Dopay, a London-headquartered startup that offers a payroll service for the unbanked, has closed a $2 million seed. Investors in the round of funding include global private equity firm ACE & Company, plus a syndicate of angels from the banking, private equity and hedge fund industries. Read More

Dopay, a London-headquartered startup that offers a payroll service for the unbanked, has closed a $2 million seed. Investors in the round of funding include global private equity firm ACE & Company, plus a syndicate of angels from the banking, private equity and hedge fund industries. Read More

Category: Tech news

hacking,system security,protection against hackers,tech-news,gadgets,gaming

Zero’s New Email App Can Help You Reach “Inbox Zero”

A new mobile email application called Zero is launching today to help users power through their inboxes on the go to achieve the often sought-after state of “inbox zero.” Aimed at heavy email users who receive a lot of inbound email, an app that promises to speed up email processing by 30 percent or more sounds too good to be true. But while still far from perfect in its present… Read More

A new mobile email application called Zero is launching today to help users power through their inboxes on the go to achieve the often sought-after state of “inbox zero.” Aimed at heavy email users who receive a lot of inbound email, an app that promises to speed up email processing by 30 percent or more sounds too good to be true. But while still far from perfect in its present… Read More

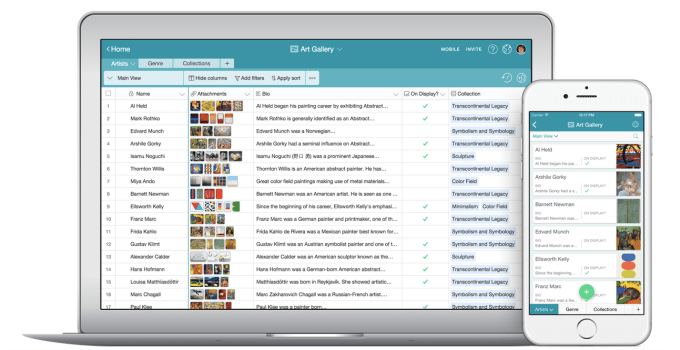

Airtable Launches Its API And Embedded Databases

Two months after launching its unique organizational tool, Airtable is rolling out two new features that’ll make it easier to share your personal spreadsheet/database hybrids with others in a way they’ll find useful. In addition to sharing direct read or edit access to the relational databases you create in its app, Airtable is today letting you draw from the underlying data using… Read More

Two months after launching its unique organizational tool, Airtable is rolling out two new features that’ll make it easier to share your personal spreadsheet/database hybrids with others in a way they’ll find useful. In addition to sharing direct read or edit access to the relational databases you create in its app, Airtable is today letting you draw from the underlying data using… Read More

Amazon Brings HD And Cellular Streaming To The iOS Instant Video App

Amazon has answered a long-standing request with an update to Amazon Instant Video that delivers streaming of HD resolution content, and allows streaming over cellular connections, rather than just Wi-Fi. The new 3.0 update also lets you beam the Amazon Instant Video library of movie and TV shows to your Apple TV via AirPlay in HD. Read More

Amazon has answered a long-standing request with an update to Amazon Instant Video that delivers streaming of HD resolution content, and allows streaming over cellular connections, rather than just Wi-Fi. The new 3.0 update also lets you beam the Amazon Instant Video library of movie and TV shows to your Apple TV via AirPlay in HD. Read More

Mobile Action Raises $2 Million To Help App Makers Attract More Users

Getting apps discovered in an increasingly packed app store is a challenge. This is why a number of firms have launched services to help app publishers figure out how to better optimize their app’s search result ranking when users type in various keywords, as well as gain other competitive intelligence. One such firm, San Francisco-based Mobile Action, has now closed on $2 million in… Read More

Getting apps discovered in an increasingly packed app store is a challenge. This is why a number of firms have launched services to help app publishers figure out how to better optimize their app’s search result ranking when users type in various keywords, as well as gain other competitive intelligence. One such firm, San Francisco-based Mobile Action, has now closed on $2 million in… Read More

Go Ahead, Play Prince Of Persia In This Tweet

If you want to relive your classic MS-DOS gaming experiences, you need venture no further than Twitter. The Internet Archive’s website-embeddable games also now work directly in tweets, when you’re viewing them on the web, or in native embeds like the one below. Jordan Mechner’s classic Prince of Persia is a good place to start, if you ask me, but anything in this… Read More

If you want to relive your classic MS-DOS gaming experiences, you need venture no further than Twitter. The Internet Archive’s website-embeddable games also now work directly in tweets, when you’re viewing them on the web, or in native embeds like the one below. Jordan Mechner’s classic Prince of Persia is a good place to start, if you ask me, but anything in this… Read More

Apple Looking Into Built-In Telephoto iPhone Camera Lenses

Apple’s iPhone is just about the best smartphone camera you can get, but a new patent application provides a good indication of how it could get even better. The patent is for a “small form factor telephoto camera (via AppleInsider) and describes how the company might make a camera with a narrower field of view, but a much higher magnification factor, as well as how such a camera… Read More

Apple’s iPhone is just about the best smartphone camera you can get, but a new patent application provides a good indication of how it could get even better. The patent is for a “small form factor telephoto camera (via AppleInsider) and describes how the company might make a camera with a narrower field of view, but a much higher magnification factor, as well as how such a camera… Read More

