Researchers only drilled through an Antarctic ice shelf to sample sediment. Instead, they found animals that weren’t supposed to be there.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

What Happens When You Swap a Human Gene With a Neanderthal’s?

Now that we’ve gotten a look at the genomes of archaic humans, researchers are trying to determine whether our differences are due to genetics.

Authoritarian Regimes Could Exploit Cries of ‘Deepfake’

Identifying doctored videos is essential. But assuming everything is faked allows autocrats to cast doubt on real videos of their violence.

How to Level Up Your At-Home Recording Studio

Ready to upgrade your USB microphone or headset to something better? Here’s how to make sense of pro(ish) audio gear.

Don’t Tell Einstein, but Black Holes Might Have ‘Hair’

The general theory of relativity states that black holes have only three observable properties; additional ones, or “hair,” do not exist. Or do they?

Our Picks From Outdoor Winter Clearance Sales Going on Now

The best time to buy is when the season is winding down. It’s not just cold-weather picks, but backpacks, headlamps, sporks, and more.

The Untold History of America’s Zero-Day Market

The lucrative business of dealing in code vulnerabilities is central to espionage and war planning, which is why brokers never spoke about it—until now.

A Billion-Dollar Dark Web Crime Lord Calls It Quits

The “big hack” redux, riot planning on Facebook, and more of the week’s top security news.

19 Face Masks We Actually Like to Wear

Plus, updated tips on how to wear them most effectively—whether you’re running, going to work, or just trying to stay safe and stylish.

Scientists Can Literally Become Allergic to Their Research

Researchers spend long periods of time around the organisms they study. Sometimes, that exposure has unintended—and potentially deadly—effects.

A New Artificial Intelligence Makes Mistakes—on Purpose

A chess program that learns from human error might be better at working with people or negotiating with them.

We Need a Global Outbreak Investigation Team—Now

The WHO’s fact-finding mission into the origins of Covid-19 was limited and late. But there are models to help prepare for the next crisis.

Extra Crunch roundup: Metromile CEO interview, Oscar Health’s IPO plans, our 2-year anniversary, more

I’m very proud of the work we’re doing here at Extra Crunch, so it gives me great pleasure to announce that today is our second anniversary.

Thanks to hard work from the entire TechCrunch team, authoritative guest contributors and a very engaged reader base, we’ve tripled our membership in the last 12 months.

As Extra Crunch enters its third year, we’re putting our foot on the gas in 2021 so we can bring you more:

- Fresh analysis about today’s most dynamic tech industries.

- Surveys of top investors about trends in your sector.

- In-depth profiles of top companies from their earliest days.

- Expanded live programming.

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

To be completely honest: Eric and I wavered about posting this announcement. Both of us would prefer to show the results of our work than make a list of future-looking statements, so I’ll sum up:

I’m proud of the work we’re doing because people around the world use the information they find on Extra Crunch to build and grow companies. That’s big!

Thanks very much for reading Extra Crunch; have a great weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Bryce Durbin

Will ride-hailing profits ever come?

Image Credits: Nigel Sussman (opens in a new window)

Before the pandemic began, I took about seven or eight hailed rides each month. Since I began physically distancing from others to stem the spread of the coronavirus in March 2020, I’ve taken exactly 10 hailed rides.

Your mileage may vary, but last year, Uber and Lyft both reported steep revenue losses as travelers hunkered down at home. Today, Alex Wilhelm says both transportation platforms plan to reach adjusted profitability by Q4 2021.

He unpacked the numbers “to see if what the two companies are dangling in front of investors is worth desiring.” Since he usually doesn’t focus on publicly traded stocks, I asked Alex why he focused on Uber and Lyft today.

“Utter confusion,” he replied.

“Investors have bid up their stocks like the two companies are crushing the game, instead of playing a game with their numbers to reach some sort of profit in the future,” Alex explained. “The stock market makes no sense, but this is one of the weirder things.”

