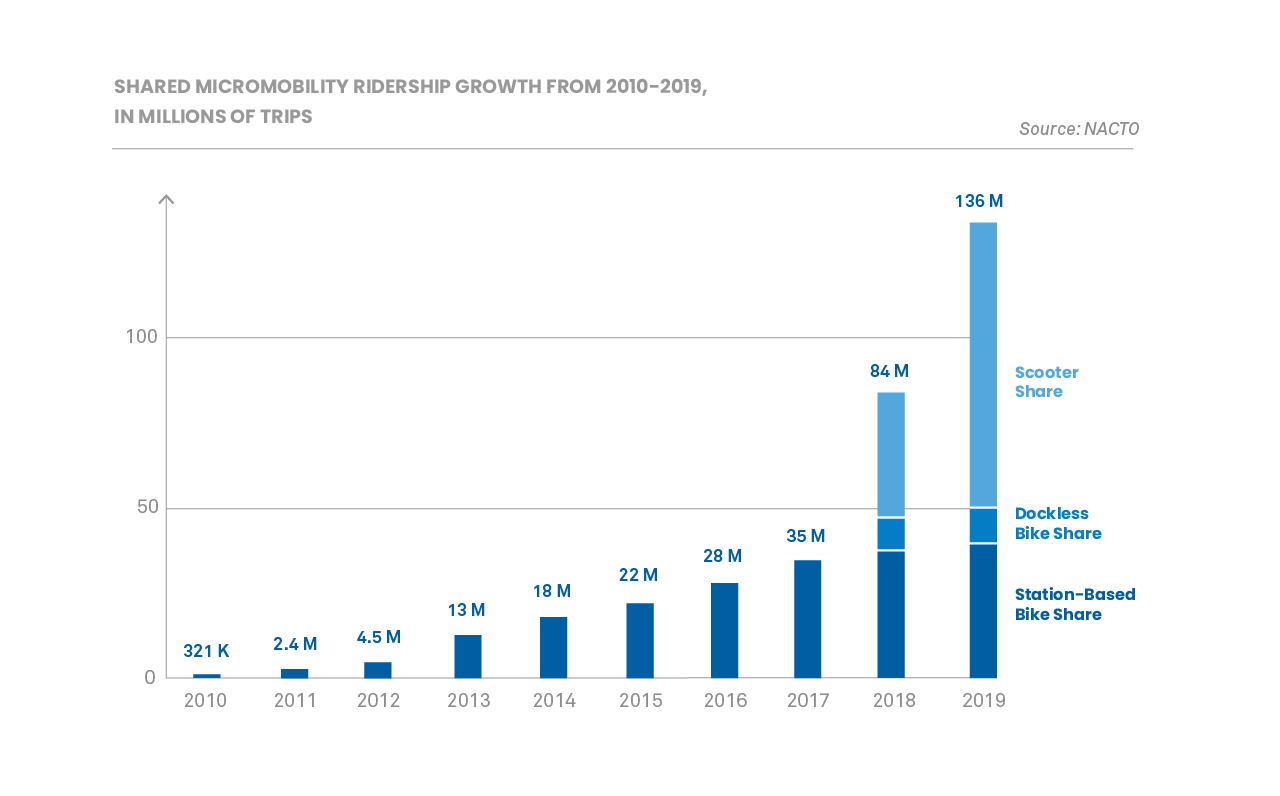

The National Association of Transportation Officials released its annual report on the growth and use of shared micromobility such as bike share, e-bike share and scooter share in the United States. This report focuses on 2019 ridership data, however, NACTO also weighs in a bit on the first half of 2020.

The study found that people in the U.S. took 136 million trips on bikes and scooters in 2019 — a 60% increase from the previous year. Of those trips, 40 million were on station-based bike share systems. The remaining 96 million trips were on dockless systems with 10 million on ebikes and 86 million on scooters.

That doesn’t mean it was a balanced picture. NACTO reported that scooter expansion was in some cases unstable as companies exited markets at the end of the year (prior to the pandemic), possibly due to over-competition and other market pressures.

Shared micromobility trips were on average 11 to 12 minutes long and for a distance of 1 to 1.5 miles. Short trips are important, NACTO said in its report, noting that 35% of all U.S. car trips are under 2 miles.

Adam Kovacevich, Lime’s head of North America and APAC Government Affairs, called the numbers “eye popping” in an emailed statement, adding that “People are voting with their feet, and they clearly want more scooters and dockless bikes in their cities.”

We’re not finished yet; one more item of note. Jump returned to the Sacramento region on Saturday. Through an agreement with SACOG, Lime said it is now the “exclusive” regional bikeshare operator for the region.

Deal of the week

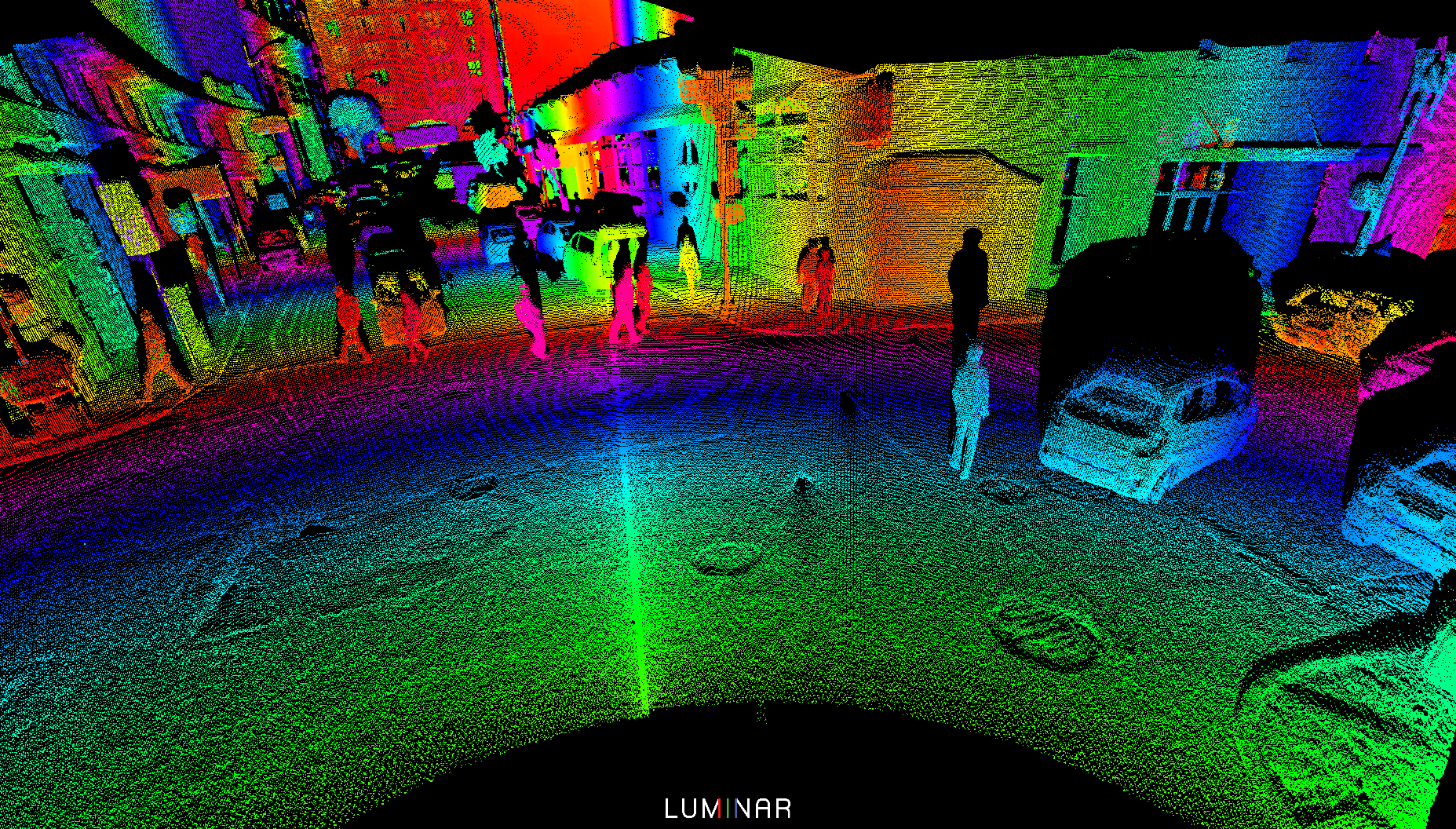

Luminar, the lidar startup founded in 2012 by whiz kid and Thiel fellow Austin Russell, has taken the SPAC path to the public markets. SUMMER OF THE SPAC CONTINUES!

The lidar startup announced it was merging with special purpose acquisition company Gores Metropoulos Inc., with a post-deal market valuation of $3.4 billion. The SPAC merger comes just three months after Luminar hit a critical milestone and announced that Volvo would start producing vehicles in 2022 equipped with its lidar and a perception stack. Volvo plans to use the Luminar technology to deploy an automated driving system for highways in its production vehicles.

