Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This Week in Apps offers a way to keep up with this fast-moving industry in one place with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps and games to try, too.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

Top Story: App Store “not a monopoly” judge rules

Image credit: Andrew Harrer/Bloomberg via Getty Images

At the start of the day on Friday, it seemed like the week’s big App Store news would be Epic Games’ attempt to get back into the App Store in South Korea, following the passage of a law that forced Apple and Google to permit apps to use third-party payment systems. But Friday turned out to have much bigger news in store.

That morning, U.S. District Judge Yvonne Gonzalez Rogers issued a ruling in California’s Epic Games v. Apple antitrust case, where the Fortnite maker had alleged Apple was abusing its market power by forcing developers to use its own in-app payment systems. The judge’s decision favored Apple on the larger matter of whether or not it was acting in a monopolistic fashion. The judge said both parties had defined Apple’s relevant market incorrectly — it wasn’t just the App Store or gaming, but specifically, the $100 billion market for digital mobile gaming transactions. And while Apple had a lot of financial success here, with a 55%+ market share and high profit margins, that success was “not illegal” under either federal or state antitrust law.

This decision also means Epic Games was in breach of its contract when it implemented its own payments system in its Fortnite iOS app (it now owes Apple $12 million for that), and Apple won’t be forced to host third-party app stores or allow apps to be sideloaded on its mobile devices. For Apple, this is a huge win.

However, the judge did find that Apple was engaging in anticompetitive behavior under California’s competition laws with regard to its anti-steering provisions, which Rogers said “illegally stifle consumer choice.” As a result, Apple may no longer prohibit developers from including links, buttons, or other calls to action in their apps that direct customers to other purchasing mechanisms besides Apple’s own.

This is a huge win for Apple’s developer community, many of whom have long since fought for the right to send customers over to their own websites to make purchases or subscribe, so they could save on fees by avoiding Apple’s in-app purchase commissions. As developer pushback has increased over the years, Apple tried to placate its community by reducing commissions from 30% to 15% for developers with under $1 million in revenues. But it had still blocked developers from telling consumers they could go elsewhere to make a payment from inside their apps.

In recent weeks, this particular guideline was starting to fall apart, as Apple made concessions related to other lawsuits and legislation, including a settlement with a Japanese regulator that saw the tech giant change its policies for “reader apps”– apps that provide access to purchased content — that would allow them to point users to their own website where users could sign up and manage their accounts. Another settlement gave developers permission to use customer contact information collected inside their app to tell customers about other payment options. And South Korea’s new law forced Apple and Google to allow developers to use their own third-party payment systems if they chose.

The larger ramifications of how this policy change will play out remain to be seen. Apple will likely still require its in-app purchase mechanism to remain in place as an option, and it may enact new rules around how and where developers can add their links or other calls to action that direct customers to alternative purchasing mechanisms. The injunction’s wording is vague enough that we’ll also likely see some attempts to place payment buttons that load up alt purchasing screens inside the app, which may not agree with how Apple interprets the ruling. It’s most likely that Apple will simply allow any developer to steer users outside the app, as it does now for the “reader” apps — a system that still makes Apple’s own IAPs feel more seamless and consumer-friendly by comparison.

Then there is the matter of developer adoption. For smaller developers, it may not make sense to try to support two separate payment mechanisms if Apple’s is still required. And some may be concerned about other, less obvious potential punitive measures for avoiding IAPs — like reduced visibility in App Store searches, perhaps, or fewer App Store Editorial highlights.

On the consumer side, things could also become more difficult. Apple’s holes in App Review have allowed too many scam apps to thrive. If these apps now also start to route around IAPs, it could finally motivate Apple to expand its review team to crack down on apps that abuse subscriptions — particularly if there will be no easy way to toggle those external subscriptions off, as there is now for Apple’s IAPs. And while ultimately that’s an issue between the customer and developer, Apple could take the fall for hosting the scam apps in the first place — especially when a scam app developer becomes unreachable and the subscription keeps renewing.

There were a few other notable bits tucked inside the ruling, which paint a picture of an App Store where almost all the revenue is delivered by games and their “whales”:

- Gaming apps account for approximately 70% of all App Store revenues and is generated by less than 10% of App Store consumers.

- Over 80% of consumer accounts generate virtually no revenue, as 80% of all apps on the App Store are free.

- Apple enjoys a market share of over 55% in the market of digital mobile gaming transactions.

