Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week, we’re looking into how President Biden’s inauguration impacted news apps, the latest in the Parler lawsuit, and how TikTok’s app continues to shape culture, among other things.

Top Stories

Judge says Amazon doesn’t have to host Parler on AWS

Logos for AWS (Amazon Web Services) and Parler. Image Credits: TechCrunch

U.S. District Judge Barbara Rothstein in Seattle this week ruled that Amazon won’t be required to restore access to web services to Parler. As you may recall, Parler sued Amazon for booting it from AWS’ infrastructure, effectively forcing it offline. Like Apple and Google before it, Amazon had decided that the calls for violence that were being spread on Parler violated its terms of service. It also said that Parler showed an “unwillingness and inability” to remove dangerous posts that called for the rape, torture and assassination of politicians, tech executives and many others, the AP reported.

Amazon’s decision shouldn’t have been a surprise for Parler. Amazon had reported 98 examples of Parler posts that incited violence over the past several weeks before its decision. It told Parler these were clear violations of the terms of service.

Parler’s lawsuit against Amazon, however, went on to claim breach of contract and even made antitrust allegations.

The judge shot down Parler’s claims that Amazon and Twitter were colluding over the decision to kick the app off AWS. Parler’s claims over breach of contract were denied, too, as the contract had never said Amazon had to give Parler 30 days to fix things. (Not to mention the fact that Parler breached the contract on its side, too.) It also said Parler had fallen short in demonstrating the need for an injunction to restore access to Amazon’s web services.

The ruling only blocks Parler from forcing Amazon to again host it as the lawsuit proceeds, but is not the final ruling in the overall case, which is continuing.

TikTok drives another pop song to No. 1 on Billboard charts, breaks Spotify’s record

@livbedumb? drivers license – Olivia Rodrigo

We already knew TikTok was playing a large role in influencing music charts and listening behavior. For example, Billboard last year noted how TikTok drove hits from Sony artists like Doja Cat (“Say So”) and 24kGoldn (“Mood”), and helped Sony discover new talent. Columbia also signed viral TikTok artists like Lil Nas X, Powfu, StaySolidRocky, Jawsh 685, Arizona Zervas and 24kGoldn. Meanwhile, Nielsen has said that no other app had helped break more songs in 2020 than TikTok.

This month, we’ve witnessed yet another example of this phenomenon. Olivia Rodrigo, the 17-year-old star of Disney+’s “High School Musical: The Musical: the Series” released her latest song, “Drivers License” on January 8. The pop ballad and breakup anthem is believed to be referencing the actress’ relationship with co-star Joshua Bassett, which gave the song even more appeal to fans.

Upon its release the song was heavily streamed by TikTok users, which helped make it an overnight sensation of sorts. According to a report by The WSJ, Billboard counted 76.1 million streams and 38,000 downloads in the U.S. during the week of its release. It also made a historic debut at No. 1 on the Hot 100, becoming the first smash hit of 2021.

On January 11, “Drivers License” broke Spotify’s record for most streams per day (for a non-holiday song) with 15.17 million global streams. On TikTok, meanwhile, the number of videos featuring the song and the views they received doubled every day, The WSJ said.

Charli D’Amelio’s dance to it on the app has now generated 5 million “Likes” across nearly 33 million views, as of the time of writing.

@charlidamelio? drivers license – Olivia Rodrigo

Of course, other TikTok hits have broken out in the past, too — even reaching No. 1 like “Blinding Lights” (The Weeknd) and “Mood” (24kGoldn). But the success of “Drivers License” may be in part due to the way it focuses on a subject that’s more relevant to TikTok’s young, teenage user base. It talks about first loves and being dumped for the other girl. And its title and opening refer to a time many adults have forgotten: the momentous day when you get your driver’s license. It’s highly relatable to the TikTok crowd who fully embraced it and made it a hit.

Weekly News

Platforms: Apple

- Apple stops signing iOS 12.5, making iOS 12.5.1 the only versions of iOS available to older devices.

- A report claims Apple’s iOS 15 update will cut support for devices with an A9 chip, like the iPhone 6, iPhone 6s Plus and the original iPhone SE.

- New analysis estimates Apple’s upcoming iOS privacy changes will cause a roughly 7% revenue hit for Facebook in Q2. The revenue hit will continue in following quarters and will be “material.”

Platforms: Google

- Google adds “trending” icons to the Play Store. New arrow icons appeared in the Top Charts tab, which indicate whether an app’s downloads are trending up or down, in terms of popularity. This could provide an early signal about those that may still be rising in the charts or beginning to fall out of favor, despite their current high position.

- Google appears to be working on a Restricted Networking mode for Android 12. The mode, discovered by XDA Developers digging in the Android Open Source Project, would disable network access for all third-party apps.

Gaming

- Goama (or Go Games) introduced a way for developers to integrate social games into their apps, which was showcased at CES. The company focuses on Asia and Latin America and has more than 15 partners, including GCash and Rappi, for digital payments and communications.

