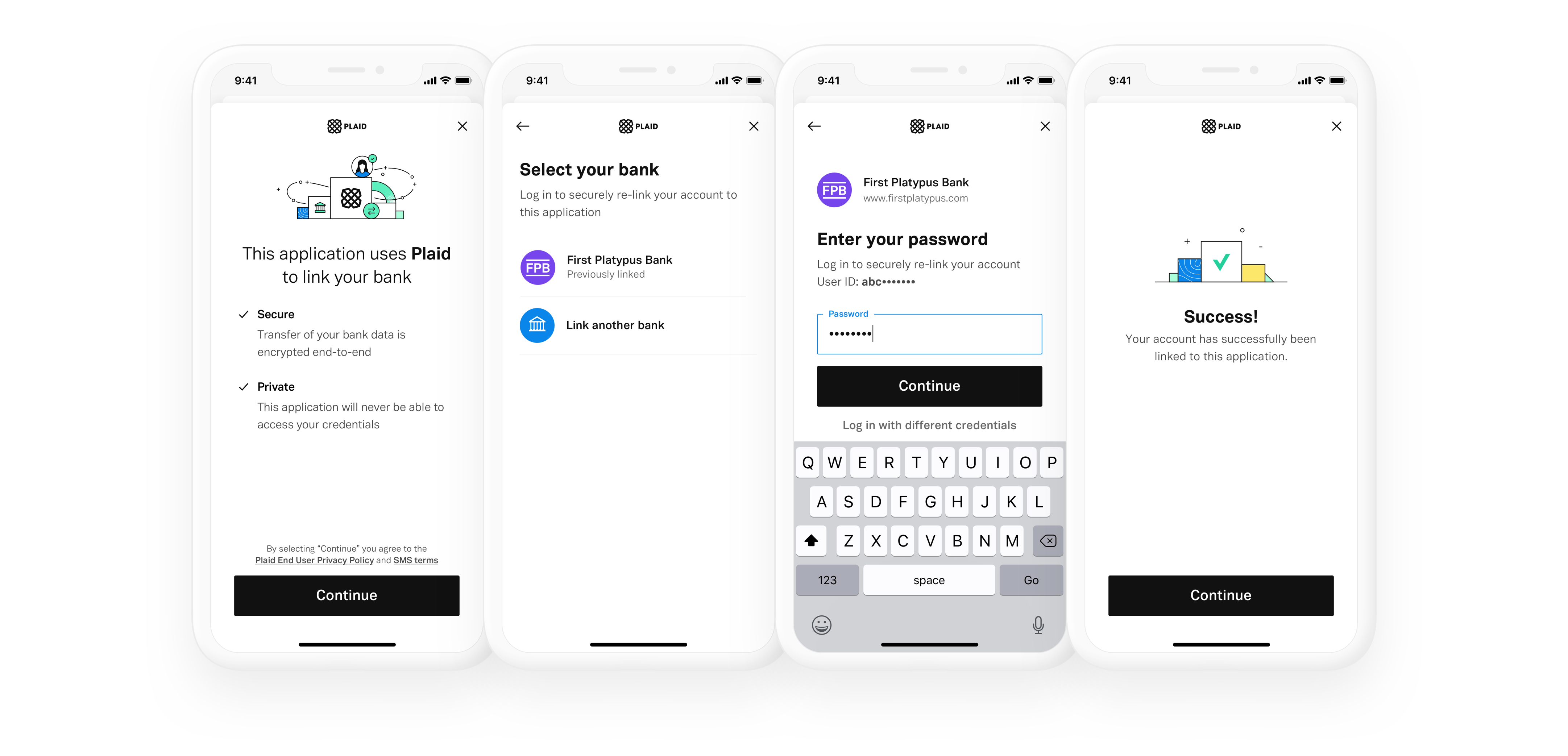

Anyone who writes online or in a word processor has likely gotten used to the inevitable squiggly line denoting a misspelled word or clumsy phrase. But what if you use a word that’s loaded, a phrase that’s too formal or not formal enough, or refer to a group of people in an outdated way? Writer is a service that watches as you type, flagging language that doesn’t match up with your style guide and values, and it just raised $5 million to scale up.

