Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry is as hot as ever, with a record 218 billion downloads and $143 billion in global consumer spend in 2020.

Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This week, we’ve got a first look at one of TikTok’s early e-commerce tests, which involves a program for sellers involving product anchors on videos and the option for affiliate sales. We’re also digging into the new iOS and Android betas, the FTC complaint against math app Prodigy and more.

Top Stories

TikTok tests a new e-commerce experience in Indonesia

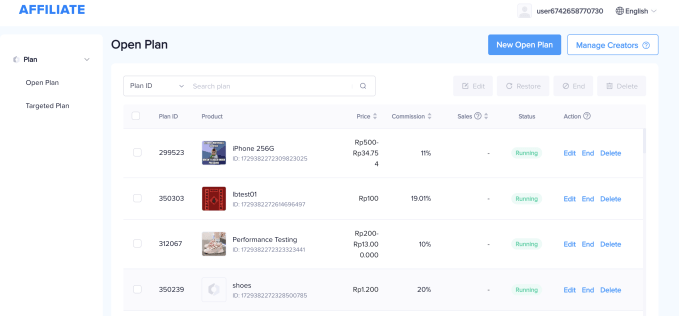

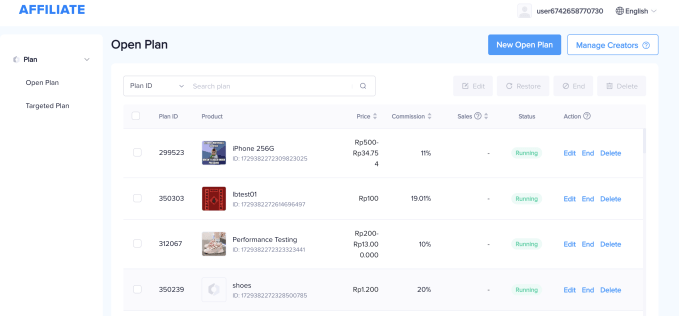

The Financial Times recently reported TikTok was preparing to launch a range of new e-commerce experiences in 2021, including the ability for creators to share links to products, support for affiliate sales, and even livestreamed shopping. Now, we’ve got a first look at some of the live tests around e-commerce that TikTok has in progress.

The company recently launched a “Seller University” website aimed at its Indonesian audience, where it details how brands can advertise their products on video. Here, TikTok explains brands have two ways to advertise, either by making their own videos or by working with affiliates.

“If you choose to sell through your personal page, you can then display products via livestreaming or short videos, with product anchors embedded in your content. When customers view your content, they can be redirected to the corresponding product detail page by clicking on the product anchor,” the site explains.

The Seller University also details other information, like how to sign up to be a TikTok seller and what sort of products are prohibited, along with other rules and guidelines.

Image Credits: TikTok

TikTok Sellers have to provide their contact information, including location, phone, email, shop and warehouse location, and other required documentation to be approved. They can then set up a Seller profile, where they can manage other users associated with their account. Once live as a Seller on the app, they’ll have a “TikTok Shop” on the second tab on their profile, which users can view when they visit the page.

When their videos showing their products are viewed, there are “product anchors” embedded in the content. Clicking on these anchors will redirect the viewer to the product detail page where they can transact. In addition, brands can collaborate with TikTok influencers to promote their products through a new “TikTok Affiliate” program.

Image Credits: TikTok

TikTok told TechCrunch the program is a test of its e-commerce solutions in Indonesia, and one of several product tests in the area of e-commerce.

