Have you ever wanted a phone you could toss off a staircase? For $550, this durable smartphone is one tough mudder.

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

A Mathematician’s Guided Tour Through Higher Dimensions

The concept of a dimension seems simple enough, but mathematicians struggled for centuries to precisely define and understand it.

User’s Guide to TechCrunch Disrupt 2021

TechCrunch Disrupt 2021 approaches in just three days. Here’s your how-to guide for everything you can expect at Disrupt.

Although the main show kicks off on Tuesday the 21st, there’ll be some sneak peeks and extras going down on Monday. Make sure to log in to Hopin by noon on Monday to catch it all, including a special series of speed networking sessions, where one attendee from each session will be selected to receive a limited edition TechCrunch Disrupt swag bag. All sessions are in Pacific Standard Time.

Monday, September 20 – Networking Sessions

- 12:30pm – 1:00pm PST: Peer to Peer: Investors:

Connect with the Disrupt community of investors to share connections, insights, and expertise. - 1:00pm – 1:30pm PST: Peer to Peer: Early Stage Founders:

Meet the founders also launching at Disrupt to share insights and grow your support network - 1:30pm – 2:00pm PST: The Full Stack:

Meet the data analysts, engineers, hackers, data scientists, and software developers that power your tech. - 2:00pm – 2:30pm PST: BIPOC & Women of Disrupt:

We invite all women and BIPOC (and all allies) attending Disrupt to join us for this roundup to inspire one another and grow your network. - 2:30pm – 3:00pm PST: B2B2Connect:

Are you working on products that make it easier for businesses to thrive? Meet and share ideas with the SaaS and Enterprise community. - 3:00pm – 3:30pm PST: DNA/Tech

: Meet the scientists who are using technology and engineering to produce advancements in health and biology. - 3:30pm – 4:00pm PST: Planet/Impact:

Passionate about making an impact on our planet? Join this networking session focused on sustainability, greentech, and cleantech projects. - 4:00pm – 4:30pm PST: MoneyMatters:

Network with the power brokers changing the face of financial services, banking and crypto. - 4:30pm – 5:00pm PST: Actuator:

Discover the builders automating our lives with robotics and hardware alongside the scientists creating the artificial intelligence that powers it all. - 5:00pm – 5:30pm PST: The Station:

Share insights with people pushing the boundaries of mobility including drone technology, autonomous vehicles, and transportation.

The Stages

There are two main stages at Disrupt – the Disrupt Stage and the Extra Crunch stage. The Disrupt Stage features interviews and panels with the biggest names in tech, plus Startup Battlefield. The Extra Crunch stage is chock full of how-to lessons specifically for founders. The full agenda is here.

Breakout Sessions

Beyond the main stages at Disrupt, you can take in smaller, interactive gatherings that pack a lot of advice, insight, and value — with plenty of time to get answers to your pressing questions. Plus, you just need an Expo Pass to get in front of these sessions. Missing your access? Grab an Expo Pass free here until Monday. All sessions are in Pacific Standard Time.

Tuesday

- 9:00 am – 9:50 am: Revolutionizing the Global Metaverse Economy with VCoin

- 9:00 am – 9:50 am: The $49B Developer Landscape with Dell

- 10:00am – 10:30am: You Complete Me with Mambu

- 11:00am – 11:30am: Saving Lives with Precision Biology, Mayfield

- 11:00am – 11:30am: The Dark Matter of Workflows: Business Technology’s Big Opportunity with Wrike

- 11:35am – 11:55am: Taking Care of the Next Generation with Mayfield

- 12:00pm – 12:50pm: Powering What’s Next: Insights from the Enterprise Software Market with Vista Equity Partners

- 1:00pm – 1:50pm: Demo Derby – How startups are disrupting the status quo with innovative data analytics, AI and modern app development with Google Cloud

- 2:00pm – 2:50pm: Thrive with an Untethered Workforce with Velocity Global

Wednesday

- 9:00am – 9:30am: Belgian Startup Pitch Competition hosted by hub.brussels

- 9:00am – 9:50am: TTA Taiwan Pavilion Pitch-Off Session – Healthcare and Enterprise

- 10:00am – 10:50am: Achieve Sustainable IT with Prometheus, Grafana, and Hardware Sentry

- 11:00am – 11:33am: Korea Pavilion Pitch Session – Hosted by KOTRA

- 11:00am – 11:50am: Hacking US Healthcare: How a Simple Platform Can Help Solve Some of America’s Most Complex Healthcare Problems with Cedar Cares

- 12:00pm – 12:50pm: Accelerate your growth using agile market research throughout the product lifecycle with Momentive.ai

- 1:00pm – 1:50pm: Securing your journey to IPO from the start with Diligent

- 1:00pm – 1:50pm: Accelerating your direct-to-consumer business with Google

- 2:00pm – 2:50pm: How to approach fundraising from Corporate VCs with Intuit

Thursday

- 9:00am – 9:55am: How to build a remote-first engineering culture with Remote

- 10:00am – 10:50am: TTA Taiwan Pavilion Pitch-off Session – Smart Tech

- 11:00am – 11:55am: The Moore’s law of software – onboarding time, with Flatfile

- 1:00pm – 1:50pm: Top Japanese Startups pitch their exciting new tech! Come watch the live JETRO pitch session

- 1:00pm – 1:50pm: Using Visual Communication to Build Your Startup’s Brand with Canva

Roundtable sessions

One thing Disrupt attendees have enjoyed the most at our events are meaningful small-group discussions. Join us for these intimate virtual conversations around fundraising, security, hiring and general founder issues. These special sessions have capped attendance limits to keep the conversations small, so make sure to get there early to save a seat.

Tuesday

- 11:00am – 11:30am: How Netflix Saved Cybersecurity with Cyvatar

- 2:30pm – 3:00pm: CISO2CISO: On the Wrong Side of Disruption with Cyvatar

- 3:00pm – 3:30pm: The toughest founder problems with Neesha Tambe, TechCrunch

Wednesday

- 11:30am – 12:00pm: Why Can’t We Stop Ransomware? with Cyvatar

- 1:00pm – 1:30pm: Startup Hiring Woes with Eric Eldon, TechCrunch

- 2:45pm – 3:15pm: Fundraising Challenges with Jordan Crook, TechCrunch

Thursday

- 10:00am – 10:30am: Startup Hiring Woes with Eric Eldon, TechCrunch

- 12:00pm – 12:30pm: Fundraising Challenges with Jordan Crook, TechCrunch

Partner Sessions

With so much going on during the conference, it’s hard to pick what we’re most excited about. Make sure not to miss these super interesting partner sessions on the Extra Crunch Stage.

Tuesday

- 9:45am – 10:05am: Bioplatforms for Saving the Planet with Mayfield

- 10:45am – 11:05am: So You Want to Build a Space Business? With The Aerospace Corporation

- 12:25pm – 12:45pm: The Inaugural Connection I.T. Superheroes Awards category winners

- 1:25pm – 1:45pm: How Circle’s $4.5B Public Listing Will Change Startup Fundraising with SeedInvest

- 2:25pm – 2:45pm: Humanizing AI: How Brands Are Revolutionizing Customer Experience in an increasingly Digital World with Soul Machines

Wednesday

- 9:45am – 10:05pm: Illuminating the Next Great Entertainment Frontier: The Connected TV Metaverse with Foxxum | rlaxx TV

- 10:45am – 11:05am The New Human and Planetary Health Pioneers with Mayfield

- 12:25pm – 12:45pm: Powering the Small Business Economy with Cloud Technology with Xero

- 1:25pm – 1:45pm: Why Employers Are Ignoring a Large Candidate Pool That’s Necessary for Growth Today with Checkr

- 2:25pm – 2:45pm: You’ve Raised Your Seed Round—Now What? Preparing for Your Series A with Samsung Next

- 2:45pm – 3:05pm: Electric Generation: The Next Frontier For American Business with Ford Motor Company

Thursday

- 9:40am – 10:00am: Rewiring the Brain to Improve the Quality of Life with Mayfield

- 10:40am – 11:00am: Scaling Businesses and Creating Value with the Everywhere Workforce with Upwork

- 11:35am – 11:40am: Esri Hackathon finalist demos

- 12:20pm – 12:40pm: Eliminating Styrofoam Protective Packaging with Cruz Foam

- 1:25pm – 1:45pm: The MIssing Block to Bring Crypto to the Masses with KuCoin

Pitch sessions

There’s nothing TechCrunch loves more than a good startup pitch – and Disrupt has got loads of them. In addition to our renowned Startup Battlefield competition, the startups in the expo get a chance to shine in these sessions. All sessions are in Pacific Standard Time.