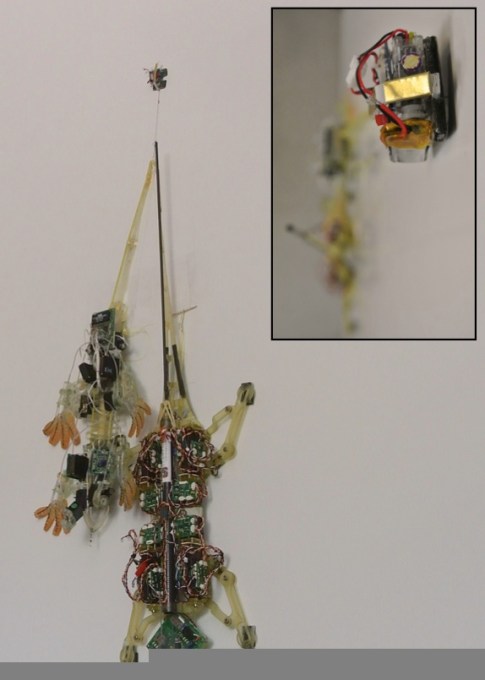

Micro Tug Robots Can Pull Objects 2,000 Times Their Own Weight

Like the noble ant or the sassy-yet-lovable tugboat, Micro Tugs can pull more than their own weight. The robots, which come from Stanford’s Biomimetics and Dextrous Manipulation Lab, use a “controllable adhesive” plate that sticks to surfaces only when shear pressure is applied. In one case a 12 gram robot was able to pull objects 2,000 times its own weight. Read More

Like the noble ant or the sassy-yet-lovable tugboat, Micro Tugs can pull more than their own weight. The robots, which come from Stanford’s Biomimetics and Dextrous Manipulation Lab, use a “controllable adhesive” plate that sticks to surfaces only when shear pressure is applied. In one case a 12 gram robot was able to pull objects 2,000 times its own weight. Read More

Review: Jawbone Up3

Six months ago, Jawbone promised the world. Then it built a step tracker.

The post Review: Jawbone Up3 appeared first on WIRED.

Maritime Data Startup Windward Raises $10.8M To Track The Oceans

Windward, which provides maritime data and analytics, has raised $10.8 million in funding led by Horizons Ventures, with participation from returning investor Aleph. This brings the company’s total raised so far to $15.8 million. The startup’s products currently include MARINT, which tracks vessel traffic using commercial satellites and alerts law enforcement and intelligence… Read More

Windward, which provides maritime data and analytics, has raised $10.8 million in funding led by Horizons Ventures, with participation from returning investor Aleph. This brings the company’s total raised so far to $15.8 million. The startup’s products currently include MARINT, which tracks vessel traffic using commercial satellites and alerts law enforcement and intelligence… Read More

Conductor Helps Customers Figure Out If They’re Ready For Google’s “Mobile Friendly” Update

Last week, Google updated its search algorithm to favor mobile-friendly pages in mobile search results — a move that could affect 40 percent of Fortune 500 websites. If you’re worried about the update, Conductor has built a new tool to help. The company says Mobile Visibility can help businesses understand which content is mobile friendly and which is not and how that affects… Read More

Last week, Google updated its search algorithm to favor mobile-friendly pages in mobile search results — a move that could affect 40 percent of Fortune 500 websites. If you’re worried about the update, Conductor has built a new tool to help. The company says Mobile Visibility can help businesses understand which content is mobile friendly and which is not and how that affects… Read More

Apple Boasts Over 3,500 Apple Watch Apps Already Available

Apple CEO Tim Cook said on today’s company earnings call that there are over 3,500 apps available at launch for the Apple Watch, which is better than the 1,000 total that were ready for iPad when that device launched in April of 2010, and 7 times the 500 apps available when the iPhone’s App Store first debuted in July 2008. Read More

Apple CEO Tim Cook said on today’s company earnings call that there are over 3,500 apps available at launch for the Apple Watch, which is better than the 1,000 total that were ready for iPad when that device launched in April of 2010, and 7 times the 500 apps available when the iPhone’s App Store first debuted in July 2008. Read More

Best Buy Will Accept Apple Pay In All U.S. Stores Later This Year

Back when Apple Pay was first launched, Best Buy wanted none of it. As a part of the MCX consortium, they were a part of an effort among retailers to build a mobile payments system of their own: CurrentC.

Back when Apple Pay was first launched, Best Buy wanted none of it. As a part of the MCX consortium, they were a part of an effort among retailers to build a mobile payments system of their own: CurrentC.

It seems Best Buy has changed its mind. 6 months later, Best Buy is jumping on the Apple Pay train. Read More

Apple ‘Working Hard’ To Catch Up With Apple Watch Demand

Apple is “working very, very hard” to meet the strong demand for Apple Watch, Apple CFO Luca Maestri told Bloomberg Businessweek in the wake of the company’s earnings call today. Apple is facing demand that it hopes to largely catch up with by the end of June, according to the executive. “It’s been really great to see the reaction of customers since their… Read More

Apple is “working very, very hard” to meet the strong demand for Apple Watch, Apple CFO Luca Maestri told Bloomberg Businessweek in the wake of the company’s earnings call today. Apple is facing demand that it hopes to largely catch up with by the end of June, according to the executive. “It’s been really great to see the reaction of customers since their… Read More

Apple Now Has $194 Billion In Cash

Apple, the word’s most valuable corporation, has a new cash tally: $194 billion.

Apple, the word’s most valuable corporation, has a new cash tally: $194 billion.

That’s to say that if you add up its cash, cash equivalents, short-term marketable securities, and long-term marketable securities, it totals $194 billion. Cash is a loose term that is usually employed at the corporate scale to include accreted value that remains functionally liquid. Read More