Both people and the companies they work for want to improve the way they write, but not just in terms of grammar and spelling. If a company says it’s inclusive, but the language in its press releases or internal blogs are peppered with anachronisms and bias, it suggests their concern only goes so far.

“Companies are hungry to put actions behind their words,” said Writer founder and CEO May Habib. “They want to be able to tell a consistent story to their users everywhere that they’re interacting with them. What Writer does is let people know when they’re using insensitive language, or things that could be considered negative, and let companies set brand guidelines.”

Right off the bat let us admit that there is a whiff of the sinister about the idea of a company dictating how its employees speak, though that’s nothing new when it comes to content and official communications. But this isn’t about controlling speech for power — it’s about recognizing that we are all flawed communicators and could use a hand keeping ourselves honest. Less thought police and more a well-informed angel sitting on your shoulder whispering things like, “Hey. Are you sure you want to describe that lawyer as ‘exotic’?”

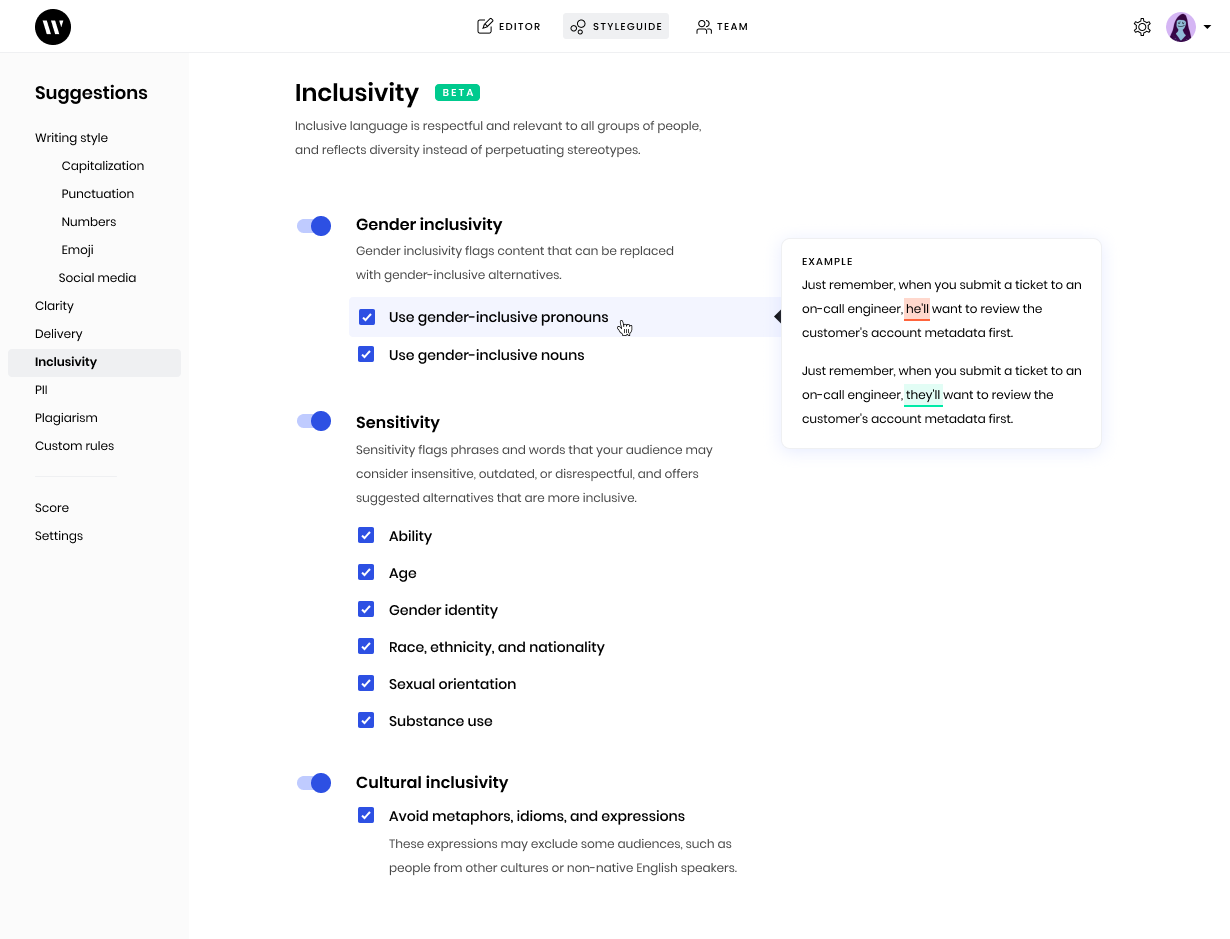

Examples of things Writer checks for. Image Credits: Writer

There are tons of slip-ups we all make along those lines; less obvious, but no less potentially offensive. It’s important in public communications, among other things, to refer to a group by the term they prefer, not the first one that pops into your head; Writer has up-to-date libraries of this information sourced from the communities themselves. Some phrases may have become politically loaded in the last couple of years, but you’re not aware; no problem, it has alternatives. You want to avoid unnecessarily gendered language, great, but everyone slips up now and then; Writer can spot it — or make the connection with previous pronouns to make sure you don’t, for example, gender an anonymous source.

Accusations of “political correctness” will dog the service, but as Habib put it: “This is beyond politics; this is about respect for people who live a certain way, or are a certain way, and prefer to use certain terms. We’re trying to help companies create communities of belonging.” And as we’ve seen over and over again in tech, there is often a serious disconnect between the stated aspiration of a company and how people are treated within them. Just using the right words is a pretty low bar to start with, honestly.