- Over 98% of Apple’s IAP revenue came from games in 2018 to 2019.

- Game transactions overall accounted for 76% of App Store revenue in 2017, 62.9% in 2018, and 68% in 2020.

Weekly News

Apple Updates

- Apple announced it will hold its next big hardware event on September 14 (10 am pt/1 pm et), when the company is expected to introduce new iPhones (iPhone 13?), which are rumored to have a new 120Hz ProMotion screen and a new Portrait mode for video called Cinematic Mode. The event, dubbed “California Streaming,” may also introduce an Apple Watch Series 7 and new AirPods. (The event invite also had a nifty AR Easter egg included.)

- Another App Store monopoly lawsuit had expanded ahead of the Epic ruling to include other developers who argued the App Store suppressed certain free apps in rankings and rejected others. Developers suing include the makers of Coronavirus Reporter, Bitcoin Lottery, WebCaller, and Caller-ID apps. It’s unclear what merit the suit will now have given the Epic decision.

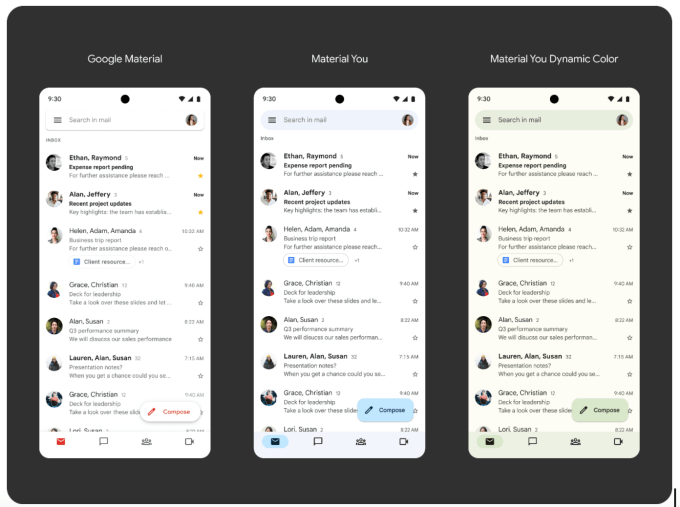

Android Updates

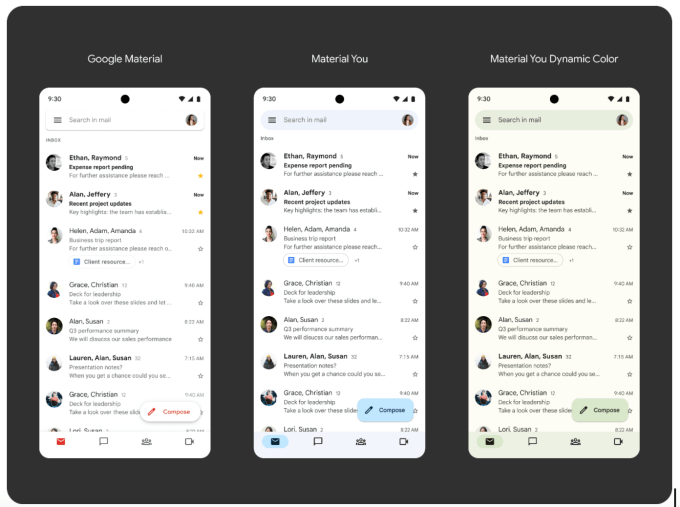

Image Credits: Google

- The final Android 12 beta arrives. Google this week rolled out the final developer beta (Android 12 Beta 5) before the public launch of its new mobile operating system in just a few weeks. The update delivered some minor tweaks and fixes but had already reached platform stability with Beta 4. Among the changes are the introduction of new Material You Clock widgets, a “Paint Chips” widget Easter Egg, a more powerful Pixel Launcher, relocated smart home controls, an overheating notification on Pixel phones, a Material You-themed Calculator app, and a search bar that’s regained rounded edges. Google Workspace apps will also feature a Material You design, which you can preview here.

- Google released Android for Cars App Library version 1.1 and completed the transition to Jetpack. Android Auto apps using features that require Car App API level 2+, such as map interactivity, vehicle’s hardware data, multiple-length text, long message and sign-in templates, can now be used in cars with Android Auto 6.7+, the company said.

- Chinese firm Xiaomi is promising 3 years of full Android OS updates, including Android 14, and an additional full year of security patches for its upcoming devices, the 11T Pro and 11T.