- Fortnite maker Epic Games is getting into movies. The animated feature film Gilgamesh will use Epic’s Unreal Engine technology to tell the story of the king-turned-deity. The movie is not an in-house project, but rather is financed through Epic’s $100M MegaGrants fund.

Augmented Reality

- Patents around Apple’s AR and VR efforts describe how a system could be identified in a way that’s similar to FaceID, then either permitted or denied the ability to change their appearance in the game.

- Pinterest launches AR try-on for eyeshadow in its mobile app using Lens technology and ModiFace data. The app already offered AR try-on for lipsticks.

Entertainment

- The CW app became the No. 1 app on the App Store this week, topping TikTok, Instagram and YouTube, thanks to CW’s season premieres of Batwoman, All American, Riverdale and Nancy Drew.

- Users of podcasting app Anchor, owned by Spotify, say the app isn’t bringing them any sponsorship opportunities, as promised, beyond those from Spotify and Anchor itself.

- YouTube launches hashtag landing pages on the web and in its mobile app. The pages are accessible when you click hashtags on YouTube, not via search, and weirdly rank the “best” videos through some inscrutable algorithm.

- Apple’s Podcasts app adds a new editorial feature, Apple Podcasts Spotlight, meant to increase podcast listening by showcasing the best podcasts as selected by Apple editors.

E-commerce

- WeChat facilitated 1.6 trillion yuan (close to $250 billion) in annual transactions through its “mini programs” in 2020. The figure is more than double that of 2019.

Fintech

- Douyin, the Chinese version of TikTok, launched an e-wallet, Douyin Pay. The wallet will supplement the existing payment options, Alipay and WeChat Pay, and will help to support the Douyin app’s growing e-commerce business.

- Neobank Monzo founder Tom Blomfield left the startup, saying he struggled during the pandemic. “I think [for] a lot of people in the world…going through a pandemic, going through lockdown and the isolation involved in that has an impact on people’s mental health,” he told TechCrunch.

- New estimates indicate about 50% of the iPhone user base (or 507 million users) now use Apple Pay.

- Samsung’s newest phones drop support for MST, which emulates a mag stripe at terminals that don’t support NFC.

Social

- Indian messaging app, StickerChat, owned by Hike, is shutting down. Founder Kavin Bharti Mittal said India will never have a homegrown messenger unless it bars Western companies from its market. Hike pivoted this month to virtual social apps, Vibe and Rush, which it believes have more potential.

- Instagram head Adam Mosseri, in a Verge podcast, said he’s not happy with Reels so far, and how he feels most people probably don’t understand the difference between Instagram video and IGTV. He says the social network needs to simplify and consolidate ideas.

- Facebook and Instagram improve their accessibility features. The apps’ AI-generated image captions now offer far more details about who or what is in the photos, thanks to improvements in image recognition systems.

- TikTok launches a Q&A feature that lets creators respond to fan questions using text or videos. The feature, rolled out to select creators with more than 10,000 followers, makes it easier to see all the questions in one place.

Health & Fitness

- Health and fitness app spending jumped 70% last year in Europe to record $544 million, a Sensor Tower report says. The year-over-year increase is far larger than 2019, when growth was just 37.2%. COVID-19 played a large role in this shift as people turned to fitness apps instead of gyms to stay in shape.

Government & Policy

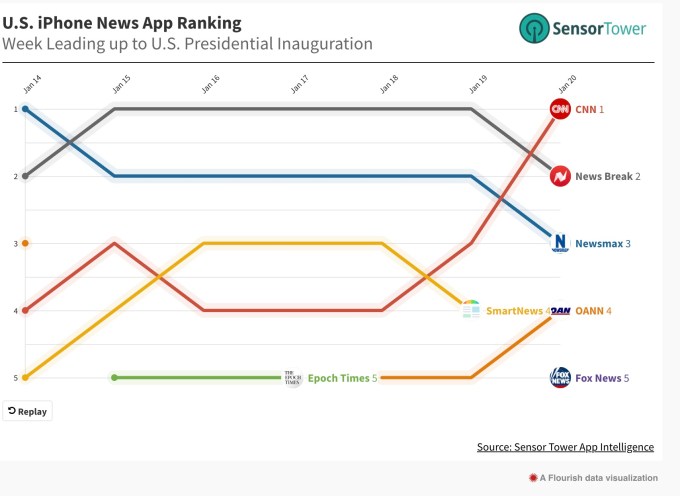

- Biden’s inauguration boosted installs of U.S. news apps up to 170%, Sensor Tower reported. CNN was the biggest mover, climbing 530 positions to reach No. 41 on the App Store, and up 170% in terms of downloads. News Break was the second highest, climbing 13 positions to No. 65. Right-wing outlet Newsmax climbed 43 spots to reach No. 108. In 2020, the top news apps were: News Break (23.7 million installs); SmartNews (9 million); CNN (5 million); and Fox News (4 million). This month, however, News Break saw 1.2 million installs, followed by Newsmax with about 863,000 installs, the report said.