Russell told me in a recent interview that they wanted to go public at some point, but the momentum from the Volvo deal along with interest within public markets led the company to take the SPAC route.

Luminar is the latest startup — and second lidar company — to turn to SPACs this summer in lieu of a traditional IPO process. In June, Velodyne Lidar struck a deal to merge with special purpose acquisition company Graf Industrial Corp., with a market value of $1.8 billion. Four electric vehicle startups have also skipped the traditional IPO path in recent months, opting instead to go public through a merger agreement with a SPAC, which are also known as blank check companies. Canoo, Fisker Inc., Lordstown Motors and Nikola Corp. have gone public via a SPAC merger this spring and summer. Shift Technologies, an online used car marketplace, also used a SPAC to go public.

Meanwhile, Chinese electric automaker Xpeng Inc. made its public market debut the old-fashioned way. Although this traditional IPO path still packed in some unexpected financial thrills. Despite escalating tensions between the U.S. and China, the company raised more than it expected in its initial public offering.

Xpeng, which began trading Thursday on the New York Stock Exchange under the ticker symbol XPEV, said in a filing that it sold 99.7 million shares for $15 each, raising about $1.5 billion through its initial public offering. The automaker had originally planned to sell 85 million shares with a price guidance of between $11 and $13.

Xpeng will need the capital. The company faces an increasingly crowded pool of electric automakers in China, including Tesla, Li Auto and Nio. Shares of Xpeng closed up at $22.79 on Friday.

Other deals that got my attention …

CoPilot, a mobile app for buying and owning vehicles, raised $10 million in a new Series A funding round led by Next Coast Ventures, with participation from Max Levchin’s SciFi Ventures and Arthur Patterson, co-founder of Accel Partners, along with existing investors Chicago Ventures. The investment brings the company’s total outside funding to $17 million.

curbFlow, a curb management startup that uses a network of computer vision devices to detect available parking spots, raised $8 million in seed stage funding led by General Catalyst and Initialized Capital. Doordash is its first paying customer. Keep an eye out for a longer piece on curbFlow; I interviewed the founder Ali Vahabzadeh about the startup and where he sees it evolving. If the name Ali Vahabzadeh sounds familiar, it should. He is the co-founder and former CEO of Chariot, the on-demand shuttle service that Ford acquired and then killed off.

Delivery Hero, the Berlin-based restaurant delivery company that operates mainly in emerging markets, acquired Dubai-based grocery delivery platform InstaShop. The acquisition values the company at $360 million, $270 million upfront plus an additional $90 million based on InstaShop meeting certain growth targets, according to the company. Investors in InstaShop are surely celebrating right now. The five year-old startup had raised just $7 million before being acquired.

Firefly, which offers Uber and Lyft drivers a digital display to make extra money by running ads, acquired Strong Outdoor. The company said it has also become the advertising partner for fleet operator Sally.

Fox Robotics, the Austin-based startup that builds automated forklifts, raised $9 million in a Series A round led by Menlo Ventures. The latest round brings its total funding to date up to $13 million, with support from previous investors Eniac, Famiglia, SignalFire, Congruent, AME and Joe.

Motiv Power Systems, a company that builds all-electric chassis and software systems for the electrification of medium-duty trucks and buses, said it has secured $15 million in additional funding from GMAG Holdings Corp. The company that the funding will be made by means of convertible notes that are expected to be converted into a Series C funding round, which Motiv is in the process of raising.

Shopmonkey, a San Jose, Calif.-based SaaS startup that serves auto repair shops, raised $25 million in a Series B funding round led by Bessemer Venture Partners with participation from Index Ventures, e.ventures and I2BF.

Zoomo, a three-year-old electric bike platform marketed to gig economy delivery workers, raised $11 million from a Series A funding round led by Australian Clean Energy Finance Corporation. Zoomo was actually Bolt Bikes until this past week. The company announced its new name along with its funding round. The round also included equity from Hana Ventures and existing investors Maniv Mobility and Contrarian Ventures, together with venture debt from OneVentures and Viola Credit.

People: layoffs, hiring and moves

It’s been a minute since I wrote about hirings and firings and such. Two bits of hiring news got my attention this week.

First up, Bloomberg reported that Rivian hired former Tesla executive Nick Kalayjian to lead its engineering. Kalayjian is replacing Mark Vinnels, a former executive a McLaren Automotive.

You might recall that relations between Rivian and Tesla are a bit prickly at the moment. Tesla filed a lawsuit in July against Rivian and four former employers on claims of poaching talent and stealing trade secrets. Specifically, Tesla claimed that Rivian instructed a recently departed Tesla employee about the types of confidential information it needed.

Rivian recently fired back. Rivian filed motion to dismiss the lawsuit, arguing that two of the three claims in the case fail to state sufficient allegations of trade-secret theft and poaching talent and instead was an attempt to malign its reputation and hurt its own recruiting efforts.

It should be noted that Kalayjian didn’t come directly from Tesla; he had a brief stint at San Francisco-based Plenty Inc., according to his Linkedin profile. Still, Kalayjian spent a decade at Tesla, and his move to Rivian likely got the attention of his former employer.

Convoy, the digital freight network that connects truckers with shippers, has hired former Expedia CEO Mark Okerstrom as the company’s president and Chief Operating Officer, effective August 31, 2020. Okerstrom will be responsible for Convoy’s finance, operations, sales, marketing, supply, and marketplace growth teams. Okerstrom wrote a blog about what prompted to leave Expedia after a decade.

Convoy is only five years old, but it’s become a giant in the nascent digital freight business. The company has managed to attract a slew of high-profile investors such as Jeff Bezos, Salesforce CEO Marc Benioff, Greylock Partners, Y Combinator, Cascade Investment (the private investment vehicle of Bill Gates) and Code.org founders Hadi and Ali Partovi. Even U2’s Bono and the Edge have invested in Convoy.

Last November, Convoy announced it had raised $400 million in a Series D funding round, funding that would be used to scale its business amid an increasingly competitive market. Convoy said at the time that its post-money valuation to $2.75 billion.

AV Spotlight: Voyage

Image Credits: Voyage

Autonomous vehicle startup Voyage is a smaller enterprise than its industry peers, in terms of capital raised and number of employees. But that doesn’t mean Voyage isn’t making moves — and progress.

The three-year-old startup tests and operates a self-driving vehicle service (with human safety operators) in retirement communities in California and Florida. They started by modifying Ford Fusion vehicles and later retrofitted FCA’s Chrysler Pacifica Hybrid minivans with its autonomous vehicle technology. Last year, Voyage partnered with FCA to provide next-generation purpose-built Pacifica Hybrid vehicles that have been developed for integration of automated technology. These vehicles come with customizations such as redundant braking and steering that are necessary to safely deploy driverless vehicles. (The partnership wasn’t announced until this spring).

Now, Voyage is lifting the veil on its third-generation robotaxi, called G3. CEO Oliver Cameron tells me G3 is designed to drive without the need of a human safety operator, equipped with COVID killing U-VC hardware and half the cost of its previous second-generation (G2) vehicle.

It might seem odd for the CEO of an AV company to exclaim that its vehicle is designed to be driverless. What Cameron means is that the vehicle generation has progressed to a point where it has all of the necessary redundancies and automotive grade hardware to move beyond testing and into commercial driverless operations. Voyage points to three technologies that get it there.

First, there’s the brain of the G3 — internally called Commander — that is powered by its perception, prediction and behavioral modules. Commander runs atop a safety-certified middleware and monitored by self-diagnostic systems. Then there’s the collision mitigation system called Shield that acts as a backup system to bring the vehicle to a safe stop if necessary. And then finally, a remote operations feature called Telessist. When the brain, or Commander, faces a novel or chaotic traffic situation it has the capability to ask for assistance.

Voyage has talked about these elements before, but it has never really dug into the compute side of things. As Cameron noted to me, “it used to be you had to choose between automotive grade and performance. Now, we have both.”

Voyage worked with Nvidia on the compute. It also involved another company, which took the Nvidia boards and made them automotive grade. “So think ruggedized aluminum, think safety certified, think liquid cooling — all the things you need to do this safely and in a vehicle,” Cameron said.

Also of note, Voyage is using Blackberry’s QNX operating system in the G3. This generation also has a number of features aimed at its senior citizen customers, including two-way voice, extra steps to help mobility-challenged riders get in and out of the vehicle, extra lighting, and an in-cabin user interface that caters to vision-impaired riders.

Inside the vehicle, Voyage has added U-VC hardware to kill COVID and other airborne diseases. Cameron said they knew it would be critical to find some cost-effective way of cleaning the vehicles. A friend suggested that he look into ambulances.

“Ambulances have really figured out how to prevent contamination from one person to another after each trip,” Cameron said. “It turns out they primarily use UV-C and it turns out in multiple studies and publications that UV-C at a certain intensity, kills COVID.”