- Google and Jio delayed their plan to launch the much-awaited JioPhone Next in India due to chip shortages.

E-commerce

- Leafly launched an in-app marijuana ordering option following the changes to Apple’s App Store rules which now permit apps to directly facilitate these orders where legal. Other marijuana apps including Eaze and Weedmaps have done the same.

- Amazon is offering Indian farmers real-time advice and info through a dedicated mobile app that helps them make decisions about crops and deploy machine learning tech. The company sees securing a steady stream of fruit, vegetables, and other groceries as a key to dominating Indian online commerce, Bloomberg reported.

- Singapore-based Shopee has overtaken Mercado Libre to become the top shopping app in Latin America, Apptopia’s research found.

Augmented Reality

- Snap has hired Nishad Pai, previously a business development and partnerships executive at Adobe, as its Global Head of Platform Partnerships Business Development, The Information reported. He will report to VP of Platform Partnerships Konstantinos “KP” Papamiltiadis, who recently came to Snap from Facebook.

Fintech

- The SEC wants to regulate Coinbase’s crypto yield-generating product, Coinbase Lend, claiming it’s a security. Company CEO Brian Armstrong disagreed and said the SEC offered no explanation as to how it reached this conclusion.

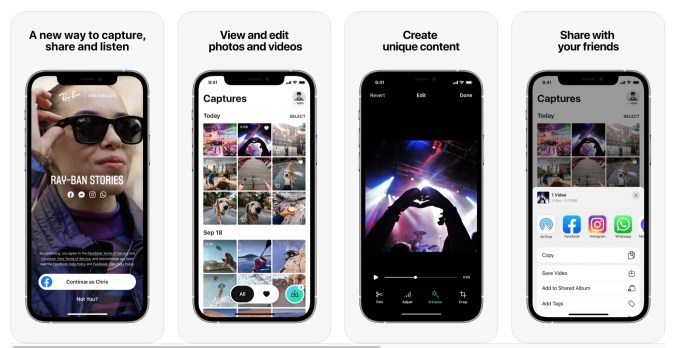

Social

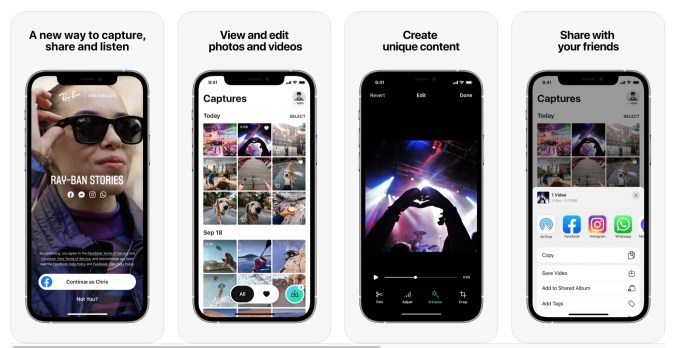

Image Credits: Facebook

- Facebook launched its Snapchat Spectacles rival in partnership with Ray-Ban. The new smart glasses are called Ray-Ban Stories and allow users to record what they’re seeing as both photos and videos using the 2 onboard 5MP cameras, as well as listen to music and take calls. The glasses must be paired with an iOS or Android device to work, and transfer video through the new Facebook View app where users can further edit the media or add effects.

- Twitter launched “Communities,” which allow users to tweet directly to others with their same interests. Initially, Twitter is testing topics like dogs, weather, sneakers, skincare, and astrology.

- Other Twitter features that launched this week include a test taking place in Turkey that allows users to react to tweets using emoji, a test of full-width photos and videos, a test of a new label to identify the “good bots,” and a test of a soft-block feature that lets you remove people from your followers instead of blocking them outright.

- Social network Peanut expanded to include more women with the launch of Peanut Menopause, a collection of features and groups that will allow women in all stages of menopause to network and discuss the topic.