Consumer advocacy groups file FTC complaint against edtech app Prodigy

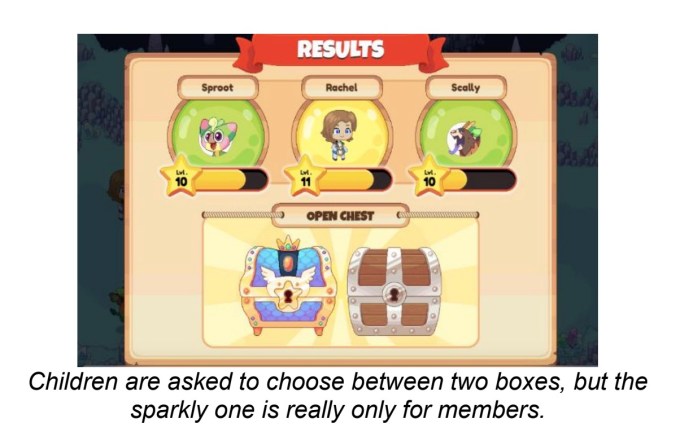

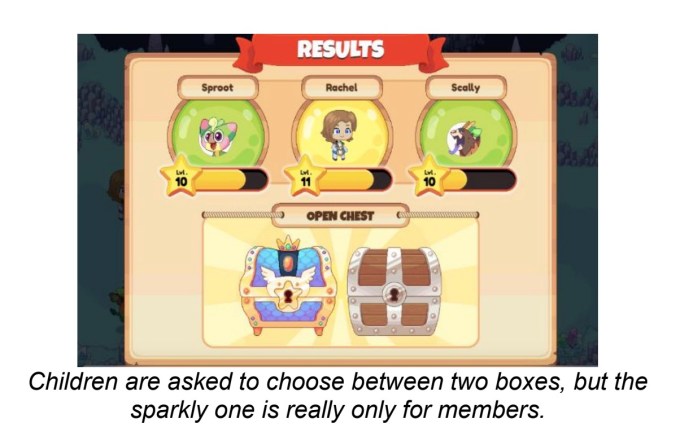

A coalition of 20 consumer advocacy groups, led by the Campaign for a Commercial-Free Childhood, have filed an FTC complaint against the popular edtech app Prodigy, which offers a math learning app for web and mobile. The app is designed much like modern-day freemium games, with math “battles” designed to improve math skills, grades and test scores.

The complaint alleges a variety of abuses, including how it aggressively pushes kids using the free version provided to schools to nag parents for the paid $59 annual subscription, which includes a richer gaming experience.

The groups also take issue with the app’s in-app rewards and badges — some of which are only available to paid users, including fancier loot boxes — saying these features cause division between those who pay and those who can’t. And it alleges that Prodigy’s claims about educational improvements don’t hold merit.

In response, Prodigy says it takes the concerns seriously, but over 95% of users play the game for free and the business model involving the paid membership is how free access is provided.

“Without this model, we would be required to put all of our educational content behind a paywall, which contradicts our mission of providing full access to fun and engaging math learning,” a company spokesperson said. “The alternative would be to generate revenue via advertising, which is not a model we believe best benefits or protects our users. We never show third-party ads on our platform, nor do we sell or lease any other user information to third parties,” they noted.

The FTC has stepped up its enforcement over how apps targeting children can behave, with a focus on data collection practices and COPPA violations, which has resulted in fines for apps like TikTok and YouTube. This complaint, however, is not about children’s privacy, but rather how they’re being marketed to via edtech.

Weekly News

Platforms: Apple

Apple rolls out iOS 14.5, beta 2. The update includes a new Apple Music interface with the ability to share lyrics on social and use new swipe gestures; new Shortcuts actions for taking screenshots, setting screen orientation switching between cellular data modes, and more; expanded support for iPad privacy features (in relation to shutting off the microphone); and more than 200 new emoji.

The most notable new emoji include the heart on fire, exhaling face, face in clouds, gender options for people with beards and an updated syringe that removes the blood, making it more useful for conversations about the COVID vaccine.

Apple welcomed the teams from 13 app companies in its inaugural cohort for Apple’s Entrepreneur Camp for Black Founders and Developers. The program focuses on building technical skills and designing a great user experience through sessions, hands-on labs, one-on-ones with Apple experts and engineers, and more. VC firm Harlem Capital will also offer mentorship.

Participants include fitness app B3am, news app Black, music app Bar Exam, 3D photos app Film3D, MIDI Controller app FormKey, healthcare app Health Auto Export, gardening app Hologarden, remote learning solution Hubli (beta testing), game Justice Royale, sneaker enthusiast app Kickstroid, nail art app Nailstry, social app Peek: Movies & TV Shows and music app TuneBend.

Platforms: Google

Google launches the first developer preview of Android 12. The update includes new privacy controls; pre-set password complexity levels of high, medium and low; other improved user experience tools and app compatibility improvements; the ability to transcode media into higher-quality formats like the AV1 image format; transitions and animations for notifications, plus the ability to decorate notifications with custom content; enrollment-specific IDs for employee-owned devices; streamlined credential management for unmanaged devices; an improved screenshot editor; better support for multi-channel audio; Project Mainline improvements; and more.

Google’s Play Store adds support for Nearby Sharing. The feature allows users to share apps and updates with nearby Android devices.

Google suspended the Trump 2020 app from the Play Store for non-functionality. The app would either hang upon first launch or immediately reported a server error. Google says the app was in violation of its policies around non-functional apps, but the app can return if it’s fixed.