The UV-C lights, provided by a company called GHSP, are placed in each row of the vehicle.

Despite the extra cost of the UV-C lighting and other features, Cameron said the G3 is still 50% cheaper than its previous generation.

“In the past 12 months, we’ve seen our sensor costs decrease by 65% and our compute costs decrease by 25%, resulting in a vehicle that is about 50% cheaper than the prior generation. And that’s puts us on a viable path to make money.”

The G3 isn’t quite ready for prime time. Beta versions of the G3 are being tested on the road in San Jose. Production vehicles and commercial driverless are expected to follow next year.

Notable reads and other tidbits

Loads of other mobility news went down this week. Let’s check it out.

Bentley’s Bentayga packed in a series of surprises for TechCrunch’s Matt Burns. Here’s what he discovered over 24 hours with the $177,000 sport utility vehicle.

Blackberry is pushing into China. The company announced it will be powering the Level 3 driving domain controller of Xpeng, one of the most-funded electric vehicle startups in China, and Tesla’s local challenger.

Bollinger Motors, the Michigan-based startup known for its rugged electric SUV and pickup truck, unveiled a delivery van concept called the DELIVER-E that it plans to start producing in 2022. This shouldn’t be confused with the E-Chassis, now called Chass-E, that the company designed for Class 3 commercial vehicles.

Elon Musk called an attempted cyberattack against Tesla “serious,” a comment that confirmed the company was the target of a foiled ransomware attempt at its massive factory near Reno, Nevada. The Justice Department released a complaint that described a thwarted malware attack against an unnamed company in Sparks, Nevada. It wasn’t clear if the company was Tesla until Musk publicly commented on it. Russian national Egor Igorevich Kriuchkov, 27, allegedly attempted to recruit and bribe a Tesla employee to introduce malware in the company’s network, according to the complaint.

Ford, Bosch and Bedrock are demonstrating automated valet parking in downtown Detroit. This system is designed to allow drivers to exit a vehicle and the vehicle would park itself in the parking structure. You might recall that Bedrock also has a pilot with automated shuttle startup May Mobility.

GM is moving the engineering team responsible for the mid-engine Chevrolet Corvette to the company’s electric and autonomous vehicle programs to “push the boundaries” on what its future EV battery systems and components can deliver, according to an internal memo from Doug Parks.

Monet, a joint venture between SoftBank Corp. and Toyota Motor Corp. unveiled two adapted vans. One of the vans pumps fresh air through the vehicle to reduce the risk of COVID-19 exposure, Reuters reported.

Pony.ai, the self-driving startup Pony.ai, and Bosch reached an agreement to explore the future of automotive maintenance and repair for autonomous fleets. The companies started in July a pilot of the robotaxi fleet maintenance at an undisclosed Bosch Car Service location in the San Francisco Bay area.

Scout Campers unveiled its new Kenai unit, a camper that packs a massive amount of equipment into its small footprint, including a 160-watt solar panel, CNET’s Roadshow reports.

Xwing, the autonomous aviation startup, revealed its go-to-market strategy, a plan that includes focusing on regional 500-mile distance cargo flights.

10 Berlin-based VCs discuss how COVID-19 has changed the landscape

A breeding ground for European entrepreneurs, Berlin has a knack for producing a lot of new startups: the city attracts top international, diverse talent, and it is packed with investors, events and accelerators. Also important: it’s a more affordable place to live and work when compared to many other cities in the region.

Berlin ranked 10th place in the 2019 Global Ecosystem Report, trailing behind only two other European cities: London and Paris. It’s home to unicorns such as N26, Zalando, HelloFresh and pioneers of the scene such as SoundCloud.

Top VCs include Earlybird, Point Nine, Project A, Rocket Internet, Holtzbrinck Ventures and accelerators such as Axel Springer Plug and Play Accelerator, hub:raum and The Family.

To get a sense of how the novel coronavirus has changed the landscape, we asked ten investors to give us an insight into their thinking during these pivotal times:

- Jeannette zu Fürstenberg, founding partner, La Famiglia

- Jorge Fonturbel, associate, Target Global

- Luis Shemtov, founding partner, Lunar Ventures

- Mike Lobanov, founding partner, Target Global

- Ludwig Ensthaler, founding partner, 468 Capital

- Mathias Ockenfels, partner, Speedinvest

- Axel Bard Bringéus, partner, EQT Ventures

- Eckhardt Weber, managing partner, Heal Capital

- Joerg Rheinboldt, managing partner, APX Axel Springer Porsche GmbH & Co. KG

- Christian O. Edler, partner, Christianedler.com

Jeannette zu Fürstenberg, La Famiglia

What trends are you most excited about investing in, generally?

Generally, we believe in a future in which we can leverage technology to free up humans from repetitive and tedious work and to empower them to shift their focus to what they consider more meaningful and impactful: that is creative and interpersonal activities. Thus, we are excited about founders working towards that future and finding answers across multiple industries, such as manufacturing or logistics, across all working-classes, and across different eras – before, during and after COVID.

What’s your latest, most exciting investment?

One of the recent additions of our new fund is Luminovo, a Munich-based company that develops a solution in the electronics industry to reduce the time and resources needed to go from an idea to a market-ready circuit board.

Are there startups that you wish you would see in the industry but don’t? What are some overlooked opportunities right now?

So far, we have only scratched the surface of the kind of efficiency gains that can potentially be achieved – particularly in industries that were considered to be boring and sluggish in the past, such as insurance or logistics. Even small improvements driven by technology can have a massive direct impact on P&L.

What are you looking for in your next investment, in general?

In general, we love to back visionary founders in the seed-stage that tap into giant industries with a high potential for digitization across Europe and the US.

Which areas are either oversaturated or would be too hard to compete in at this point for a new startup? What other types of products/services are you wary or concerned about?

COVID has sprung a myriad of companies in the communication and collaboration space into existence. While we believe in a future in which products and processes will be inherently remote-first, we will see a consolidation of that space that only allows for an oligopolistic market structure similar to how there is only one Zoom and Google Meet in the video communication space today.

How much are you focused on investing in your local ecosystem versus other startup hubs (or everywhere) in general? More than 50%? Less?

We have always considered ourselves as one of the few funds in Germany with a significant investment footprint both in Europe and the US. COVID has emphasized that we are able to invest entirely remotely and hence we will continue and even increase our activities across multiple hubs, such as Munich, Paris, or London.

Which industries in your city and region seem well-positioned to thrive, or not long-term? What are companies you are excited about (your portfolio or not), which founders?

Germany’s economy relies on wealthy traditional companies sitting on top of capital to be unlocked which new entrants can make use of. This has been true before 2020, and COVID will only demand more and accelerated innovation across these traditional industries ranging from automotive, manufacturing, to the chemical industry.

How should investors in other cities think about the overall investment climate and opportunities in your city?

Berlin and other German cities have consistently proven to develop and grow new leaders across multiple categories such as banking (N26), mobility (Flixbus and Lilium), or data analytics (Celonis). This is certainly driven by a mix of talents coming out of world-class educational institutions, the relative low cost of living in tech hubs, and large local incumbents with massive capital to invest and spend.

Do you expect to see a surge in more founders coming from geographies outside major cities in the years to come, with startup hubs losing people due to the pandemic and lingering concerns, plus the attraction of remote work?

While COVID has accelerated remote-first products and processes, we still believe that people will flock back to startup hubs such as Berlin or Munich, especially given the relatively low cost of living compared to other tech hubs like San Francisco. Nevertheless, we will continue to see an increasing number of companies scattered across multiple time zones building products that are inherently remote first, regardless where the general work environment will shift into.

Which industry segments that you invest in look weaker or more exposed to potential shifts in consumer and business behavior because of COVID-19? What are the opportunities startups may be able to tap into during these unprecedented times?

We are lucky in that our investment focus has been on sector verticals such as Logistics, Supply chain, manufacturing or the future of work, which have all captured significant tailwind from Covid.

How has COVID-19 impacted your investment strategy? What are the biggest worries of the founders in your portfolio? What is your advice to startups in your portfolio right now?

While our investment strategy on a high level will not change, we are putting longer sales cycles into consideration as potential customers of our portfolio companies now are focusing on capital efficiency which also holds true for our founders. Thus, we advise them to focus on extending the runway both by increasing capital efficiency as well as taking on additional funding.

Are you seeing “green shoots” regarding revenue growth, retention or other momentum in your portfolio as they adapt to the pandemic?

As our economy is still in the midst of dealing with the effects of COVID, it is too early to tell, but we definitely see positive indications driven by efforts of portfolio companies that could adapt quickly and shipped features catered to the current needs. One example is Personio, which extended their HR offerings with features that solve the need of customers who shifted to short-time work.

What is a moment that has given you hope in the last month or so? This can be professional, personal or a mix of the two.

What gave me hope was the cohesion of the German economy that fought together for solutions and support during these difficult times. One positive example was the German Startup Association that helped achieve additional governmental financial aid for German SMEs.