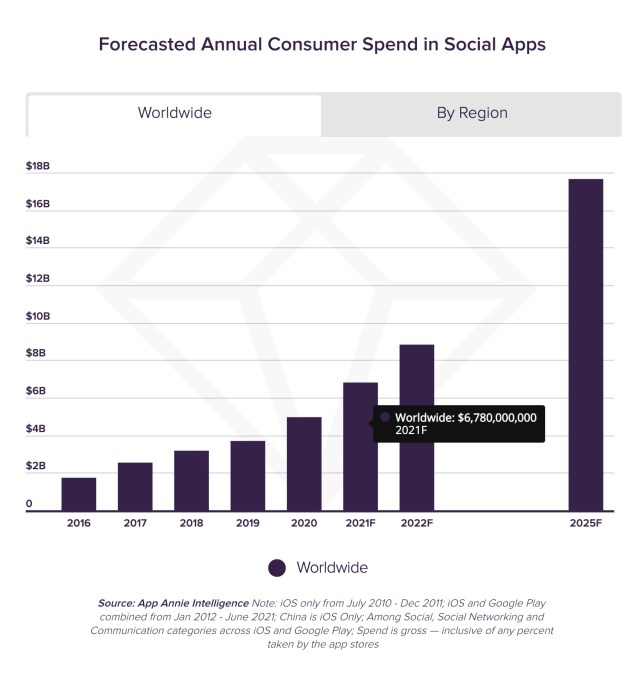

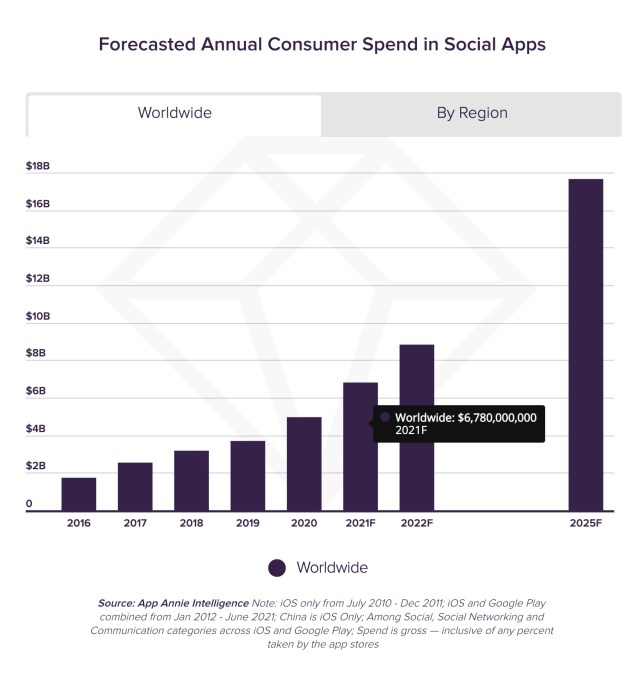

- Consumer spending in social apps will hit $17.2 billion annually by 2025 up from $6.78 billion in 2021, according to new data from App Annie. The boom is largely attributed to the growth of live streaming. In H1 2021, $3 out of every $4 spent in the top 25 social apps came from those that offered livestreams.

Image Credits: App Annie

Photos

- Google Photos adds new ways to print. The app already offered photo prints, books, and more, but now introduces larger photo print sizes and new canvas prints. Now, for $0.18 per print (plus shipping), you can choose between the existing 4×6, 5×7, or 8×10 prints, or four additional sizes: 11×14, 12×18, 16×20, and 20×30 prints. New canvas prints will be added in sizes 8×10, 16×16, 20×30, 24×36, 30×40, and 36×36.

- Dispo, the photo-sharing app that emulates disposable cameras, is now pilot testing a feature that will allow users to sell their photos as NFTs. The company hasn’t fully determined what blockchain it would use, if it would partner with an NFT marketplace, or what cut it would take from these sales if it moves forward.

- Glass launches its photo-sharing app for photographers disenchanted with Instagram. The subscription app allows users to upload photos and follow others, view photo metadata, comment, and more.

Messaging

- WhatsApp says users will now be able to encrypt their chat backups in the cloud. While the Facebook-owned app has allowed end-to-end encrypted chats for more than a decade, there was not yet an option to securely store their chat backup to the cloud, meaning iCloud on iOS or Google Drive on Android. The company has now created a system that will allow users to lock their backups with a 64-digit encryption key, which can be stored offline or in a password manager. Or they can create a password that backs up the key into a cloud-based “backup key vault” that WhatsApp has built.