TechCrunch’s favorites from Techstars’ Boston, Chicago and workforce accelerators

Image Credits: Techstars (opens in a new window)

In the theater, a “four-hander” is a play that was written for four actors.

Today, I’m appropriating the term to describe this roundup by Greg Kumparak, Natasha Mascarenhas, Alex Wilhelm and Jonathan Shieber that recaps their favorite startups from Techstars accelerators.

The quartet selected four startups each from Chicago, Boston and Techstars Workplace Development.

“As always, these are just our favorites, but don’t just take our word for it. Dig into the pitches yourself, as there’s never a bad time to check out some super-early-stage startups.”

As more insurtech offerings loom, CEO Dan Preston discusses Metromile’s SPAC-led debut

Image Credits: Nigel Sussman (opens in a new window)

Neoinsurance company Metromile began trading publicly this week after it combined with a special purpose acquisition company.

Metromile will likely be one of 2021’s many SPAC-led debuts, so Alex interviewed CEO Dan Preston to learn more about the process and what he learned along the way.

A notable takeaway: “Preston said SPACs are designed for a specific class of company; namely those that want or need to share a bit more story when they go public.”

Adtech and martech VCs see big opportunities in privacy and compliance

Image Credits: alashi (opens in a new window) / Getty Images

Senior Writer Anthony Ha and Extra Crunch Managing Editor Eric Eldon surveyed three investors who back adtech and martech startups to learn more about what they’re looking for and whether deal flow has recovered at this point in the pandemic:

- Eric Franchi, partner, MathCapital

- Scott Friend, partner, Bain Capital Ventures

- Christine Tsai, CEO and founding partner, 500 Startups

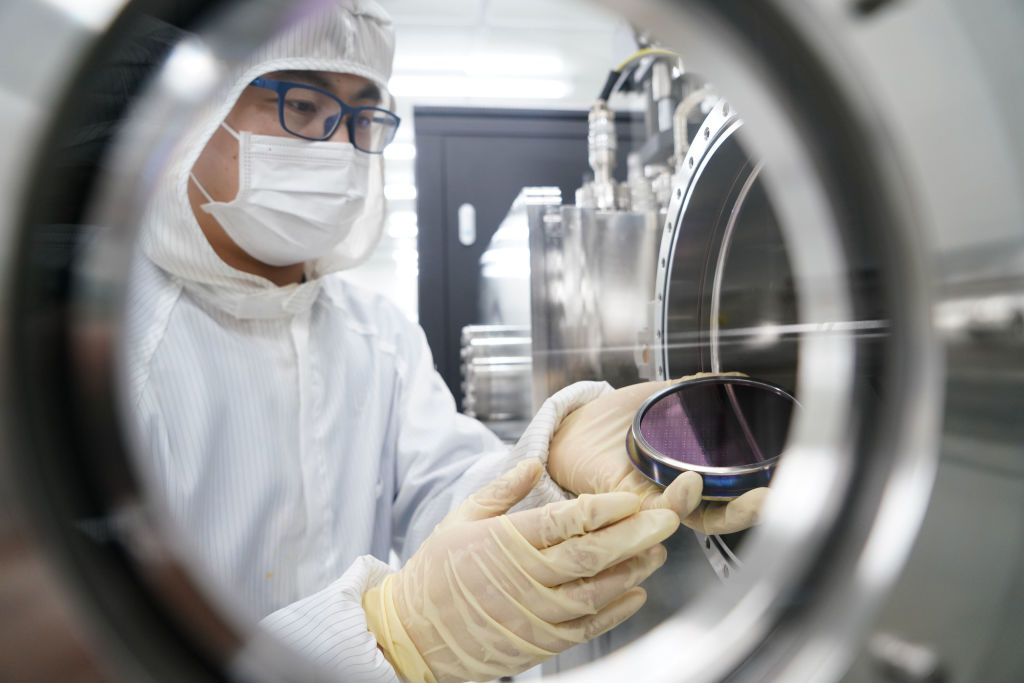

Commercializing deep tech startups: A practical guide for founders and investors

Image Credits: VCG (opens in a new window) / Getty Images

I have a hard time envisioning all of the hurdles deep tech founders must overcome before they can land their first paying customer.