E-commerce

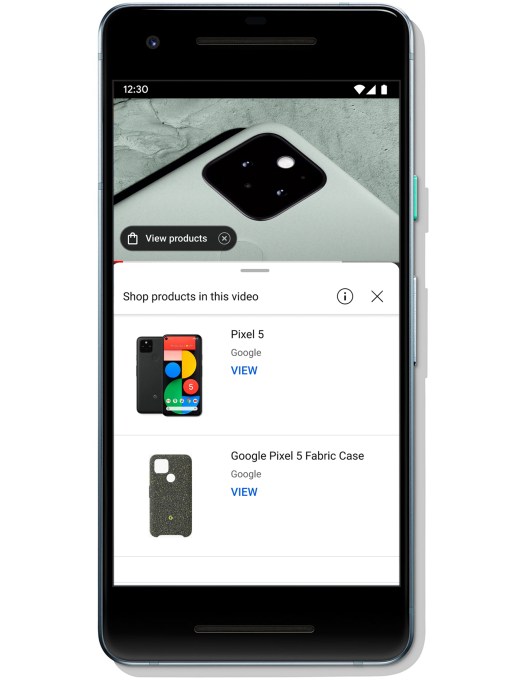

YouTube says it’s now beta testing a new e-commerce shopping experience in the app that allows creators to market products to fans, who can then buy directly on YouTube. The feature, which aims to compete with TikTok’s growing shopping ambitions, will expand later in 2021 beyond the initial group of creators.

Image Credits: YouTube

Fintech

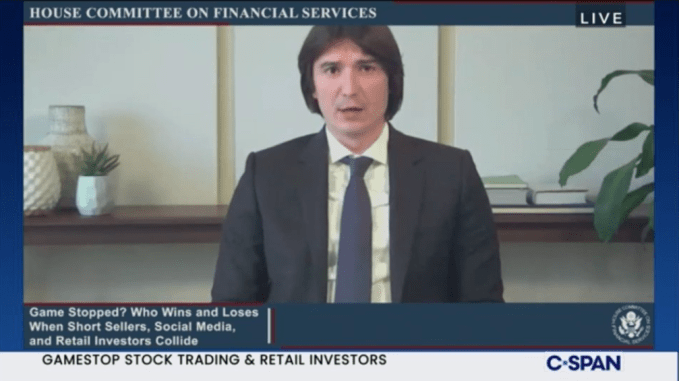

Robinhood’s CEO Vlad Tenev testified before Congress this week over the GameStop frenzy. Tenev denied helping hedge funds and asked for the SEC to modify trading rules. AOC pointed out that Robinhood isn’t truly free, it’s just hiding the cost from retail investors by subsidizing free trades with payment for order flow. (A percentage of its revenue Tenev ridiculously claimed he couldn’t recall, saying only “it’s over 50%.”)

From the hearing, via CSPAN

Social

TikTok parent ByteDance is exploring a sale of its TikTok operations in India to Bangalore-headquartered Glance, a mobile content platform founded by InMobi founder Naveen Tewari. Glance operates a TikTok rival Roposo, which has seen massive growth since TikTok was banned in India over national security concerns. The two companies — ByteDance and Glance parent InMobi Pte — share an investor with SoftBank, which initiated the talks, per a Bloomberg report.

Instagram is fixing the iMessage bug. Some suspected the issue was related to Apple and Facebook’s ongoing public battles, but Instagram said the problem where Instagram links in iMessage wouldn’t show a preview was just a bug. The company noted a fix will arrive soon.

TikTok inks a multi-year deal with UFC which includes livestreams of pre- and post-fight content, and other behind-the-scenes footage. The content will stream on UFC TikTok accounts including @UFC, @UFCRussia, @UFCBrasil and @UFCEurope.

Douyin, the Chinese version of TikTok, now has 550 million users for its in-app Search feature alone. The app last reported in September it had 600 million daily users, indicating an even larger base of MAUs.

Right-wing social network Parler announced it’s back online for existing users and will re-open to new users next week. The company also has a new interim CEO, Mark Meckler, who previously co-founded the Tea Party Patriots.

Triller is mired in controversy over its MAUs. A Billboard report says the company misrepresented the number of monthly active users it had — 25 million instead of the 50 million it claimed. Triller CEO Mike Lu had said the discrepancies didn’t matter because there’s “no legal definition” for an MAU. After the report came out, Lu denied the company was inflating its numbers. We happen to recall that Triller immediately threatened to sue over a report that it had inflated its downloads last year.

Photos

YouTube star David Dobrik’s photo-sharing app Dispo, backed by a $4 million seed, launched into private beta to a ton of buzz. The app quickly maxed out TestFlight’s 10,000-person limit, instead of being the low-key beta debut the team had expected. Dispo’s gimmick is that users have to wait 24 hours to see the photos they snap.