Tuesday

- 10:00am – 11:00am: Startup Alley Pitch Session

- 12:00pm – 1:00pm: Startup Alley Pitch Session

- 2:00pm – 3:00pm: Startup Alley Pitch Session

Wednesday

- 9:00am – 9:30am: Belgian Startup Pitch Competition hosted by hub.Brussels

- 9:00am – 9:50am: TTA Taiwan Pavilion Pitch-off Session – Healthcare & Enterprise

- 10:00am – 11:00am: Startup Alley Pitch Session

- 11:00am – 11:33am: Korea Pavilion – Startup Pitch Session with KOTRA

- 12:00pm – 1:00pm: Startup Alley Pitch Session

- 2:00pm – 3:00pm: Startup Alley Pitch Session

Thursday

- 9:00am – 9:50am: Startup Alley Pitch Session

- 10:00am – 10:50am: TTA Taiwan Pavilion Pitch-off Session – Smart Tech

- 11:40am – 12:20pm: Pitch Deck Teardown

- 1:00pm – 1:50pm: Top Japanese Startups pitch their exciting new tech with JETRO

Expo and Expo Crawl

Our expo is teeming with early-stage founders launching new and exciting offerings. We’ve carved out some dedicated time in the agenda to catch up with these enterprising entrepreneurs. Search Expo in the agenda to bookmark those sessions.Fun Stuff and Prizes

It’s not all serious business at Disrupt. We’ve put together some fun things and games. Download and complete the Disrupt Passport for a chance to win a VanMoof X3 e-bike, Bose noise-canceling headphones or a Sonos Beam Sound Bar. Session Videos and Transcriptions

Missed a session? All the Extra Crunch Stage and Disrupt Stage recordings will be posted on the Disrupt event page at the close of the show. Plus, you can read the transcripts with Otter.ai. Otter’s giving attendees free access for a month using promo code: TCDISRUPT2021.See you at Disrupt!

Executive coaching for employees is complicated and emotional

Welcome to Startups Weekly, a fresh human-first take on this week’s startup news and trends. To get this in your inbox, subscribe here.

BetterUp, a reskilling and coaching platform for employees before and beyond the C-suite, is getting in touch with its emotions. This week, the richly funded unicorn startup announced a pair of acquisitions in the emotional artificial intelligence and people management space: Motive and Impraise. The terms of the deal weren’t disclosed.

BetterUp announced its acquisitions after a busy stint, which included passing $100 million in annual recurring revenue, expanding to Europe, and hitting 1 million individual coaching sessions on its platform.

I’ll be honest. It’s par for the course to see a growth-stage startup use milestones to inorganically expand through acquisitions. How else do you grow into your valuation? BetterUp’s duo of deals still stood out to me because they signal a somewhat unconventional direction for where the coaching industry is going. Stay with me.

BetterUp claims that it pioneered the category of coaching by focusing on employees, not just C-suite executives. With these acquisitions, it’s shifting how that coaching looks and lives. Motive, for example, will help BetterUp clients understand the emotional context behind data that they already aggregate, through engagement surveys or polls. It’s a plug-and-play approach that helps employers more immediately act on employee sentiment, instead of waiting for the long-game of coaching to play out.

On the other end of the funnel, Impraise uses technology to help managers better support their direct reports, through real-time performance reviews and more seamless feedback channels. Like Motive, Impraise is a step outside of the traditional boundaries of what coaching looks like.

“The direct-report relationship is where change happens in people’s lives,” BetterUp CEO and co-founder Alexi Robichaux said. “It doesn’t actually happen in coaching sessions; change happens after.”

In some ways, these acquisitions are BetterUp admitting that coaching for all employees has to be an end-to-end solution that requires everyone in the company – from HR to managers – to be involved. It can’t be a weekly calendar invite. This sort of investment could cause employers to shy away from even offering services to their staff to begin with, but pressure to retain may force them to try anyways. For other coaching and up-skilling platforms, the bar continues to be raised.

“Coaching can be a point solution, but that’s not enough and we know that better than anyone because we invented the point solution,” Robichaux said. “If you don’t have the data platform, if you don’t have the outcomes. If you don’t have the AI to personalize this, you can go coach 50 managers at your company,” but not every employee.

In the rest of this newsletter, I’ll walk us through Atlanta’s big bootstrapped moment, Casper’s nightmare and Apple’s day. As always, you can find me on Twitter @nmasc_ and listen to my podcast, Equity.

Atlanta’s big bootstrapped moment

Step aside Austin and Miami, Atlanta is in town. All eyes were on the city this week after Intuit bought local business Mailchimp for a staggering $12 billion. The Atlanta-based email marketing company never took any outside funding, which meant the deal was one of the biggest ever for a bootstrapped company. And while some saw Mailchimp’s massive exit as a win for the Atlanta startup and venture ecosystem, others felt differently.

Here’s what to know: Part of Mailchimp’s strategy as an untraditional tech company included not giving Mailchimp employees equity, and prioritizing profit-sharing as well as higher salaries. It sounds good, until your startup exits for $12 billion and you realize you don’t have any equity in the business that you helped build. It’s a knock against bootstrapping, as we discussed during Equity. Employees spoke to Business Insider about their first reactions, answering if the deal does indeed empower the local ecosystem.

Outside the inbox:

- Atlanta’s sundry startups join in global VC funding boom

- Collab Capital closes $50 million debut fund to back Black founders

Casper’s nightmare

Image Credits: Bryce Durbin/TechCrunch

My scoop this week uncovered that Casper, the direct-to-consumer mattress company, had another round of layoffs that impacted two dozen employees, as well as its CMO, CTO and COO. The round of layoffs and executive shuffle comes a little over a year since Casper cut 21% of its workforce and shut down its European operations.

The easy take here is that Casper is struggling with management and direction and has been on its back foot since its public debut last year. However, I’d argue that there’s more nuance here.

Here’s what to know: One founder in the direct-to-consumer space, who spoke on the condition of anonymity due to her lack of direct knowledge with the company said that Casper’s layoffs could also be a response to Apple’s iOS 14.5 update, which will crack down on apps that track users’ data without permission. The setting restricts the advertising data that companies can access, making it harder to justify budget and understand the efficacy of their sales strategy.

For DTC companies, the uncertainty of in-person retail activity plus difficulty of advertising attribution is a challenging hurdle to surpass.

Don’t sleep on this:

- Facebook revamps its business tool lineup following threats to its ad targeting business

- Choices and constraints: How DTC companies decide which strategy to follow

- Data remains a vital part of the marketing world

Apple (a) day

Apple went back on stage with yet another virtual event to announce updates, upgrades and brand new unveils. The TechCrunch team, of course, couldn’t resist a chance to live blog. Read our full coverage here.

Apple went back on stage with yet another virtual event to announce updates, upgrades and brand new unveils. The TechCrunch team, of course, couldn’t resist a chance to live blog. Read our full coverage here.

Here’s what to know: It was all about the new iPhone 13. Brian Heater explained the context around the launch and what’s actually new about the smartphone.

Last year’s iPhone 12 was a massive seller, bucking the trend of stagnating smartphone sales, in part due to a bottleneck in sales from the unplanned delay, but also because it finally brought 5G connectivity to Apple’s mobile line.

Lucky number iPhone 13 (no skipping for superstition’s sake, mind) features a familiar design. The front notch has finally been shrunken — now 20% smaller than its predecessor — while the rear-facing camera system has also gotten a redesign. The screen is now 28% brighter, Super Retina XDR display on both the iPhone 13 and 13 mini at 1200 nits.

On and off the stage:

- Apple patches an NSO zero-day flaw affecting all devices

- Apple brings macro, low-light and cinema-focused updates to the iPhone 13 Pro camera

- The iPhone 13 Pro and Pro Max feature 120Hz display, better cameras

- Apple Watch Series 7 arrives with a larger, more rugged display

Around TC

Our prep sessions are done. The Battlefield companies are amped. And a photo booth is coming.

TechCrunch Disrupt kicks off next week! Our flagship event, featuring speakers like Melanie Perkins and Reid Hoffman, runs virtually September 21 to 23. The events team has truly spent months on making this a virtual event that feels engaging, spontaneous and true to our personality as a publication. And after getting a sneak peek this past week, I can promise you that it’s different from any other online conference that I’ve attended during the pandemic.

Anyways, all this is to say that I’m amped to join the stage with my colleagues, interview the brightest names in tech, and meet as many entrepreneurs as possible. Are you joining? Buy tickets using my discount code “MASCARENHAS20.”

Across the week

Seen on TechCrunch

Facebook knows Instagram harms teens. Now, its plan to open the app to kids looks worse than ever

Inside Reach Capital’s edtech-powered returns

Canva’s problem with PDF and its $40B valuation

Seen on Extra Crunch

3 strategies to make adopting new HR tech easier for hiring managers

What could stop the startup boom?

The value of software revenue may have finally stopped rising

Edtech leans into the creator economy with cohort-based classes

The GoPro-ification of the iPhone

Hello friends, and welcome back to Week in Review!

Last week, we talked about some sunglasses from a company that many people do not like very much. This week, we’re talking about Apple and the company 1,600 times smaller than it that’s facing similar product problems.

If you’re reading this on the TechCrunch site, you can get this in your inbox from the newsletter page, and follow my tweets @lucasmtny

(Photo by Brooks Kraft/Apple Inc.)

the big thing

When you get deep enough into the tech industry, it’s harder to look at things with a consumer’s set of eyes. I’ve felt that way more and more after six years watching Apple events as a TechCrunch reporter, but sometimes memes from random Twitter accounts help me find the consumer truth I’m looking for.