Dating

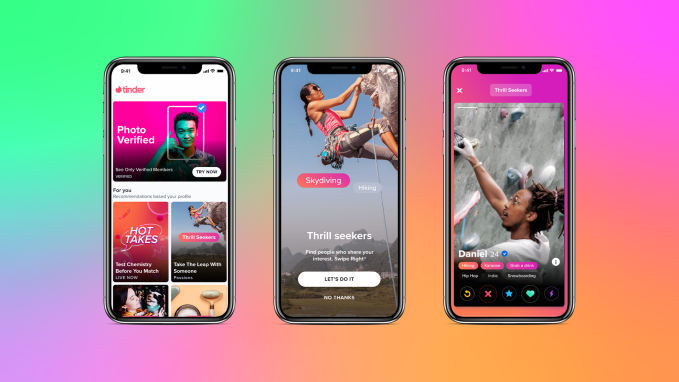

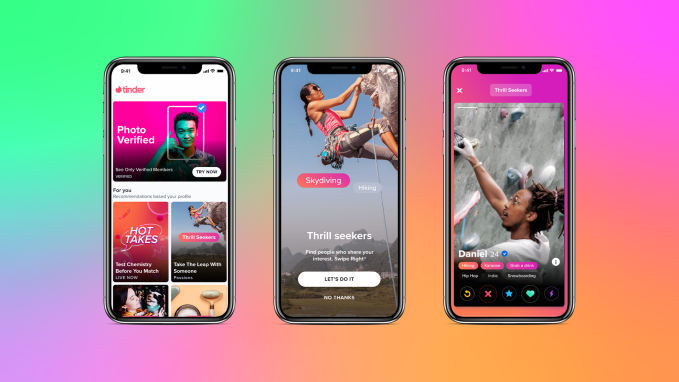

Image Credits: Tinder

- Tinder added a new home for interactive, social features with the launch of Tinder Explore. The new section will feature events, like the return of the popular “Swipe Night” series, as well as ways to discover matches by interests and dive into quick chats before a match is made. Combined, the changes help to push Tinder further away from its roots as a quick match-based dating app into something that’s more akin to a social network aimed at helping users meet new people.

- Tinder CEO Jim Lanzone has left the dating app to take the top job at Yahoo, which btw, owns TechCrunch.

Streaming & Entertainment

- Spotify playlist curators are complaining about the streamer’s reporting system that favors bad actors over innocent parties. Currently, playlists created by Spotify users can be reported in the app for a variety of reasons — like sexual, violent, dangerous, deceptive, or hateful content. When a report is submitted, the playlist in question will have its metadata immediately removed, including its title, description, and custom image. There is no internal review process that verifies the report is legitimate before the metadata is removed, which has allowed bad actors (and sometimes their bots) to constantly report playlists that are gaining bigger followings than their own.

- Apple Music will now use Shazam to address attribution and royalties issues around DJ mixes. Apple Music is working with major and independent labels to devise a fair way to divide streaming royalties among DJs, labels, and artists who appear in the mixes, it said.

Gaming

- Amazon’s game-streaming service added support for Chromebook and its own Fire Tablets, including the Fire 7, Fire HD 8, and Fire HD 10. The company has already supported Android, iOS (via a web app), Windows, Mac, and Fire TV. It also added a new “Family” channel for $2.99/month that offers 35 curated games that are appropriate for younger children and is preparing to launch a retro gaming channel, as well.

- Genshin Impact version 2.1 is a hit. The game from miHoYo has generated $151 million in its first week (starting Sept. 1) across iOS and Android, or more than the game accumulated during the full month of August and up 5x from the week prior, Sensor Tower reports.

- Google announced the winners of its Indie Games Festival, which included: Bird Alone by George Batchelor, United Kingdom; Cats in Time by Pine Studio, Croatia; Gumslinger by Itatake, Sweden; CATS & SOUP by HIDEA, Korea; Rush Hour Rally by Soen Games, Korea; The Way Home by CONCODE, Korea; Mousebusters by Odencat, Japan; Quantum Transport by ruccho, Japan; and Survivor’s guilt by aso, Japan.