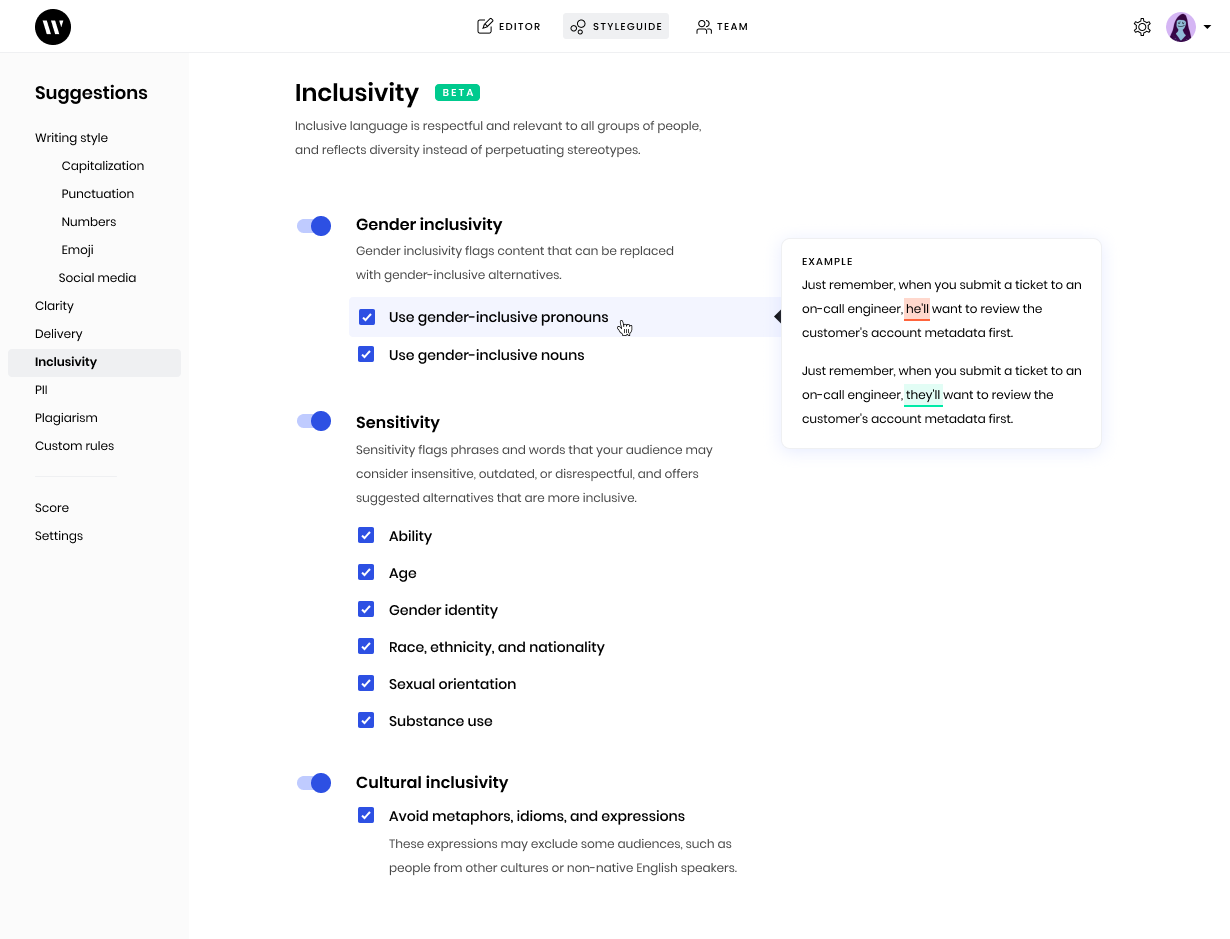

Image Credits: Writer

Writer isn’t just a growing blacklist of words you should think twice about using, though. The natural language processing engine at the heart of it is also very concerned with things like sentence complexity, paragraph length and tone. It has to have this deeper understanding, Habib explained, because “it’s not enough to underline — you need to know what to replace it with, and when you replace it, you need to fit it into the sentence. These are actually hard NLP problems.”

That lets it fit into a variety of roles in addition to promoting inclusive language. It can watch for the usual spelling and grammar mistakes, as well as things like formality, active voice, “liveliness” (whatever that is, I don’t have it) and other metrics that help define a brand.

And of course you can bring in your own style guide so your editors don’t have to roll their eyes at serial commas in headlines, double dashes instead of em dashes, e-mail instead of email and all the rest of the little nips and tucks that keep a brand’s writing in a generally recognizable shape.

Image Credits: Writer

The service can also switch between style guides or adjust or disable itself in different apps and sites — so internal emails aren’t given the same guidelines as press releases, or a blog post’s style can be differentiated from a newsletter’s.

Obviously Grammarly is a big competitor here, but Habib feels that it and the growing number of in-browser or in-app checking services are very focused on the technical piece. Writer is less about preventing an individual writer’s errors, and more about creating consistency among groups of writers and making sure they are working from the same high-level linguistic standards.