As that dumb little tweet indicates, Apple is charging toward a future where it’s becoming a little harder to distinguish new from old. The off-year “S” period of old is no more for the iPhone, which has seen tweaks and new size variations since 2017’s radical iPhone X redesign. Apple is stretching the periods between major upgrades for its entire product line and it’s also taking longer to roll out those changes.

Apple debuted the current bezel-lite iPad Pro design back in late 2018 and it’s taken three years for the design to work its way down to the iPad mini while the entry-level iPad is still lying in wait. The shift from M1 Macs will likely take years as the company has already detailed. Most of Apple’s substantial updates rely on upgrades to the chipsets that they build, something that increasingly makes them look and feel like a consumer chipset company.

This isn’t a new trend, or even a new take, it’s been written lots of times, but it’s particularly interesting as the company bulks up the number of employees dedicated to future efforts like augmented reality, which will one day soon likely replace the iPhone.

It’s an evolution that’s pushing them into a similar design territory as action camera darling GoPro, which has struggled again and again with getting their core loyalists to upgrade their hardware frequently. These are on laughably different scales, with Apple now worth some $2.41 trillion and GoPro still fighting for a $1.5 billion market cap. The situations are obviously different, and yet they are both facing similar end-of-life innovation questions for categories that they both have mastered.

This week GoPro debuted its HERO10 Black camera, which brings higher frame rates and a better performing processor as it looks to push more of its user audience to subscription services. Sound familiar? This week, Apple debuted its new flagship, the iPhone 13 Pro, with a faster processor and better frame rates (for the display not the camera here, though). They also spent a healthy amount of time pushing users to embrace new services ecosystems.

Apple’s devices are getting so good that they’re starting to reach a critical feature plateau. The company has still managed to churn out device after device and expand their audience to billions while greatly expanding their average revenue per user. Things are clearly going pretty well for the most valuable company on earth, but while the stock has nearly quadrupled since the iPhone X launch, the consumer iPhone experience feels pretty consistent. That’s clearly not a bad thing, but it is — for lack of a better term — boring.

The clear difference, among 2.4 trillion others, is that GoPro doesn’t seem to have a clear escape route from its action camera vertical.

But Apple has been pushing thousands of employees toward an escape route in augmented reality, even if the technology is clearly not ready for consumers and they’re forced to lead with what has been rumored to be a several-thousand-dollar AR/VR headset with plenty of limitations. One of the questions I’m most interested in is what the iPhone device category looks likes once its unwieldy successor has reared its head. Most likely is that the AR-centric devices will be shipped as wildly expensive iPhone accessories and a way to piggy back off the accessibility of the mobile category while providing access to new — and more exciting — experiences. In short, AR is the future of the iPhone until AR doesn’t need the iPhone anymore.

Image Credits: Tesla

other things

Here are the TechCrunch news stories that especially caught my eye this week:

Everything Apple announced this week

Was it the most exciting event Apple has ever had? Nah. Are you still going to click that link to read about their new stuff? Yah.

GoPro launches the HERO10 Black

I have a very soft spot in my heart for GoPro, which has taken a niche corner of hardware and made a device and ecosystem that’s really quite good. As I mentioned above, the company has some issues making significant updates every year, but they made a fairly sizable upgrade this year with the second-generation of their customer processor and some performance bumps across the board.

Tesla will open FSD beta to drivers with good driving record

Elon Musk is pressing ahead with expanding its “Full Self-Driving” software to more Tesla drivers, saying that users who paid for the FSD system can apply to use the beta and will be analyzed by the company’s insurance calculator bot. After 7 days of good driving behavior, Musk says users will be approved.

OpenSea exec resigns after ‘insider trading’ scandal

NFTs are a curious business; there’s an intense amount of money pulsating through these markets — and little oversight. This week OpenSea, the so-called “eBay of NFTs,” detailed that its own VP of Product had been trading on insider information. He was later pushed to resign.

Apple and Google bow to the Kremlin

Apple and Google are trying to keep happy the governments of most every market in which they operate. That leads to some uncomfortable situations in markets like Russia, where both tech giants were forced by the Kremlin to remove a political app from the country’s major opposition party.

Image Credits: Gitlab

extra things

Some of my favorite reads from our Extra Crunch subscription service this week:

What could stop the startup boom?

“…We’ve seen record results from cities, countries and regions. There’s so much money sloshing around the venture capital and startup worlds that it’s hard to recall what they were like in leaner times. We’ve been in a bull market for tech upstarts for so long that it feels like the only possible state of affairs. It’s not…”

The value of software revenue may have finally stopped rising

“…I’ve held back from covering the value of software (SaaS, largely) revenues for a few months after spending a bit too much time on it in preceding quarters — when VCs begin to point out that you could just swap out numbers quarter to quarter and write the same post, it’s time for a break. But the value of software revenues posted a simply incredible run, and I can’t say “no” to a chart…“

Inside GitLab’s IPO filing

“…The company’s IPO has therefore been long expected. In its last primary transaction, GitLab raised $286 million at a post-money valuation of $2.75 billion, per PitchbBook data. The same information source also notes that GitLab executed a secondary transaction earlier this year worth $195 million, which gave the company a $6 billion valuation…”

Thanks for reading, and again, if you’re reading this on the TechCrunch site, you can get this in your inbox from the newsletter page, and follow my tweets @lucasmtny

Lucas Matney

This Week in Apps: Apple’s iPhone event, App Annie hit with securities fraud, OpenSea goes mobile

Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record 218 billion downloads and $143 billion in global consumer spend in 2020. Consumers last year also spent 3.5 trillion minutes using apps on Android devices alone. And in the U.S., app usage surged ahead of the time spent watching live TV. Currently, the average American watches 3.7 hours of live TV per day, but now spends four hours per day on their mobile devices.

Apps aren’t just a way to pass idle hours — they’re also a big business. In 2019, mobile-first companies had a combined $544 billion valuation, 6.5x higher than those without a mobile focus. In 2020, investors poured $73 billion in capital into mobile companies — a figure that’s up 27% year-over-year.

This Week in Apps offers a way to keep up with this fast-moving industry in one place, with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps and games to try, too.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

Top Stories

Apple Event wrap-up

It’s official, new iPhones are here. But everyone is talking about the iPad mini instead.

(Photo by Brooks Kraft/Apple Inc.)

Apple this week introduced its updated iPhone 13 lineup, which includes iPhone 13 in pretty new shades, an iPhone mini, and the more powerful iPhone 13 Pro and Pro Max. Consumers may care most about the battery life improvements — 1.5 hours longer on iPhone 13 mini and iPhone 13 Pro; 2.5 hours more on iPhone 13 and Pro Max, compared with their respective iPhone 12 models. Cameras got a decent upgrade, powered by the A15 Bionic, which enables additions like “Cinematic Mode” (a mode that allows you to change focus between subjects). Plus, Pro models can do macro photography and now include support for ProRes video recording at 1080p 30 fps with the 128GB storage option and up to 4K 30 fps with 256GB, 512GB and 1TB storage options. (Yes, there’s a 1TB iPhone now, and no more 64GB models. Hooray!)

Image Credits: Apple

The bigger news in terms of hardware, however, was the iPad mini ($499+), aka the BIG iPhone, which got a significant update. The new device has an 8.3-inch display, front and rear-facing 12-megapixel cameras, 80% faster performance with the A15 Bionic, 40% faster CPU, support for 5G, and it adds a USB-C port and a relocated Touch ID that’s now on the top button. It also now supports Center Stage and Apple Pencil (2nd generation.) It’s also available in new finishes: space gray, pink, purple and starlight.

Apple noted there are more than 1 million apps designed specifically for iPad devices. The full App Store has 2.22 million or more, according to various estimates. A popular and affordable iPad mini could encourage more development beyond the iPhone.

Other announcements included a new standard iPad with spec bumps, a new Apple Watch Series 7 with a slightly bigger screen and fall detection for cyclists, an updated Fitness+ with Pilates and meditation, and a nifty MagSafe Wallet that will track the location where it was separated from your iPhone.

Apple sherlocks Watch keyboard apps

Image Credits: FlickType

Frustrated iOS developer Kosta Eleftheriou, who is already engaging in a legal battle with Apple over money lost to App Store scams and other matters, couldn’t hold back his frustration when he saw Apple announce its new Apple Watch Series 7 would now sport a familiar-looking keyboard. Eleftheriou’s own FlickType keyboard app for Apple Watch was repeatedly rejected from the App Store for months on end, causing a lengthy delay in getting his app to market. The developer also claims to have had conversations with Apple execs about his keyboard app, which he says was once even considered an acquisition target.

Apple’s position on the matter is that it had to remove Eleftheriou’s app due to guidelines it had at the time prohibiting keyboard extensions, which the company had on the books due to what it believed would offer a poor consumer experience on earlier versions of Apple Watch, which had a smaller screen. These guidelines were later dropped once Apple learned of the app’s accessibility functions, which allowed the app to be published.

