Contributor

When Flavia Deutsch and Paula Crespi were raising a groundbreaking $1.7 million seed round for their parenting startup in Brazil, they had to turn away male investors.

“The men were already writing us checks, but the women — we had to convince them,” Deutsch explained of the seed round for Theia, which ended the year as the largest all-female founded company raise in Latin America. “For every male investor we had, we wanted one female investor as well,” Deutsch said. And for good reason.

Many studies have established that female-founded companies outperform their all-male counterparts. Boston Consulting Group reports that for every dollar a female founder or co-founder raises, she generates 2.5X more revenue than a male founder.1 First Round Capital’s research held that the female-founded companies it backed performed 63% better than all-male founding teams.2 The Ewing Marion Kauffman Foundation’s showed that return on investment from women-led teams is 35% higher than their all-male counterparts.3 AllRaise, a nonprofit promoting women in VC, found that “companies with women on their founding teams are likely to exit at least one year faster compared to the rest of the market, and the number of exits for companies with at least one female founder is growing at a faster rate year-over-year than exits for companies with only male founders.”4 Jen Neundorfer, founding partner at Jane VC, succinctly explains her fund’s thesis of investing in female founders as, “investing in an overlooked asset class that is overperforming.” After all, it’s a “trillion-dollar opportunity.”5

And in the 2020s, much of that opportunity will be in emerging markets. The first year that the largest IPOs globally came from emerging markets was 2017. Since then, it has been a straight line up and to the right. Nazar Yasin, who invests in emerging markets as the founder of Rise Capital, says, “this trend isn’t going away.” Given that most GDP growth now coming from emerging markets, where most global internet users live, “the future of market capitalization growth in the internet sector globally belongs to emerging markets.”

Latin America takes the global lead in funding women

And it just may belong to the women who start companies there.

New data from Gene Teare at Crunchbase shows that Latin America currently takes the global lead in investment dollars directed to women.

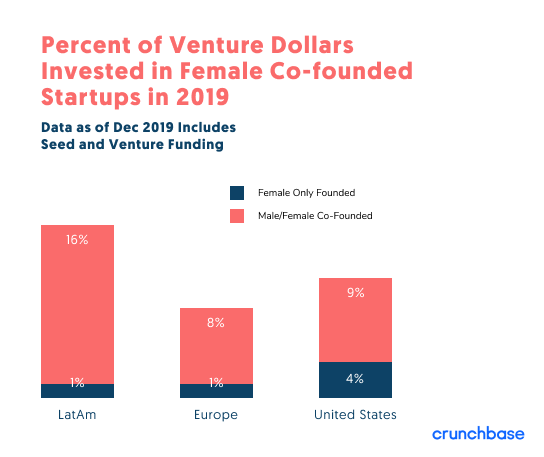

via Crunchbase

In 2019, investments into mixed female-male founding teams represented 16% of dollars invested in Latin America, 9% in the U.S. and only 8% in Europe.

This number includes a $400 million Series F into Nubank, the Brazilian challenger bank co-founded by Cristina Junqueira, who was — not for the first time — pregnant at the time of the raise. Junqueira is not only the female co-founder currently leading the largest neobank in the world, she is also the female co-founder currently leading the world’s largest venture-backed company.

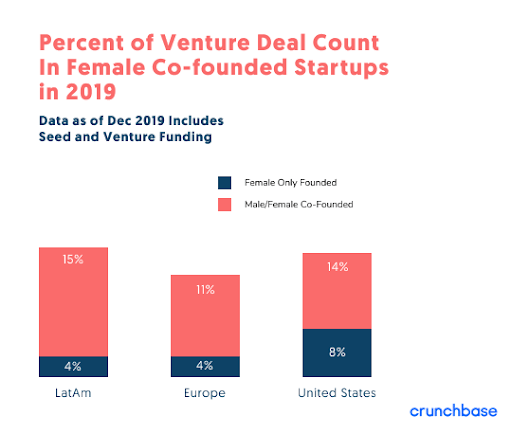

via Crunchbase

Overall, total investment dollars into both mixed male-female teams and female-only teams represented 17% of total dollars invested in Latin America, 13% in the U.S. and 9% in Europe.

In terms of deal volume, mixed female-male founded teams make up 15% of investments in 2019 in Latin America, in comparison with 14% in the U.S. and 11% in Europe. One contributor is fintech. In Latin America, 35% of fintech companies have a female co-founder, 5X more than the global average of 7%.6

That said, in terms of funding all-female teams, the U.S. still leads. In Latin America, the women-only teams made up 4% of investment deals in 2019, on par with Europe but behind the U.S. average of 8%.

Read the conclusion, Women are the secret ingredient in Latin America’s outsized returns, on Extra Crunch.