How do you sustainably scale a company that probably doesn’t have revenue and isn’t likely to for the foreseeable future? How big is the TAM for an unproven product in a marketplace that’s still taking shape?

Vin Lingathoti, a partner at Cambridge Innovation Capital, says entrepreneurs operating in this space face a unique set of challenges when it comes to managing growth and risk.

“Often these founders with Ph.D.s and postdocs find it hard to accept their weaknesses, especially in nontechnical areas such as marketing, sales, HR, etc.,” says Lingathoti.

How will investors value Metromile and Oscar Health?

Image Credits: Nigel Sussman (opens in a new window)

This week, auto insurance startup Metromile completed its combination with SPAC INSU Acquisition Corp. II.

Last Friday, health insurance company Oscar Health announced its plans to launch an initial public offering.

As the saying goes: Past performance is no guarantee of future results, but using 2020 debuts by neoinsurance firms Lemonade and Root as a reference point, Alex says the IPO window is wide open for other players in the space.

“All the companies in our group are pretty good at adding customers to their businesses,” he found.

Dear Sophie: How can I improve our startup’s international recruiting?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie:

We’ve been having a tough time filling vacant engineering and other positions at our company and are planning to make a more concerted effort to recruit internationally.

Do you have suggestions for attracting workers from abroad?

— Proactive in Pacifica

5 creator economy VCs see startup opportunities in monetization, discovery and much more

Image Credits: ALLVISIONN (opens in a new window) / Getty Images

The people who produce viral TikTok duets, in-demand Substack newsletters and popular YouTube channels are doing what they love. And the money is following them.

Many of these emerging stars have become media personalities with full-fledged production and distribution teams, giving rise to what one investor described as “the enterprise layer of the creator economy.”

More VCs are backing startups that help these digital creators monetize, produce, analyze and distribute content.

Natasha Mascarenhas and Alex Wilhelm interviewed five of them to learn more about the opportunities they’re tracking in 2021:

- Benjamin Grubbs, founder, Next10 Ventures

- Li Jin, founder, Atelier Ventures

- Brian O’Malley, general partner, Forerunner Ventures

- Eze Vidra, managing partner, Remagine Ventures

- Josh Constine, principal, SignalFire

Are SAFEs obscuring today’s seed volume?

Image Credits: Nigel Sussman (opens in a new window)

Simple agreements for future equity are an increasingly popular way for startups to raise funds quickly, but “they don’t generate the same paperwork exhaust,” Alex Wilhelm noted this week.

This creates cognitive dissonance: Investors see a hot market, while people who rely on public data (like journalists) get a different picture.

“SAFEs have effectively pushed a lot of public signal regarding seed deals, and even smaller rounds, underground,” says Alex.

Container security acquisitions increase as companies accelerate shift to cloud

Image Credits: Andriy Onufriyenko / Getty Images

Many enterprise companies were snapping up container security startups before the pandemic began, but the pace has picked up, reports Ron Miller.

The growing number of companies going cloud-native is creating security challenges; the containers that package microservices must be correctly configured and secured, which can get complicated quickly.

“The acquisitions we are seeing now are filling gaps in the portfolio of security capabilities offered by the larger companies,” says Yoav Leitersdorf, managing partner at YL Ventures.

Two $50M-ish ARR companies talk growth and plans for the coming quarters

Image Credits: Bryce Durbin / TechCrunch

In December 2019, Alex Wilhelm began reporting on startups that had reached the $100M ARR mark. A year later, he decided to reframe his focus.

“Mostly what we managed was to collect a bucket of companies that were about to go public,” he said.