One question — which would have to either be worked out through the discovery process in court or through some sort of congressional investigation — is how long Apple had a Watch keyboard design on its product roadmap? Was Apple rejecting a third-party Watch keyboard app (and others like it, to be clear) over this purported “poor experience” at a time when Apple was actively designing its own keyboard UI? And how could there be a corporate firewall in place between App Store review activity and the company’s own plans, if Apple was considering an acquisition of FlickType at the time, as the lawsuit alleges?

Eleftheriou has a difficult path ahead of him going up against Apple’s legal team, but he’s more motivated than ever now. “See you in court, @Apple” he tweeted after the Watch reveal.

So now we know. See you in court, @Apple. https://t.co/hJtPI2Z83J pic.twitter.com/1s7MUSLTpc

— Kosta Eleftheriou (@keleftheriou) September 14, 2021

App Annie charged with securities fraud

The U.S. Securities and Exchange Commission (SEC) charged App Annie, as well as its co-founder and former CEO and Chairman Bertrand Schmitt, with securities fraud. App Annie and Schmitt have agreed to pay over $10 million to settle the fraud charges which are related to “deceptive practices and making material misrepresentations about how App Annie’s alternative data was derived,” the SEC said. The charges have to do with how App Annie used non-aggregated and non-anonymized data to alter its model-generated estimates to be more accurate, while telling trading firms that protections were in place against the misuse of confidential data. (More details and the full complaint can be read here on TechCrunch.)

In response to the bombshell news, one competitor has spoken up. Apptopia co-founder and CEO Jonathan Kay wrote about how his firm took the time to build the company and data estimates “the right way,” which is why some of its estimates in the past hadn’t been accurate. (It wasn’t cheating the system.) This proved to be the better strategy. “We did not take shortcuts to spur breakneck scale; oftentimes founders feel the pressure to do so to meet unrealistic Board, VC or Market expectations. We haven’t and we don’t,” he said.

Meanwhile, Appfigures shared a similar sentiment, adding they were disappointed to hear the news and hoped the actions didn’t erode trust in the industry. “Strict privacy has been one of our founding principles and has served our users and us well for 12 years. We believe the trust of our users is our most valuable asset,” their statement read.

Weekly News

Platforms: Apple

- The Epic Games/Apple lawsuit will drag on. After last week’s ruling, which will now allow developers to add to iOS apps links to their website and other ways to pay, Epic said it would appeal. The Fortnite maker wanted Apple to be dubbed a monopolist, which would force iOS to be opened up to alternative app stores, like its own, or at least allow side-loading. But the judge said Apple’s success was “not illegal.”

- Developers were invited to submit their iOS 15, iPadOS 15, tvOS 15 and watchOS 8 apps to the App Store, ahead of the public launch on Monday.

- Apple introduced new marketing tools for app developers. Developers can now create custom marketing assets, including banners and images, to promote apps across social media and elsewhere. To get started, you select an app and a template, then customize the design and add present messages. The assets will be immediately available in the right sizes and can be shared with short links or codes that direct users to the App Store product page.

Image Credits: Apple

Android Updates

- A leaked document points toward an Android 12 release date of October 4th. The document informs OEM partners when to stop approving builds for prior versions of Android.

- Meanwhile, Samsung released an Android 12 beta to Galaxy S21 owners. The beta is for Samsung’s One UI 4, its version of Android, and arrives on September 14 — the same day Apple announced the iPhone 13.

- Google announced it would port a privacy-focused feature from Android 11 to older phones running Android 6 and higher. The feature automatically restricts apps’ permissions to sensitive phone features, like the storage or camera, if the app hasn’t been used for several months.

- Google delivered the first five stable Jetpack Wear OS libraries (wear, wear-input, wear-ongoing, wear-phone-interactions and wear-remote-interaction), to help developers build high-quality Wear OS apps. The company recently updated the Android Jetpack Wear OS libraries as well.

- Google invited users to join its Pixel Superfans group, which was previously kept under wraps. The pilot program provides insider access and a VIP experience, including access to a private Facebook Group, and perks like private Q&As and events, opportunities to share ideas with the Google team, limited-edition swag and more to come.

Augmented Reality

Image Credits: Snap

- Snapchat launched a new global portal Lens in partnership with Sotheby’s and the Estate of Christo. The Lens, “The Last Christo: Original Works for The Arc de Triomphe,” overlays Snap’s AR onto Christo’s work to give viewers an entirely new experience of the installation. The experience will also come to Snap’s main Camera and the Snap Map early next week.

Fintech

MassMutual will have to pay a $4 million fine as part of a settlement with Massachusetts regulators involving the conduct of former employee Keith Gill, also an online trader who goes by “Roaring Kitty.” Gill was heavily involved with the GameStop meme-stock drama from earlier this year. The stock was a favorite with day traders on Reddit’s WallStreetBets message board. Trading app Robinhood had restricted the trading of this and other meme stocks, leading to a congressional investigation.

Social

Image Credits: Twitter

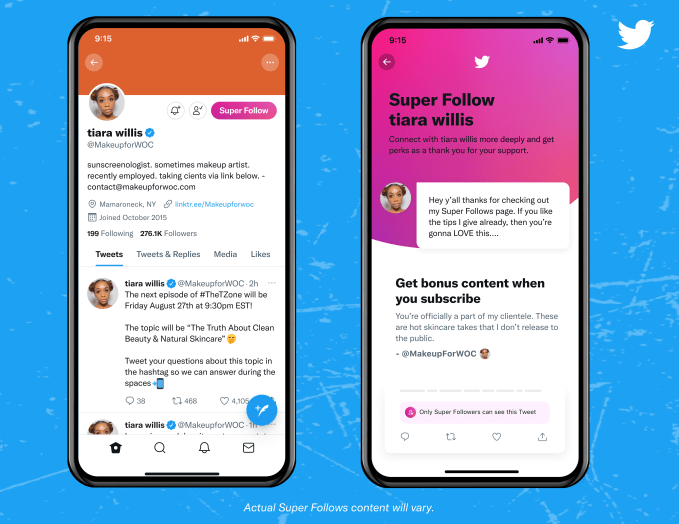

- Twitter Super Follows have only generated around $6,000 in the U.S. in the first two weeks the feature has been live across the U.S. and Canada. Canadian in-app revenue was around $600. Some small portion may be attributed to Ticketed Space, so true adoption figures may be even lower. Fewer than 100 creators in the U.S. have been offered access to Super Follows, which is impacting these figures. But all iOS users in these markets are able to subscribe to the participating creators.

- A Dept. of Homeland Security report warned law enforcement agencies that domestic extremists had used TikTok to recruit people to their causes and share tactical guidance in the lead up the January 6 attack on the U.S. Capitol.

- TikTok blocked content related to the “devious licks” viral challenge which was encouraging students to create havoc at schools by stealing things, including soap dispensers, hand sanitizer, COVID test kits, bathroom sinks and doors, classroom tech and more. As a result, schools across the U.S. have locked down access to bathroom facilities.

- A Facebook whistleblower has shared a damning set of internal docs with The Wall Street Journal, including how Instagram’s own internal research indicated how the app impacted teenage girls’ mental health over body image, leading them to have, in some cases higher rates of depression, anxiety and suicidal thoughts. Following the news, Senators Marsha Blackburn (R-TN) and Richard Blumenthal (D-CT) announced a probe into Facebook’s lack of transparency around its internal research.

- As news of Instagram’s impact on teens leaked, TikTok added more mental health resources of its own, including a “well-being guide” in its Safety Center, a primer on eating disorders, expanded search interventions and opt-in viewing screens on potentially triggering searches.

- LinkedIn announced a $25 million creator fund ahead of its plans to test a Clubhouse-style audio feature.

- Snap hired Jacqueline Beauchere, the chief online safety officer at Microsoft, to be its first-ever global head of platform safety. In her role, Beauchere will advise the company’s decisions on policies, guidelines, features and tools focused on safety and well-being.

Messaging

- The beta version of the Signal for Android app expanded its privacy-focused crypto payments feature first introduced in April. The feature, MobileCoin, was previously only available in the U.K. It’s now offered in Switzerland, France and Germany. The app saw a few other design tweaks as well.

- WhatsApp launched the first test of a public directory for businesses within its app, starting in São Paulo, Brazil. The feature allows users to find shops and services through a directory in the app, which could then kick off their mobile commerce transactions.

- A report from The Financial Times (non-paywalled summary here) details how the Telegram app has exploded as a hub for cybercriminals who buy and sell stolen data and hacking tools. One channel featuring data dumps had more than 47,000 subscribers before being shut down.

