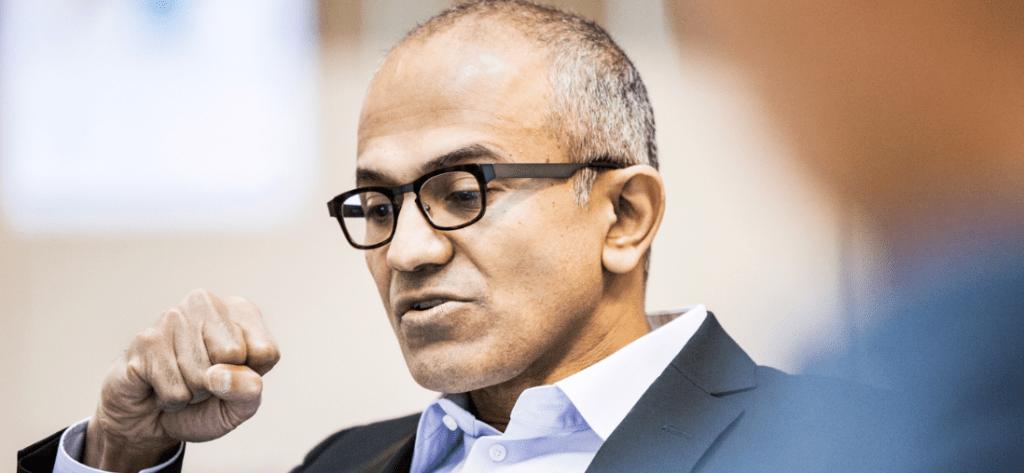

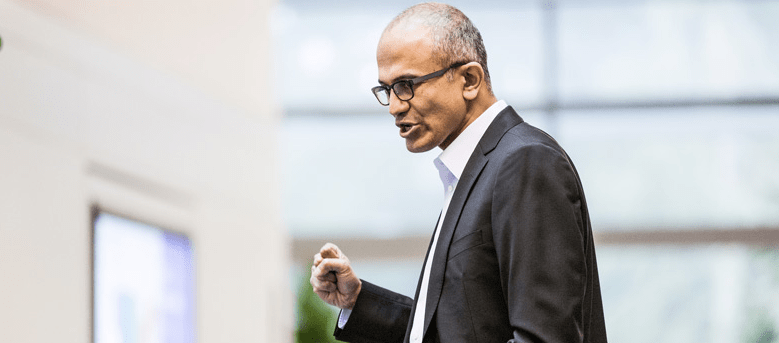

Microsoft crowned a new leader today, with Satya Nadella taking over the reins from exiting CEO Steve Ballmer. Bill Gates will spend a portion of his time at the company assisting with product choices.

While Nadella was essentially the unanimous choice of those outside the company — your humble servant included — his clippings have become too nice. Let’s take a moment instead to focus on what could go wrong for the new CEO.

To be plain, Nadella’s new role is one of the hardest, if not the hardest, jobs in technology. Microsoft is still pulling its re-org together at the same time it is changing its business model. This puts Nadella in the helm partway through two key and coinciding changes to the company.

The following list is a sample of the issues and challenges that Nadella may face during his tenure as CEO of Microsoft:

Windows Phone growth stalls, failing to reach the 10 percent mark in the next two years

Windows Phone’s excellent 2013 was capped by a disappointing fourth quarter sales figure of Lumia Windows Phone handsets. If that presages a broad slowdown of Windows Phone sales, Microsoft’s mobile momentum could stall, pushing that magical 10 percent market share figure further and further out into the future.

That would harm developer interest in Windows Phone, and by extension, the larger Windows ecosystem, thus harming the still nascent Windows Store. That’s not to diminish the fact that Windows Phone itself needs all the developer attention it can muster. Falling growth is anathema to such dotage.

The PC market could face materially worse returns than expected

The global PC market is expected to contract a few points this year, and then bottom out in 2015. That might not happen. If the PC market sees continued weakness akin to what happened in 2013, PC unit volume could decline until key partner OEMs bow out.

And PC volume has been the savior of the Windows 8.x platform as it has slowly arranged its ducks in a row. Without that key influx of new devices, Windows 8.x’s store is all gussied up with no one to dance with.

Worse-than-expected PC sales would also harm OEM revenues for Microsoft, both from consumers and enterprises. This brings us to:

Enterprises refuse to give up Windows XP

A huge chunk of the PC market remains on Windows XP. Nearly 30 percent, to be precise. For an operating system that Microsoft wants to go dark in April, that’s downright depressing.

