Apple’s flagship noise-canceling headphones have a premium build and a premium price tag, but they also sound better than the rest.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

A Hacker Tried to Poison a Florida City’s Water Supply

The attacker upped sodium hydroxide levels in the Oldsmar, Florida, water supply to extremely dangerous levels.

Everyone on Twitter Needs an Etiquette Manual

After a year of quarantine, we could all use help relearning how to connect to people in a healthy way.

How Did They Find the Secret Space Lab in Captain Marvel?

They talk about something called state vectors. What the heck are those, and would it really work?

Tips on How to Snag a PlayStation 5 (Good Luck!)

Months after launch, Sony’s latest console is proving difficult to find for many. We’ve got some tips on how to score one.

Forget Blood—Your Skin Might Know If You’re Sick

This glowing microneedle test could catalyze a transition from blood-based diagnostics to a stick-on patch.

All These Mutant Virus Strains Need New Code Names

As potentially more dangerous variants of Covid-19 spread, scientists are taking a crack at giving them clearer names that’ll help in the fight.

A Historic Union Vote Gets Underway at Amazon

A warehouse in Bessemer, Alabama, could become the first Amazon union in the US. But it won’t happen overnight.

The Secret, Essential Geography of the Office

A workplace has its own informal cardinal directions: elevatorward, kitchenward, bathroomward. It’s a map we share.

Films of the Era Will Be as Unbalanced as the Pandemic Itself

What will films look like because of Covid-19? The same as during any other traumatic event. Some good, some bad, some brilliant.

A Silicon Chip Shortage Is Causing Big Issues for Automakers

Car companies have had to reduce output, pause production, and even idle shifts and entire factories.

How Choreography Can Help Robots Come Alive

Dance and robotics rarely overlap. But if they did, it could make robots seem less like industrial contrivances, and more like empathetic beings.

Hasselblad X1D II 50C: out of the studio and into the streets

We crawled into an abandoned school bus, trespassed through dilapidated hallways, dodged fleeting thunderstorms and wandered through empty streets of Chinatown late into the evening. For two summery weeks, I couldn’t have been happier.

New York City was in lockdown. I’d been quarantined in my dinky apartment, disheartened and restless. I was anxious to do something creative. Thankfully, the Hasselblad X1D II 50C arrived for review, along with approval from the studio heads for socially-distanced, outdoor shoots.