Of course security is also a concern — no one wants a keylogger running on their machine, however helpful it may be. Habib was careful to emphasize that Writer runs locally in the browser as a plug-in, integrating with Word or Chrome for now but with other apps and services on the way. “None of that data ever hits a writer server, and no metadata — all the processing is done in the text area,” she said. The only data that’s sent back is the fact that a given suggestion was used, such as changing “should of” to “should have” or “illegal aliens” to “undocumented immigrants.” No user data is used to train the models and no content apart from the correction itself is sent or stored on Writer’s servers.

Writer is available now, for $11/person/month (with the obligatory free trial period, of course) for a basic version and some unspecified amount for enterprise deals with multiple style guides, plagiarism detection, and so on. It’s only available in English, and although there is of course demand for the service in other languages, the depth of the NLP model and the specificity of what it recognizes to the language mean it does not generalize well. To take on Spanish or Korean would be to develop an entirely new product. So English it is for now.

The company is new, and has been developing its NLP engine (on the back of a previous effort, which monitored user-facing language in GitHub repos) for 18 months in something like stealth. The $5 million seed round, led by Upfront Ventures, Aspect Ventures, Bonfire Ventures, and Broadway Angels should help the company scale, though it already has some top-tier, household-name customers, so with that and the money, its immediate future seems to be secure.