As Windows XP ages, it holds off future PC purchases and makes companies that use it less secure. Microsoft would prefer more secure customers running shiny new Windows 7 or 8 boxes. There has been a presumption that XP users would make the switch. That doesn’t appear to be the case. That’s Nadella’s new problem.

Windows 8.x fails to garner significant tablet market share, despite updates

Surface had a solid fourth quarter in 2013, taking in $893 million on revenue. However, that was during a quarter in which Microsoft spent heavily on advertising for the two new devices it had just launched.

I don’t think that anyone expects Microsoft to beat that number in the current quarter. A better question is how well the larger set of tablet devices running Windows 8.x sell. Microsoft is preparing an update to Windows 8.x that is mostly focused on improving the Mouse And Keyboard experience, not its touch brother.

So the Windows 8.x we have for mobile today is likely the Windows 8.x for mobile we are going to have for some time. Whether consumers are willing to buy those devices has thus far been a mixed bag. Nadella needs to find a way to increase tablet sales, a device class that I suspect uses Windows Store apps on a larger per-unit scale than other form factors.

Surface Continues To Lose Money

Despite more than doubling its revenue in the period, Surface lost tens of million of dollars in the past quarter.

Microsoft has been strident in the past in stating that it intends to have strong margins on the Surface line of products. But the mere cost of Surface revenue was more than the revenue itself, meaning that the larger Surface loss for the period was much larger than you might think.

Spending heavily to support your new business model is a good plan. But at some point Surface will need to flip to the black. It’s up to Nadella to ensure that the Surface project can finally be taken off financial life support and walk under its own steam.

Office 365 revenues fail to match declining traditional Office revenues

Office 365 has seen very strong growth in its early stages. Microsoft reported, for example, that Office 365 Home Premium has collected 3.5 million subscribers during its most recent earnings call. A fine figure, but one that only points to a third of a billion dollars or so in revenue.

Microsoft also sells Office 365 to businesses large and small, governments, and educational customers. What isn’t clear — and may not come to pass — is whether there is enough market space for Microsoft to replace its traditional Office revenues completely, and then grow the sum. So far, Microsoft has shown good momentum, but Nadella could find himself with a substitute product that can’t generate as much cash as its predecessor.

Azure could slip against Amazon’s AWS with Nadella’s leadership tied up elsewhere

Windows Azure, Microsoft’s IaaS and PaaS cloud computing could services slip given that Nadella’s attention will be now more broadly distributed. Nadella is synonymous with the cloud for a reason.

If Microsoft cedes ground to Amazon, or more precisely fails to grow its share of this market, it could harm its ability to promote its own software products, not to mention see a key new revenue source stagnate.

Another economic slowdown could harm business buying cycles that have been key for Microsoft’s growth

The economy remains fragile. That is a material risk for Nadella. For example, it was corporate spend that kept Microsoft’s OEM revenues from falling heavily in its most recent quarter. As TechCrunch reported:

Critically, Windows OEM revenue for the period only declined 3 percent, a figure that was cushioned by 12 percent more OEM revenue to commercial customers. So, large companies offset weak consumer demand, mostly.

This is a more general risk, but a portion of Microsoft’s recovery thus far is due to macroeconomic conditions outside of its control. That flips and Nadella has a new problem on his hands.

Poor integration of Nokia’s tens of thousands of workers

The Nokia deal is about to bring a huge chunk of new staff into Microsoft’s business roughly at the same time that it is picking up a new leader. That could go poorly. Nadella will have to welcome droves of people into a culture that he will be only freshly in charge of.

And, given that Stephen Elop was tipped as a leading CEO candidate, some could be unhappy that their guy did not win.

Nokia’s hardware division drags on Microsoft’s margins and net income

Nokia, when whole, was not a particularly profitable company. The piece that Microsoft bought isn’t much better. I’ve done most of the leg work already on what impact Nokia could have on Microsoft’s earnings, and it looked slight.

But, in the harsh afterglow of Google’s Motorola purchase and sale, you have to wonder what might happen.

Executive exits

And finally, it has been an assumption that Nadella will have full avail of Microsoft’s cadre of executive vice presidents. That may not be the case.

Now that the dust has cleared on the CEO question, those who hoped for the role and did not get it could exit. Also, while Nadella is generally considered to be well-liked internally, he can hardly be universally popular. If key talent departs, he could find himself lacking down-ticket leadership in key areas.

–

Much of the above is completely theoretical. But so is the future. Nadella is a strong CEO pick, but his job will be industrial strength. Let’s see what happens.