Any other thoughts you want to share with TechCrunch readers?

Similar to how the past financial crisis allowed companies such as Stripe or Shopify to become ubiquitous parts of our daily life, these unprecedented times now will also give birth to new forms and shapes in which new ideas will grow into large businesses and we are excited to partner up with founders willing to take a bet on that future.

Jorge Fonturbel, Target Global

The week’s biggest IPO news had nothing to do with Monday’s S-1 deluge

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. (You can sign up for the newsletter here!)

Ready? Let’s talk money, startups and spicy IPO rumors.

The week’s biggest IPO news had nothing to do with Monday’s S-1 deluge

During Monday’s IPO wave I was surprised to see Asana join the mix.

After news had broken in June that the company had raised hundreds of millions in convertible debt, I hadn’t guessed that the productivity unicorn wouldn’t give us an S-1 in the very next quarter. I was contentedly wrong. But the reason why Asana’s IPO is notable isn’t really much to do with the company itself, though do take the time to dig into its results and history.

What matters about Asana’s debut is that it appears set to test out a model that, until very recently, could have become the new, preferred way of going public amongst tech companies.

Here’s what I mean: Instead of filing to go public, and raising money in a traditional IPO, or simply listing directly, Asana executed two, large, convertible debt offerings pre-debut, thus allowing it to direct list with lots of cash without having raised endless equity capital while private.

The method looked like a super-cool way to get around the IPO pricing issue that we’ve seen, and also provide a ramp to direct listing for companies that didn’t get showered with billions while private. (That Asana co-founder Dustin Moskovitz’s trust led the debt deal is simply icing on this particular Pop-Tart).

This brief column was going to be all about how we may see unicorns follow the Asana route in time, provided that its debt-powered direct listing goes well. But then the NYSE got permission from the SEC to allow companies to raise capital when they direct-list.

In short, some companies that direct-list in the future will be able to sell a bloc of shares at a market-set value that would have previously set their “open” price. So instead of flogging the stock and setting a price and selling shares to rich folks and then finding out what public investors would really pay, all that IPO faff is gone and bold companies can simply offer shares at whatever price the market will bear.

All that is great and cool, but as companies will be able to direct-list and raise capital, the NYSE’s nice news means that Asana is blazing a neat trail, but perhaps not one that will be as popular as we had expected.

The NASDAQ is working to get in on the action. As Danny said yesterday on the show, this new NYSE method is going to crush traditional IPOs, provided that we’re understanding it during this, its nascent period.

Market Notes

Look, this week was bananas, and my brain is scrambled toast. You, like myself, are probably a bit confused about how it is only finally Saturday and not the middle of next week. But worry not, I have a quick roundup of the big stuff from our world. And, notes from calls with the COO of Okta and the CEO of Splunk, from after their respective earnings report:

- China-based fintech giant Ant is super profitable and super big and super powerful and is going to have a mega-IPO that matters, even if it isn’t happening Stateside. (This has long been expected.)

- As I write to you, the TikTok saga is not yet over, but between the lawsuits and smokescreens and other crap, it appears that Microsoft and perhaps Walmart are the leading bidding duo. What a year.

- SPACs for real companies are happening, and Boston unicorn Desktop Metal is pushing ahead with one. This is an event to watch, and if it goes well we could see a bunch more in rapid-fire fashion.

- Speaking of which, here’s a run-down of all the companies that filed to go public on Monday. You are welcome, as that post was annoying to compile. (I jest, it was fun as hell.)

- Also this week, Y Combinator had a two-day Demo Day confab that we wrote a lot about. Sure, these are early-stage companies, but their ranks will generate some material winners. So catch up here, with that link containing our chat about the startups and directions to all our coverage.

- And for fun, here are some slightly deeper looks at Snowflake and Sumo Logic’s respective IPO filings, and a contrarian take on why Palantir has problems, but also some merit.

Over to our chats, starting with Okta COO and co-founder Frederic Kerrest:

- Okta had a good quarter. But instead of noodling on just the numbers, we wanted to chat with its team about the accelerating digital transformation and what they are seeing in the market.

- On the SMB side, Kerrest reported little to no change. This is a bit more bullish than we anticipated, given that it seemed likely that SMB customers would have taken the largest hit from COVID.

- Kerrest also told us some interesting stuff about how the wave of COVID-related spend has changed: “We actually have seen the COVID ‘go home and remote work very quickly’ [thing], we’ve actually seen that rush subside a little bit, because you know now we’re five months into [the pandemic], so they had to figure it out.”

- This is a fascinating comment for the startup world.

- Okta is big and public and is going to grow fine for a while. Whatever. For smaller companies aka startups that were seeing COVID-related tailwinds, I wonder how common seeing “that rush subside a little bit” is. If it is very common, many startups that had taken off like a rocket could be seeing their growth come back to Earth.

- And if they raised a bunch of money off the back of that growth at a killer valuation, they may have just ordered shoes that they’ll struggle to grow into.

And then there was new McLaren F-1 sponsor Splunk, data folks who are in the midst of a transition to SaaS that is seeing the firm double-down on building ARR and letting go of legacy incomes:

- I spoke with CEO Doug Merritt, kicking off with a question about his use of the word “tectonic” regarding the shift to data-driven decisions from Splunk’s earnings report. (“As organizations continue to adapt to tectonic societal shifts brought on by COVID-19, one thing is constant: the power of data to radically transform business.”)

- I wanted to know how far down the American corporate stack that idea went; are mid-size businesses getting more data-savvy? What about SMBs? Merritt was pretty bullish: “We’re getting to tectonic,” he said during our call, adding that before “it really was the Facebooks, the Googles, the Apples, the DoorDashes, [and] the LinkedIns that were using [Splunk].” But now, he said, even small restaurant chains are using data to better track their performance.

- Relating this back to the startup world, I’ve been curious if lots of stuff that you and I think is cool, like low-code business app development, will actually find as wide a footing in the market as some expect. Why? Because most small and medium-sized businesses are not tech companies at all. But if Merritt is right, then the CEO of Appian might be right as well about how many business apps the average company is going to have in a few years’ time.

And finally for Market Notes, my work BFF and IRL friend Ron Miller wrote about Box’s earnings this week, and how the changing world is bolstering the company. It’s worth a read. (Most public software companies are doing well, mind.)

Various and Sundry

We’re already over length, so I’ll have to keep our bits-and-bobs section brief. Thus, only the brightest of baubles for you, my friend:

- Y Combinator startups are focusing on revenue in this more uncertain world. Per The Information, the startup org has encouraged startups in its world to “focus on generating revenue” and how to juice enough cash from their operations to endure sans checks from private investors.

- Given the pace of private investments into certain startup niches today, it’s almost odd advice. But what is true for late-stage SaaS companies (very hot!) might not hold true for smaller YC companies that are focused on consumers.

- Natasha wrote about a particularly hot startup from this YC batch, so I reached out to a hot company from a prior batch, namely Tandem. But they didn’t want to talk on the record, so no news there. Alas.

- The Fastly deal is super cool and you should read more about it. As was this $300 million investment.

And with that, we are out of room. Hugs, fist bumps and good vibes,

Reliable Robotics is bringing remote piloting to small cargo planes

Nearly one year ago, a Cessna 172 Skyhawk stealthily made aviation history when it landed at a small airport in Northern California marking the completion of the first successful remote-piloted flight of a passenger airplane in the United States.

The company behind this milestone in commercial aviation history is Reliable Robotics, a startup founded in 2017 by former SpaceX and Tesla engineers who previously brought autopilot to the electric vehicle auto driving masses and made the Dragon rocket soar.

The company has raised $33.5 million in venture funding from investors including Lightspeed Venture Partners and Eclipse Ventures, Pathbreaker Ventures and Teamworthy Ventures, and is now making its pitch to potential customers in the logistics and shipping industry.

Robert Rose, the co-founder of Reliable Robotics, comes from a family of flyers. Both of this grandfathers flew in World War Two and had done stints as a pilot himself. In fact, the company’s origins stem from Rose’s attempts to get back in the cockpit and behind the yoke.

“Flying’s hard,” Rose said. “It requires a lot of cognitive ability.”

But a lot of that cognitive ability are tasks that Rose, with his experience designing Tesla’s autopilot system and the flight systems for both the Falcon and Dragon spacecraft, knew could be automated. Helping Rose to automate these tasks is Juerg Frefel, the company co-founder, vice president of engineering and the former leader of the team behind the computing platform for the Falcon 9 and Dragon spacecrafts.

Reliable’s systems aren’t fully automated, there’s still a pilot behind the scenes, but that pilot is monitoring systems and controlling the plane remotely, rather than sitting in the cockpit.

Reliable started its experiments with retrofitting existing planes with autonomous systems in much the same way that Tesla began its journey into manufacturing by using existing frames for aircraft rather than designing its own.