News & Reading

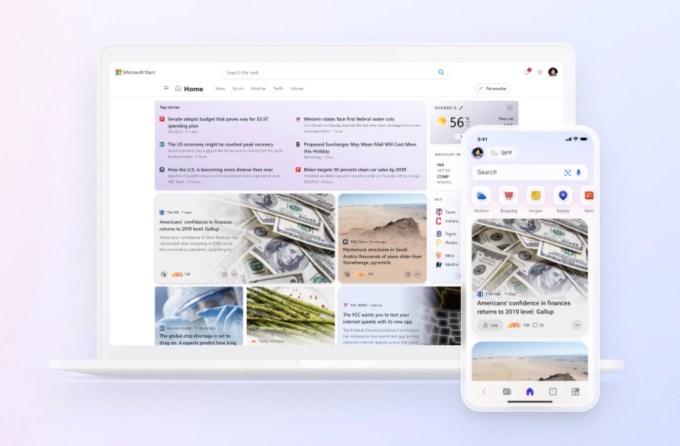

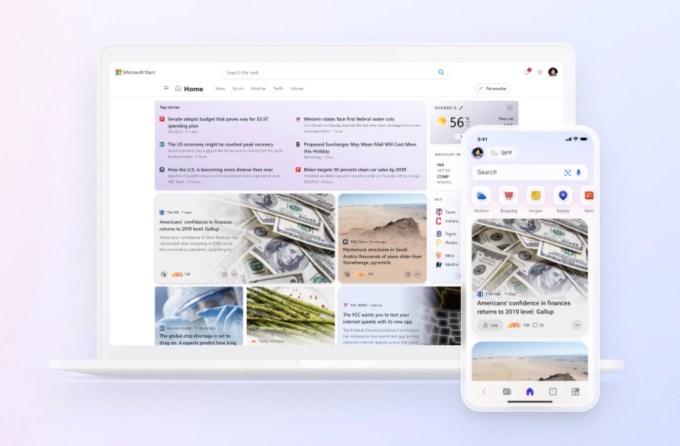

Image Credits: Microsoft

- Microsoft this week launched a news service called Microsoft Start which personalizes the news for its readers, both by explicit and implicit signals. Users can customize the page to their liking by adding and removing topics or give individual stories a thumbs up or down. It will also get smarter the more you use the service. On mobile, Microsoft Start is available as an app for iOS and Android.

Utilities

- Apple Maps brings its Street View competitor Look Around to Italy, city-state Vatican City, San Marino, and Andorra.

Government & Policy

- Google is under investigation in the EU for forcing Android phone manufacturers to pre-install its voice assistant, Google Assistant on Android devices. The AI assistant has been the default on Android devices since 2017.

Funding and M&A

Mobile game publisher Jam City raised $350 million and closed on its purchase of game publisher Ludia for $165 million. The deal follows Jam City’s decision to drop its $1.2 billion plan to go public via a SPAC. The new funding is a combination of equity and debt and comes from Netmarble, Kabam, and affiliates of funds managed by Fortress Investment Group.

Mobile game publisher Jam City raised $350 million and closed on its purchase of game publisher Ludia for $165 million. The deal follows Jam City’s decision to drop its $1.2 billion plan to go public via a SPAC. The new funding is a combination of equity and debt and comes from Netmarble, Kabam, and affiliates of funds managed by Fortress Investment Group.

Travel app Headout raised $12 million in Series B funding led by Glade Brook Capital, an investor in Airbnb, Uber, Instacart, and others, for its tour-booking marketplace that has grown 800% since January and reached profitability in July. The company plans to hire 150+ people with the funds.

Travel app Headout raised $12 million in Series B funding led by Glade Brook Capital, an investor in Airbnb, Uber, Instacart, and others, for its tour-booking marketplace that has grown 800% since January and reached profitability in July. The company plans to hire 150+ people with the funds.

Live-shopping startup Whatnot is raising new capital at a $1.5 billion valuation, according to a report from The Information, which also says existing investor Andreessen Horowitz is involved in the new round. The app focuses on collectibles, like sports cards, Pokémon cards, Funko Pop figurines and others.

Live-shopping startup Whatnot is raising new capital at a $1.5 billion valuation, according to a report from The Information, which also says existing investor Andreessen Horowitz is involved in the new round. The app focuses on collectibles, like sports cards, Pokémon cards, Funko Pop figurines and others.

Varo Bank raised a massive $510 million Series E funding round led by new investor Lone Pine Capital, valuing the business at $2.5 billion. The neobank, which has now raised $992.4 million since its 2015 founding, last year became the first U.S. neobank to be granted a national bank charter.

Varo Bank raised a massive $510 million Series E funding round led by new investor Lone Pine Capital, valuing the business at $2.5 billion. The neobank, which has now raised $992.4 million since its 2015 founding, last year became the first U.S. neobank to be granted a national bank charter.

Fintech app Nuula, aimed at small businesses, raised $120 million in new funding to build out a “super app” that will offer business banking, payments, cash flow forecasting, credit score monitoring, customer sentiment tracking, and more. The funding was a combination of $20 million in equity from Edison Partners, and a $100 million credit facility from funds managed by the Credit Group of Ares Management Corporation.