Since then, he has recalibrated his sights. In the latest entry of a new series focusing on “$50M-ish” companies, he studies SimpleNexus, which offers digital mortgage software, and photo-editing service PicsArt.

Alex has more interviews and data dives coming on other companies in this cohort, so stay tuned.

With a higher IPO valuation, is Bumble aiming for Match.com’s revenue multiple?

Image Credits: Nigel Sussman (opens in a new window)

Dating platform Bumble initially set a price of $28 to $30 for its upcoming IPO, but at its new range of $37 to $39, Alex calculated that it could reach a max valuation of $7.4 billion to $7.8 billion.

Extrapolating revenue from its Q3 2020 numbers, he attempted to find the company’s run rate to see if it’s overpriced — and how well it stacks up against rival Match.

Oscar Health’s IPO filing will test the venture-backed insurance model

Mario Schlosser (Oscar Health) at TechCrunch Disrupt NY 2017

Jon Shieber and Alex Wilhelm co-bylined a story about Oscar Health, which filed to go public last week.

Although the health insurance company claims 529,000 members and a compound annual growth rate of 59%, “it’s a deeply unprofitable enterprise,” they found.

Jon and Alex parsed Oscar Health’s 2019 comps and its 2020 metrics to take a closer look at the company’s performance.

“Both Oscar and the high-profile SPAC for Clover Medical will prove to be a test for the venture capital industry’s faith in their ability to disrupt traditional healthcare companies,” they write.

SoftBank and the late-stage venture capital J-curve

Image Credits: Tomohiro Ohsumi (opens in a new window) / Getty Images

Managing Editor Danny Crichton filed a column about Softbank’s Vision Fund that tried to answer a question he asked in 2017: “What does a return profile look like at such a late stage of investment?”

Softbank’s recent earnings report shows that its $680 million bet on DoorDash paid off handsomely, bringing back $9 billion. Compared to its competition, “the fund is actually doing quite decent right now,” he wrote. But Softbank has invested $66 billion in 74 unexited 74 companies that are worth $65.2 billion today.

“SoftBank quietly chopped half of the performance fees for its VC managers, from $5B to $2.5B, which led us to ask: are the best investments in the fund already in SoftBank’s rearview mirror? One upshot: WeWork seems to have turned something of a corner, with some improvements in its debt profile portending more positive news post-COVID-19.”

Tony Florence, the low-flying head of NEA’s tech practice, on the art of building household brands

Tony Florence isn’t as well known to the public as other top investors like Bill Gurley or Marc Andreessen, but he’s someone who founders with SaaS and especially marketplace e-commerce companies know — or should. He’s responsible for the global tech investing activities for NEA, one of the world’s biggest venture firms in terms of assets under management (it closed its newest fund with $3.6 billion last year).

Florence has also been involved with a long list of e-commerce brands to break through, including Jet, Gilt, Goop, Casper, Letgo, and Moda Operandi.

It’s because we talked earlier this week with one of his newer e-commerce bets, Maisonette, that we wanted to ask him about brand building more than a year into a pandemic that has changed the world in both fleeting and permanent ways. We wound up talking about how customer acquisition has changed; what he thinks of the growing number of companies trying to roll up third-party sellers on Amazon; and how upstarts can maintain momentum when even younger companies become a shiny new fascination for customers.

Note: one topic that he couldn’t and wouldn’t comment on is the future of one founder who Florence has backed twice, Marc Lore, who stepped down from Walmart last month to begin building what he recently told Vox is a multi-decade project to build “a city of the future.” (More on this to come, evidently.)

Part of our chat with Florence, lightly edited for length and clarity, follows:

TC: You’ve funded a number of very different businesses that have managed to grow even as Amazon has eaten up more of the retail market. Is there any sector or vertical you wouldn’t back because of the company?