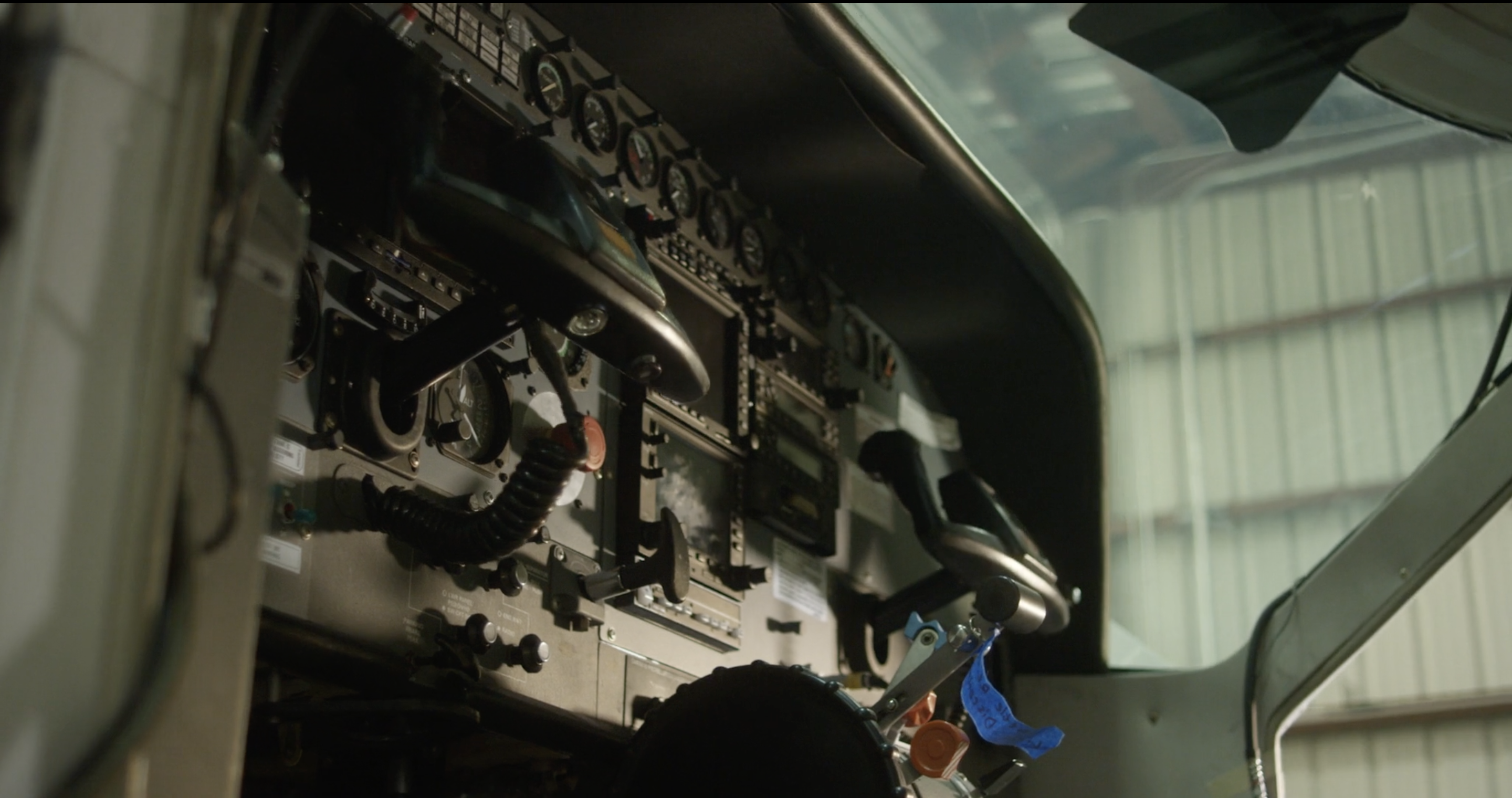

Control systems inside a Cessna retrofitted by Reliable Robotics. Image Credit: Reliable Robotics

“We spent the first portion of our flight test program focused on the C172. We thoroughly tested every aspect of our system in simulation and conducted rigorous safety checks before operating the aircraft without a pilot on board and are now proud to share what we’ve been working on,” said Rose, in a statement.

The company started with the Cessna 172 Skyhawk but graduated to the larger Cessna 208 Caravan. The Caravan, which is designed as a passenger plane, is also used by logistics companies like FedEx for shipping. In June, the company demonstrated a fully remote landing for the Caravan over the San Jose approach path — a particularly heavily trafficked route.

“There’s never been a privately funded program that’s ever done anything like that before,” said Rose.

Enabling remote piloting and automating certain aspects of flight has tremendous potential to drive down costs and improve efficiencies in an industry that’s struggling with multiple stresses.

“Automated aircraft are going to fundamentally shift the entire airline business, and Reliable Robotics is well positioned to be a key player in this new market,” said David Neeleman, a founder of several commercial airlines including JetBlue (and an investor in Reliable Robotics).

The company’s autonomous platform can be applied to any fixed wing aircraft, but Reliable’s co-founder and chief executive doesn’t expect to be selling components. Instead, Reliable Robotics will retrofit and operate aircraft as a service for its customers, Rose said.

“Initially, by necessity, we’re going to have to operate this as a service,” said Rose. “The certification of systems for air. If you want to operate in the airspace you have to certify your maintenance plan, your procedures… the entire business needs to be certified by the FAA… If for the first time someone operates an aircraft with no pilot on board that entire business is going to have to be certified. At least for the first several years we see this being operated as a service.”

Reliable conducted its first retrofit and flight on a Cessna Caravan owned by FedEx, which operates around 235 planes in its fleet, according to Rose. Several other shipping companies also use the Caravan for air logistics.

“There’s a communication component, a ground network, a control center for operating the thing. It’s entirely a vertically integrated enterprise,” Rose said. “Integrated hardware that allows us to control flight systems and get telemetry and data [and that’s] integrated into a custom computer that can process this and fly the aircraft and integrated into a ground network so a pilot in our control center can oversee the operations of the plane.”

Rose said the pitch to customers is increasing pilot utilization. “How could the economics change if [pilots] could teleport from one aircraft of the next after they’re done flying?” Rose said. “Our system enables you to more efficiently utilize the pilot and more efficiently utilize the aircraft.”

Closeup of a Reliable Robotics control system. Image Credit: Reliable Robotics

Startups Weekly: With Asana, JFrog, Palantir, Snowflake, Sumo and Unity, we’re in peak season for tech IPOs

Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7 a.m. PT). Subscribe here.

Pandemic numbers are looking better, it’s still a couple months before U.S. elections and a growing line of tech companies have already ventured out into public markets successfully this summer. Hard to imagine conditions beating the present any time soon, whether you’re traditionally banked, going with a direct listing or getting inside a SPAC vehicle.

We covered the frenzy this week with an eye toward what other startups can learn about the way these companies have arrived at this point. Here are the headlines for each, from Asana to Unity.

But first, consider this special episode of our Equity podcast from Wednesday, where the team reviews the news. And for a faster(ish) read, Extra Crunch subscribers should also check out Alex Wilhelm’s “super-long roundup” of the companies.

The IPOs:

As losses expand, Asana is confident it has the ticket for a successful public listing

Palantir and the great revenue mystery

The bullish case for Palantir’s direct listing (EC)

Leaked S-1 says Palantir would fight an order demanding its encryption keys

Palantir’s S-1 alludes to controversial work with ICE as a risk factor for its business

Unpacking the Sumo Logic S-1 filing (EC)

A quick peek at Snowflake’s IPO filing

Industry experts say it’s full speed ahead as Snowflake files S-1

Unity’s IPO numbers look pretty … unreal?

Sequoia strikes gold with Unity’s IPO filing

Regarding that last one, EC members should be sure to check out our popular deep dive from last year detailing how Unity came to be a leading gaming engine.

Finally, here’s one last EC headline to get you ready for what is sure to be another week of official S-1s, leaked filing information, rumors of imminent IPO dates, controversies over methods of going public, etc.:

SaaS stocks survive earnings, keeping the market warm for software startups, exits

Image Credits: Getty Images

You don’t know SPACs

Special purpose acquisition companies are an older model of financial vehicle used to take companies public that has become a hot trend in recent years as more tech startups try to figure out liquidity events. Here’s Connie Loizos, who put together a long list of questions and answers about SPACs, concluding that the trend is here for the long-term:

[One] investment banker says he’s seeing less interest from VCs in sponsoring SPACs and more interest from them in selling their portfolio companies to a SPAC. As he notes, “Most venture firms are typically a little earlier stage investors and are private market investors, but there’s an uptick of interest across the board, from PE firms, hedge funds, long-only mutual funds.”

That might change if [A* SPAC founder] Kevin Hartz has anything to do with it. “We’re actually out in the Valley, speaking with all the funds and just looking to educate the venture funds,” he says. “We’ve had a lot of requests in. We think we’re going to convert [famed VC] Bill Gurley from being a direct listings champion to the SPAC champion very soon.”