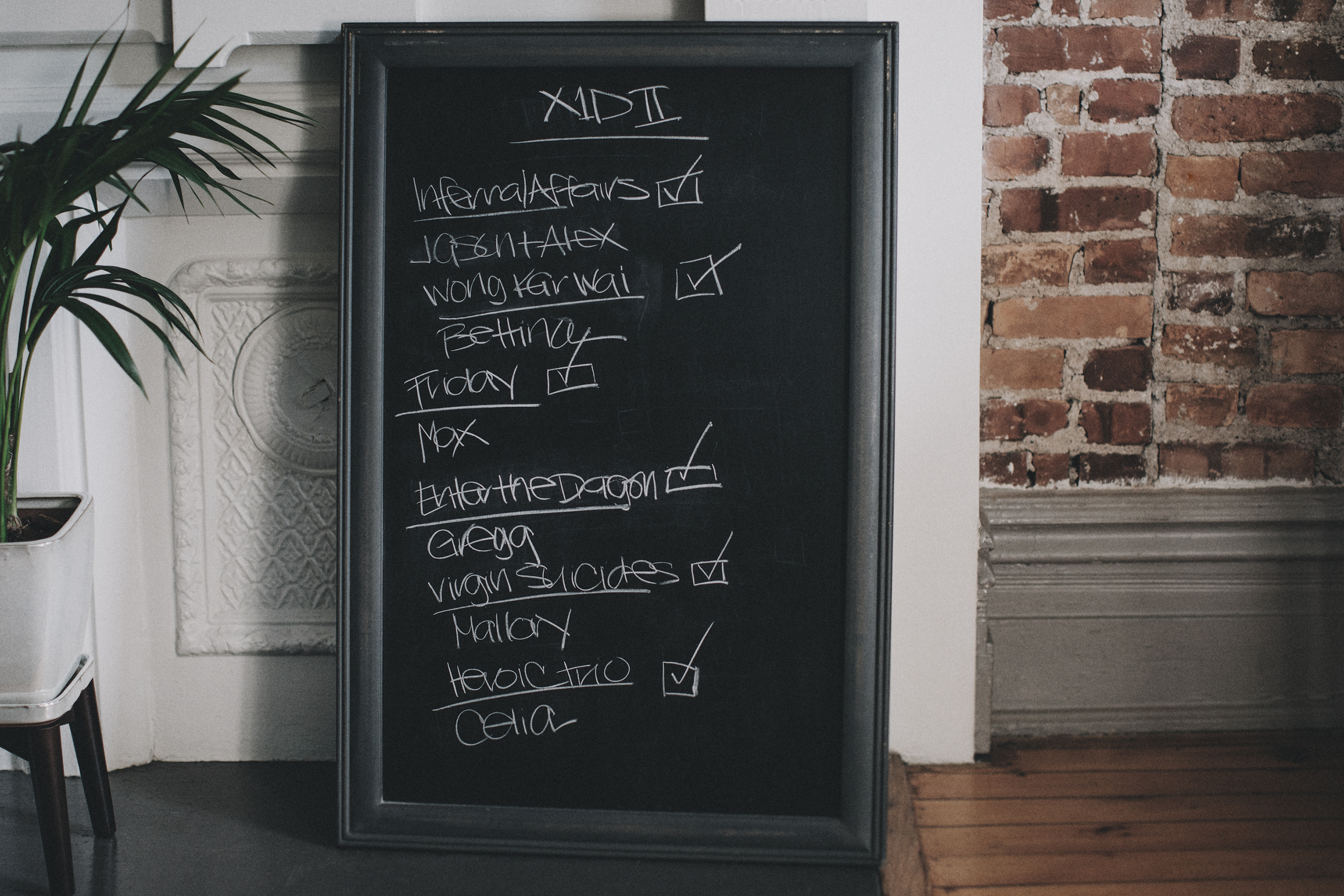

Taking pictures of the mundane (flowers, buildings, and such) would’ve been a disservice to a $10,000 camera kit, so instead, my friends and I collaborated on a fun, little project: we shot portraits inspired by our favorite films.

Image Credits: Veanne Cao

Equipped with masks and a bottle of hand sanitizer, we put the X1D II 50C and 80mm F/1.9 lens (ideal for close-ups without actually having to be close up) through its paces in some of NYC’s less familiar backdrops.

Before I get into any trouble for the last photo – Alex and Jason are professional stuntmen and that’s a rubber prop gun. They were reenacting the penultimate scene from Infernal Affairs – a brilliant piece of Hong Kong cinema (much better than the Scorsese remake).

While the camera is slightly more approachable in terms of cost and ease of use with a few upgrades (larger, more responsive rear screen, a cleaned-up menu, tethering capabilities, faster startup time and shutter release), the X1D II is essentially the same as its predecessor. So I skipped the standard review.

Image Credits: Veanne Cao

What it is, what it isn’t

The most common complaint about the X1D was its slow autofocus, slow shutter release and short battery life. The X1D II improved on these features, though not by much. Rather than seeing the lag as a hindrance, I was forced to slow down and re-wire my brain for a more thoughtful shooting style (a pleasant side effect).

As I mentioned in my X1D review, Apple and other smartphone manufacturers have made shooting great pictures effortless. As such, the accessibility has created a culture of excessively capturing everyday banalities. You shoot far more than you’ll ever need. It’s something I’m guilty of. Pretty sure 90% of the images on my iPhone camera roll are throwaways. (The other 10% are of my dog and he’s spectacularly photogenic.)