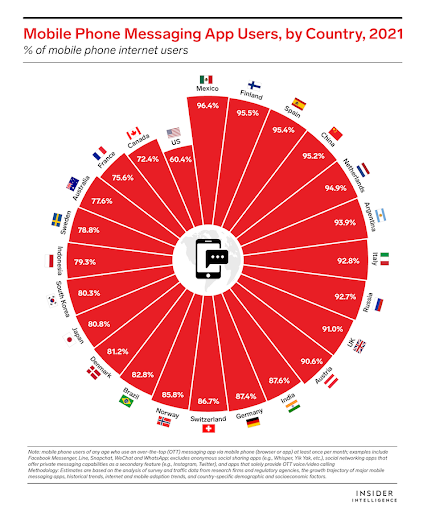

- Emarketer reports the number of monthly messaging app users worldwide will rise 6.1%, to 3.09 billion, in 2021. This is a deceleration of growth from 2020, when the number grew nearly 14%, but an increase from a pre-pandemic estimate of 5.5% growth. By 2024, the firm predicts more than three-fourths of internet users will use a mobile messaging app.

Image Credits: eMarketer

Dating

- Tinder announced it’s rolling out video profiles to more markets across Europe, Asia and Latin America. The feature was first introduced to a handful of countries earlier this year, allowing users to express themselves using video instead of just photos.

Image Credits: Tinder

Streaming & Entertainment

- Jeffrey Katzenberg’s failed streaming app Quibi settled its lawsuit with interactive video firm Eko, which alleged Quibi had infringed on its patents. Both parties have agreed to dismiss their legal claims, and QBI Holdings LLC, which holds the remaining Quibi assets, will transfer the intellectual property and technology for its “Turnstyle” mobile-video viewing feature to Eko.

- Clubhouse hired a head of News from NPR, Nina Gregory, to help it build out publisher relationships. Gregory led NPR’s Arts Desk for the last seven years.

- Apple announced new streaming partners for its upcoming iOS 15 SharePlay feature that allows for co-watching content through FaceTime. At WWDC, Apple said the feature would work with video apps Apple TV+, Disney+, HBO Max+, ESPN+ Paramount+, Pluto TV, NBA App, Twitch and TikTok. This week Apple said it was adding STARZ, BET+, TV Everywhere Apps from ViacomCBS (MTV, Paramount Network, & Comedy Comedy Central), and Chinese streaming service Youku. On the music side, it’s adding Spotify, TuneIn and SoundCloud, which join Apple Music.

- Apple’s Shazam app announced it has been used in the iOS Control Center over 1 billion times. The company previously noted it had passed one billion songs being recognized every month in June 2021. Both metrics paint a picture of the massive traction Apple’s first-party apps can gain based on their platform advantage.

- Celeb-to-fan connections app Cameo adds a new feature, Cameo Calls, that aims to digitize the fan “meet-and-greet” experience. At launch, fans can now connect with over 500 celebs for one-on-one, face-to-face calls by buying a ticket from their phone. The talent sets the pricing, which averages up to $31 minutes per call.

Gaming

Image Credits: Sensor Tower

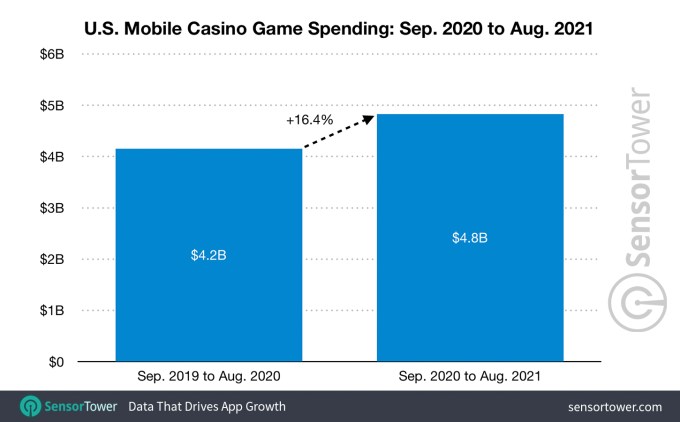

- U.S. mobile casino game spending grew by 16.4% to $4.8 billion during the last 12 months, according to a new Sensor Tower report. The No. 1 title from September 1, 2020 to August 31, 2021 was Coin Master from Moon Active, which generated $650.5 million. This was followed by Bingo Blitz from Playtika, then Slotomania from Playtika.

- Zynga announced ReVamp, the first “social deception” gaming title on Snapchat. The vampire-themed, multiplayer game is a spin on “Among Us,” as players work to unveil the imposter. The game takes place inside an old mansion where players have to complete renovation tasks, while the vampire players must avoid suspicion.

Productivity

- Google’s internal R&D division is working on a newsletters project called Museletter that allows for subscription-based access to Google Drive content, like spreadsheets, docs and slides.

Image Credits: Google

Health & Fitness

- The FTC warned health apps, like those tracking fitness or menstrual cycles, to notify consumers impacted by data breaches. The Commission voted 3-2 to clarify that health apps were included in the agency’s 2009 Health Breach Notification Rule, which required vendors to notify customers of data breaches.

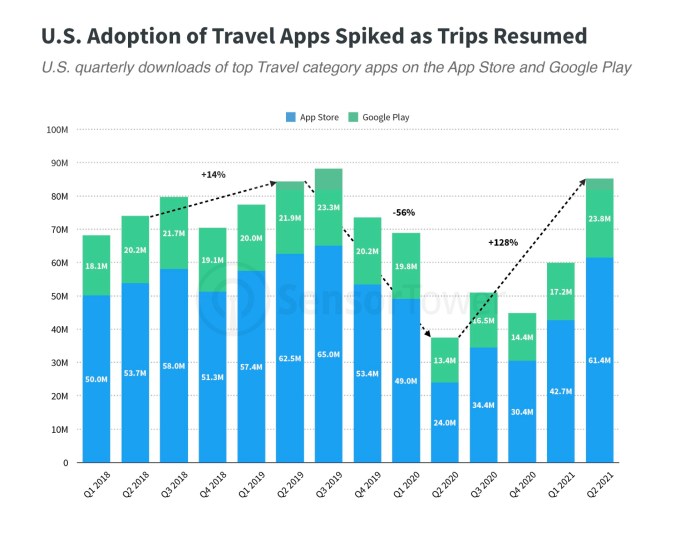

Travel

- Downloads of top Travel apps in the U.S. reached 61.4 million on Apple’s App Store and 23.8 million on Google Play in Q2 2021, according to a new report by Sensor Tower. This represented the highest number of quarterly downloads since the outbreak of COVID-19.

Image Credits: Sensor Tower

Government & Policy

- Russia was considering fining Google and Apple over their hosting of a tactical voting app from opposition leader Alexei Navalny, but the “Smart Voting” app was removed by both stores. The companies had previously been warned to remove the app over claims of “election interference.” Apple’s upcoming iCloud Private Relay privacy feature also won’t be available in Russia, a support document recently noted in an update.

- Ireland’s Data Protection Commission (DPC) said it has opened two investigations into the video-sharing platform TikTok. The first covers how TikTok handles children’s data and whether it complies with Europe’s General Data Protection Regulation. The DPC will also examine TikTok’s transfers of personal data to China.

- South Korea fined Google $177 million for blocking Android customization by device makers, saying this was an abuse of its dominant position in the market.

- Chinese police are using a new fraud prevention app installed on more than 200 million mobile phones to identify and question people who have browsed foreign financial news sites, The FT reported. The police claimed they were working to combat the surge in fraud often carried out by foreign businesses controlled by Chinese and Taiwanese.

- Tencent and Alibaba said they will open up their apps to competitors, following a meeting with the Ministry of Industry and Information Technology (MIIT) last week. For eight years, the two companies have split China’s internet in two, The FT reported, replicating each other’s services and even blocking the posting of links in each other’s apps. That will now change in the weeks ahead.

Security & Privacy

Image Credits: Bryce Durbin / TechCrunch

- Apple patched a zero-day flaw that was impacting its top devices, including iPhone, iPad, Mac and Watches. Citizen Lab discovered the vulnerability and was credited with the find. The iMessage flaw was actively exploited by Pegasus, a spyware app developed by the Israeli company NSO Group, which gives government customers complete access to a target device, including data, photos, messages and location. The vulnerability was used to hack the iPhones belonging to at least one Bahraini activist.

- A new Android app, Nahoft, allows Iranians to speak freely by turning up to 1,000 characters of Farsi text into a jumble of random words. The text can then be sent to anyone over other messaging apps, but the recipient has to use Nahoft on their own device to read it.

- Apple reportedly threatened to remove Facebook from the App Store over human trafficking concerns following a 2019 BBC report about the matter, The WSJ reported.

- An untethered iOS 14.5.1 jailbreak was demoed working on the iPhone 12 Pro Max, in the days ahead of the iOS 15 release.