Messaging

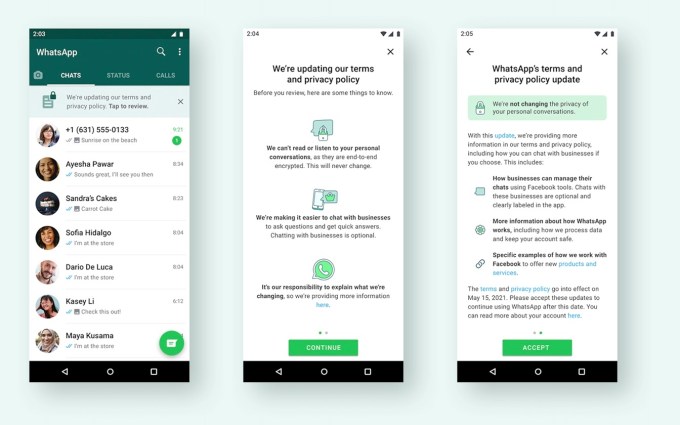

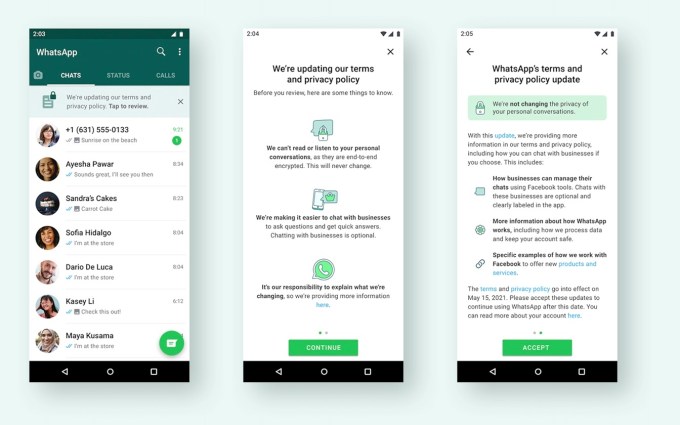

Image Credits: WhatsApp

WhatsApp will roll out an in-app banner in an attempt to better explain its new privacy policy. When clicked, users will be directed toward policy information they can review at their leisure ahead of the May 15 deadline to accept the changes.

Streaming & Entertainment

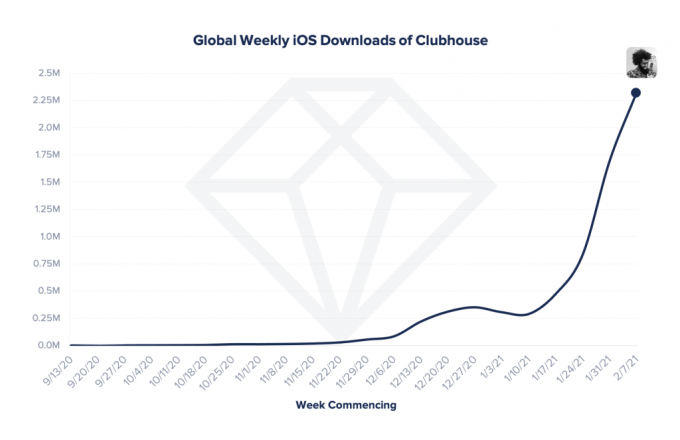

Image Credits: App Annie

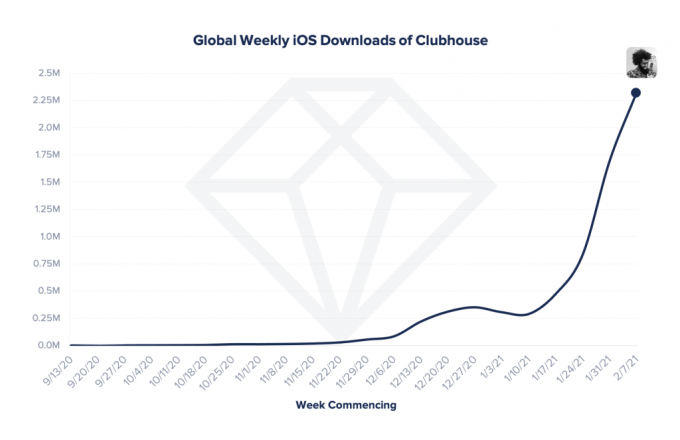

Clubhouse has topped 8 million global downloads, 2.6 million of which were in the U.S., according to a new report from App Annie. The report also highlighted the broader impact Clubhouse is having on social audio, as local audio apps are gaining new installs, too.

Global mobile users streamed 935 billion hours of video in 2020, up 40% YoY, says App Annie. The pandemic impacts were clear — users went from 146 billion hours in Q1 2019 to 240 billion in Q4 2020, a 65% rise in two years.

