Apple announced a whole bunch of new products today at its fancy Cupertino campus in what was its first hardware event since becoming a $1 trillion company. The company proudly unveiled the iPhone XS, the iPhone XS Max, the Apple Watch Series 4 and more.

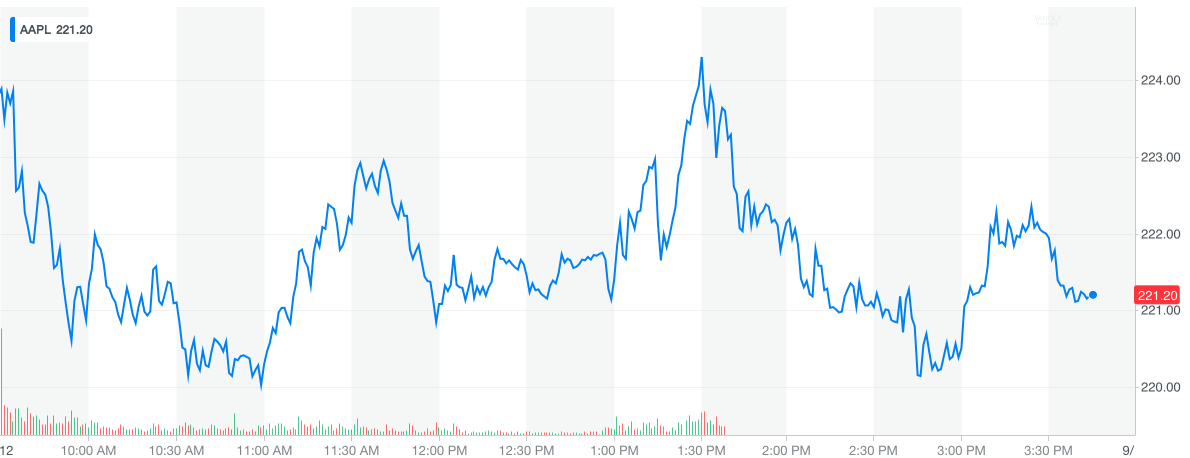

The stock market behaved as we expected. Apple’s stock spent much of the day hovering down 1 percent, dropping as low as 2 percent at the conclusion of the big presentation. Apple (NASDAQ: AAPL) recovered by the time the markets closed, ending the day, again, down about 1.2 percent. Exciting stuff, I know.

As we’ve said before, the stock price doesn’t typically do all that much during hardware spectacles like this. Despite the amount of fanfare leading up to these big presentations, as was the case preceding the iPhone X announcement, Wall Street doesn’t overreact. Why? Because they’ve seen it all before and like many of our loyal readers, they know what’s coming. Plus, all the press leading up to the event usually takes away any opportunity for a true surprise. Leaks, too, eliminate the shock factor.

As we’ve said before, the stock price doesn’t typically do all that much during hardware spectacles like this. Despite the amount of fanfare leading up to these big presentations, as was the case preceding the iPhone X announcement, Wall Street doesn’t overreact. Why? Because they’ve seen it all before and like many of our loyal readers, they know what’s coming. Plus, all the press leading up to the event usually takes away any opportunity for a true surprise. Leaks, too, eliminate the shock factor.

A few of Apple’s competitors’ stocks, however, tumbled on the news of its new lineup of iPhones and its latest Apple Watch.

Fitbit tanks

Fitbit’s (NYSE: FIT) stock took the hardest hit on Wednesday as Apple announced its newest smartwatch, the Apple Watch Series 4. Fitbit, the creator of a competing wearable health and fitness device, closed down nearly 7 percent.

Samsung, another one of Apple’s competitors, was down just 1 percent on the news of Apple’s new fancy-schmancy phones.

The iPhone XS, according to Apple CEO Tim Cook, is the best and greatest phone the company has ever made. And they’ll be the industry’s first smartphones to be powered by 7nm chips.

U.S. chipmaker Qualcomm’s (NASDAQ: QCOM) stock dipped 2 percent on that news. Apple and Qualcomm have been going head-to-head in a long-running patent war. Apple, as a result, has been working to remove Qualcomm equipment from its phones.

Samsung and Qualcomm closed down about 1 percent Wednesday.

A strong year for Apple

Apple’s stock is up more than 30 percent so far this year. The company shipped some 41 million phones in Q2 2018, per Canalys (via email), and has continued to disclose positive earnings in its lead-up to the big $1 trillion. Apple beat analyst expectations when it reported $53.3 billion in revenue in its latest earnings report, up 17 percent year-over-year.

The company’s stock took a slight hit earlier this week after President Trump tweeted that Apple’s prices may climb due to China tariffs.

Apple prices may increase because of the massive Tariffs we may be imposing on China – but there is an easy solution where there would be ZERO tax, and indeed a tax incentive. Make your products in the United States instead of China. Start building new plants now. Exciting! #MAGA

— Donald J. Trump (@realDonaldTrump) September 8, 2018

The tweet was a response to a letter Apple wrote to the Trump administration warning them that tariffs may increase the cost of its products, including the Apple Watch, AirPods and HomePods.

“It is difficult to see how tariffs that hurt U.S. companies and U.S. consumers will advance the Government’s objectives with respect to China’s technology policies,” Apple wrote, per CNBC. “We hope, instead, that you will reconsider these measures and work to find other, more effective solutions that leave the U.S. economy and U.S. consumer stronger and healthier than ever before.”

If you missed today’s event or you’re already ready to relive it (no judgment), we live-blogged the whole thing here. Catch up on all the new hardware here.