The X1D II, however, is not an easy camera. It’s frustrating at times. If you’re a beginner, you may have to learn the fundamentals (ISO, f-stops, when to click the shutter), but the payoff is worth it. There’s an overwhelming sense of gratification when you get that one shot. And at 50 megapixels, it’s packed with details and worthy of hanging on your wall. Shelling out a ton of money for the X1D II won’t instantly make you a better photographer, but it ought to encourage you to become one.

Without the contrived studio lights and set design, our outdoor shoots became an exercise in improvisation: we wandered through the boroughs finding practicals (street lights, neon lights… the sun), discovering locations, and switching spots when things didn’t pan out.

We explored, we had purpose.

My takeaway from the two weeks with this camera: pause and be meaningful in your actions.

Reviewed kit runs $10,595, pre-taxed:

Hasselblad X1D II 50C Mirrorless Camera – $5,750

Hasselblad 80mm F/1.9 XCD Lens – $4,845

What are these rich people doing pumping crappy assets?

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s broadly based on the daily column that appears on Extra Crunch, but free, and made for your weekend reading. Want it in your inbox every Saturday morning? Sign up here.

Ready? Let’s talk money, startups and spicy IPO rumors.

It’s been a bizarre few weeks, with Robinhood raising a torrent of new funds to keep its zero-cost trading model afloat during turbulent market conditions, other neo-trading houses changing up their business model and more. But amidst all the moves in startup-land, something has been itching in the back of my head: Why are several rich people pumping crappy assets?

It’s fine for a retail investor to share trading ideas amongst themselves; it has happened, will happen, and will always happen. But we’ve seen folks like Elon Musk and Chamath Palihapitiya use their broad market imprint to encourage regular folks — directly and indirectly — to buy into some pretty silly trades that could lose the retail crowd lots of money that they may not be able to afford.

Think of Elon coming back to Twitter to pump Doge, a joke of a cryptocurrency that is highly volatile and mostly useless. Or Chamath putting money into GameStop publicly, a move that he is better equipped than most to get into and out of. Which he did. And made money. Most folks that played the GameStop casino have not been as lucky, and many have lost more than they can afford.

Caveat emptor and all that, but I do not love folks with savvy and capital leading regular people into risky trades or into assets that are not backed by long-term fundamentals, but instead a small shot at near-term returns. Yoof.

Finally, keeping up the theme of general annoyance, Senator Hawley is back in the news this week with an attention-focused announcement of an idea to block big tech companies from buying smaller companies. As you would expect from the insurrection-friendly Senator, it’s not an incredibly serious proposal, and it’s written so vaguely as to be nearly humorous.

But as I wrote here on my personal blog about all of this, what does matter out of the generally irksome pol is that there is bipartisan interest in limiting the ability of big tech companies to buy smaller companies. For startups, that is not good news; M&A exits are critical liquidity events for startups, and big companies have the most money.

It’s no sauté of my onions if startup valuations fall, but I think there’s been plenty of attention noting that some Democrats and some Republicans in the U.S want to undercut top-down tech M&A, and not nearly enough notice concerning what the effort might do to startup valuations and funding. And if those metrics dip, there could be fewer upstarts in the market actually working to take on the giants.

Food for thought.

Market Notes

The Exchange caught up once again with Unity CFO Kim Jabal. We did so not merely to make jokes with her about games that we like or don’t like, but to keep tabs on how Jabal thinks as the financial head of a company that was private when she joined, and public now. A few observations:

- GAAP v. Non-GAAP: I asked about Unity’s recent Q4 net income, measured using generally accepted accounting principles, or GAAP. It was impacted by some share-based comp numbers. Jabal was clear that her team and investors are more focused on non-GAAP numbers. Why? They strip out non-cash charges like share-based comp and provide a different perspective into corporate performance. This is standard startup practice, but her comment shows how if your company is growing quickly post-IPO, you can stick to adjusted metrics and have no issue. If growth slows, I bet that changes.