Cameo, the app that connects customers with celebs for paid personalized messages, is said to be raising $100 million, valuing its business at $1 billion, reports Bloomberg Quint. Not coincidentally, Facebook just began testing its Cameo clone, Super.

YouTube reveals its 2021 plans. In a blog post from Chief Product Officer Neal Mohan, YouTube gave a look at coming updates across its suite of apps:

- YouTube to redesign its YouTube VR app homepage to improve navigation, accessibility and search functionality.

- YouTube says it will expand its video chapters feature to add chapters automatically and update the watch experience to be more intuitive, including on the tablet.

- YouTube TV, now with 3 million-plus users, will introduce a paid add-on that will support 4K streaming, DVR for off-line playback and unlimited simultaneous in-home streams.

- YouTube Kids will add a feature that allows parents to specify the channels and videos their kids are allowed to watch.

- YouTube will expand its Applause tipping feature to more creators in 2021.

- YouTube Music will improve playlist creation and make those playlists more discoverable.

- And as noted above, YouTube is testing an e-commerce feature that lets users check out on the app.

- YouTube Shorts, an in-app TikTok rival of sorts, will come to the U.S. in March, following its tests in India.

Gaming

Microsoft xCloud, the game streaming service that lets users play Xbox games on Android tablets and phones, has begun testing a web version. In a review by The Verge, the experience is described as similar to the mobile version, with a simple launcher, recommendations, access to cloud games through Xbox Game Pass Ultimate and the ability to resume recently played games.

Apple demanded sensitive data from Valve to aid in its legal battle with Epic Games. The request included things like total yearly sales of apps and in-app products; annual ad revenues from Steam; annual revenues from Steam; annual earnings gross or net from Steam; and more. Apple also wanted the names of all Steam apps, price and IAP, and date range available. Valve, not surprisingly, did not agree to this. PCGamer has the full report.

Epic Games expands its legal fight with Apple to the EU. The Fortnite owner filed a formal antitrust complaint with the European Commission, alleging Apple’s anti-competitive restrictions that have “eliminated competition in app distribution and payments.” Epic Games is also fighting Apple in the U.S., U.K. and Australia.

We’re bringing our fight to end Apple’s App Store monopoly to Europe. Apple’s practices are harming consumers and app developers in Europe and around the world, and we’re joining the #EU’s ongoing investigation into Apple’s abuse of its dominant position https://t.co/LIb346QmEi

— Epic Games Newsroom (@EpicNewsroom) February 17, 2021

Stadia layoffs shocked team. Google Stadia, the game streaming service available via Chromecast Ultra, the Chrome browser, ChromeOS tablets and the Stadia mobile app for Android, recently shut down its in-house game development studio, Stadia Games and Entertainment. A report from Kotaku this week indicates how much of a surprise this was to team, as just days before the mass layoffs, leadership was praising staff for their “great progress.”

Health & Fitness

Apple tells developers that only apps submitted by recognized public health authorities will be able to publish “health pass” apps to the App Store. These apps are designed to show someone’s COVID-19 testing and vaccination status. Apple says it will accept apps from government, medical and other credentialed institutions, healthcare providers, laboratories and test kit manufacturers.

Apple promotes iOS health apps to Apple Card holders. In honor of American Heart Month, Apple emailed Apple Card users savings on iOS health apps including Strava, Ten Percent Happier, Sleep Cycle and Lifesum.