In the meantime, asked if his SPAC has a specific target in mind already, Hartz says it does not. He also takes issue with the word “target.”

Says Hartz, “We prefer ‘partner company.’” A target, he adds, “sounds like we’re trying to assassinate somebody.”

Image Credits: Dougal Waters / Getty Images

Inside the nearly 200 companies of Y Combinator’s Summer 2020 demo day

After YC’s first remote-only demo day this spring, the seed-stage venture firm switched from recorded pitches to live ones. The TechCrunch team was on hand to cover the 192 presentations over Monday and Tuesday this week. We’ve written up these two handy guides to help you find your newest competitors, employers or maybe investment:

The 98 companies from Y Combinator’s Summer 2020 Demo Day 1

The 94 companies from Y Combinator’s Summer 2020 Demo Day 2

The staff also picked out their dozen or so favorites from each day, for Extra Crunch subscribers:

Our 11 favorite companies from Y Combinator’s S20 Demo Day: Part 1

Our 12 favorite startups from Y Combinator’s S20 Demo Day: Part 2

(Check out this special demo day edition of Equity for a free audio rundown.)

One company wasn’t in the mix — a startup called Trove, that provides internal compensation SaaS tools, and has just raised a huge new round from Andreessen Horowitz. Natasha Mascarenhas has more.

What investors are saying about startup cities in 2020: Chicago edition

Cities around the world have developed strong tech scenes, but these startup hubs are at the center of potential disruption from pandemic problems plus the possibilities of remote work. We’re surveying investors around the world about what’s next for their home bases. This week, Matt Burns checks in with top Chicago investors about the tech future of the biggest Midwestern city. Here’s Constance Freedman of proptech-oriented fund Moderne Ventures, who is investing in the middle of all these changes:

World-class startups still need world-class feeders, so I don’t expect expansion to reach all that far, but perhaps density or proximity to work becomes less important for those who work there. This may give more cities a change to rise, including Chicago.

So what does this mean for Chicago startup ecosystem? I think Chicago is poised to come out well. The city is affordable to begin with … like 50% more affordable than the West or East Coast hubs. If I live in Chicago I can afford space, I can enjoy my city and I have good transportation if I want to bail out of the city and move to the suburbs. Chicago has a strong ecosystem of universities and capital that can sustain it and may become more appealing to those (tech people and investors) who moved out to go to the coasts in the first place and now realize they don’t need to be there. As people migrate to live where they really want to live, with the lifestyle they want to have, near family they want to be with, they begin to look for more local opportunities and that may bring some great talent back to Chicago and other markets outside of the coasts.

Chicago has long been known for banking, real estate, health care and insurance. I think these sectors and others are poised to do well. The largest opportunity for us (and any major city) is how to close the education gap, which leads to closing the income gap and from there — the sky is the limit!

Meanwhile, Mike Butcher is working on surveys across Europe, and would like to hear from you if you are an investor in Paris or Warsaw.

Around TechCrunch (Disrupt Time)

Conan is coming to Disrupt 2020

Presenting TechCrunch Disrupt’s Asia sessions

Benchmark’s Peter Fenton is joining us at Disrupt

Learn why embedded finance is the future of fintech at Disrupt

Laura Deming, Frederik Groce, Amish Jani, Jessica Verrilli and Vanessa Larco are coming to Disrupt

Carbon Health’s Eren Bali and Color’s Othman Laraki will join us at Disrupt 2020

Black founders can get tactical advice at Disrupt

Five real reasons to attend Disrupt 2020 online

Hear from experienced edtech investors on the market’s overnight boom at Disrupt 2020

Startup Alley exhibitors: Register for VC-led Fundraising & Hiring Best Practices webinar

Here’s how you can get a second shot at Startup Battlefield

Two weeks left on early-bird pricing for TC Sessions: Mobility 2020

Grab your student discount pass for TC Sessions: Mobility 2020

Register for our last pitch-off next week on September 2

Extra Crunch discount now available for military, nonprofits and government employees

Across the week

TechCrunch

The pandemic has probably killed VR arcades for good

Femtech poised for growth beyond fertility

Five proven ways to attract and hire more diverse talent

Will automation eliminate data science positions?

Eduardo Saverin on the ‘world of innovation past Silicon Valley’

The H-1B visa ban is creating nearshore business partnership opportunities

Meet the startups from Brinc’s first online Demo Day

Extra Crunch

What can growth marketers learn from lean product development?

Alexa von Tobel: Eliminating risk is the key to building a startup during an economic downturn

As DevOps takes off, site reliability engineers are flying high

How to establish a startup and draw up your first contract

COVID-19 is driving demand for low-code apps

Synthetic biology startups are giving investors an appetite

Funding for mental health-focused startups rises in 2020

Box CEO Aaron Levie says thrifty founders have more control

#EquityPod

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

This is the fourth episode of the week, pushing our production calendar to the test. Happily, we’ve managed to hold it together amidst the news deluge that the last few days have brought. It was a good week for our scheduling change, with the main episode of the show coming to you on Thursday afternoon versus Friday morning.

Change is good.

But unchanging this time around was our hosting lineup, with Natasha Mascarenhas and Danny Crichton and myself yammering with Chris Gates on the mix. Here’s what we got into:

- The CEO of TikTok is out, bids are swirling and who will wind up owning a piece of all of TikTok’s global operations is not clear. Walmart is in the mix, apparently, which feels very 2020.

- The New York Stock Exchange has gotten approval from the SEC for a new type of direct listing, one in which the company going public can sell a bloc of shares during the normal price discovery process. This means that all the banker-faff of setting a price and roadshowing to various investor groups could be going the way of the buffalo.

- About time, maybe? That was our take after reading this Bill Gurley note and the latest SEC news.

- But while the direct listing world is getting more interesting, the SPAC world is taking flight. Desktop Metal is going public via a SPAC which is all sorts of fascinating. A younger, Boston-based unicorn going public in this manner is eye catching!

- And then two funding rounds, the first from Finix, which can’t stop adding to its Series B. And Mural, which raised the largest Series B we can recall.

And with that, we’re all going to bed. We’re tired. No more news, thanks!

Subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

A must-see conversation on the state of VC, this year at Disrupt

On a surface level, the world of venture capital doesn’t look to change much year to year. But in truth, the industry is very much in flux, with many firms grappling with a lack of diversity, dealing with succession questions, and confronting a growing pipeline of aging portfolio companies — to name just a few of the issues of the day.

In fact, one of the biggest shifts in the industry — one that’s years in the making but with no end in sight — is its atomization. Once a clubby industry, the landscape today sees new players, backed up by real dollars, every day, all over the world.

Indeed, at this year’s Disrupt, we’re very excited to be sitting down with three venture investors who spent much of their careers with powerful outfits before more recently — and boldly — striking out on their own to build their own brands.

It’s with their help that we’re going to take stock of many of the trends roiling the industry right now.

Lo Toney was a VP at Cake Financial, a general manager with Zynga, and the CEO of an online coding startup before jumping into the world of venture capital, first at Comcast Ventures and later at GV where he spent several years as a partner.

If he was tempted to stay with Alphabet’s influential venture arm, he didn’t, instead turning his work at GV — which centered increasingly on finding and funding promising and diverse fund managers and startups — into the opportunity to create his own shop. Now, Plexo Capital not only counts Alphabet among its biggest financial backers, but it has amassed stakes in roughly two dozen funds and many more startups. With most of them run exclusively or in part by people of color, Toney has also become a leading light for others who recognize diversity as a competitive advantage.

Then there’s Renata Quintini, who has spent the last year quietly building a new outfit, Renegade Partners, with cofounder Roseanne Wincek. Wincek previously worked at the venture giant IVP. Quintini, similarly, has held a number of investing roles at esteemed institutions. Among them is the Stanford Management Company, where she was an investment manager focused on VC and private equity investments, and Felicis Ventures, where as a general partner she worked with a wide number of rising stars, including the satellite company Planet, the self-driving startup Cruise Automation (now owned by GM), Dollar Shave Club (which sold to Unilever), and Bonobos (snapped up by Walmart).

It wasn’t a surprise when Lux Capital poached Quintini, in fact. But even Lux, which prides itself on the kind of deep science expertise that Quintini shares, couldn’t keep her from leaving to create something all her own.

The story isn’t so dissimilar for Dayna Grayson, who studied systems engineering and worked in product design before jumping into the world of venture capital, first as a principal with the Boston-based firm Northbridge Venture Partners and afterward, as a partner with the venture giant NEA.

There, based in Washington, D.C., Grayson led a wide number of deals for the firm, including in the metal 3D printing company Desktop Metal — a five-year-old company that, absent an unforeseen development, is soon to be publicly traded and valued in the multiple billions of dollars.