Funding and M&A

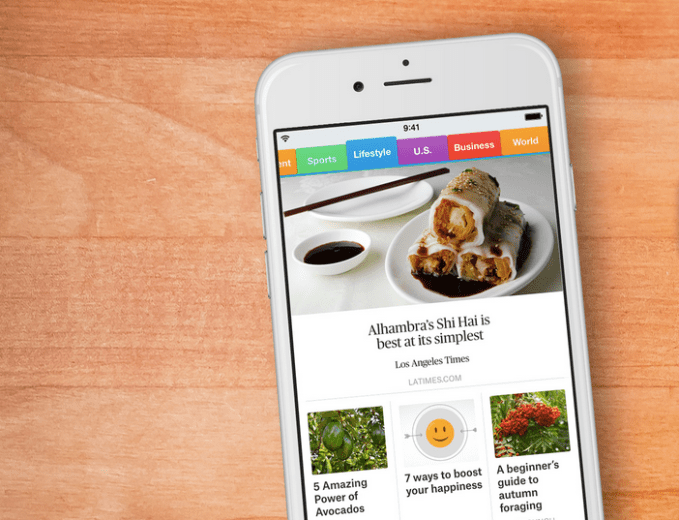

Image Credits: SmartNews

Tokyo-based news aggregator SmartNews raised $230 million in Series F funding, valuing its business at $2 billion. The funding included U.S. investors Princeville Capital and Woodline Partners, as well as JIC Venture Growth Investments, Green Co-Invest Investment and Yamauchi-No.10 Family Office in Japan.

Tokyo-based news aggregator SmartNews raised $230 million in Series F funding, valuing its business at $2 billion. The funding included U.S. investors Princeville Capital and Woodline Partners, as well as JIC Venture Growth Investments, Green Co-Invest Investment and Yamauchi-No.10 Family Office in Japan.

Venice, California-based Elodie Games raised $32.5 million for its cross-play, co-op games that run on PCs, consoles and mobile devices. The round was led by Galaxy Interactive and Andreessen Horowitz (a16z). The company, founded by mobile gaming vets Christina Norman and David Banks, two veterans of Riot Games, had previously raised $5 million in 2020.

Venice, California-based Elodie Games raised $32.5 million for its cross-play, co-op games that run on PCs, consoles and mobile devices. The round was led by Galaxy Interactive and Andreessen Horowitz (a16z). The company, founded by mobile gaming vets Christina Norman and David Banks, two veterans of Riot Games, had previously raised $5 million in 2020.

Livestream shopping platform Whatnot, which focuses on collectibles like Pokémon cards and Funko Pops, confirmed the close of its $150 million Series C, valuing its business at $1.5 billion. Returning investors a16z and Y Combinator’s Continuity Fund joined new investor CapitalG (Google Capital) in the round. The Information previously reported the fundraise.

Livestream shopping platform Whatnot, which focuses on collectibles like Pokémon cards and Funko Pops, confirmed the close of its $150 million Series C, valuing its business at $1.5 billion. Returning investors a16z and Y Combinator’s Continuity Fund joined new investor CapitalG (Google Capital) in the round. The Information previously reported the fundraise.

Bangalore-based Byju’s acquired California-headquartered coding platform Tynker for $200 million. The platform, which is available across platforms, including mobile, counts BBC Learning, Google, Microsoft, Mattel and NASA among its partners.

Bangalore-based Byju’s acquired California-headquartered coding platform Tynker for $200 million. The platform, which is available across platforms, including mobile, counts BBC Learning, Google, Microsoft, Mattel and NASA among its partners.

San Francisco-based fantasy sports startup Sleeper is now valued at $400 million after raising $40 million in a round led by Andreessen Horowitz. The company has over 3 million users, most of whom are aged between 18 and 35. It has expanded into esports during the pandemic, after initially focusing on the NFL and the NBA.

San Francisco-based fantasy sports startup Sleeper is now valued at $400 million after raising $40 million in a round led by Andreessen Horowitz. The company has over 3 million users, most of whom are aged between 18 and 35. It has expanded into esports during the pandemic, after initially focusing on the NFL and the NBA.

India-based networking app Apna, which helps blue-collar workers upskill and find jobs, raised a $100 million Series C led by Tiger Global. The round values the business at $1.1 billion and makes the company India’s youngest unicorn.

India-based networking app Apna, which helps blue-collar workers upskill and find jobs, raised a $100 million Series C led by Tiger Global. The round values the business at $1.1 billion and makes the company India’s youngest unicorn.

Chat app Discord raised $500 million in a new round of funding led by Dragoneer Investment Group, valuing the business at $15 billion — more than double the valuation it was given at its last round of funding in 2020. The platform, which is particularly popular with gamers, has over 150 million monthly active users.

Chat app Discord raised $500 million in a new round of funding led by Dragoneer Investment Group, valuing the business at $15 billion — more than double the valuation it was given at its last round of funding in 2020. The platform, which is particularly popular with gamers, has over 150 million monthly active users.

India’s Mobile Premier League (MPL) raised $150 million in a round of funding led by Legatum Capital, valuing its business at $2.3 billion. The three-year-old company connects game publishers with players on its app platform, allowing users to access a range of free gaming titles.

India’s Mobile Premier League (MPL) raised $150 million in a round of funding led by Legatum Capital, valuing its business at $2.3 billion. The three-year-old company connects game publishers with players on its app platform, allowing users to access a range of free gaming titles.

Streetwear resale platform Grailed raised $60 million in Series B funding in a round led by competitor Goat Group, which also included Gucci CEO Marco Bizzarri, Groupe Artémis, Thrive Capital and Index Ventures. The company had 7 million users and 3 million listings at the time of the deal, but only 20% of users are female.

Streetwear resale platform Grailed raised $60 million in Series B funding in a round led by competitor Goat Group, which also included Gucci CEO Marco Bizzarri, Groupe Artémis, Thrive Capital and Index Ventures. The company had 7 million users and 3 million listings at the time of the deal, but only 20% of users are female.

Indonesian investment app for retailer investors Pluang announced $55 million in new funding led by Square Peg, with participation from SIG, UOB Venture Management, Go-Ventures and Openspace Ventures. The app has 3 million users.

Indonesian investment app for retailer investors Pluang announced $55 million in new funding led by Square Peg, with participation from SIG, UOB Venture Management, Go-Ventures and Openspace Ventures. The app has 3 million users.

Indian investment app Groww is in advanced talks to raise $250 million in new funding in a round that would value the business at $3 billion. Deal terms may still change. Tiger Global, Coatue and TCV have held conversations to lead or co-lead the round. The app is on track for around $35 million in ARR.

Indian investment app Groww is in advanced talks to raise $250 million in new funding in a round that would value the business at $3 billion. Deal terms may still change. Tiger Global, Coatue and TCV have held conversations to lead or co-lead the round. The app is on track for around $35 million in ARR.

Downloads

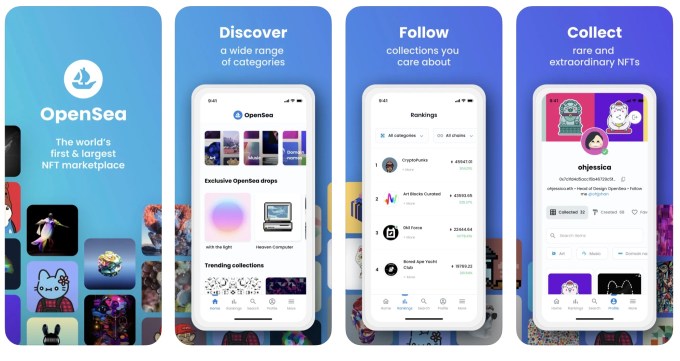

OpenSea: NFT Marketplace

Image Credits: OpeaSea on App Store

Amid an insider trading controversy, in which OpenSea’s Chief Product Officer Nate Chastain was caught buying NFT artwork shortly before they hit the site’s front page, then fired, the NFT marketplace company launched its first mobile app. The app, which is available as of Thursday on both the iOS App Store and Google Play, certainly arrives at a questionable time — why not wait for the dust to settle on the scandal, before moving forward with a mobile experience, sans CPO?

In any event, the new app allows users to connect their current profile, then search, filter, discover and save favorite NFTs, as well as view collections and item stats. The app will also link to blog posts about OpenSea developments and the NFT ecosystem as a whole. And it will link to exclusive releases. What you can’t do with OpenSea’s app, at least not yet, is actually purchase NFTs.

Castlevania: Grimoire of Souls

Image Credits: Konami

The latest reboot of the classic title is an Apple Arcade exclusive. Launched on Friday, September 17, Castlevania: Grimoire of Souls offers a new take on the popular side-scrolling action game — but one that’s free from in-app purchases or ads. The game features character designs and music from series creators Ayami Kojima and Michiru Yamane, and will see players embark on a new adventure where they “hack, slash, whip and blast their way through Dracula’s army using a variety of attacks, weapons, and unique character moves.” Characters available to play include Alucard, Simon Belmont, Charlotte, Shanoa and Maria, with more to come. An Apple Arcade subscription is $4.99 per month or can be purchased with an Apple One subscription plan.

SEC Regional Director Erin Schneider is joining us at Disrupt

If ever there was a time when working at the Securities and Exchange Commission was a dull affair, that’s no longer true. The federal agency that’s responsible for protecting investors and maintaining fair and orderly functioning of our securities markets is busier than ever, thanks to the rise of SPACs, cryptocurrencies and new rules around how startups raise money. And that’s just the tip of the iceberg.

In just a few of its many cases, it this week charged App Annie, the mobile data and analytics firm, as well as its co-founder and former CEO and Chairman Bertrand Schmitt, with securities fraud.