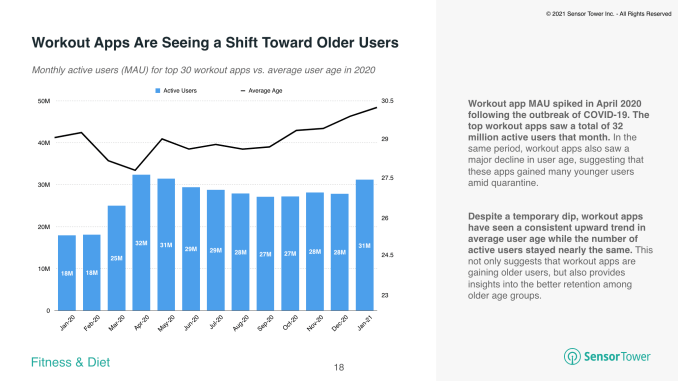

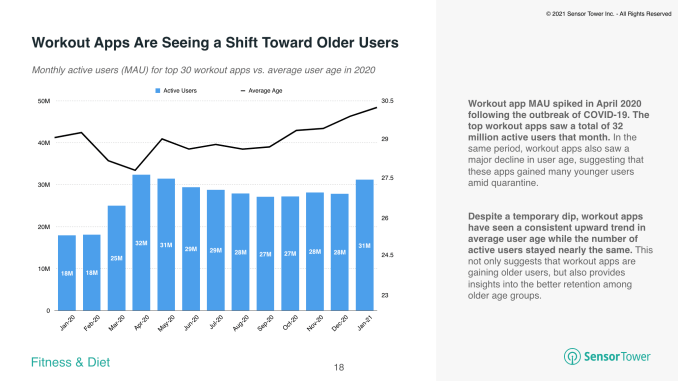

U.S. health & fitness apps saw over 405 million installs in 2020, up 22% year-over-year, reports Sensor Tower. The apps, which benefited from gym closures amid COVID, saw $838 million in consumer spend, up 42% YoY. The average age of users also continued climb, demonstrating better retention with older users.

Image Credits: Sensor Tower

A second report from the firm indicated U.S. pharmacy app installs were up 47% as the COVID-19 vaccine began to roll out.

Productivity

Microsoft launched a unified app for iPad that combines Word, PowerPoint, Excel and OneNote into one single app. The app is a free download with in-app subscriptions, starting at $6.99/month. A $69.99/year subscription is also available. Microsoft previously launched unified apps for the iPhone and Android.

Government & Policy

TikTok faces a new series of regulatory complaints in Europe, including unfair terms over its virtual currency, whose exchange rate can be modified by TikTok; unfair terms in relation to copyright, related to TikTok’s ability to redistribute users’ videos without paying them (e.g. for ads); child safety concerns over suggestive content and “hidden marketing” of its branded Hashtag Challenges; and other accusations of misleading data processing and privacy practices.

North Dakota’s Senate votes down the App Store bill that would have forced Apple to allow users to sideload apps on their mobile devices. The bill was funded by the advocacy group Coalition for App Fairness, which includes Epic Games, Spotify, Match Group, Tile and others with a beef against Apple over its commission structure. Similar bills are under consideration in Arizona and Georgia.

Breaking: The North Dakota senate just voted down the bill that would've banned Apple and Google from taking a cut of app sales from firms in the state.

Arizona and Georgia are considering similar bills, which are attracting intense lobbying on all sides.https://t.co/jKRBnH7NeI

— Jack Nicas (@jacknicas) February 16, 2021

Adtech

The Post-IDFA Alliance, which consists of Liftoff, Fyber, Chartboost, InMobi, Vungle and Singular, launched a new “No IDFA? No Problem” resource that aims to help publishers and advertisers navigate the iOS 14 transition.

Security

File sharing app SHAREit, one of the world’s most popular apps, is found to have several security flaws, researchers reported. The vulnerabilities could be abused to leak sensitive user data and “execute arbitrary code” with app permissions.

Funding and M&A

Robinhood rival Public.com raised $220 million just months after its $65 million Series C, as previously reported by TechCrunch. Prior investors returned, including Greycroft, Accel, Tiger Global, Inspired Capital, and others, valuing the business at $1.2 billion.

Robinhood rival Public.com raised $220 million just months after its $65 million Series C, as previously reported by TechCrunch. Prior investors returned, including Greycroft, Accel, Tiger Global, Inspired Capital, and others, valuing the business at $1.2 billion.

Robinhood rival Webull raised $150 million in a new round that values the business at over $1 billion. The brokerage was founded by Alibaba alum Wang Anquan and, like Public.com, has benefitted from the exodus of disgruntled Robinhood users, who left over the GameStop debacle.

Robinhood rival Webull raised $150 million in a new round that values the business at over $1 billion. The brokerage was founded by Alibaba alum Wang Anquan and, like Public.com, has benefitted from the exodus of disgruntled Robinhood users, who left over the GameStop debacle.

Math learning app Photomath raised $23 million in Series B funding in a round led by Menlo Ventures. The app, now with 220 million downloads, lets you point your phone at a math problem and it explains the solution.

Math learning app Photomath raised $23 million in Series B funding in a round led by Menlo Ventures. The app, now with 220 million downloads, lets you point your phone at a math problem and it explains the solution.

Live video shopping startup Talkshoplive raised $3 million from Spero Ventures for its live video shopping platform that lets users watch its videos on the web and mobile web — or anywhere else they’re embedded.

Live video shopping startup Talkshoplive raised $3 million from Spero Ventures for its live video shopping platform that lets users watch its videos on the web and mobile web — or anywhere else they’re embedded.