- COVID: Will the COVID bump to gaming stick? Per Jabal, when her company has seen a bump in engagement historically, results don’t tend to fall back to prior plateaus. I wonder if this will be the case for all COVID-boosted parts of the startup and big-tech landscape. If so, it’s very good news.

- Know your metrics: Jabal said that her key metrics are non-GAAP operating margin and free cash flow — apart from growth, I’d add. That’s super clear and easy to grok. Startup CEOs, please have a similar distillation ready when we chat about your latest round.

And speaking of startups, let’s talk about a company that I’ve had my eye on that recently raised more capital: Deepgram. I covered the company’s Series A, a $12 million round in March 2020. Now it has raised $25 million more, led by Tiger, so this is a fun case of big money investing early-stage, I think. Regardless, Deepgram was a bet on a particular model for speech recognition, and, then, its market. its new investment implies that both wagers came out the right way up.

And I was chatting with the CEO of Databricks recently (more here on its latest megaround), who mentioned the huge gains made in AI, and more specifically around generative adversarial networks (GANs) NLP, and more. Our read is that we should expect to see more Deepgram-ish rounds in the future as AI and similar methods of approaching data make their way into workflows.

And fintech player Payoneer is going public. Via a SPAC. You can read the investor presentation here. Payoneer is not a pre-revenue firm going out via a blank check; it did an expected $346 million in 2020 rev. I’m bringing it to you for two reasons. One, read the deck, and then ask yourself why all SPAC decks are so ugly. I don’t get it. And then ask yourself why isn’t it pursuing a traditional IPO? Numbers are on pages 32 and 40. I can’t figure it out. Let me know if you have a take. Best response gets Elon’s dogecoin.

Various and Sundry

Wrapping up this week, TechCrunch has a new newsletter coming out on apps that is going to rule. Sarah Perez is writing it. You can sign up here, it’s free!

And if you need a new tune, you could do worse than this one. Have a great weekend!

Bumble’s first date with the public markets

The public markets have been so active lately that it’s hard to drum up excitement for yet another company making its way to the bull market. But, in the case of Bumble, a dating app where women message first, next week’s public debut is worth paying attention to.

The market for dating startups has long had an 11-year-old elephant in the room: Match Group. The Dallas company owns popular dating brands including Tinder, Hinge, OkCupid, and more, which some saw as the singular exit point for startups that help people meet.

Bumble, founded by Whitney Wolfe Herd, will change that narrative with its entrance into the public markets. Bumble is seeking to raise more than $1 billion upon debut. The company could be worth between $5.73 billion and $6.14 billion, looking at a diluted valuation.

Bumble’s choice to swipe past the classic route to sell to Match Group tells us that Wolfe Herd is bullish that the exit environment is strong for dating apps, as loneliness amid the pandemic continues to impact the masses.

Cleo Capital’s Sarah Kunst, a former senior adviser to Bumble, tells me that Bumble is making history in a few ways, and “may well unleash a tidal wave of new funding and startups in the space.”

“As the youngest woman to ever take a company public, Whitney has proven that dating, a category long shunned by venture investors, is a highly lucrative and fast growing sector,” Kunst said. “She also is at the vanguard of several dawning realizations in tech: companies founded outside of Silicon Valley, companies founded by women, and gender parity on boards.”

We’ll be all over this on TechCrunch and Extra Crunch next week, but in the meantime, let’s get through the other news of the week. Make sure to follow me on Twitter so I can bother you the remaining six days of the week.

Pandemic-era valuations

Valuations are simply the price that an investor thinks a startup is worth — nothing more, nothing less. When a big event happens in the world of startups, such as a massive exit or blockbuster IPO, startups within the sector-of-interest often enjoy a boom in valuations.

Here’s what to know: This week, we explored whether edtech enjoyed that same burst of energy. According to over a dozen investors, edtech isn’t seeing skyrocketing valuations. It’s a surprise to me, but venture capitalists have their theories as to why (and seemingly are energized enough by exit opportunities in the meantime).