Undoubtedly Grayson could have stayed longer. Instead, nearly eight years into her career with NEA, she left late last year to cofound the early-stage venture firm Construct Capital with Rachel Holt, one of Uber’s first employees.

There is so much to talk about with these entrepreneurial investors, from how they compete against the heavyweights, to how they think about startups in a post COVID world, to whether or not VCs have begun to over-index on business-facing investments to their own detriment — or if, conversely that opportunity remains limitless right now. That’s saying nothing about SPACs, rolling funds, and the latest twist in direct listings.

You definitely won’t want to miss this very timely conversation about the state of VC.

Disrupt 2020 runs from September 14 through September 18 and will be 100% virtual this year. Get your front row seat to see Grayson, Quintini and Toney live with a Disrupt Digital Pro Pass or a Digital Startup Alley Exhibitor Package. We’re excited to see you there.

India’s Reliance Retail to acquire Future Group’s units for $3.4 billion

Reliance Retail, India’s largest retail chain, has found a much simpler way to expand its dominant position in the country: Acquire most of the second largest bricks-and-mortar retailer.

On Saturday evening (local Indian time), Reliance Retail said it has reached an agreement with Future Group to acquire the latter’s retail and wholesaler business, and its logistics and warehousing business for $3.4 billion. The acquisition will help Reliance Retail command one-third of the bricks-and-mortar stores of India’s modern retail sector.

The announcement today further complicates the future of Amazon and Walmart’s Flipkart in India, the largest open market globally by users, where e-commerce still accounts for just 3% of all retail sales. India’s retail market is estimated to balloon to $1.3 trillion by 2025, up from $700 billion last year, according to consultancy firm BCG and local trade group Retailers’ Association India.

Amazon has showed interest in Future Retail, too. The company, which last year bought a tiny portion of Future Group’s business, was in talks to increase its stakes in the firm, according to earlier local media reports. The American e-commerce firm, which has invested over $6.5 billion in its India business, said in January that it had also inked a deal with Future Group to help the Indian firm sell online.

Future Group, which kickstarted its journey as a stonewashed-fabric seller in the 1980s, serves millions of customers through more than 1,500 stores in more than 400 cities. Today’s deal will help Future Retail, known for its Big Bazaar hypermarket chain and Pantaloons clothing shops, reduce its debt.

Ambani addressing the Bengal Global Business Summit on January 16,2018 in Kolkata, India. (Photo by Debajyoti Chakraborty/NurPhoto via Getty Images)

Mukesh Ambani, who controls Reliance Industries (of which Reliance Retail is a subsidiary), has secured about $20 billion from Facebook, Google, and 11 other high-profile investors for his telecom venture Jio Platforms this year.

Now Ambani, who is India’s richest man, has set his eyes on e-commerce. Jio Platforms and Reliance Retail last year announced JioMart. The e-commerce venture, which began test trials in select suburbs of Mumbai late last year, has expanded to more than 200 cities and towns across India.

Facebook, which has invested $5.7 billion in Jio Platforms, said the company will explore ways to work with Reliance to digitize the nation’s 60 million mom and pop stores as well as other small and medium-sized businesses.

“With this transaction, we are pleased to provide a home to the renowned formats and brands of Future Group as well as preserve its business ecosystem, which have played an important role in the evolution of modern retail in India,” said Ambani’s daughter Isha, who serves as a Director at Reliance Retail, in a statement.

“We hope to continue the growth momentum of the retail industry with our unique model of active collaboration with small merchants and kiranas as well as large consumer brands. We are committed to continue providing value to our consumers across the country,” she added.

This Week in Apps: Unreal Engine saved, Fortnite banned and TikTok talks to everyone

Welcome back to This Week in Apps, the TechCrunch series that recaps the latest OS news, the applications they support and the money that flows through it all.

The app industry is as hot as ever, with a record 204 billion downloads and $120 billion in consumer spending in 2019. People are now spending three hours and 40 minutes per day using apps, rivaling TV. Apps aren’t just a way to pass idle hours — they’re a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus.

In this series, we help you keep up with the latest news from the world of apps, delivered on a weekly basis.

This week, two big stories dominated the news: Apple’s fight with Fortnite maker Epic Games and TikTok’s negotiations with top U.S. tech firms over a sale. The former story saw Microsoft coming to Epic Games’ aid in court, in a surprise move.

Meanwhile, TikTok deal talks are happening quickly as both Oracle and Microsoft’s names have emerged as top suitors. But this week, we saw Walmart joining in the talks, too. Yes, Walmart!

One has to wonder if the TikTok that emerges from an acquisition like this will even be the TikTok that people today love to use, what with all these new corporate synergies that come into play.

Top Stories

Apple gets petty in fight with Epic Games

Image credit: Kyle Grillot/Bloomberg via Getty Images

Sorry, Apple, but this is not a good look.

On Friday, the $2 trillion company took its battle with Fortnite maker Epic Games to a whole new level of petty. Just as Fortnite for iOS and Mac was officially blocked from being able to issue updates for its apps, Apple featured Fortnite top competitor PUBG Mobile in the App Store in an editorial story on the Today tab. Apple’s App Store Twitter account also posted about PUBG Mobile’s New Era.

Oh my gosh they did it. They actually did it. They’re running a featured story on the App Store about PUBG today.

pic.twitter.com/M4nwA3sBQA

— Mike Beasley (@MikeBeas) August 28, 2020

This isn’t coincidental, but a conscious decision on Apple’s part to demonstrate its market power. That is: if you don’t want to play by our rules, fine — we’ll just give business to your competitor instead. Being featured on the App Store drives downloads for an app, which helps an app find new users and reconnect with existing ones.

Apple made its point, but it sure was an ugly way to do it.

In a surprise move, Microsoft came out in support of Epic Games this week. Microsoft GM of gaming developer experiences Kevin Gammill submitted a letter to the court that said Apple’s move to cut ties with Epic would harm game developers. Microsoft uses Epic’s Unreal Engine for its own title, “Forza Street,” but the company understands the damage Apple can do to the gaming industry if it stopped Epic from being able to work on Unreal Engine by disabling its Apple developer account.

Plus, if there’s a battle between the gaming industry and Apple, Microsoft will probably take game developers’ sides these days. After all, Microsoft is in the gaming business and its own cloud gaming service xCloud is banned from the App Store, too, as is Google’s Stadia. Apple’s decision to disallow cloud gaming is anti-consumer and fairly unpopular.

The judge in the Apple v. Epic case this week gave Epic Games a temporary restraining order against Apple, but only to stop Apple from retaliating against Epic Games by blocking the company’s Unreal Engine. Judge Yvonne Gonzalez Rogers also chastised Apple for the move, saying that Epic and Apple were free to litigate against each other, but “their dispute should not create havoc to bystanders.”

It’s becoming pretty clear that Apple’s way of running the App Store is not just a set of rules, it’s become a way for Apple to control other businesses, and even limit their growth. Apple’s ban on cloud gaming looks a lot like a way for Apple to protect its own gaming business at the expense of rivals. In the meantime, a patent reveals Apple is working on its own cloud gaming system. Yikes.

Unfortunately, in battles of this size we’re not exactly left with a hero to root for. Epic Games is no indie underdog being crushed by the big guy. It is the big guy. Microsoft is doing okay too. And when Facebook complains that Apple wouldn’t allow its gaming app into the store, or when it rejected Facebook’s app for informing users of Apple’s 30% cut, it’s easy enough to shrug and move on. Oh poor Facebook is not a sentiment people are capable of feeling these days.

But it’s important to remember that what Apple is doing to these big guys, it’s also doing to the smaller ones. We already saw that with the Basecamp Hey debacle. More recently, Apple rejected the free, open-source WordPress app from the App Store for failing to add Apple’s in-app purchase system and because some of the app’s web views could lead to information about WordPress’s pricing plans.

Heads up on why @WordPressiOS updates have been absent… we were locked by App Store. To be able to ship updates and bug fixes again we had to commit to support in-app purchases for .com plans. I know why this is problematic, open to suggestions. Allow others IAP? New name?

— Matt Mullenweg (@photomatt) August 21, 2020

The issue was resolved and Apple even apologized, but it’s clear that something is very, very broken at the App Store. And the ultimate loser is the consumer.

In Steve Jobs’ day, GV General Partner M.G. Siegler pointed out in a recent blog post, Apple believed in its App Store and payment systems would win on their own merits, not because they were forced. In Jobs’ own words: “Our philosophy is simple — when Apple brings a new subscriber to the app, Apple earns a 30 percent share; when the publisher brings an existing or new subscriber to the app, the publisher keeps 100 percent and Apple earns nothing.”

How times have changed.

TikTok nears U.S. deal and loses CEO

(Photo by CHRIS DELMAS/AFP via Getty Images)

TikTok is busy. On Monday, the world’s biggest app sued the U.S. government over Trump’s executive order, claiming it had been enacted without evidence and without any due process. Meanwhile, Vietnamese technology firm VNG also sued TikTok over music licensing issues and the U.K. began readying governmental restrictions on TikTok’s activities. TikTok is also still trying to come up with a deal that will allow its app to return to India.