Fintech app Nuula, aimed at small businesses, raised $120 million in new funding to build out a “super app” that will offer business banking, payments, cash flow forecasting, credit score monitoring, customer sentiment tracking, and more. The funding was a combination of $20 million in equity from Edison Partners, and a $100 million credit facility from funds managed by the Credit Group of Ares Management Corporation.

Financial comparison super app Jeff raised a $1.5 million seed extension led by J12 Ventures for its app that operates in Vietnam and plans to move into Indonesia, followed by the Philippines.

Financial comparison super app Jeff raised a $1.5 million seed extension led by J12 Ventures for its app that operates in Vietnam and plans to move into Indonesia, followed by the Philippines.

U.K. food sharing app OLIO raised $43 million in Series B funding led by Swedish investment firm VNV Global and New York-based hedge fund Lugard Road Capital/Luxor. The app allows users to post a photo of unwanted food to share it with the local neighborhood.

U.K. food sharing app OLIO raised $43 million in Series B funding led by Swedish investment firm VNV Global and New York-based hedge fund Lugard Road Capital/Luxor. The app allows users to post a photo of unwanted food to share it with the local neighborhood.

Mayk.it, a social music creation app founded by TikTok and Snap alums, raised $4 million in seed funding and launched to the public. The app allows users to produce, own and share music they make with their phones. Investors include Greycroft, Chicago Ventures, Slow Ventures, firstminute, Steven Galanis, Randi Zuckerberg, YouTuber Mr. Beasts’ Night media, Spotify’s first CMO Sophia Bendz, Cyan Banister, artist T-Pain and music industry veteran Zach Katz, among others.

Mayk.it, a social music creation app founded by TikTok and Snap alums, raised $4 million in seed funding and launched to the public. The app allows users to produce, own and share music they make with their phones. Investors include Greycroft, Chicago Ventures, Slow Ventures, firstminute, Steven Galanis, Randi Zuckerberg, YouTuber Mr. Beasts’ Night media, Spotify’s first CMO Sophia Bendz, Cyan Banister, artist T-Pain and music industry veteran Zach Katz, among others.

Fertility tracking app Flo closed on $50 million in Series B funding co-led by VNV Global and Target Global. The round values the business at $800 million. Flo has 200 million global users and leverages machine learning to make cycle predictions, offer health insights, and send health alerts.

Fertility tracking app Flo closed on $50 million in Series B funding co-led by VNV Global and Target Global. The round values the business at $800 million. Flo has 200 million global users and leverages machine learning to make cycle predictions, offer health insights, and send health alerts.