The charges come hot on the heels of another case that the SEC announced late last month against Manish Lachwani, the former CEO of Silicon Valley startup HeadSpin, who has been accused of defrauding investors out of $80 million by falsely claiming HeadSpin had achieved stronger and more consistent growth on the customer and revenue front than was the case.

It also still has an active case against former Theranos president “Sunny” Balwani, who, unlike Theranos and its founder Elizabeth Holmes, has refused to settle with the agency.

Of course, in the midst of its active fieldwork, it’s getting used to grappling — publicly — with powerful tech CEOs. It famously became a target of Elon Musk several years ago when it filed securities fraud charges against him tied to his social media activities. (It continues to try reining in the tweets of Musk, who has openly mocked the agency.)

More recently, it found itself the target of a Twitter tirade by Coinbase CEO Brian Armstrong.

Leading the charge in each of these cases and many more is Erin Schneider, who attended UC Berkeley as an undergraduate and law student and who, after a brief stint as a staff accountant at PWC and as a lawyer with a global law office, headed to the SEC as a staff attorney. She has steadily worked her way up since, and in May 2019 was appointed as the head of its San Francisco office, which leads enforcement and examinations in not only Northern California but also the Pacific Northwest.

Because she and her colleagues have their hands particularly full, you can imagine how excited we are that Schneider is coming to Disrupt (September 21-23) to discuss some of the agency’s many current challenges — as well as its victories.

If you’re interested in learning more about the SEC’s ever-evolving approach to Silicon Valley startups, and why you shouldn’t expect its interest to dissipate any time soon, you really won’t want to miss this conversation.

Disrupt is coming up fast. Don’t miss our conversation with Schneider or with Brian Armstrong himself, or actor-entrepreneur Ryan Reynolds, or investor Chamath Palihapitiya, or the many other powerful speakers who will be gracing our virtual stage this year. Get your ticket now for less than $100 — and we’ll see you soon.

Divining the real value of my favorite fintech sub-niche

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter. It’s inspired by what the weekday Exchange column digs into, but free, and made for your weekend reading. Want it in your inbox every Saturday? Sign up here.

Thank you for clicking on this email. With a subject line like that you are legend for being here.

Of course, we’re talking buy-now-pay-later (BNPL) companies today, a particular part of the larger fintech world that is more than interesting.

Thanks to recent mega-buys of players in the BNPL space from Square and PayPal, we’ve been getting closer to understanding just what the value of the companies in the space may really be — and for the myriad BNPL startups in the market, it’s big news.

But while I was on vacation (Michael’s fault, it turns out), Goldman Sachs decided to buy GreenSky, a public BNPL company. Which means that we can quickly run some numbers on the deal and add this latest arrow to our How To Value A BNPL Company quiver.

My friend and colleague — and former deskmate, back in the day — Ryan Lawler has an interview with Goldman that is worth reading. The transaction is worth $2.24 billion, per Goldman, driving the value of GreekSky dramatically higher in its aftermath, as investors digested the implied deal premium to the company’s previous share price.

What sort of volume was GreenSky’s home-improvement-focused BNPL doing? Here’s the company’s latest earnings report:

Transaction Volume: Second quarter transaction volume was $1.5 billion, an increase of 14% when compared to the second quarter of 2020. Approved credit lines for the quarter were the highest in Company history and are a positive leading indicator of momentum as home improvement supply chain and labor market shortages ease.

So a $6 billion run-rate at a price of $2.24 billion. That works out to about $0.37 in corporate value for each dollar in GMV that GreenSky handles. Which is the lowest number we’ve seen to date.

As a reminder, here’s what we’ve found more recently, with both of us keeping in mind that not every figure below is perfectly apples:apples; these are directional figures more than absolutes:

- Affirm: $2.94 in value per dollar of serviced GMV

- AfterPay: $1.84 per dollar of serviced GMV (at Square price)

- Paidy: $1.80 per dollar of serviced GMV (at PayPal price)

- Klarna: $0.57 per dollar of serviced GMV

GreenSky sits at the bottom of the list. Perhaps growth is the reason? A 14% GMV growth rate doesn’t give the company much leeway to grow, even if it manages a higher take rate. It’s hard to burnish a growth rate that starts with a one, especially if the leading line atop your investor relations page is “GREENSKY, INC. IS A GROWTH COMPANY.”

Akin to how we’ve seen diverging SaaS revenue multiples, striated along the axes of revenue growth and revenue quality, there’s likely something similar afoot here. Loss ratios, take rates, and GMV growth are vectors by which BNPL companies will be valued differently.

BNPL startups can find their most accurate comp in growth and loan quality terms, and then work backwards to their present-day market worth. It’s good to have data.

Mammoths?

I was going to spend the bulk of this newsletter discussing Mammoth Biosciences, and its plan to Jurassic Park the world, but TechCrunch beat me to it. I spoke to one of its investors — Thomas Tull — about the deal, but will hold onto those notes for a bit. I suspect we’ll need them in time.

One neat funding round to close us out

Disrupt is next week, and with an IPO cycle upon us I’ve fallen behind my usual funding round cadence. (And comms, sorry!) So, here’s a makeup entry for our shared enjoyment: Postal.

The company works in the marketing tech space, operating what its website claims is the “largest” business-to-business “gifting marketplace.” More simply, it helps companies send personalized physical goods to customers. Which it claims has a very high ROI.

In a somewhat ironic twist, I actually have to do some disclosures at this juncture. It turns out the company’s leading investors are Mayfield and OMERS. Those two firms led my former employer’s Series B and C rounds, respectively. But if I didn’t write about companies to which my Crunchbase connection didn’t cause some sort of awkward frisson, I’d have to cut out too large a swath of the market. I’ll just keep bringing up the matter when we have to.

Postal works in a somewhat similar space to Sendoso, though, to my understanding, the latter company deals a bit more with employee gifting over customer-focused efforts. In time they’ll compete directly if they both keep growing. Sendoso raised $100 million earlier this week, because of course it did.

Other players in the space include Reachdesk and Alyce (which raised $30 million earlier this year), among others. The business of building tech to deliver personalized physical goods is pretty big, it turns out. (You can make an NFT joke here, if you’d like.)

PitchBook pegs Sendoso’s new valuation at $640 million (post-money) and Alyce at $135 million (post-money). Present-day valuations for Reachdesk and Postal.io were not available.

Okay that is enough for now. Have a delightful weekend, and I’ll see you at Disrupt! You may see a lot of me on the Extra Crunch stage. — Alex

SoftBank’s Marcelo Claure is coming to Disrupt next week

SoftBank has been on a tear in Latin America. The Japanese investment conglomerate just announced it has launched its second Latin America-focused fund with a $3 billion capital commitment from the company that may grow as the fund explores “options to raise additional capital,” according to SoftBank. The vehicle follows hot on the heels of SoftBank’s debut Latin America-focused fund, announced in March 2019 with an initial $2 billion in committed capital.

It’s easy to see what all the fuss is about. Led by Marcelo Claure, CEO of SoftBank Group International and COO of SoftBank Group Corp., the outfit’s roughly four dozen employees — who operate out of Miami, São Paulo and Mexico City — have helped SoftBank identify and fund 48 startups into which it has plugged $3.5 billion and, according to the firm, which feature a combined (on paper, notably) net IRR of 85%.

Among the so-called unicorns that SoftBank has backed — and, in some cases, helped drive into unicorn territory — are QuintoAndar, Rappi, Mercado Bitcoin, Gympass and MadeiraMadeira. Recently, it also co-led a $350 million Series D round in Argentine personal finance management app Ualá.

It’s so busy that it just brought aboard two new managing partners at the end of last week to help out with all that investing.

Amazingly, overseeing investments in Latin America is just one of the many roles that Claure, a native of Bolivia, plays for SoftBank. (He also oversees a vast portfolio of SoftBank’s operating companies, including Arm, Brightstar, Fortress, SB Energy and Boston Dynamics; he oversees SoftBank’s ownership in T-Mobile US; and he serves as executive chairman of WeWork, which he ran as interim CEO after founder Adam Neumann was forced to resign.) Still, one senses that it may be his greatest passion right now, and we’re thrilled to say that he’ll be joining us at Disrupt on the morning of Thursday, September 23rd, to talk all about it.

If you care about where SoftBank is shopping in Latin America right now — or generally want to understand better what sparked the torrid pace of investing there that the industry has seen over the last 18 months — this is a conversation you won’t want to miss.

Even better, Claure joins a whole host of amazing speakers at Disrupt, including Canva CEO Melanie Perkins, actor-entrepreneur Ryan Reynolds and Coinbase CEO Brian Armstrong.

The show is coming up fast. Get your ticket now for less than $100 before the price goes up in a few short days; we’ll see you there.

China Roundup: Beijing is tearing down the digital ‘walled gardens’

Hello and welcome back to TechCrunch’s China roundup, a digest of recent events shaping the Chinese tech landscape and what they mean to people in the rest of the world.

This week, China gets serious about breaking down the walled gardens that its internet giants have formed for decades. Two major funding rounds were announced, from the newly established autonomous driving unicorn Deeproute.ai and fast-growing, cross-border financial service provider XTransfer.