On Thursday, things went from bad to worse as TikTok CEO Kevin Mayer resigned. The former Disney executive had joined the social network just over 100 days ago, but said this was not the job he signed up for. His hiring now increasingly looks like a way what many had suspected all along — a way for TikTok’s Chinese parent company, ByteDance, to point to Americans in exec roles at TikTok as a way to reassure U.S. regulators about its business.

According to reports, Mayer was left out of the negotiations to sell TikTok, which were instead headed by ByteDance founder and CEO Zhang Yiming. Mayer was also said to be scheduled to leave TikTok as part of a planned sale, as his role would no longer exist. But the exec’s sudden departure is bad for morale at a time when TikTok’s existence in the U.S. market remains in question.

Meanwhile, the question of who is talking to TikTok would be easier to answer by who is not. Only Apple went on record to say it’s not interested. Microsoft and Oracle have emerged as top suitors in the days since Trump’s E.O. Oracle is reportedly nearing a $20 billion deal. But this week, Walmart also expressed interest in TikTok, teaming up with Microsoft, before trying to first team up with Alphabet and SoftBank. Walmart…yes really. It imagines it could sell to customers on the platform and expand its ad business.

Other News

- Apple releases new betas. Apple’s 6th developer betas for iOS 14, iPadOS 14, watchOS 7 and tvOS 14 rolled out this week, as did the latest public betas for iOS an iPadOS. The company typically releases its software updates in September, so these are getting close to the final versions.

- Facebook and Instagram expand Shopping features. Facebook this week introduced a new “Shop” section in its app, which aims to redirect Facebook users to sellers’ storefronts without leaving Facebook, similar to Instagram’s existing shopping experience. Instagram also began testing live shopping, where businesses can show off content in live videos. Dozens of live video shopping startups will be impacted by the new competition.

- YouTube is testing Picture-in-Picture mode on iOS. But will supporting the feature impact YouTube’s ability to upsell subscriptions to those who want access to background play?

- Ever shuts down app after building facial recognition tech using customer data. Cloud photo storage app Ever is shutting down. The company last year was the subject of an NBC News report which found Ever had been using its customers’ photos to develop facial recognition technology that it turned around and offered for sale by way of the Ever API to business clients, including law enforcement and the military. Unfortunately, that ill-gotten business lives on, rebranded as Paravision.

- Amazon launches a fitness band and app called Halo. The service will sell for $64.99 for a six-month membership at launch. Oh, do we trust Amazon with our health data now?

- Facebook warns Apple’s upcoming ad tracking restrictions will significantly impact app developers’ ability to target ads. The company says that without targeting and personalization, mobile app install campaigns brought in 50% less revenue for publishers and it expects the impact to Audience Network on iOS 14 will be even greater. Consumers, sick of being tracked everywhere on the web, are going to be fine with this. Facebook will also be OK. Small startups that used highly targeted ads to save themselves from having to pay for tons more impressions to reach their desired audience, however…

- Android security bug let malicious apps siphon user data. Google confirmed the bug was patched in March after a security researcher reported it.

Funding and M&A

- LaunchNotes raised a $1.8 million seed round to help companies better communicate their software updates. No more “bug fixes and performance improvements.”

- Berlin-based Delivery Hero acquired InstaShop for $360 million. The latter is based in Dubai and has half a million users in five markets.

- Unity files to go public. A rival to Epic Games’ Unreal Engine with its own Unity Game Engine, Unity claims its engine powers over half the top games on mobile, PC and consoles, and 53% of the top 1,000 games on iOS and Android. Not surprisingly, its numbers look strong.

Downloads

Bingie helps you find new things to watch.

Image Credits: Bingie

Bingie aims to turn getting Netflix recommendations from friends into a more structured experience. The app for streamers let them get together with friends to discuss, discover and share recommendations across services. The app looks well-built, but overlooks the fact that not all friend groups share common interests. It would be interesting to see it expand to include fellow fans, like TV Time offers, in a later update. Bingie is free on iOS. Read the full review on TechCrunch.

Firefox Daylight for Android

Mozilla this week launched Firefox 79 for Android, aka Firefox Daylight, after more than a year of development. The new browser is faster and entirely overhauled, offering a new user interface, Mozilla’s browser engine GeckoView, enhanced tracking protection, a private mode (based on the privacy browser Firefox Focus), a new bookmarking tools, support for add-ons and more.

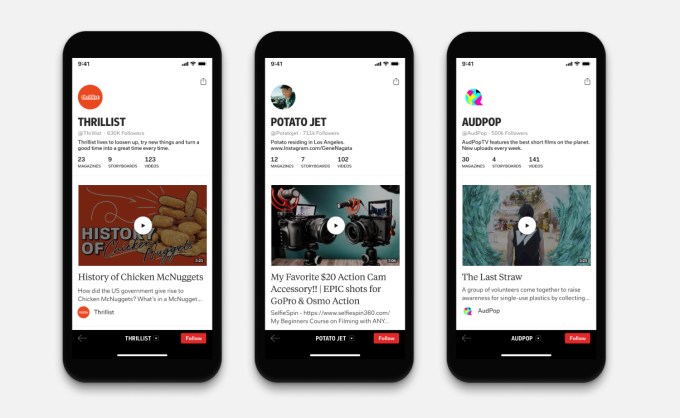

Flipboard gets into video

Image Credits: Flipboard

News magazine app Flipboard has been around for years, but its latest update introduces a big change. The app now allows users to follow video content from hundreds of publishers, including national/global news outlets, local news and (carefully vetted) indie producers. Users can even build out their own video-only collections to stay on top of the latest news in the form of video, or they can add video-only feeds into existing magazines. Publishers can also add video to their static round-ups known as Storyboards. Flipboard TV, as the new feature is called, was previously a Samsung exclusive. Now the ad-supported version is available to all.

Walmart-exclusive TrillerTok will run on Azure, or Oracle, or something

If you can’t keep up with the latest rumor mill on TikTok’s impending doom acquisition, my suggestion is simple: don’t. Or instead, enjoy it for what it is: one of the most absurd bakeoff deals in investment banking history.

Walmart and its always low prices are in the fray. Oracle is looking to find synergies to make enterprise resource planning software more enticing to Gen Z workers. Triller — who the hell are they again? — is supposedly teaming up with an asset management firm (and a planet near the Hoth system) called Centricus according to Bloomberg (to which TikTok responded nah). Twitter is in — maybe? — with key corporate strategic advice from Beyoncé on the social network’s debt underwriting strategy.

SoftBank is apparently looking, and also just happened to announce yesterday its intention to sell off $14 billion of its core Japanese mobile services business to net cash quickly. (The upshot is that at least TikTok lost most of its value before SoftBank’s investment!)

Everything here is absurd. TikTok is absurd. The videos of people doing what they are doing on TikTok are absurd. TikTok’s growth is absurd. A president setting a deadline on the sale of a company is absurd. This process is absurd. Selling a company as large as TikTok in 45 days is absurd. Walmart is absurd (and also a mirage, since they are still banned from New York City lest someone gets discounted soap in a pandemic).

I warned a few weeks ago to “beware bankers” peddling TikTok rumors. And that’s still the right answer, in the sense that of course we are going to get to the furthest reaches of the M&A universe as bankers try to salvage TikTok’s final sale price (“We’re approaching the Centricus system, sir!”). But that approach is so much more boring than just assuming that every rumor is true and trying to imagine Wall Street advisors trundling through this morass of bids.

My advice here is simple: let’s all take our analyst hats off for a week and put on our clown costumes, since — and it’s key you don’t work at TikTok for this or have money at stake in the company — this story is actually enjoyable.

COVID-19 is serious, the U.S. presidential election is weeks away, social justice in our cities is critically important. Just in the past few hours, T’Challa passed away, Hurricane Laura ripped up the Gulf Coast, and the longest continuously-serving Japanese prime minister of the post-war era (yes, I know, that’s a lot of qualifiers) just resigned due to health issues. It can get weighty on the front pages of the newspapers these days.

So it’s just nice to know that you can flip to the business pages and get some farce.

Maybe this whole story will eventually turn into the next great business book à la Barbarians at the Gate. But at least the barbarians then knew how to destroy a company with the proper levels of debt leverage. Here, you’ve got the pre-smoldered detritus of a business being bid on by the company that brought us The Greeter.

Whatever this saga brings next (hint: Microsoft buying the company), I’ll just say this: the warmth and cheeriness that TikTok provided millions of teenagers though short videos of awakward dance routines is the same mirth that it provides acerbic financial analysts with a caustic eye on the markets. In what has been a miserable year for all of us, for that small twinkle of amusement, I’m thankful.

Original Content podcast: Netflix’s ‘High Score’ is a selective tour through video game history

“High Score” is a new Netflix documentary series that looks back at the early years of the video game industry.