- Ireland’s Data Protection Commission (DPC) sent a draft decision to fellow EU Data Protection Authorities over the WhatsApp-Facebook data sharing policy. This means a decision on the matter is coming closer to a resolution in terms of what standards of transparency is required by WhatsApp.

- German app developer Florian Mueller of FOSS Patents filed a complaint with the EU, U.S. DOJ and other antitrust watchdogs around the world over Apple and Google’s rejection of his COVID-related mobile game. Both stores had policies to only approve official COVID-19 apps from health authorities. Mueller renamed the game Viral Days and removed references to the novel coronavirus to get the app approved. However, he still feels the stores’ rules are holding back innovation.

Productivity

- Basecamp’s Hey, which famously fought back against Apple’s App Store rules over IAP last year, has launched a business-focused platform, Hey for Work, expected to be public in Q1. The app has more App Store ratings than rival Superhuman, a report found. Currently, Hey has a 4.7-star rating across 3.3K reviews; Superhuman has 3.9 rating across only 274 reviews.

Trends

- Baby boomers are increasingly using apps. Baby boomers/Gen Xers in the U.S. spent 30% more time year-over-year in their most used apps, App Annie reports. That’s a larger increase than either Millennials or Gen Z, at 18% and 16%, respectively.

Funding and M&A

- Curtsy, a clothing resale app for Gen Z women, raised an $11 million Series A led by Index Ventures. The app tackles some of the problems with online resale by sending shipping supplies and labels to sellers, and by making the marketplace accessible to new and casual sellers.

- Storytelling platform Wattpad acquired by South Korea’s Naver for $600 million. The reading apps whose stories have turned into book and Netflix hits will be incorporated into Naver’s publishing platform Webtoon.

- On-demand delivery app Glovo partnered with Swiss-based real estate firm, Stoneweg, which is investing €100 million in building and refurbishing real estate in key markets to build out Glovo’s network of “dark stores.”

- Pocket Casts app is up for sale. The podcast app was acquired nearly three years ago by a public radio consortium of top podcast producers (NPR, WNYC Studios, WBEZ Chicago and This American Life). The owners have now agreed to sell the app, which posted a net loss in 2020. (NPR’s share of the loss was over $800,000.)

- Travel app Maps.me raised $50 million in a round led by Alameda Research. The funding will go toward the launch of a multi-currency wallet. Cryptocurrency lender Genesis Capital and institutional cryptocurrency firm CMS Holdings also participated in the round, Coindesk reported.

- Bangalore-based hyperlocal delivery app Dunzo raised $40 million in a round that included investment from Google, Lightbox, Evolvence, Hana Financial Investment, LGT Lightstone Aspada and Alteria.

- London-based food delivery app Deliveroo raised $180 million in new funding from existing investors, led by Durable Capital Partners and Fidelity Management, valuing the business at more than $7 billion.

- Dating Group acquired Swiss startup Once, a dating app that sends one match per day, for $18 million.

Downloads

Bodyguard

Image Credits: Bodyguard

A French content moderation app called Bodyguard, detailed here by TechCrunch, has brought its service to the English-speaking market. The app allows you to choose the level of content moderation you want to see on top social networks, like Twitter, YouTube, Instagram and Twitch. You can choose to hide toxic content across a range of categories, like insults, body shaming, moral harassment, sexual harassment, racism and homophobia and indicate whether the content is a low or high priority to block.

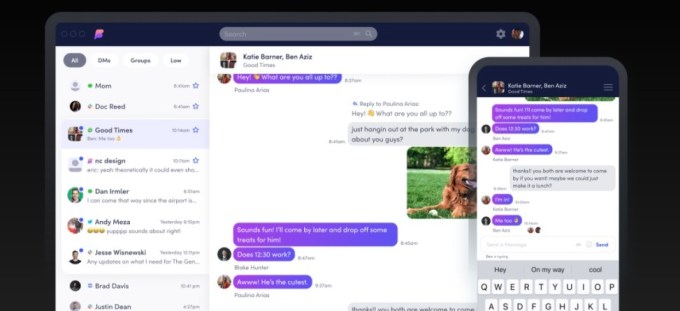

Beeper

Image Credits: Beeper

Pebble’s founder and current YC Partner Eric Migicovsky has launched a new app, Beeper, that aims to centralize in one interface 15 different chat apps, including iMessage. The app relies on an open-source federated, encrypted messaging protocol called Matrix that uses “bridges” to connect to the various networks to move the messages. However, iMessage support is more wonky, as the company actually ships you an old iPhone to make the connection to the network. But this system allows you to access Beeper on non-Apple devices, the company says. The app is slowly onboarding new users due to initial demand. The app works across MacOS, Windows, Linux, iOS and Android and charges $10/mo for the service.