TF: You have to be thoughtful about Amazon. I wouldn’t say there’s one particular area that you either can ignore or feel like you’re completely comfortable and open to, given the scale of their platform. At the same time, there are founding principles and fundamentals that we think about as they relate to companies being able to compete and operate successfully.

TC: And these are what? You’ve backed Marc Lore, Philip Krim (of Casper), Sylvana and Luisana of Maisonette. Do they have something in common?

TF: Sometimes [founders] come at the problem organically; they’re living it [and want to solve it]. Other times, somebody like Marc sees a business opportunity and just attacks it. But there are commonalities. These are folks who are very customer centric, who are focused on good, fundamental unit economics, and who are obsessive about their people, their teams. It takes a village to build a young successful company, and all of those founders you mentioned are great at recruiting world-class people. There’s a sense of vision and mission and culture.

When you wake up and decide to do something, the majority of people you talk to just want to tell you the reasons why it can’t work, so it also takes a certain [wherewithal] to have such conviction around what you’re doing that you’re kind of all in on it, and you’re going to break through no matter what.

TC: Maisonette was going to open a brick-and-mortar store but put a pin in that plan because of COVID. Will we go back to seeing direct-to-consumer brands opening real-world locations when this is over? Has the pandemic permanently changed that calculation?

TF: Leading up to the pandemic, a lot of the young DTC companies that were direct-to-consumer brands, and even the traditional e-commerce marketplaces, were experimenting with offline. Some of it was out of necessity, frankly. Sometimes [customer acquisition costs] became so expensive that it was actually cheaper for them to go offline. In other cases, it was done because the customer wanted that closed loop experience, as with [mattress maker] Casper.

A lot of companies [opened these stores] in a contained way it worked really well. It’s very accretive financially to the overall business contribution, margin wise. It was accretive for the overall customer experience. And in many cases, it didn’t cannibalize anything. It just expanded the [total addressable market].

We’re spending a lot of time right now continuing to think through what are the permanent changes that are going to come out of the pandemic, but I would say the omnichannel model has really has started to take shape and succeed if you look at big retailers like Walmart and Target, so I think there will be an omnichannel dynamic to many of these companies that we’re talking about. Also, over the last 12 months, the cost of acquisition and the efficacy of marketing has swung back in the favor of these young companies. It’s improved to a point where we don’t really even need to think about offline.

TC: I know it had become expensive to acquire customers digitally because it was so crowded out there. Did it become less crowded?

TF: There were very few platforms that these companies could use pre pandemic that weren’t oversaturated . . . it was just very competitive, and that would bid up the cost of acquisition. In the last 12 months, you’ve seen big parts of that market go away. With airlines and financial services and a lot of the spend going way down, it’s become a lot cheaper for companies to market digitally.

TC: Still, it feels at times that it’s hard to maintain a brand’s momentum over time; there’s always some new outfit nipping at its heels. How does a brand itself fresh and relevant in 2021?

TF: There’s a hits dynamic — a fad dynamic — in the consumer space, so that’s always a challenge. You [compete by] continually reinventing and adding [to your offerings]. You see that in social categories, you see that in marketplaces [where they add] managed services and other components [like] payments, and you clearly see it in the way some of the direct-to-consumer companies continue to add new products to the mix.

You focus on the core aspects of your brand and its mission and vision and make sure that the customers really feel that. There’s a community dynamic that has really occurred the last four or five years around e-commerce companies. Glossier is a great example of a company that built a great community around a core set of product offerings, and that has really propelled that company beyond its core customer customer base.

There’s also a contextual commerce opportunity. Goop is a great example this; Gwyneth [Paltrow] brilliantly came up with [an effective way] to merge content and commerce, and that’s something a lot of companies in the commerce space have started to invest in.

TC: Content, community and not necessarily speed, so focusing on what Amazon does not. Can I ask: do you think Amazon needs to be reigned in?