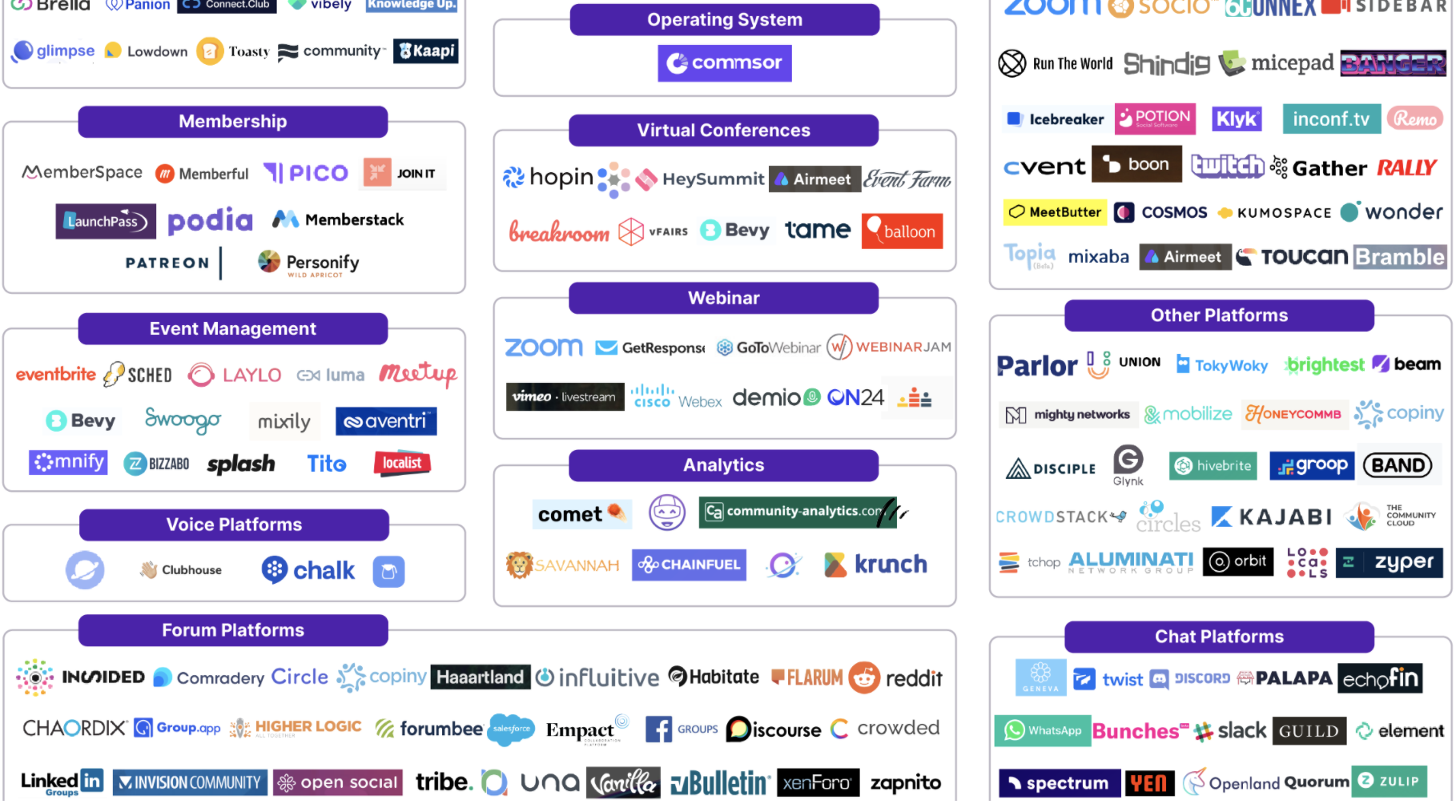

Event networking app Grip raised a $13 million Series A, despite the pandemic. The app pivoted last year to support virtual, hybrid and live events, instead of just in-person events.

Event networking app Grip raised a $13 million Series A, despite the pandemic. The app pivoted last year to support virtual, hybrid and live events, instead of just in-person events.

Mobile gaming startup Artie raised $10 million for its gaming platform that lets users play mobile games without installing an app, from the browser or anywhere links can be shared online. Investors included Zynga founder Mark Pincus, Kevin Durant and Rich Kleiman’s Thirty Five Ventures, Scooter Braun’s Raised In Space, Shutterstock founder Jon Oringer, Tyler and Cameron Winklevoss, Googler Manuel Bronstein and YouTube co-founder Chad Hurley.

Mobile gaming startup Artie raised $10 million for its gaming platform that lets users play mobile games without installing an app, from the browser or anywhere links can be shared online. Investors included Zynga founder Mark Pincus, Kevin Durant and Rich Kleiman’s Thirty Five Ventures, Scooter Braun’s Raised In Space, Shutterstock founder Jon Oringer, Tyler and Cameron Winklevoss, Googler Manuel Bronstein and YouTube co-founder Chad Hurley.