Reading Rec’s

Downloads

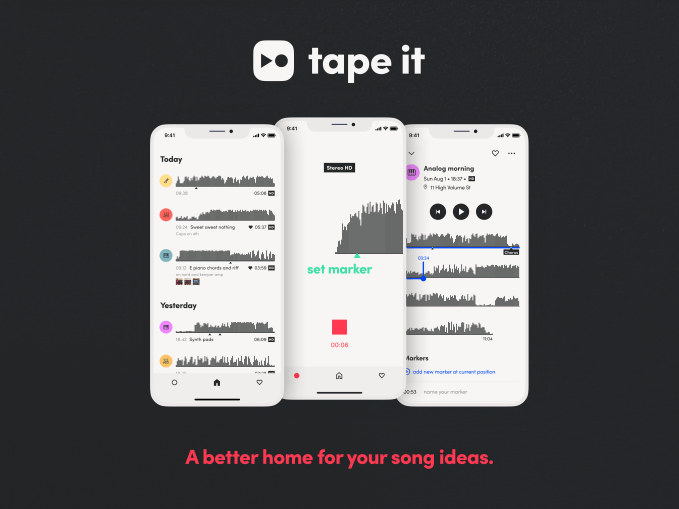

Tape It

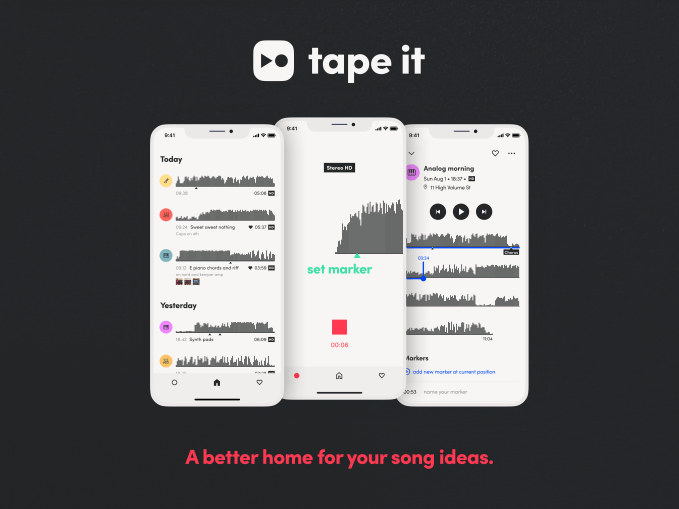

Image Credits: Tape It

Tape It launches an AI-powered music recording app designed to be a better alternative to using Apple’s built-in Voice Memos app for quick recordings. The app offers a variety of features, including higher-quality sound, automatic instrument detection, support for markers, notes and images, and more, and will later expand to include collaboration features. It also breaks longer recordings onto multiple lines, more like wrapped text, which it believes is easier to work with than one long, horizontal scroll. But the standout feature is its support for “Stereo HD” quality, which leverages two microphones on newer iPhone models to improve the recording’s sound quality. This feature is a $20 per year subscription, but the app is a free download on iOS. (Full review here.)

Marvel Unlimited (update)

Image Credits: Marvel

The Marvel Unlimited comics subscription app has been overhauled with the latest release. The updated version introduces 27 Infinity Comics, which are high-res vertical comics for phones and tablets. At launch, these include series like X-Men Unlimited, Captain America, Black Widow, Deadpool, Shang-Chi, and Venom/Carnage. By year-end, there will be 100 of these available. The app provides access to over 29,000 comics. The updated version of the app was rebuilt by DMED Technology, which worked closely with Marvel, to deliver a combination of new features and technology, which include enhanced curation, search, personalization, speed, and performance, as well as support for offline reading. DMED is the team within Disney Media & Entertainment Distribution that builds, manages, and maintains Disney’s apps and sites that reach 380 million users globally each month, including Marvel, ESPN, ABC News, ABC, Disney Now, Disney.com, National Geographic, FX, and more. (Full review here.)

ETA 3 (update)

Image Credits: ETA

First launched in 2014, ETA offered an Apple Watch app that made it easier to get the travel time to favorite places right on your wrist. Now, the developer has rebuilt ETA to transform it into a new app for Apple Watch. With ETA 3, the app is entirely independent from the iPhone for starters. You can quickly glance at your locations and see the travel time to your destinations like home, work, school, the airport and any others you input. It now also supports cycling times in addition to driving, walking, and transit. And it will support all calendars, so you can sync your appointments to the app to see the travel time to your next meeting. You can also organize top locations into lists, sync workouts with Apple Health, and more.

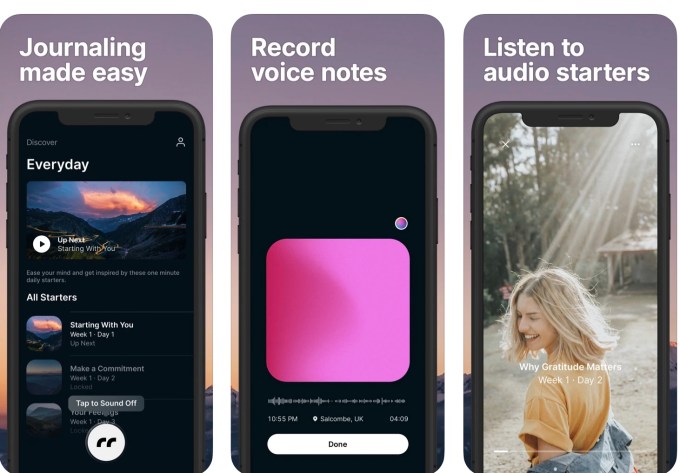

Sound Off

Image Credits: Sound Off

A new app called Sound Off offers an easy way to keep a journal using only your voice. Ideal for those who like to think out loud, the app offers daily prompts that help you get started when you don’t know what to say. The app will focus on topics like gratitude, happiness, confidence, relationships, reflection, friendships, sleep, habits, anxiety, family, and more, giving you time to reflect and practice self-care. The recordings are saved locally to your iPhone, so the app developer cannot access them, and are backed up by default using iCloud.

Mobile game publisher Jam City

Mobile game publisher Jam City