TF: If you’re competing with them [in the] cloud market or a commerce market, they’re a very formidable competitor, and you got to take them very, very seriously. They’re at a scale that’s just incredibly impressive. But I do think you’re seeing a lot of innovation around the edges and companies finding areas that Amazon maybe can’t focus on or isn’t focusing on.

TC: What do you think of these Amazon Marketplace roll-ups that we’re seeing? There’s been at least a half of dozen of them that already, including Thrasio, which announced $750 million this week. All are raising money hand over first.

TF: We haven’t made an investment in the area, though we’re watching very closely. It can be a very capital intensive strategy to execute on because you’re buying brands and then bringing them onto the platform to consolidate and grow, but there’s just an enormous long tail to the e-commerce space and this is an opportunity to consolidate that.

TC: Like, an infinite opportunity? How many roll-ups can the market support?

TFL I do think that we’ll see a handful of these companies get to decent scale. The question will be whether you’ve got more of an arbitrage going on [by] buying companies and generating synergies or there’s some fundamental bigger breakthrough. If you could use AI [and] machine learning to understand how to better serve customers and think about customer acquisition a little bit better, that would be really interesting. If there are real economies of scale to the supply chains [or] baseline infrastructure, that would certainly be interesting.

It’s early on. It remains to be seen how this is gonna play out.

Pictured above, left to right: NEA’s global managing director, Scott Sandell, and Florence, who is the head of global tech investing activities at NEA and who works alongside Mohamad Makhzoumi, who oversees the firm’s healthcare practice.

Daily Crunch: Jack Dorsey and Jay Z invest in bitcoin development

Jack Dorsey and Jay Z create a bitcoin endowment, Datadog acquires a Startup Battlefield company and BuzzFeed experiments with AI-generated quizzes. This is your Daily Crunch for February 12, 2021.

Oh, and before we get started: Consider applying to the Early Stage pitch off and submitting a pitch deck for feedback on Extra Crunch Live!

The big story: Jack Dorsey and Jay Z invest in bitcoin development

The Twitter founder and rapper/entrepreneur have put 500 bitcoin (currently worth more than $23 million) into an endowment called ?trust, which Dorsey said is being set up as a blind trust.

He also said the endowment will focus initially on bitcoin development in Africa and India — India’s government has been reluctant to embrace cryptocurrencies thus far, while Africa (especially Nigeria) has had a surge in transactions.

A job description for ?trust’s board members says that the organization’s mission is to “make bitcoin the internet’s currency.”

The tech giants

Datadog to acquire application security management platform Sqreen — Originally founded in France, Sqreen participated in TechCrunch’s Startup Battlefield in 2016.

BuzzFeed uses AI to create romantic partners in its latest quiz — Director of Product for Quizzes Chris Johanesen said he’s hoping this will be the first in a series of “stunt-y experiments.”

Startups, funding and venture capital

Online workspace startup Notion hit by outage, citing DNS issues — Notion’s service was not loading as of around 9 a.m. ET on Friday.

Ember names former Dyson head as consumer CEO, as the startup looks beyond the smart mug — Ember is best known for its smart, heated mugs.

Advice and analysis from Extra Crunch

2 years in, Extra Crunch is helping readers build and grow companies around the world — You don’t need a membership to read about what Extra Crunch has accomplished and what’s next.

Felicis’ Aydin Senkut and Guideline’s Kevin Busque on the value of simple pitch decks — Even though Busque is a co-founder of TaskRabbit, he didn’t get the response he was hoping for the first time he pitched Senkut.

Will ride-hailing profits ever come? — A detour into Uber and Lyft’s numbers.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

Minneapolis bans its police department from using facial recognition software — Thirteen members of the city council voted in favor of the ban, with no opposition.

Use today’s tech solutions to meet the climate crisis and do it profitably — As we enter the most crucial decade of climate action, we need to ensure that clean technologies become the only acceptable norm.

Sweden’s data watchdog slaps police for unlawful use of Clearview AI — Earlier this month Canadian privacy authorities found Clearview had breached local laws.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.