Low-code app development service OutSystems raised $150 million in a round led by Abdiel Capital and Tiger Global, valuing the business at $9.5 billion.

Low-code app development service OutSystems raised $150 million in a round led by Abdiel Capital and Tiger Global, valuing the business at $9.5 billion.

Cross-border neobanking app Zolve raised $15 million in a seed round led by Accel and Lightspeed. The app was founded by the Raghunandan G, the founder of ride-hailing firm TaxiForSure, which exited to Ola. It’s aimed at people moving from India to the U.S. or vice versa.

Cross-border neobanking app Zolve raised $15 million in a seed round led by Accel and Lightspeed. The app was founded by the Raghunandan G, the founder of ride-hailing firm TaxiForSure, which exited to Ola. It’s aimed at people moving from India to the U.S. or vice versa.

Dating app Jigsaw raised $3.7 million for its app that hides daters’ faces with puzzle pieces in an effort to push users to engage and get to know each other before the reveal. While “face reveals” are popular on social media, a dating app that does this lends itself to objectifying people by not showing the face, as users focus on the daters’ body instead.

Dating app Jigsaw raised $3.7 million for its app that hides daters’ faces with puzzle pieces in an effort to push users to engage and get to know each other before the reveal. While “face reveals” are popular on social media, a dating app that does this lends itself to objectifying people by not showing the face, as users focus on the daters’ body instead.

Downloads

Outfit

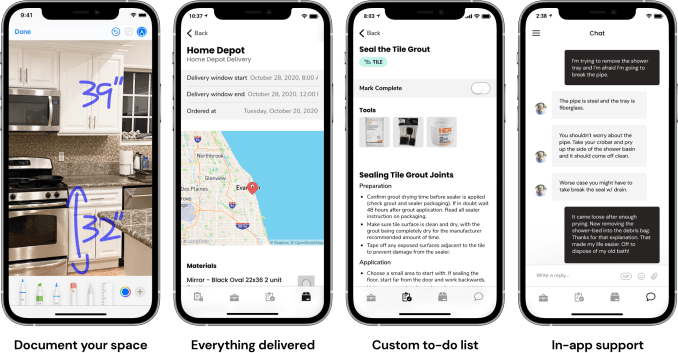

Image Credits: Outfit

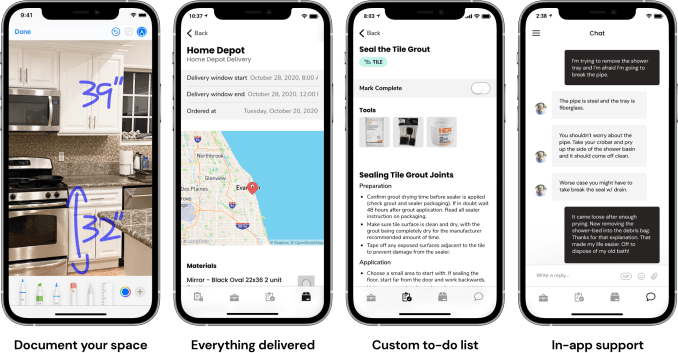

TechCrunch this week covered DIY home renovation startup Outfit, which leverages consumers’ mobile devices to help them with their home projects. After submitting information, including dimensions and photos, Outfit’s app offers the customer a step-by-step guide for completing the project, including documenting their space, getting items and tools delivered, a custom to-do list and receiving support while the project is underway.

Hush

Image Credits: Hush

Hush, a recently launched Safari ad blocker for Mac, iPhone and iPad, does more than just block ads. The app also works to block other invasive trackers and those annoying cookie warnings that now pop up everywhere due to GDPR laws. (it actually doesn’t consent or deny the “accept cookies?” requests — it just blocks the scripts and elements on the website. It doesn’t interact with the site or click any buttons.

Unlike some blockers, Hush doesn’t collect your data. It doesn’t log your browser habits or passwords or even collect crash reports. It’s also free, but you can sponsor the developer on GitHub.

Zillow’s update

The updated version of Zillow’s 3D Home app introduced new technology that combines into one interface 3D Home tours, listing photos and AI-generated floor plans. To create the floor plans and home tour, the app uses computer vision and machine learning on panoramic photos the agent or photographer captured using the app and a 360-degree camera. The app also leverages AI to predict things like room dimensions and square footage. Both the home tour and floor plan can then be automatically uploaded to the lists and added to a website, MLS or shared on email/social media.

Due to the pandemic, Zillow 3D Home tours published on for-sale listings increased 255% during 2020 as customers used it as a safer way to tour properties, the company also noted.

Robinhood rival Public.com

Robinhood rival Public.com