Tear down the walls

The Chinese internet is infamously siloed, with a handful of “super apps” each occupying a cushy, protective territory that tries to lock users in and keep rivals out. On Tencent’s WeChat messenger, for instance, links to Alibaba’s Taobao marketplace and ByteDance’s Douyin short video service can’t be viewed or even redirected. That’s unlike WhatsApp, Telegram or Signal that offer friendly URL previews within chats.

E-commerce platforms fend off competition in different ways. Taobao uses Alibaba’s affiliate Alipay as a default payments option, omitting its arch rival WeChat Pay. Tencent-backed JD.com, a rival to Alibaba, encourages its users to pay through its own payments system or WeChat Pay.

But changes are underway. “Ensuring normal access to legal URLs is the basic requirement for developing the internet,” a senior official from China’s Ministry of Industry and Information Technology said at a press conference this week. He added that unjustified blockages of web links “affect users’ experience, undermine users’ rights, and disrupt market orders.”

There is some merit in filtering third-party links when it comes to keeping out the likes of pornography, misinformation and violent content. Content distributors in China also strictly abide by censorship rules, silencing politically sensitive discussions. These principles will stay in place, and MIIT’s new order is really to crack anticompetitive practices and wane the power of the bloated internet giants.

The call to end digital walled gardens is part of MIIT’s campaign, started in July, to restore “orders” to the Chinese internet. While crackdowns on internet firms are routine, the spate of new policies announced in recent months — from new data security rules to heightened gaming restrictions — signify Beijing’s resolution to curb the influence of Chinese internet firms of all kinds.

The deadline for online platforms to unblock URLs is September 17, the MIIT said earlier. Virtually all the major internet companies have swiftly issued statements saying they will firmly carry out MIIT’s requirements and help promote the healthy development of the Chinese internet.

Internet users are bound to benefit from the dismantling of the walled gardens. They will be able to browse third-party content smoothly on WeChat without having to switch between apps. They can share product links from Taobao right within the messenger instead of having their friends copy-paste a string of cryptic codes that Taobao automatically generates for WeChat sharing.

Robotaxi dream

Autonomous driving startup Deeproute.ai said this week it has closed a $300 million Series B round from investors including Alibaba, Jeneration Capital, and Chinese automaker Geely. The valuation of this round was undisclosed.

We’ve seen a lot of publicity from Pony.ai, WeRide, Momenta and AutoX but not so much Deeproute.ai. That in part is because the company is relatively young, founded only in 2019 by Zhou Guang after he was “fired” by his co-founders at the once-promising Roadstar.ai amid company infighting.

Investors in Roadstar.ai reportedly saw the dismissal of Zhou as detrimental to the startup, which had raised at least $140 million up to that point, and subsequently sought to dissolve the business. It appears that Zhou, formerly the chief scientist at Roadstar, still commands the trust of some investors to support his reborn autonomous driving venture.

Like Pony.ai and WeRide, Deeproute is trying to operate its own robotaxi fleets. While the business model gives it control over reams of driving data, it’s research- and cash-intensive. As such, major Chinese robotaxi startups are all looking at faster commercial deployments, like self-driving buses and trucks, to ease their financial stress.

Cross-border trade boom

The other major funding news this week comes from Shanghai-based XTransfer, which helps small-and-medium Chinese exporters collect payments from overseas. The Series C round, led by D1 Partners, pulled in $138 million and catapulted Xtransfer’s valuation to over $1 billion. The proceeds will go towards product development, hiring and global expansion.

Founded by former executives from Ant Group, XTransfer tries to solve a pain point faced by small and medium exporters: opening and maintaining bank accounts in different countries can be difficult and costly. As such, XTransfer works as a payments gateway between its SME customer, the party that pays it, and their respective banks.

As of July, XTransfer’s customers had surpassed 150,000, most of which are in mainland China. The company of over 1,000 employees is also expanding into Southeast Asia.

While business-to-business export is booming in China, more and more products are also being directly sold from Chinese brands to consumers around the world. Some of the most successful examples, like Shein and Anker, use a different set of payments processors for their direct-to-consumer sales, which tend to be in bigger volume but smaller in average ticket value.

1 change that can fix the VC funding crisis for women founders

Contributor

The venture capital industry as we know it is broken. At least for women, that is.

In terms of funding to women founders, 2020 was among the worst years on record. On a global level, only 9% of all funds deployed to technology startups went to founding teams that included at least one woman. Solo woman founders and all-women teams raised just 2% of all VC dollars, Crunchbase data showed.

Shockingly, this number is actually less than it was when we first started counting a decade ago, well before many high-profile diversity initiatives launched with the goal of fixing this very problem.

This funding gap isn’t just a moral crisis — it’s an economic one. The lack of investment into women-founded startups is a missed opportunity worth trillions of dollars. That’s because of overwhelming evidence that startups founded by women outperform startups founded by men: They generate more revenue, earn higher profits and exit faster at higher valuations. And they do all this while raising way less money.

What we’re doing isn’t working. Through research for my next book on women founders and funders, I kept asking myself the same question: When it comes to fixing the funding gap for women founders, what’s the one thing we can do that will make everything else easier or unnecessary?

I now believe that our best bet for long-term change is to focus our efforts on increasing the number of women investing partners who can write large seed checks. Here’s why.

Women investors are up to 3x more likely to fund women founders

Recently, one of the top VCs in the world told me how challenging it is to diversify his senior team. He expressed it as an accepted fact and a widespread belief. This is a common trope in Silicon Valley: Everyone wants gender diversity, but it’s so hard to find all the senior women!

In the venture capital industry, who you hire at the senior level is who you hang out with. And who you hire at the senior level determines who your fund will back.

Since studies now show that women investors are up to three times more likely to invest in women founders, it is clear that the fastest way to fund more women is to hire more women investing partners with check-writing ability. The effect to venture firms? Returns.

“When U.S. VC firms increased the proportion of female partners, they benefited with 9.7% more profitable exits and a 1.5% spike in overall fund returns annually,” explained Lisa Stone of WestRiver Group.

Data from All Raise and PitchBook reinforce the “correlation between hiring female decision-makers at the investment level and outperformance at the fund level,” adding that “69.2% of U.S. VCs that scored a top-quartile fund between 2009 and 2018 had women in decision-making roles.”

It shouldn’t be surprising that women investors are more likely to invest in women founders. That’s because humans have a propensity toward homophily — the tendency for like to attract like and for similarity to breed connection.

Homophily is why a vegan VC is more likely to invest in a vegan food tech, a gamer is more likely to hang out with gaming founders, or a parent is more likely to invest in a parent marketplace. People gravitate toward what they know.

Deena Shakir, who happens to be a woman and a mother, recently led Lux Capital’s investment into women’s health unicorn Maven. Shakir had multiple high-risk pregnancies with multiple complications, emergency C-sections, NICU stays and breastfeeding challenges.

“It is no coincidence that I am joined on Maven’s board of directors by four other mothers … and a brand-new father … whose personal journeys have also informed their professional conviction,” Shakir wrote in a Medium post.

Why seed checks have the greatest impact on the ecosystem

I believe that to fix the funding gap for women founders and jump-start the virtuous cycle of venture capital investing into women, we should focus on getting more seed checks into the hands of women founders. That’s because seed investing is a leading indicator of whether we are headed in the right direction in terms of closing the funding gap for women, according to Jenny Lefcourt, a partner at Freestyle and co-founder of All Raise, the leading nonprofit focused on diversifying the VC industry.

This doesn’t discount the importance of investments made into women founders at later stages. When a women founder lands Series D capital, it boosts this year’s numbers into women founders and likely brings that particular founder closer to a liquidity event that will lead her (and her executives) to invest in more women.

That said, the greatest impact on the future ecosystem will come from widening the top of the funnel and giving more women at the seed stage the shot to one day reach a momentous Series D funding like Maven. After all, who we fund now becomes who we fund later.

Why large seed checks matter most

Finally, the size of the check is also important when thinking about how to have the biggest impact on the ecosystem.

I know first-hand that microchecks are critical to building an inclusive ecosystem. When women invest at the seed level — in any amount — they jumpstart a virtuous cycle of women funding women. That’s why when I stepped in to lend a hand at my portfolio company when the solo woman founder took a parental leave, one of my key projects was to develop Jefa House, a way for Jefa’s own executives to easily invest in other women-founded startups.

That said, large party rounds made up entirely of small angel checks are few and far between. Similar challenges face small checks from emerging fund managers. Although the sheer number of emerging managers has increased 9x in seven years, the reality is that most emerging managers simply don’t have much money.

Are women venture capitalists who run their own microfunds more likely to invest in amazing women founders than Tier 1 funds with few or no women investing partners? Yes. Will it take them a long time to compete with those Tier 1 funds in terms of check size? Yes.

This is why it matters so much when leading funds hire or promote women to the partner level. Not only does it give women founders a better shot at funding from high-signal shops, but the moves that top funds make are key signals to others in the ecosystem: In venture capital, women investors don’t have to sit at the kids’ table.

Why we must hire women investing partners