Etc: Beyond edtech, this survey can give us key intel on how sectors that faced a pandemic lift, such as fintech and e-commerce, are valued and ranked by investors. It might suggest that the noise is louder than the actual dollars and cents.

- Why one Databricks investor thinks the company may be undervalued

digitally generated image of money tornado.

Carta tackles the startup liquidity problem

Don’t let the Demo Days fool you: Venture capital is getting bigger, faster, and older. But if you’re an angel who invested in a startup that was meant to go public in 2014, you might be getting a little bit impatient and want your capital back.

Carta is trying to create a solution to help startups trade secondary shares, pre-exit events, to bring liquidity earlier on in a startup’s life.

Here’s what to know: The tool, CartaX, finally launched this week after being teased out for months. Upon launch, Carta sold nearly $100 million of its own shares on its own cap table, at more than double its last valuation post-Series F round.

Etc: Carta is, of course, hoping that its cap-table management business will help it pull off the operation unlike others who have tried and failed. Here is some context from Danny Crichton:

That wave of liquidity startups ran into two problems: One was regulatory, and the other was a lack of company information about cap tables and that company’s current financial picture. Stock buyers were essentially flying blind while buying into companies, which some investors were more than willing to do, but that blindness limited the market demand for secondary shares significantly.

Image: JaaakWorks/iStock/Getty Images

The art of a startup narrative

It’s normal if sculpting a story out of the hot mess that is your day-to-day doesn’t feel natural. It’s like writing a story before you know exactly what you want to accomplish with each and every word. The difficulty doesn’t diminish the necessity, though.

Here’s what to know: Whether it’s pitching for a story or for millions of dollars, founders need to know how to nail their startup’s narrative. We got into the nuts in bolts in the latest edition of Extra Crunch Live, a virtual event series for early-stage founders.

We were very heads down, building these open-source projects and trying to create good software, and we just hadn’t thought a lot about the narrative. Over the years, that’s gotten a lot better, but it’s also become a lot more self-evident to us and much clearer as we write and build the business,” said Raj Dutt, Grafana’s co-founder and CEO.

Etc: Speaking of advice, here’s one warning story by Silicon Valley editor Connie Loizos about how an insurtech startup got their idea swiped (and funded) by their own venture backer. And to offset that stress, here’s one inspiring story, by yours truly, about how one woman went from user to chief executive of a startup in less than a year.

detail of a microphone with some bokeh on background

Work with really cool people, and me

Extra Crunch is now hiring for reporter, editor and project manager positions

It’s almost our second birthday, and in lieu of presents, want to send us candidates? The Extra Crunch team, which I’m a part of, is hiring for new contract positions to help us dig out what’s really going on in the world of startups.

Check out the amazing speakers joining us on Extra Crunch Live in February

Our live, virtual event series is back and better than ever with a stacked lineup and a ton of advice for early-stage startup folks.

Plus, a new gift for your inbox:

Wrapping up this week, TechCrunch has a new newsletter coming out on apps that is going to rule. Sarah Perez is writing it. You can sign up here, it’s free!

Across the week

Seen on TechCrunch

New antitrust reform bill charts one possible path for regulating big tech

The cloud infrastructure market hit $129B in 2020

A growing number of startups are creating APIs to assess and offset corporate carbon emissions

China’s national blockchain network embraces global developers

Seen on Extra Crunch

Udemy’s new president discusses the re-skilling company’s future

4 strategies for deep tech founders who are fundraising

Spotify Group Session UX teardown: The fails and their fixes

Dear Sophie: What’s the recipe for an H-1B

@EquityPod: A lake house architect, Miami VC, and homeowner walk into a wine bar

In this week’s podcast, the Equity team got their west coast correspondent back (aka me) and had a good ol’ time talking about everything from Miami to millennial homes.

Listen to the podcast to hear us chat about Drizly’s new parent, a new Nellie Levchin-backed startup, and UiPath’s big new valuation. We, of course, got into off topic conversations such as a sommelier that hates people and the lake house dynamic.

Until next week,